India Dried Fruits and Nuts Market Size, Share, Trends and Forecast by Type, Category, Application, and Region, 2026-2034

India Dried Fruits and Nuts Market Summary:

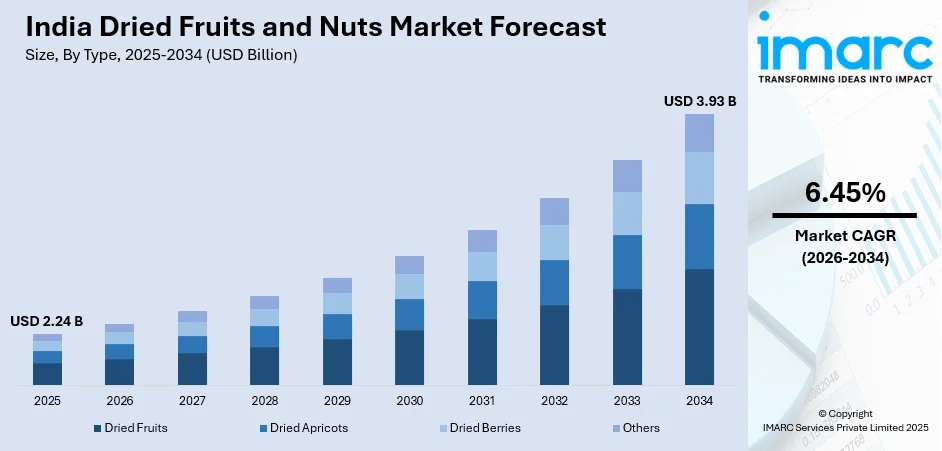

The India dried fruits and nuts market size was valued at USD 2.24 Billion in 2025 and is projected to reach USD 3.93 Billion by 2034, growing at a compound annual growth rate of 6.45% from 2026-2034.

The India dried fruits and nuts market is experiencing robust growth, driven by evolving consumer preferences towards healthier food items and increasing awareness of nutritional benefits. Rising disposable incomes across urban and semi-urban regions have enabled greater spending on premium snack categories, while expanding retail infrastructure and e-commerce penetration have improved product accessibility nationwide. Government initiatives supporting horticulture development and food processing sectors continue to strengthen domestic production capabilities and supply chain efficiency across the India dried fruits and nuts market share.

Key Takeaways and Insights:

-

By Type: Dried fruits dominate the market with a share of 46.07% in 2025, owing to their widespread culinary applications, nutritional density, and cultural significance in traditional Indian cuisine. The versatility of dried fruits in bakery, confectionery, and direct consumption fuels sustained demand across consumer segments.

-

By Category: Conventional leads the market with a share of 72.09% in 2025. This dominance is driven by established supply chains, competitive pricing structures, and broad consumer familiarity with traditionally sourced products available through extensive distribution networks.

-

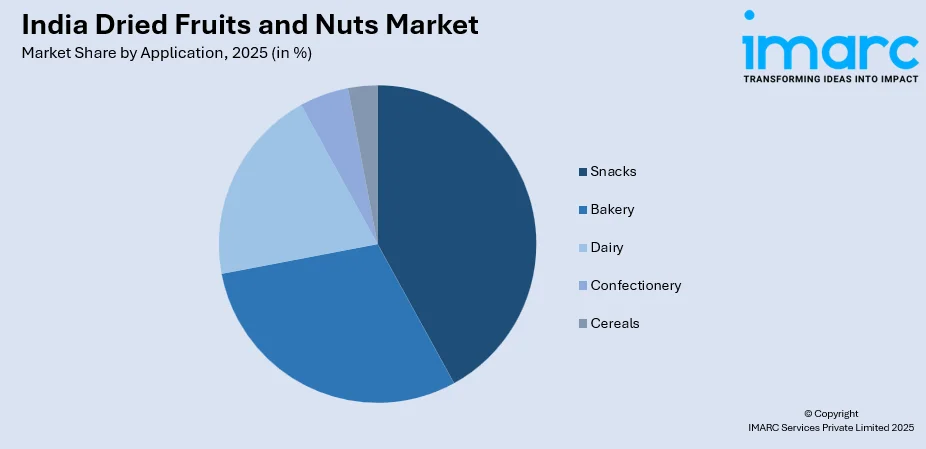

By Application: Snacks represent the largest segment with a market share of 42.12% in 2025, reflecting the growing consumer preferences for convenient, nutrient-rich snacking alternatives that align with modern lifestyles and health-conscious dietary choices throughout India.

-

By Region: North India comprises the largest region with 32% share in 2025, driven by higher disposable incomes, strong cultural traditions incorporating dried fruits in festive celebrations, and concentration of major metropolitan consumption hubs, including Delhi and Chandigarh.

-

Key Players: Key players drive the India dried fruits and nuts market by expanding product portfolios, enhancing quality standards, and strengthening nationwide distribution networks. Their investments in branding, processing technology, and strategic partnerships with retailers accelerate market penetration and consumer awareness.

To get more information on this market Request Sample

The India dried fruits and nuts market continues to evolve rapidly, propelled by transformative changes in consumer eating habits and the growing emphasis on functional nutrition. Health-conscious consumers increasingly prioritize nutrient-dense snacking options, driving the demand for almonds, cashews, raisins, dates, and various dried berries across demographic segments. The expansion of organized retail channels and quick-commerce platforms has democratized access to premium dried fruits and nuts, reaching consumers in tier-two and tier-three cities. According to the Nuts and Dry Fruits Council of India, consumption of dried fruits witnessed a notable increase of 20% in 2023, underscoring the market's strong momentum. Product innovations through value-added offerings, including flavored variants, trail mixes, and fortified snack bars, address diverse consumption occasions. The festive gifting culture remains a significant demand driver, with dried fruits maintaining traditional prominence in celebratory occasions. Furthermore, institutional demand from bakery, confectionery, and dairy industries provides stable consumption patterns, complementing the direct-to-consumer (D2C) retail segment.

India Dried Fruits and Nuts Market Trends:

Rising Preferences for Healthy Snacking Alternatives

Indian consumers are increasingly gravitating towards nutrient-rich snacking options that align with wellness-focused lifestyles. Health awareness has intensified among the urban population seeking convenient alternatives to traditional calorie-dense snacks. The Farmley Healthy Snacking Report 2024 revealed that makhanas and dried fruits emerged as preferred choices for 67% of Indian consumers surveyed in 2024. This behavioral shift is particularly pronounced among millennials and Generation Z consumers who prioritize clean-label products. The trend is reshaping product development strategies across the industry, driving innovations in packaging formats and flavor profiles.

Digital Commerce Transformation in Distribution Channels

E-commerce and quick-commerce platforms are fundamentally reshaping how consumers purchase dried fruits and nuts across India. As per IMARC Group, the India e-commerce market size reached USD 107.7 Billion in 2024. Digital retail channels provide unprecedented accessibility to premium products, particularly benefiting consumers in smaller towns previously underserved by organized retail. Online platforms enable direct brand-consumer engagement while offering extensive product assortments and competitive pricing. This digital transformation is accelerating market penetration across geographic regions.

Product Innovations and Value-Added Offerings

Market participants are introducing innovative product formulations to capture evolving consumer preferences and create differentiated positioning. Value-added products, including flavored nuts, trail mixes, date-based snacks, and nut butter variants, are gaining significant traction. In June 2024, Nutraj launched the NutrajSnackrite Daily Nutrition Pack containing twenty-one packets of trail mix. The Snackrite collection united the health benefits of nuts, seeds, and dried fruits into creative blends, perfect for convenient snacking or daily nutritional consumption. These innovations address diverse consumption occasions while commanding premium price points. The trend of premiumization is encouraging investments in processing capabilities and new product development.

Market Outlook 2026-2034:

The India dried fruits and nuts market demonstrates strong fundamentals for sustained expansion through the forecast period, supported by favorable demographic trends and evolving consumption patterns. Increasing urbanization continues to drive the demand for convenient, nutritious food options among working professionals and health-conscious households. The market generated a revenue of USD 2.24 Billion in 2025 and is projected to reach a revenue of USD 3.93 Billion by 2034, growing at a compound annual growth rate of 6.45% from 2026-2034. Investment flows into processing infrastructure, cold chain development, and brand building are strengthening market capabilities while government support for horticulture and food processing industries provides enabling policy environment for industry expansion.

India Dried Fruits and Nuts Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Dried Fruits |

46.07% |

|

Category |

Conventional |

72.09% |

|

Application |

Snacks |

42.12% |

|

Region |

North India |

32% |

Type Insights:

- Dried Fruits

- Dried Apricots

- Dried Berries

- Others

Dried fruits dominate with a market share of 46.07% of the total India dried fruits and nuts market in 2025.

The dried fruits segment maintains commanding market presence driven by deep-rooted culinary traditions and widespread household consumption patterns across India. Products, including raisins, dates, figs, and prunes, serve multiple purposes, ranging from direct snacking to incorporation in traditional sweets and savory preparations. The segment benefits from established supply chains and extensive retail availability through both organized and unorganized channels. As per OEC, in 2023, India exported USD 28.5M worth of dried fruits, ranking it as the 20th largest exporter of dried fruits (from 181) globally.

Consumer preferences continue to evolve towards premium quality dried fruits with emphasis on origin traceability and processing standards. The bakery and confectionery industries represent significant institutional demand channels, utilizing dried fruits as key ingredients in cakes, cookies, and traditional mithai preparations. Festival seasons amplify consumption, as dried fruits feature prominently in gifting traditions and celebratory cooking. Product innovations, including flavored variants and convenient single-serve packaging formats are expanding consumption occasions beyond traditional use cases.

Category Insights:

- Organic

- Conventional

Conventional leads with a share of 72.09% of the total India dried fruits and nuts market in 2025.

The conventional category maintains overwhelming market dominance, supported by established agricultural practices, competitive pricing structures, and extensive distribution infrastructure reaching consumers across geographic segments. Conventional products benefit from mature supply chains connecting farmers to processors and ultimately retailers, ensuring consistent product availability and price stability. The segment's accessibility through traditional retail channels, including kirana stores, mandis, and modern trade outlets, ensures broad consumer reach.

Mass market positioning enables conventional dried fruits and nuts to address price-sensitive consumer segments while maintaining acceptable quality standards. The online retail sector in India is expected to attain INR 22,27,940 Crore (USD 260 Billion) by 2030 from an anticipated amount of INR 642,675 Crore (USD 75 Billion) by 2024, highlighting the digital transformation's contribution to conventional product distribution. Processing advancements in drying technologies, packaging innovations, and preservation methods continue to enhance product quality and shelf life across the conventional segment.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Bakery

- Dairy

- Snacks

- Confectionery

- Cereals

Snacks exhibit a clear dominance with a 42.12% share of the total India dried fruits and nuts market in 2025.

The snacks application segment demonstrates robust growth momentum, as consumers increasingly substitute traditional fried snacks with healthier alternatives featuring dried fruits and nuts. Busy urban lifestyles and growing health consciousness drive demand for convenient, nutrient-dense snacking options that deliver sustained energy without compromising nutritional quality.

Product innovations through trail mixes, flavored nut varieties, and portion-controlled packaging formats address diverse consumption occasions from office snacking to post-workout nutrition. Quick-commerce platforms have significantly enhanced accessibility of premium snack products, enabling impulse purchases and expanding the addressable consumer base. The segment benefits from evolving snacking patterns among younger demographics who prioritize ingredients transparency and functional nutrition in their food choices.

Regional Insights:

- North India

- South India

- East India

- West India

North India represents the leading segment with a 32% share of the total India dried fruits and nuts market in 2025.

North India commands the largest regional market share, driven by higher disposable income levels, greater health awareness, and deeply entrenched cultural traditions incorporating dried fruits in daily consumption and festive celebrations. Major metropolitan centers, including Delhi, Chandigarh, and Lucknow, serve as primary consumption hubs with well-developed retail infrastructure and strong modern trade penetration. The region's affluent consumer base demonstrates willingness to pay premium prices for quality products and imported varieties.

Consumption patterns in North India have historically been concentrated but are expanding to tier-two and tier-three cities through improved distribution networks and e-commerce reach. The region's prominence in festivals, such as Diwali, and wedding seasons drives significant seasonal demand spikes for dried fruits as gifting items and cooking ingredients. Delhi was projected to have over 4.5 Lakh weddings during November-December 2024, as per information from the Confederation of All India Traders. Cold storage infrastructure development in northern states supports supply chain efficiency while proximity to major import gateways facilitates access to international varieties.

Market Dynamics:

Growth Drivers:

Why is the India Dried Fruits and Nuts Market Growing?

Escalating Health Consciousness and Dietary Transformation

The growing awareness regarding nutritional benefits is fundamentally reshaping food consumption patterns across Indian demographics. Consumers are increasingly prioritizing nutrient-dense foods rich in proteins, vitamins, minerals, antioxidants, and dietary fiber as healthier alternatives to processed snacks. This shift is particularly pronounced among the urban population seeking functional nutrition that supports active lifestyles and wellness goals. The trend of preventive healthcare is encouraging dietary modifications favoring whole foods over processed alternatives. Educational initiatives and social media influence continue to amplify consciousness about the health benefits associated with regular nut consumption. With increasing emphasis on health and wellness, the market is set to expand. As per IMARC Group, the India health and wellness market size is set to attain USD 256.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.3% during 2025-2033.

Expanding E-commerce and Modern Retail Infrastructure

Digital commerce transformation is revolutionizing distribution landscapes and enhancing product accessibility across geographic regions previously underserved by organized retail. Online platforms and quick-commerce applications have democratized access to premium dried fruits and nuts, enabling consumers in smaller towns to purchase quality products conveniently. India registered 886 Million internet users in 2024, with online grocery sales gaining significant momentum across consumer categories. Modern retail expansion through supermarket chains, hypermarkets, and specialty food stores provides enhanced shopping experiences with curated product assortments. The proliferation of dedicated health food sections within retail environments elevates category visibility while digital platforms enable direct brand-consumer engagement. Additionally, data-driven personalization and targeted promotions on digital platforms improve customer acquisition and repeat purchases. Efficient cold-chain logistics and faster last-mile delivery further strengthen consumer trust and support sustained growth in the dried fruits and nuts market.

Cultural, Festive, and Gifting Consumption Patterns

Cultural traditions and festive consumption strongly drive the demand for dried fruits and nuts in India. Nuts and dried fruits hold symbolic value during festivals, weddings, and religious occasions, making them essential components of celebrations and gifting practices. Demand spikes during festivals, such as Diwali, Eid, Raksha Bandhan, and weddings, supporting seasonal sales growth. Premium packaging and gift boxes enhance appeal for corporate and personal gifting. Increasing preference for healthy gifting alternatives further boosts category demand. Urban consumers increasingly replace traditional sweets with dried fruits and nut assortments due to health considerations. Hospitality and social gatherings also contribute to bulk consumption. These culturally embedded consumption patterns provide consistent baseline demand while seasonal peaks deliver revenue surges. The combination of tradition and evolving health preferences ensures long-term relevance of dried fruits and nuts across generations.

Market Restraints:

What Challenges is the India Dried Fruits and Nuts Market Facing?

Price Volatility and Commodity Market Fluctuations

Dried fruits and nuts prices remain susceptible to global commodity market fluctuations, currency exchange rate variations, and seasonal production variabilities that impact affordability for price-sensitive consumers. Import dependency for premium varieties amplifies exposure to international price movements and trade policy changes. Additionally, sudden price spikes often force retailers to adjust pack sizes or pricing strategies, which can dampen consumption growth and affect long-term demand stability.

Import Dependency and Supply Chain Vulnerabilities

Heavy reliance on imports for certain dried fruit and nut varieties creates supply chain vulnerabilities and exposes the market to geopolitical and trade disruption risks. India's position as the world's largest importer necessitates robust logistics infrastructure and strategic sourcing diversification to ensure consistent product availability. Moreover, extended transit times and port congestion can disrupt inventory planning, increasing holding costs and limiting responsiveness to sudden demand surges.

Infrastructure Constraints and Cold Chain Limitations

Inadequate cold storage infrastructure and processing facilities in certain regions constrain supply chain efficiency and product quality maintenance throughout distribution networks. These infrastructure gaps particularly affect product freshness and shelf life in emerging consumption markets beyond major metropolitan centers. Furthermore, limited access to modern warehousing raises post-harvest losses and increases wastage, reducing overall market efficiency and profitability.

Competitive Landscape:

The India dried fruits and nuts market exhibits a fragmented competitive structure with presence spanning large established players, emerging D2C brands, and extensive unorganized sector participation. Leading market participants focus on product quality differentiation, brand building, and distribution network expansion to capture market share. Companies invest significantly in processing infrastructure, backward integration with farming communities, and innovative product development to strengthen competitive positioning. Strategic partnerships with e-commerce platforms and modern retailers are helping brands enhance visibility and reach across urban and semi-urban markets. Additionally, increased emphasis on sustainable sourcing and transparent supply chains is becoming a key differentiator in gaining long-term consumer trust.

Recent Developments:

-

In May 2025, Farmley completed a USD 42 Million Series C funding round led by global consumer-focused investment firm L Catterton, with participation from existing shareholders, including DSG Consumer Partners. The investment positioned the healthy snacking brand to further scale the dried fruits and nuts segment across India through regional market expansion, product innovations, and advanced food technology development.

-

In February 2025, the Nuts and Dry Fruits Council of India hosted the second edition of MEWA India 2025 at the Jio World Convention Centre in Mumbai. The opening event highlighted a lively display of the sector, comprising an enlightening panel discussion and an engaging culinary presentation that provided guests with a look at the varied ‘flavors of India’s nuts and dried fruit selections’.

India Dried Fruits and Nuts Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Dried Fruits, Dried Apricots, Dried Berries, Others |

| Categories Covered | Organic, Conventional |

| Applications Covered | Bakery, Dairy, Snacks, Confectionery, Cereals |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India dried fruits and nuts market size was valued at USD 2.24 Billion in 2025.

The India dried fruits and nuts market is expected to grow at a compound annual growth rate of 6.45% from 2026-2034 to reach USD 3.93 Billion by 2034.

Dried fruits dominated the market with a share of 46.07%, driven by widespread culinary applications, cultural significance in traditional cuisine, and versatile usage across bakery, confectionery, and direct consumption segments.

Key factors driving the India dried fruits and nuts market include rising health consciousness among consumers, expanding e-commerce and modern retail infrastructure, growing disposable incomes, government support for horticulture development, and increasing demand for convenient and nutritious snacking alternatives.

Major challenges include price volatility due to commodity market fluctuations, heavy dependence on imports for certain premium varieties, inadequate cold storage infrastructure in emerging markets, supply chain complexities, and competition from the unorganized sector with lower quality standards.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)