India DNA Testing Market Size, Share, Trends and Forecast by Product Type, Technology, Application, and Region, 2025-2033

India DNA Testing Market Overview:

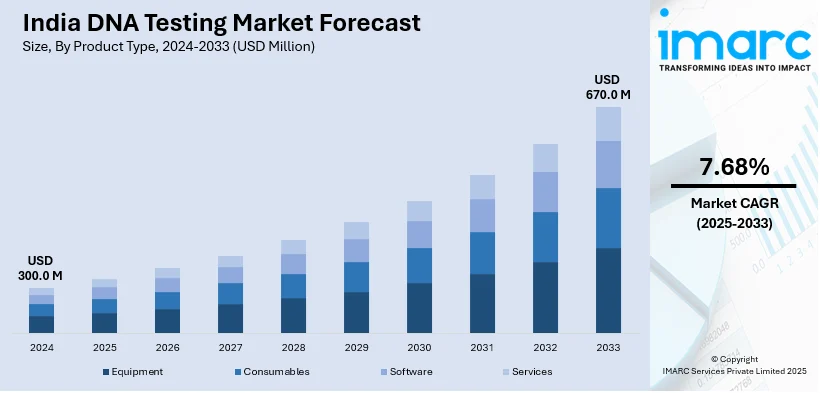

The India DNA testing market size reached USD 300.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 670.0 Million by 2033, exhibiting a growth rate (CAGR) of 7.68% during 2025-2033. The market is driven by rising prevalence of genetic disorders, increasing demand for personalized medicine, growing awareness about ancestry and health-related genetic testing, advancements in genomic technologies, and numerous government initiatives supporting biotechnology, making DNA testing more accessible and affordable for early disease detection, diagnosis, and treatment planning.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 300.0 Million |

| Market Forecast in 2033 | USD 670.0 Million |

| Market Growth Rate 2025-2033 | 7.68% |

India DNA Testing Market Trends:

Increasing Prevalence of Genetic Disorders and Chronic Diseases

The growing prevalence of genetic disorders and chronic diseases in India has led to a rising need for sophisticated diagnostic tools, such as DNA testing. Genetic disorders like thalassemia, sickle cell anemia, and specific inherited cancers are of specific concern. Early detection by means of genetic testing allows for early intervention, tailored treatment protocols, and informed reproductive decisions. As per the Department of Biotechnology's Annual Report 2021, an effort has been made toward dealing with genetic disorders through R&D activities. The report points toward progress in diagnostic technology and therapeutic approaches to reducing the effects of these disorders. Additionally, the National Biotechnology Development Strategy 2021-25 lays out the government's pledge to develop the biotechnology industry, which includes genetic testing services. The strategy looks to improve the delivery of healthcare by incorporating the use of modern biotechnological tools, and thus the treatment of genetic disorders and chronic conditions. The growing prevalence of chronic diseases, including cardiovascular ailments and diabetes, also fuels the need for genetic testing. Determining genetic predispositions allows individuals to implement preventive strategies and clinicians to individualize treatment protocols appropriately. This individualized approach not only enhances patient outcomes but also maximizes healthcare resources.

To get more information on this market, Request Sample

Technological Advancements in Genetic Testing

Innovations in technology have tremendously increased the precision, access, and price affordability of genetic testing in India. Next-Generation Sequencing (NGS) and Polymerase Chain Reaction (PCR)-based diagnostic innovations have completely changed the arena of work to encompass full-scale genomic studies at lesser expenses. Indian Biological Data Centre (IBDC) is an integrated repository providing a wide range of biological datasets such as nucleotide sequences and proteomic data. This centralized platform makes research and development in genetic testing possible and allows for the development of more effective diagnostic tools. Furthermore, the Central Drugs Standard Control Organisation (CDSCO) has streamlined the process for the approval of recombinant DNA (r-DNA) origin drugs, promoting a positive climate for innovation in genetic testing technology. The organization’s January 2025 updated list of approved r-DNA origin drugs is a manifestation of the rising uptake of state-of-the-art biotechnological products in the healthcare system. These technological innovations not only enhanced the quality of genetic testing but also made it accessible to a larger population. As the cost declines further and precision escalates, the uptake of genetic testing is anticipated to penetrate further, driving the growth of the market.

India DNA Testing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, technology, and application.

Product Type Insights:

- Equipment

- DNA Analyzers

- PCR (Polymerase Chain Reaction) Machines

- Sequencers

- Electrophoresis Systems

- Others

- Consumables

- Reagents and Kits

- PCR Consumables

- Primers

- Probes

- DNA Extraction Kits

- Sample Collection Devices

- Others

- Software

- Data Analysis Software

- Laboratory Information Management System (LIMS)

- Genetic Analysis Software

- Bioinformatics Software

- Others

- Services

- Testing Services

- Genetic Testing

- Forensic Testing

- Others

- Data Interpretation Services

- Consultation Services

- Genetic Counseling

- Laboratory Services

- Sample Processing

- DNA Sequencing Services

- Others

- Testing Services

The report has provided a detailed breakup and analysis of the market based on the product type. This includes equipment (DNA analyzers, PCR (Polymerase Chain Reaction) machines, sequencers, electrophoresis systems, and others), consumables (reagents and kits, PCR consumables (primers, probes), DNA extraction kits, sample collection devices, and others), software (data analysis software, laboratory information management system (LIMS), genetic analysis software, bioinformatics software, and others), services (testing services (genetic testing, forensic testing, and others), data interpretation services, consultation services (genetic counseling), laboratory services (sample processing, DNA sequencing services), and others.

Technology Insights:

- Polymerase Chain Reaction (PCR) Based

- In-Situ Hybridization

- Microarray

- Next-Generation Sequencing (NGS) DNA Diagnosis

A detailed breakup and analysis of the market based on technology have also been provided in the report. This includes polymerase chain reaction (PCR) based, in-situ hybridization, microarray, and next-generation sequencing (NGS) DNA diagnosis.

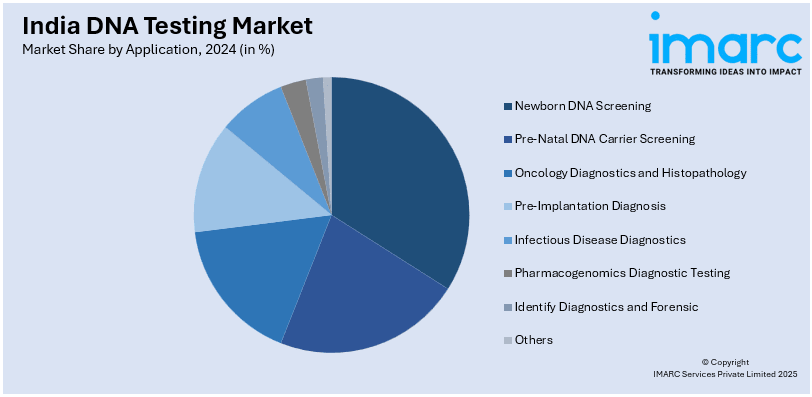

Application Insights:

- Newborn DNA Screening

- Pre-Natal DNA Carrier Screening

- Oncology Diagnostics and Histopathology

- Pre-Implantation Diagnosis

- Infectious Disease Diagnostics

- Pharmacogenomics Diagnostic Testing

- Identify Diagnostics and Forensic

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes newborn DNA screening, pre-natal DNA carrier screening, oncology diagnostics and histopathology, pre-implantation diagnosis, infectious disease diagnostics, pharmacogenomics diagnostic testing, identify diagnostics and forensic, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India DNA Testing Market News:

- February 2025: Metropolis Healthcare collaborated with Roche to launch HPV DNA testing in India, with the goal of improving early detection of cervical cancer. The partnership broadens access to sophisticated genetic diagnostics, enhancing disease prevention and treatment. The initiative propels the India DNA testing market by boosting awareness and adoption of molecular diagnostics.

- February 2025: Strand Life Sciences unveiled a portal for rare disease diagnosis and ushered in genetic testing at reasonable costs in India. The development has the intent to enhance the detection and management of rare genetic diseases at the early stages with more accessible DNA testing. Widespread adoption levels and awareness through the expansion of reasonably priced genetic testing are fueling the India DNA testing market.

India DNA Testing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Technologies Covered | Polymerase Chain Reaction (PCR) Based, In-Situ Hybridization, Microarray, Next-Generation Sequencing (NGS) DNA Diagnosis |

| Applications Covered | Newborn DNA Screening, Pre-Natal DNA Carrier Screening, Oncology Diagnostics and Histopathology, Pre-Implantation Diagnosis, Infectious Disease Diagnostics, Pharmacogenomics Diagnostic Testing, Identify Diagnostics and Forensic, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India DNA testing market performed so far and how will it perform in the coming years?

- What is the breakup of the India DNA testing market on the basis of product type?

- What is the breakup of the India DNA testing market on the basis of technology?

- What is the breakup of the India DNA testing market on the basis of application?

- What are the various stages in the value chain of the India DNA testing market?

- What are the key driving factors and challenges in the India DNA testing market?

- What is the structure of the India DNA testing market and who are the key players?

- What is the degree of competition in the India DNA testing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India DNA testing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India DNA testing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India DNA testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)