India Distemper Market Size, Share, Trends and Forecast by Type, Application, Resin Type, and Region, 2025-2033

India Distemper Market Overview:

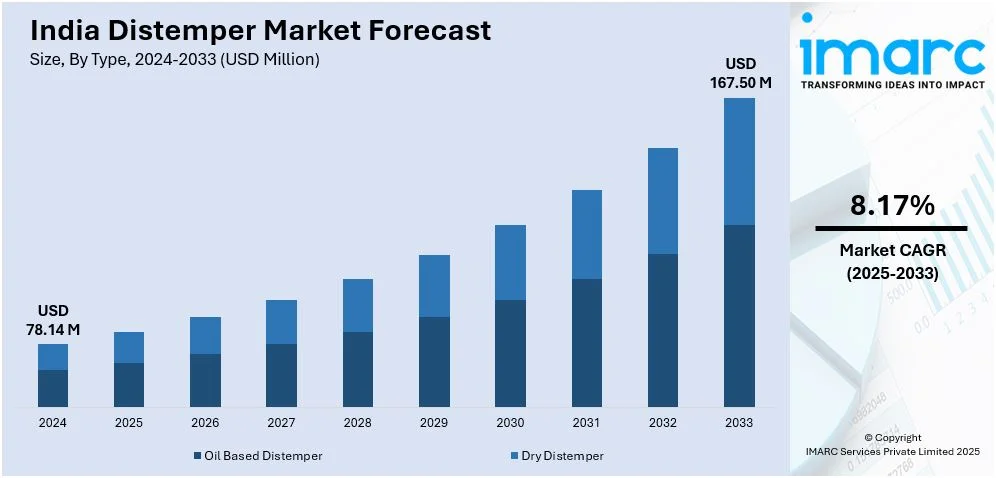

The India distemper market size reached USD 78.14 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 167.50 Million by 2033, exhibiting a growth rate (CAGR) of 8.17% during 2025-2033. The market is experiencing steady growth, driven by the increasing demand for cost-effective wall coatings and the expanding construction sector. Rising urbanization, government initiatives for affordable housing, and consumer preference for economical home décor solutions are contributing to market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 78.14 Million |

| Market Forecast in 2033 | USD 167.50 Million |

| Market Growth Rate 2025-2033 | 8.17% |

India Distemper Market Trends:

Expansion of Manufacturing Capacity Driving Market Growth

Grasim Industries' Birla Opus has shown a strong commitment to expanding its presence in the Indian distemper market. The company's continuous focus on enhancing production capabilities has allowed it to meet the growing demand for affordable wall coatings. By expanding its product range and improving distribution networks, it has strengthened its market reach, especially in rural and semi-urban areas. In November 2024, Grasim Industries further accelerated its growth by launching its fourth manufacturing plant in Chamarajanagar, Karnataka, adding 20 MLPA to its distemper production capacity. This development significantly boosted domestic supply, ensuring better product availability and stable pricing. The increased output also improved supply chain efficiency, allowing consumers easier access to affordable, quality paints. Additionally, the operational expansion enhanced competitive dynamics in the market, encouraging innovation and product differentiation. The company's reliance on advanced manufacturing technologies ensured consistent product quality while promoting sustainability through energy-efficient processes. Retailers benefited from a reliable supply chain, while consumers enjoyed budget-friendly choices without compromising durability. By addressing supply gaps and offering accessible distemper solutions, Grasim Industries has strengthened its leadership in the market. This strategic move not only expanded market accessibility but also influenced competitors to accelerate their production capabilities.

To get more information on this market, Request Sample

Eco-Friendly Innovation Enhancing Consumer Choice

The growing demand for sustainable products has driven innovation in the Indian distemper market. Consumers are increasingly seeking non-toxic and eco-friendly alternatives for healthier living spaces. Companies have responded by introducing innovative products that prioritize both environmental and health considerations. In October 2024, Sri Sri Gaudhan Paints introduced a groundbreaking eco-friendly distemper made from cow dung. The product offers a safer, non-toxic option with antibacterial and antifungal properties, addressing common wall maintenance issues in humid regions. This launch not only provided an eco-conscious alternative but also positioned the brand as a leader in sustainable paint solutions. Moreover, the paint's availability in 1,600 shades allowed consumers to embrace environmentally responsible choices without compromising aesthetics. Unlike conventional paints containing volatile organic compounds (VOCs), this product minimized air pollution and health risks. By offering an odorless and quick-drying solution, it enhanced user convenience and safety. This development further diversified the distemper market by encouraging competition and motivating other manufacturers to adopt sustainable practices. Consumers, now more aware of eco-friendly options, increasingly preferred green coatings. As a result, Sri Sri Gaudhan Paints contributed to the market's shift toward sustainability, fostering long-term environmental benefits.

India Distemper Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, application, and resin type.

Type Insights:

- Oil Based Distemper

- Dry Distemper

The report has provided a detailed breakup and analysis of the market based on the type. This includes oil based distemper and dry distemper.

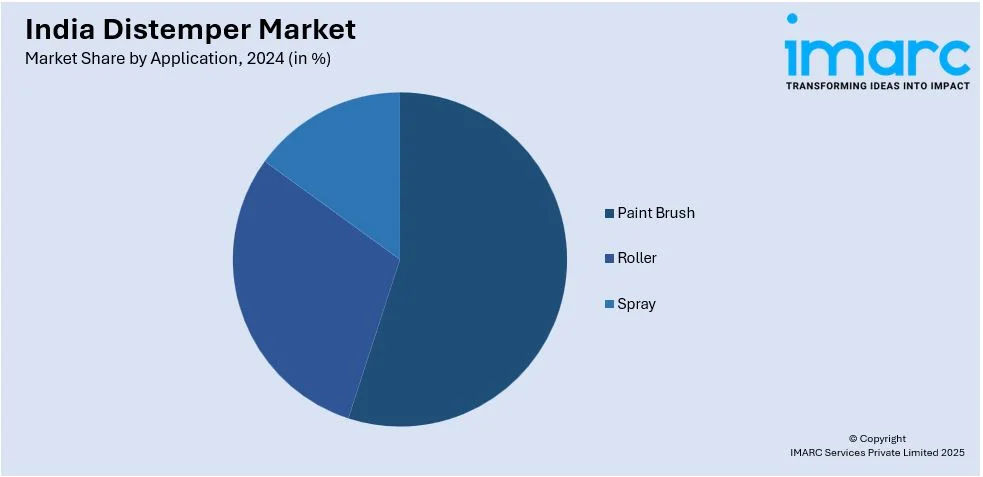

Application Insights:

- Paint Brush

- Roller

- Spray

The report has provided a detailed breakup and analysis of the market based on the application. This includes paint brush, roller, and spray.

Resin Type Insights:

- Acrylic

- Synthetic

- UNO Acrylic

The report has provided a detailed breakup and analysis of the market based on the resin type. This includes acrylic, synthetic, and UNO acrylic.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Distemper Market News:

- February 2025: Akzo Nobel India expanded its portfolio with Dulux Promise Freedom, a cost-effective emulsion offering superior durability, whiteness, and coverage. Positioned as an upgrade from traditional distemper, it increased competition in the Indian industry and provided consumers with an affordable, high-quality alternative.

- December 2024: Shalimar Paints introduced the Mela Series, including water-based distemper, addressing the demand for affordable and durable wall coatings. By targeting unpainted walls in rural areas, the initiative expanded market accessibility, driving growth in India's distemper segment through enhanced affordability and quality.

India Distemper Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Oil Based Distemper, Dry Distemper |

| Applications Covered | Paint Brush, Roller, Spray |

| Resin Types Covered | Acrylic, Synthetic, UNO Acrylic |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India distemper market performed so far and how will it perform in the coming years?

- What is the breakup of the India distemper market on the basis of type?

- What is the breakup of the India distemper market on the basis of application?

- What is the breakup of the India distemper market on the basis of resin type?

- What are the various stages in the value chain of the India distemper market?

- What are the key driving factors and challenges in the India distemper market?

- What is the structure of the India distemper market and who are the key players?

- What is the degree of competition in the India distemper market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India distemper market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India distemper market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India distemper industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)