India Domestic Air Cargo Transport Market Size, Share, Trends and Forecast by Service Type, Cargo Type, Aircraft Type, End-User Industry, and Region, 2025-2033

India Domestic Air Cargo Transport Market Overview:

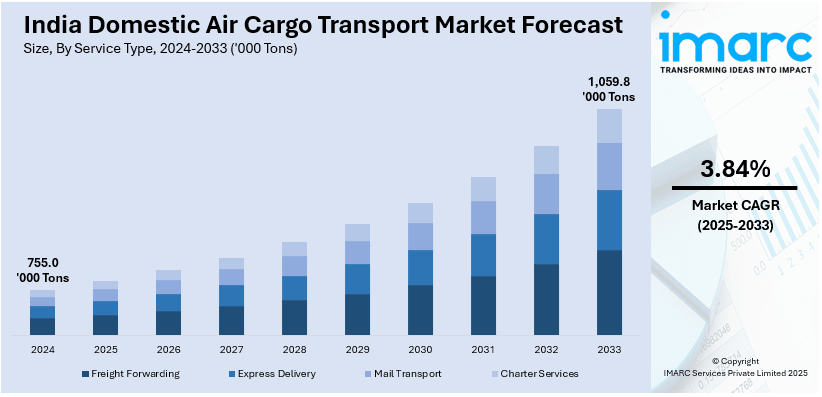

The India domestic air cargo transport market size reached 755.0 Thousand Metric Tons in 2024. Looking forward, IMARC Group expects the market to reach 1,059.8 Thousand Metric Tons by 2033, exhibiting a growth rate (CAGR) of 3.84% during 2025-2033. Rising e-commerce demand, express delivery services, time-sensitive shipments, increasing trade volumes, expansion of regional airports, government initiatives, infrastructure upgrades, and technological advancements in cargo tracking and logistics management are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 755.0 Thousand Metric Tons |

| Market Forecast in 2033 | 1,059.8 Thousand Metric Tons |

| Market Growth Rate 2025-2033 | 3.84% |

India Domestic Air Cargo Transport Market Trends:

Expansion of Dedicated Cargo Operations

India's domestic air cargo sector is undergoing a substantial change toward the formation of independent cargo operations with specialized freighter fleets. This strategy aims to increase cargo capacity to satisfy rising demand caused by the rise of e-commerce, medicines, and perishable products transportation. Airlines are aggressively investing in specialized cargo infrastructure, which improves connectivity on regional and international routes. Partnerships and consumer involvement initiatives are also gaining traction, promoting seamless logistical solutions. With the government's sustained emphasis on logistical infrastructure and supporting regulations, the industry is primed for rapid growth. The emergence of dedicated cargo carriers is projected to improve operating efficiency, optimize cargo handling, and shorten transit times, therefore contributing to the overall modernization of the country's air freight network. This progression illustrates the expanding role of air freight in facilitating commerce and economic growth. For example, in July 2024, Air India announced plans to carve out a separate cargo entity with dedicated freighters, aiming to increase cargo volumes to 2.5 million tons by 2027. The airline initiated a program to onboard, engage, and expand with regional, national, and global customers.

To get more information on this market, Request Sample

Emphasis on Multimodal Logistics Solutions

The domestic air cargo industry in India is implementing multimodal logistics technologies to boost efficiency and simplify supply chain operations. Integrating air cargo with road, rail, and maritime transportation networks is becoming increasingly important in ensuring regional connectivity. This integrated strategy enables speedier delivery, lowers costs, and removes logistical bottlenecks. Logistics providers, politicians, and multinational corporations are working together to optimize infrastructure and increase last-mile connectivity. The emphasis on multimodal logistics complements the government's attempts to improve trade facilitation and meet ambitious cargo volume objectives. With technological developments, real-time tracking, and automation, companies may better manage inventories and ensure timely delivery. This integrated logistics network is intended to boost the domestic air freight ecosystem, fostering economic growth and meeting the growing needs of e-commerce and other important industries. For instance, in February 2024, Air Cargo India 2024, held at the Jio World Convention Centre in Mumbai, focused on multimodal logistics solutions to bolster India's logistics network. The event welcomed participation from over 300 global brands and hosted approximately 12,000 visitors representing 50 countries.

India Domestic Air Cargo Transport Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on service type, cargo type, aircraft type, and end-user industry.

Service Type Insights:

- Freight Forwarding

- Express Delivery

- Mail Transport

- Charter Services

The report has provided a detailed breakup and analysis of the market based on the service type. This includes freight forwarding, express delivery, mail transport, and charter services.

Cargo Type Insights:

- General Cargo

- Perishable Goods

- Pharmaceuticals and Healthcare Products

- Electronics and High-Value Goods

- E-commerce Shipments

- Automotive Parts and Machinery

A detailed breakup and analysis of the market based on the cargo type have also been provided in the report. This includes general cargo, perishable goods, pharmaceuticals and healthcare products, electronics and high-value goods, e-commerce shipments, and automotive parts and machinery.

Aircraft Type Insights:

- Dedicated Freighters

- Passenger Belly Cargo

- UAVs (Drones)

The report has provided a detailed breakup and analysis of the market based on the aircraft type. This includes dedicated freighters, passenger belly cargo, and UAVs (drones).

End-User Industry Insights:

- E-commerce

- Manufacturing and Industrial

- Retail and FMCG

- Healthcare and Pharmaceuticals

- Agriculture and Seafood

A detailed breakup and analysis of the market based on the end-user industry have also been provided in the report. This includes e-commerce, manufacturing and industrial, retail and FMCG, healthcare and pharmaceuticals, and agriculture and seafood.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Domestic Air Cargo Transport Market News:

- In January 2025, Blue Dart Express inaugurated India's largest low-emission integrated logistics center at Bijwasan, Delhi. The 2.5 lakh sq ft facility aimed to improve land and air connections in northern India, handling up to 550,000 inbound and outbound shipments daily.

- In December 2024, Afcom Holdings, a Chennai-based cargo airline, received its Air Operator's Certificate from the Directorate General of Civil Aviation. The airline planned to commence regular scheduled operations in 2025, focusing on enhancing domestic cargo transport capabilities.

India Domestic Air Cargo Transport Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Thousand Metric Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Freight Forwarding, Express Delivery, Mail Transport, Charter Services |

| Cargo Types Covered | General Cargo, Perishable Goods, Pharmaceuticals and Healthcare Products, Electronics and High-Value Goods, E-commerce Shipments, Automotive Parts and Machinery |

| Aircraft Types Covered | Dedicated Freighters, Passenger Belly Cargo, UAVs (Drones) |

| End-User Industries Covered | E-commerce, Manufacturing and Industrial, Retail and FMCG, Healthcare and Pharmaceuticals, Agriculture and Seafood |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India domestic air cargo transport market performed so far and how will it perform in the coming years?

- What is the breakup of the India domestic air cargo transport market on the basis of service type?

- What is the breakup of the India domestic air cargo transport market on the basis of cargo type?

- What is the breakup of the India domestic air cargo transport market on the basis of aircraft type?

- What is the breakup of the India domestic air cargo transport market on the basis of end-user industry?

- What are the various stages in the value chain of the India domestic air cargo transport market?

- What are the key driving factors and challenges in the India domestic air cargo transport?

- What is the structure of the India domestic air cargo transport market and who are the key players?

- What is the degree of competition in the India domestic air cargo transport market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India domestic air cargo transport market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India domestic air cargo transport market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India domestic air cargo transport industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)