India Driver Assistance Systems Market Size, Share, Trends and Forecast by Type, Technology, Vehicle Type, and Region, 2025-2033

India Driver Assistance Systems Market Overview:

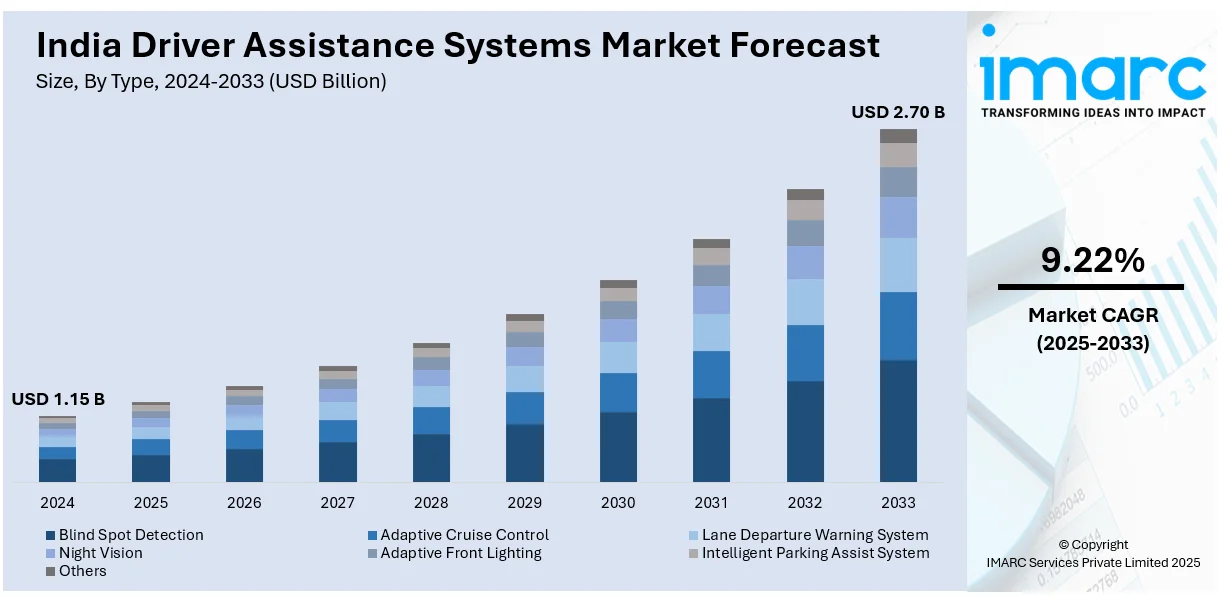

The India driver assistance systems market size reached USD 1.15 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.70 Billion by 2033, exhibiting a growth rate (CAGR) of 9.22% during 2025-2033. The market is witnessing steady growth due to the increasing focus on road safety, rising vehicle automation, and growing consumer awareness. Advancements in sensor technologies and government initiatives promoting vehicle safety features are further driving adoption. Both domestic and global automotive players are enhancing their offerings to meet evolving demands. These trends are shaping a competitive landscape for the India driver assistance systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.15 Billion |

| Market Forecast in 2033 | USD 2.70 Billion |

| Market Growth Rate 2025-2033 | 9.22% |

India Driver Assistance Systems Market Trends:

Rising Focus on Road Safety

India has one of the highest road accident rates globally, prompting urgent calls for improved vehicle safety. Government initiatives, such as the Bharat New Vehicle Safety Assessment Program (BNVSAP), and rising consumer awareness are pushing automakers to adopt advanced driver assistance systems (ADAS). Features like automatic emergency braking, lane departure warnings, and adaptive cruise control are being increasingly integrated into vehicles to reduce accidents and fatalities. The focus on road safety is no longer limited to premium vehicles, mid-range and even budget segments are gradually incorporating these technologies. As consumers become more conscious of safety ratings and features, the demand for driver assistance systems is expected to continue growing across diverse vehicle categories. For instance, in March 2025, Honda Automobile India Pvt. Ltd. (HCIL), a top producer of luxury vehicles in India, achieved a significant sales achievement with 50,000 ADAS-equipped Honda cars currently operating on Indian streets. This accomplishment highlights HCIL’s dedication to Honda’s worldwide vision of “Safety for Everyone” and its objective to reach zero traffic collision deaths involving Honda motorcycles and cars by 2050.

To get more information on this market, Request Sample

Government Regulations and Safety Mandates

The Indian government has taken proactive steps to enhance vehicle safety standards, mandating the inclusion of basic safety features such as airbags and ABS in new vehicles. These measures have paved the way for more advanced systems like ADAS. Regulatory frameworks, both existing and upcoming, are encouraging OEMs to integrate safety-enhancing technologies to comply with evolving norms. Additionally, incentives and guidelines related to vehicle safety testing and compliance are accelerating the adoption of advanced driver assistance features. As regulatory bodies continue to tighten safety mandates and push for international standards alignment, manufacturers are increasingly investing in research, development, and integration of ADAS technologies, thereby driving the India driver assistance systems market growth. For instance, in November 2023, the Bengaluru Metropolitan Transport Corporation (BMTC) implemented Advanced Driver Assistance System (ADAS) technology in ten buses as a pilot project to increase safety and reduce accidents.

India Driver Assistance Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, technology, and vehicle type.

Type Insights:

- Blind Spot Detection

- Adaptive Cruise Control

- Lane Departure Warning System

- Night Vision

- Adaptive Front Lighting

- Intelligent Parking Assist System

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes blind spot detection, adaptive cruise control, lane departure warning system, night vision, adaptive front lighting, intelligent parking assist system, and others.

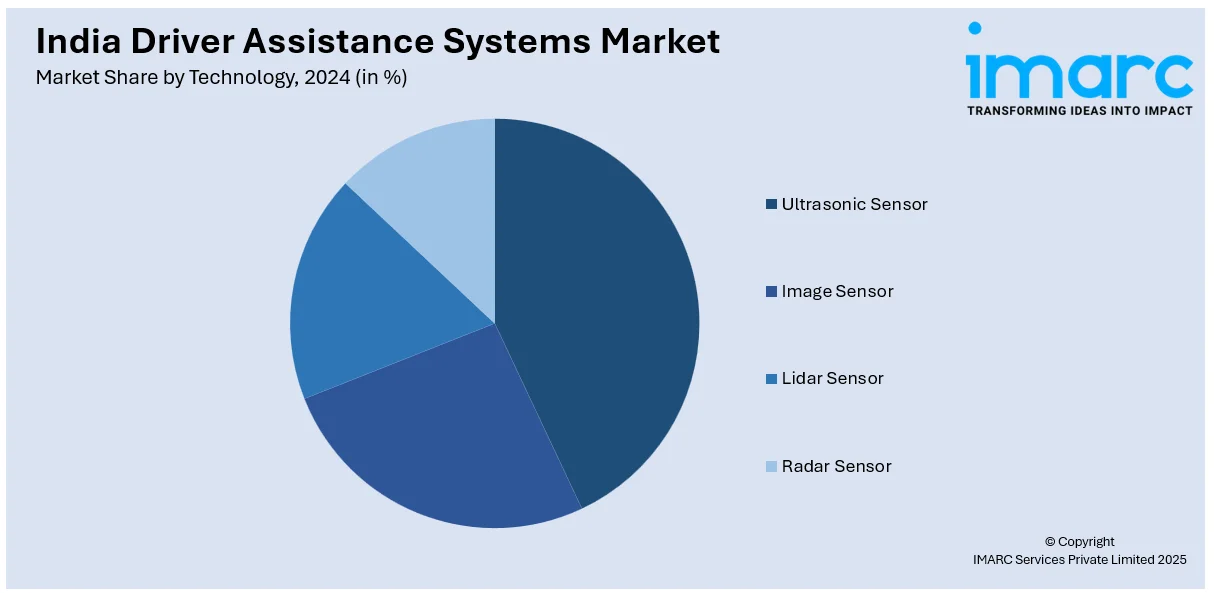

Technology Insights:

- Ultrasonic Sensor

- Image Sensor

- Lidar Sensor

- Radar Sensor

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes ultrasonic sensor, image sensor, lidar sensor, and radar sensor.

Vehicle Type Insights:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger cars, light commercial vehicles, and heavy commercial vehicles.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Driver Assistance Systems Market News:

- In June 2024, Genesys International unveiled the first AI-powered navigation map in India for automobiles and mobility services. The goal of this new technology is to make driving more convenient and customized. The updated map has more than 30 million points of interest (POIs) and 8.3 million kilometers of roadways. This implies that practically wherever in India, drivers can obtain trustworthy and accurate directions.

- In September 2023, Mahindra & Mahindra's mass-market SUV, the XUV 700, incorporated Advanced Driver Assistance Systems (ADAS), which has since become the new buzzword in the Indian auto industry. As the name implies, ADAS can greatly reduce the number of collisions, injuries, and fatalities by assisting the driver in managing various driving conditions.

India Driver Assistance Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blind Spot Detection, Adaptive Cruise Control, Lane Departure Warning System, Night Vision, Adaptive Front Lighting, Intelligent Parking Assist System, Others |

| Technologies Covered | Ultrasonic Sensor, Image Sensor, Lidar Sensor, Radar Sensor |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India driver assistance systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India driver assistance systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India driver assistance systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The driver assistance systems market in India was valued at USD 1.15 Billion in 2024.

The India driver assistance systems market is projected to exhibit a CAGR of 9.22% during 2025-2033, reaching a value of USD 2.70 Billion by 2033.

The India driver assistance systems market is growing due to increasing focus on road safety, regulatory mandates promoting vehicle safety, and rising demand for advanced automotive technologies. Improvements in sensor and camera systems, urban traffic challenges, and growing consumer interest in smart driving features also support market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)