India Distributed Antenna System Market Size, Share, Trends and Forecast by Offering, System Type, Coverage, Technology, End-Use, and Region, 2025-2033

India Distributed Antenna System Market Overview:

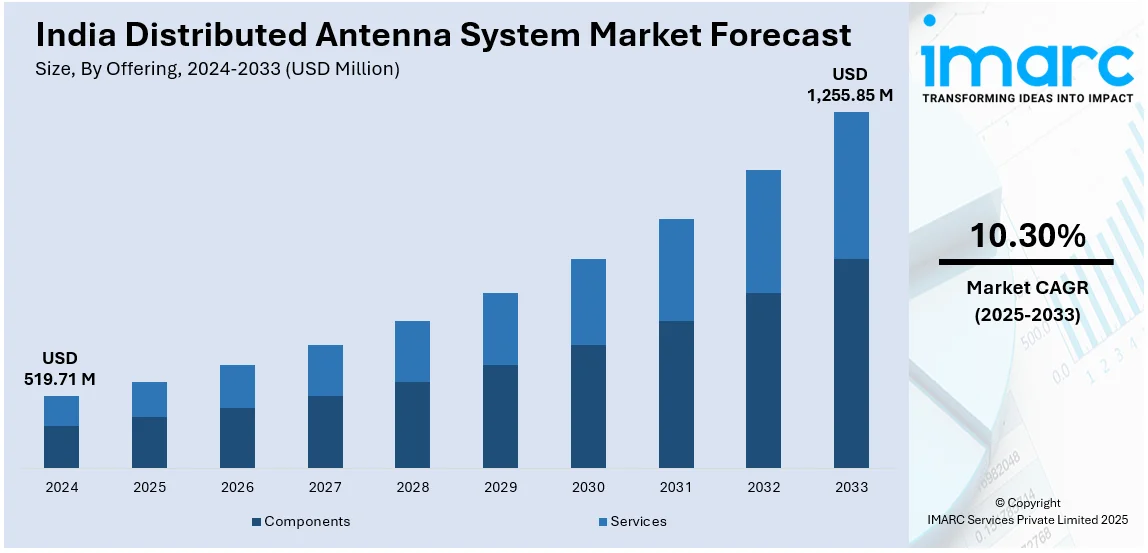

The India distributed antenna system market size reached USD 519.71 Million in 2024 Looking forward, IMARC Group expects the market to reach USD 1,255.85 Million by 2033 exhibiting a growth rate (CAGR) of 10.30% during 2025-2033 Rising mobile data traffic, expanding 5G deployment, and escalating demand for in-building coverage are driving the India distributed antenna system (DAS) market outlook. Additionally, the growing investments in the telecom sector, along with government initiatives further fuels its adoption, ensuring seamless connectivity across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 519.71 Million |

| Market Forecast in 2033 | USD 1,255.85 Million |

| Market Growth Rate (2025-2033) | 10.30% |

India Distributed Antenna System Market Trends:

Rising Mobile Data Traffic

The growing mobile data traffic is significantly influencing the India distributed antenna system market outlook, ensuring seamless connectivity across various sectors. Increasing smartphone penetration and digital transformation are leading to higher data consumption, encouraging telecom providers to enhance network infrastructure. With India’s internet user base expected to surpass 900 million by 2025, fueled by the growing adoption of Indic languages in digital content, the demand for high-speed internet is rising, as per market reports. Distributed antenna system (DAS) helps manage heavy data loads efficiently, improving network performance in crowded urban areas and indoor environments. The surge in video streaming, online gaming, and remote work is further contributing to mobile data growth. Public places like airports, malls, and stadiums require uninterrupted connectivity, increasing its deployments for better coverage. Businesses and industries depend on strong mobile networks for smooth operations, accelerating its adoption across sectors. Telecom companies are investing in DAS to prevent network congestion and ensure consistent service quality. Additionally, increased social media engagement and cloud-based services are boosting DAS installations nationwide.

To get more information on this market, Request Sample

Growing 5G Deployment

The rising need for high-speed, low-latency communication is driving telecom operators to expand 5G infrastructure nationwide. DAS plays a critical role in improving 5G signal coverage, especially in dense urban areas and large indoor environments. Since high frequency 5G signals struggle to penetrate buildings, DAS solutions are essential for ensuring seamless indoor connectivity. As enterprises adopt advanced technologies like artificial intelligence (AI) and Internet of Things (IoT), reliable 5G networks become crucial for smooth digital operations. Government initiatives supporting 5G expansion are further accelerating the adoption of distributed antenna system across various industries. The rising development of smart buildings and urban infrastructure is increasing the need for efficient network solutions, driving its deployment. Telecom providers are making significant investments in distributed antenna system to enhance 5G network quality and capacity. Notably, in November 2024, Nokia signed a multi-billion-dollar contract with Bharti Airtel to deliver 4G and 5G equipment, strengthening India's telecom infrastructure. This expansion supports the growing number of connected devices, ensuring stable network performance in high-traffic areas. Industries like healthcare, education, and retail are leveraging distributed antenna system to enhance digital experiences and operational efficiency. Moreover, the increasing prevalence of remote work and digital transactions is further fueling the India distributed antenna system market growth.

India Distributed Antenna System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on offering, system type, coverage, technology, and end-use.

Offering Insights:

- Components

- Services

The report has provided a detailed breakup and analysis of the market based on the offering. This includes components and services.

System Type Insights:

- Active

- Passive

- Digital

- Hybrid

A detailed breakup and analysis of the market based on the system type have also been provided in the report. This includes active, passive, digital, and hybrid.

Coverage Insights:

- Indoor

- Outdoor

The report has provided a detailed breakup and analysis of the market based on the coverage. This includes indoor and outdoor.

Technology Insights:

- Carrier Wi-Fi

- Small Cells

- Self-Organizing Network

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes carrier Wi-Fi, small cells, self-organizing network, and others.

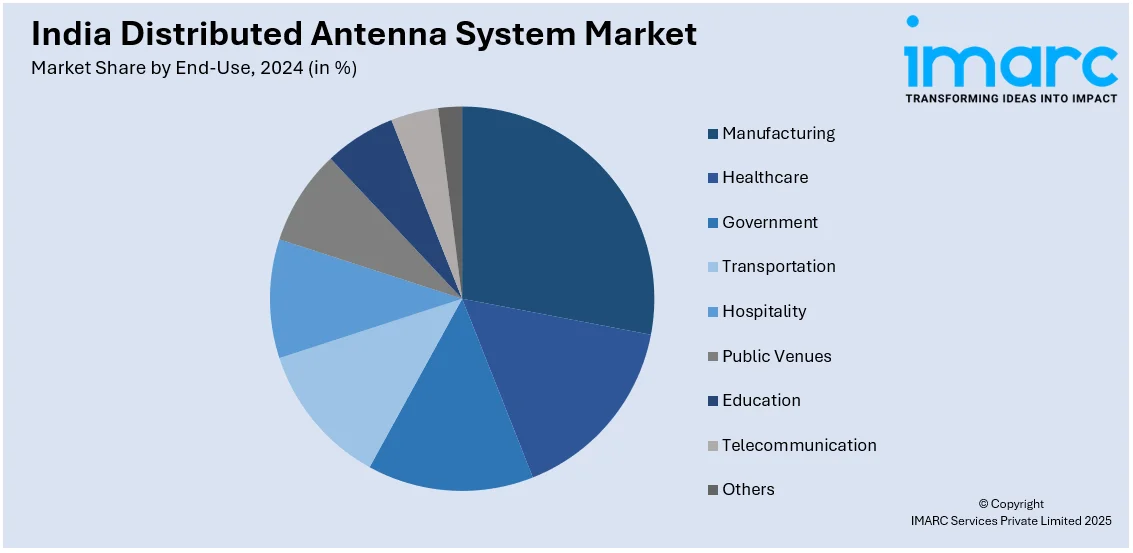

End-Use Insights:

- Manufacturing

- Healthcare

- Government

- Transportation

- Hospitality

- Public Venues

- Education

- Telecommunication

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes manufacturing, healthcare, government, transportation, hospitality, public venues, education, telecommunication, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Distributed Antenna System Market News:

- In December 2024, Bharti Airtel signed a multi-billion-dollar agreement with Swedish telecom giant Ericsson to enhance 4G and 5G network coverage across India. This agreement extends their two-decade-long partnership, reinforcing Airtel's commitment to advanced telecom infrastructure.

- In November 2024, Frog Cellsat Limited secured a contract to install its OneDAS (Active Distributed Antenna System) at Guwahati Airport’s new terminal, marking its fourth major airport project after successful deployments at Noida International Airport, Mumbai International Airport, and the upcoming Navi Mumbai International Airport.

India Distributed Antenna System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offerings Covered | Components, Services |

| System Types Covered | Active, Passive, Digital, Hybrid |

| Coverages Covered | Indoor, Outdoor |

| Technologies Covered | Carrier Wi-Fi, Small Cells, Self-Organizing Network, Others |

| End-Uses Covered | Manufacturing, Healthcare, Government, Transportation, Hospitality, Public Venues, Education, Telecommunication, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India distributed antenna system market from 2019-2033

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India distributed antenna system market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India distributed antenna system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The distributed antenna system market in India was valued at USD 519.71 Million in 2024.

The India distributed antenna system market is projected to exhibit a CAGR of 10.30% during 2025-2033, reaching a value of USD 1,255.85 Million by 2033.

Rising mobile data traffic, expanding 5G rollout, growing investments in telecom infrastructure, and increasing demand for seamless in-building coverage are driving market growth. The surge in smartphone usage, video streaming, smart cities, and enterprise digitalization is boosting the need for efficient network solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)