India Dyes and Pigments Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2025-2033

India Dyes and Pigments Market Overview:

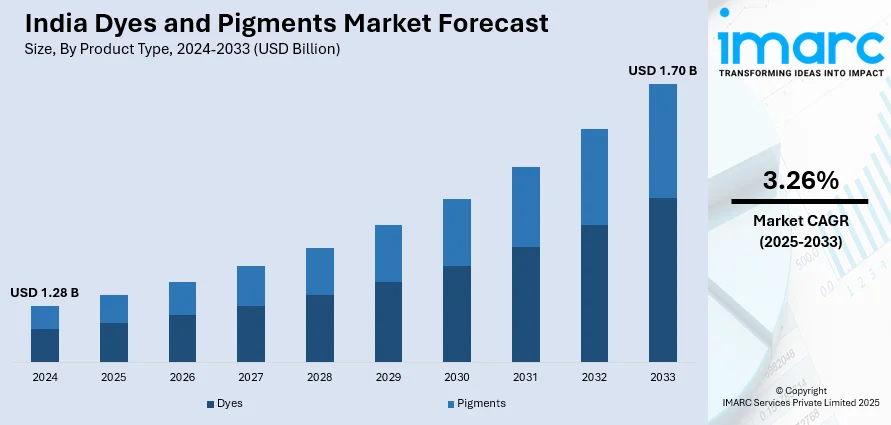

The India dyes and pigments market size reached USD 1.28 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.70 Billion by 2033, exhibiting a growth rate (CAGR) of 3.26% during 2025-2033. India's dyes and pigments market is driven by strong growth in the textile, construction, plastics, and packaging industries, escalating demand for eco-friendly colorants, expanding export opportunities, technological advancements in manufacturing, and supportive government initiatives aimed at boosting domestic production and reducing dependence on imported raw materials.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.28 Billion |

| Market Forecast in 2033 | USD 1.70 Billion |

| Market Growth Rate 2025-2033 | 3.26% |

India Dyes and Pigments Market Trends:

Expansion of the Indian Textile Industry

One of the key drivers of India's dyes and pigments market is the growing textile industry, which has a major share in domestic consumption of dyes. India is among the largest producers of garments and textiles in the world, and the industry is associated with the use of dyes and pigments owing to the extensive coloring demands in fabric processing. From conventional cotton textile to contemporary synthetic blends, each type of fabric requires specialized formulations of dyes, thus driving the need for various types of dyes including reactive, vat, acid, and disperse dyes. Moreover, the increasing disposable incomes and growing fashion consciousness are also propelling local textile consumption, especially in urban and semi-urban India. Additionally, favorable government programs, such as the Production Linked Incentive (PLI) scheme and the Integrated Textile Parks, have helped drive modernization, expansion of scale, and export competitiveness in the textile industry.

To get more information on this market, Request Sample

Rising Demand from the Plastics and Packaging Industry

Another driver fueling the development of India's dyes and pigments market is the rapid development of the plastics and packaging sector, led by the surging FMCG, pharma, and e-commerce industries. In this segment, colorants like masterbatches, plastic dyes, and high-performance pigments play a vital role in providing bright colors, brand consistency, and UV stability to plastic products from containers and bottles to films and wrappers. With the packaging business being extensively design- and consumer-focused, color distinction is absolutely important to product attraction and marketability. Domestic as well as international brands are asking for packaging with colors and motifs matching their brands thus promoting the consumption of consistent, strong, and quality pigments. Furthermore, breakthroughs in flexible packaging, multilayer film, and biodegradable plastic are promoting the demand for specialty pigments with compatibility to emerging materials and the ability to withstand changing conditions and maintain color strength. India's food packaging and pharmaceutical industries also depend on non-toxic, food-grade colorants, and the pressure for regulatory compliance has driven demand for safer, certified colorants.

India Dyes and Pigments Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type and application.

Product Type Insights:

- Dyes

- Reactive Dyes

- Disperse Dye

- Direct Dye

- Sulfur Dye

- Vat Dye

- Azo Dye

- Others

- Pigments

- Organic

- Inorganic

The report has provided a detailed breakup and analysis of the market based on the product type. This includes dyes (reactive dyes, disperse dye, direct dye, sulfur dye, vat dye, azo dye, and others) and pigments (organic and inorganic).

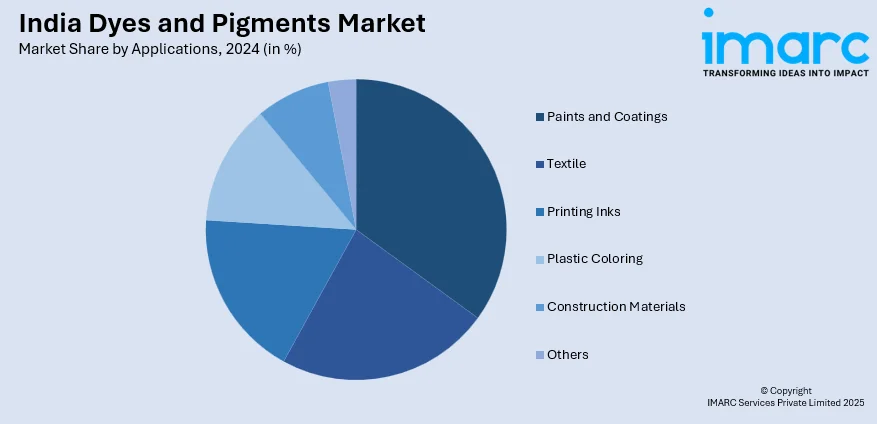

Applications Insights:

- Paints and Coatings

- Textile

- Printing Inks

- Plastic Coloring

- Construction Materials

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes paints and coatings, textile, printing inks, plastic coloring, construction materials, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Dyes and Pigments Market News:

- February 2025: The European Union and India's Ministry of Textiles initiated seven projects with an EUR 9.5 million grant to enhance India's textile and handicraft sector. Spanning nine states, these projects aim to benefit 35,000 individuals, including artisans, MSMEs, and farmer-producers. Focusing on natural dyes, bamboo crafts, handlooms, and traditional textiles, the initiatives promote sustainability, resource efficiency, and market access, aligning with India's Sustainable Bharat Mission and the EU's Global Gateway Strategy.

- December 2024: Sudarshan Chemical Industries launched Sumica Bright Gold 41633, a natural mica-based effect pigment tailored for coatings, plastics, and printing inks. The product targeted both domestic and export markets with a focus on high-end applications.

- November 2023: Green Leaf Pigments Private Limited announced that it is establishing a dyes and pigments manufacturing unit in Ankleshwar, Gujarat, with a production capacity of 200 metric tons per month and an investment of INR 6.03 crore. This facility is expected to supply essential materials for industries such as textiles, plastics, paints, and cosmetics.

India Dyes and Pigments Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Applications Covered | Paints and Coatings, Textile, Printing Inks, Plastic Coloring, Construction Materials, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India dyes and pigments market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India dyes and pigments market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India dyes and pigments industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The dyes and pigments market in India was valued at USD 1.28 Billion in 2024.

The India dyes and pigments market is projected to exhibit a CAGR of 3.26% during 2025-2033, reaching a value of USD 1.70 Billion by 2033.

Key factors driving the India dyes and pigments market include the growing demand from the textile and apparel industry, expansion of the automotive and packaging activities, increasing use in consumer goods, and rising adoption of eco-friendly and sustainable products. Government initiatives supporting manufacturing also contribute to the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)