India Drug Delivery Devices Market Size, Share, Trends and Forecast by Route of Administration, Application, End User, and Region, 2025-2033

India Drug Delivery Devices Market Size and Share:

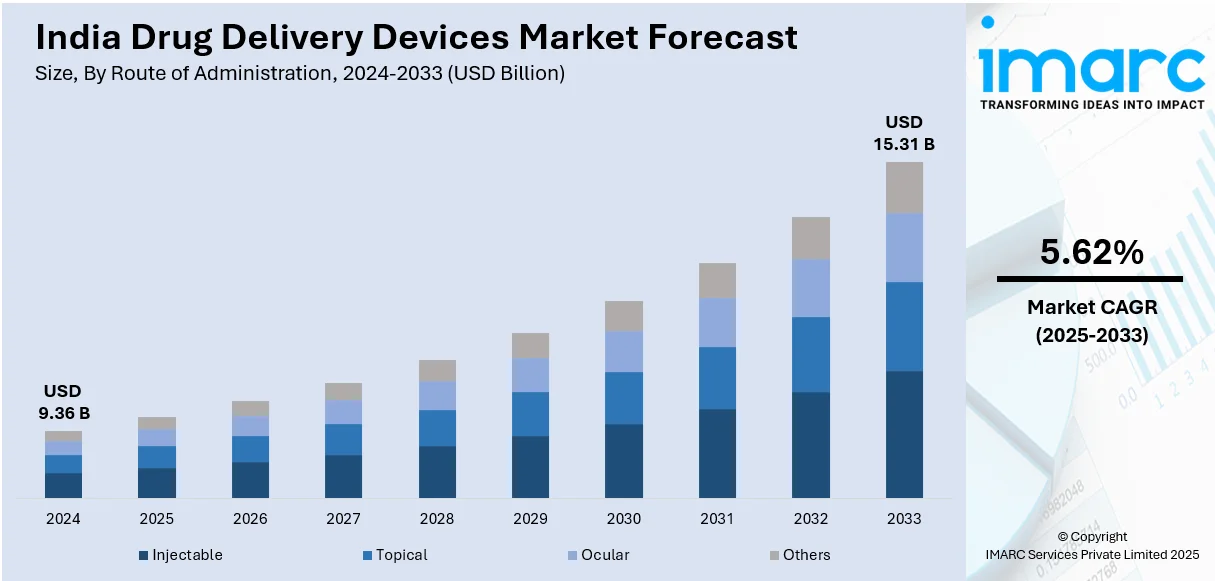

The India drug delivery devices market size reached USD 9.36 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 15.31 Billion by 2033, exhibiting a growth rate (CAGR) of 5.62% during 2025-2033. Government policies encouraging domestic device production, research in the pharmaceutical sector, rising demand for novel drug delivery technology, prevalence of chronic disorders, growing healthcare infrastructure, strategic investment by foreign medical device companies, and burgeoning use of non-invasive drug delivery systems, are driving the India drug delivery devices market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.36 Billion |

| Market Forecast in 2033 | USD 15.31 Billion |

| Market Growth Rate 2025-2033 | 5.62% |

India Drug Delivery Devices Market Trends:

Rising Prevalence of Chronic Diseases

India has been experiencing a sudden spike in the rate of prevalence of chronic ailments like diabetes, cardiovascular conditions, respiratory diseases, and cancer. This increased disease burden has a direct effect on the demand for sophisticated drug delivery systems to ensure accurate, efficient, and patient-friendly drug delivery. As per the International Diabetes Federation (IDF), India is expected to have 92.97 million diabetic patients by 2030. The rise in the number of diabetic patients has increased the demand for insulin delivery systems like insulin pens, pumps, and transdermal patches, which provide convenience of administration and enhanced patient compliance. Correspondingly, pulmonary conditions such as asthma and chronic obstructive pulmonary disease (COPD) are increasing with more air pollution and changes in lifestyle. The Global Burden of Disease (GBD) study showed that COPD was the second largest cause of death in India in 2019. This has caused an increased requirement for inhalers, nebulizers, and nasal drug delivery devices that yield targeted and effective drug delivery in the management of respiratory disorders.

To get more information on this market, Request Sample

Expansion of the Pharmaceutical Sector

Technological innovations are taking a revolutionary turn in influencing the India drug delivery devices market by increasing efficiency and patient benefits. As the need for precision-based drug delivery grows, innovations like smart drug delivery systems, connected devices, and automated injectors are gaining popularity. These technologies enhance medication compliance, minimize dosing errors, and provide more patient-centric solutions, improving treatment efficacy and accessibility. Emergence of wearable drug delivery systems and needle-free injectable technologies is catering to patient pain and discomfort issues, thus enhancing user compliance. Nanotechnology-driven drug delivery is also enabling more targeted therapy, especially in oncology and in the management of chronic diseases. Self-administered devices, including auto-injectors and pre-filled syringes, are also emerging, lowering hospital visits and long-term therapy convenience. With India increasingly adopting digital healthcare, these technologies are poised to transform the market, providing improved therapeutic efficacy, patient safety, and treatment accessibility in urban and rural areas.

India Drug Delivery Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on route of administration, application, and end user.

Route of Administration Insights:

- Injectable

- Topical

- Ocular

- Others

The report has provided a detailed breakup and analysis of the market based on the route of administration. This includes injectable, topical, ocular, and others.

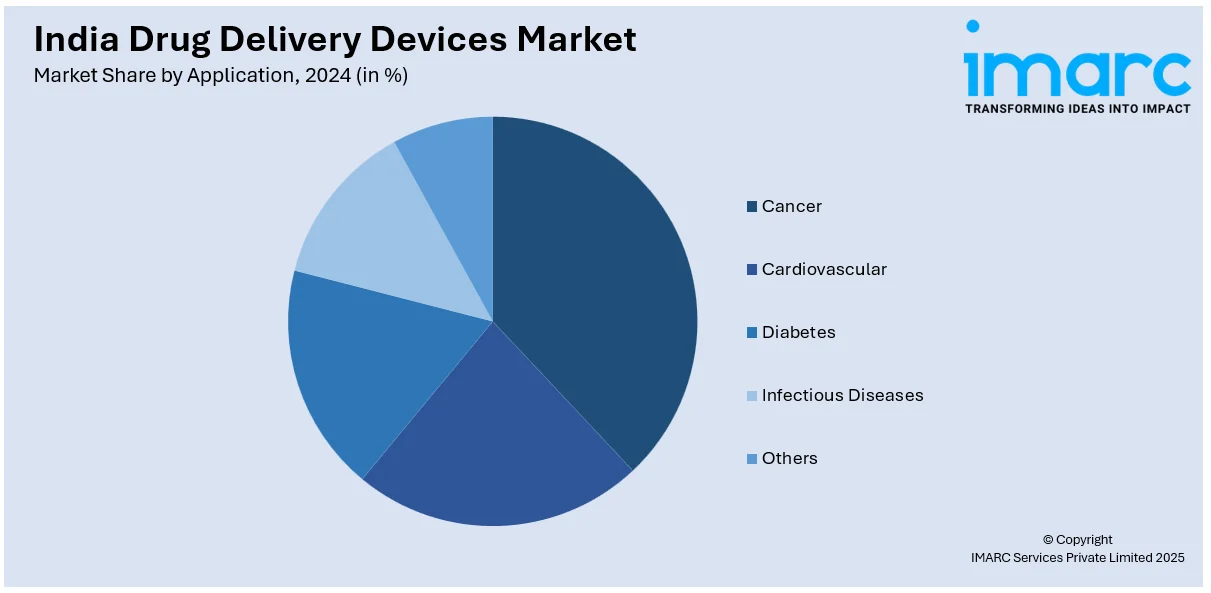

Application Insights:

- Cancer

- Cardiovascular

- Diabetes

- Infectious Diseases

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cancer, cardiovascular, diabetes, infectious diseases, and others.

End User Insights:

- Hospitals

- Ambulatory Surgical Centers

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, ambulatory surgical centers, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Drug Delivery Devices Market News:

- December 2024: Cipla got approval from CDSCO for distribution and sales of inhaled insulin in India, providing the option of a needle-free alternative for diabetes patients. This breakthrough broadens the horizon of pulmonary drug delivery to improve patient convenience and compliance. The launch of such innovative products enhances India's drug delivery business by promoting adoption of technology as well as regulations.

- November 2024: AptarGroup opened a new pharmaceutical plant in Taloja, near Mumbai, to promote local production of breakthroughs like pressurized metered dose inhaler (pMDI) valves, breath-actuated devices, and single-dose nasal sprays. This move enhances India's drug delivery devices industry by amplifying local production capability and enabling Indian pharma firms to introduce nasal sprays and inhalers in domestic and international markets.

India Drug Delivery Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Routes of Administration Covered | Injectable, Topical, Ocular, Others |

| Applications Covered | Cancer, Cardiovascular, Diabetes, Infectious Diseases, Others |

| End Users Covered | Hospitals, Ambulatory Surgical Centers, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India drug delivery devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India drug delivery devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India drug delivery devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The drug delivery devices market in India was valued at USD 9.36 Billion in 2024.

The India drug delivery devices market is projected to exhibit a CAGR of 5.62% during 2025-2033, reaching a value of USD 15.31 Billion by 2033.

The market for drug delivery devices in India is driven by the increasing cases of chronic diseases, a higher demand for self-administration and home healthcare, expanding healthcare infrastructure, and improvements in drug delivery technology. Moreover, government programs and increasing awareness about healthcare are promoting the acceptance of innovative and effective drug delivery methods.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)