India E-commerce Logistics Market Size, Share, Trends and Forecast by Service, Business, Destination, Product, and Region, 2026-2034

India E-Commerce Logistics Market Summary:

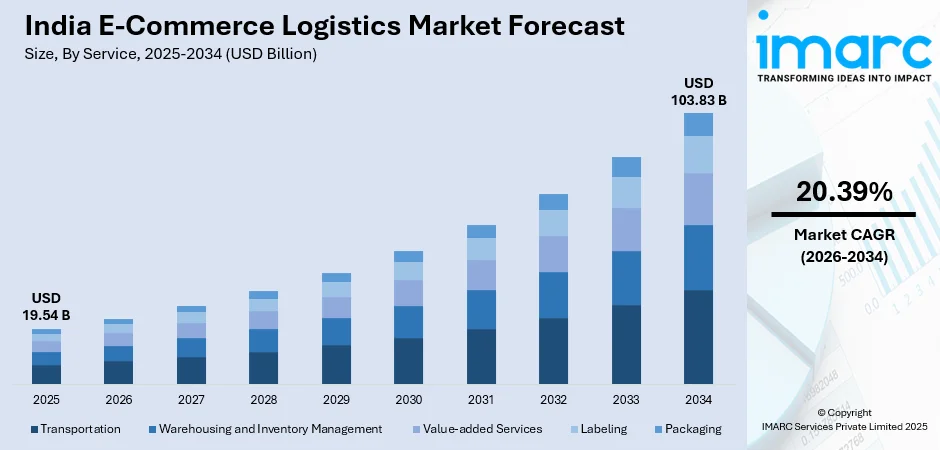

The India e-commerce logistics market size was valued at USD 19.54 Billion in 2025 and is projected to reach USD 103.83 Billion by 2034, growing at a compound annual growth rate of 20.39% from 2026-2034.

The India e-commerce logistics market stands as one of the fastest-growing segments within the broader logistics industry, driven by rapid digital transformation and evolving consumer expectations. The market benefits from expanding internet penetration, rising smartphone adoption, and increasing preference for online shopping across urban and rural areas. Growing investments in technology infrastructure, automated warehousing solutions, and last-mile delivery innovations continue propelling market expansion across diverse product categories and distribution channels nationwide.

Key Takeaways and Insights:

-

By Service: Transportation dominates the market with a share of 41% in 2025, reflecting the critical importance of efficient movement of goods from warehouses to end consumers through optimized delivery networks across India.

-

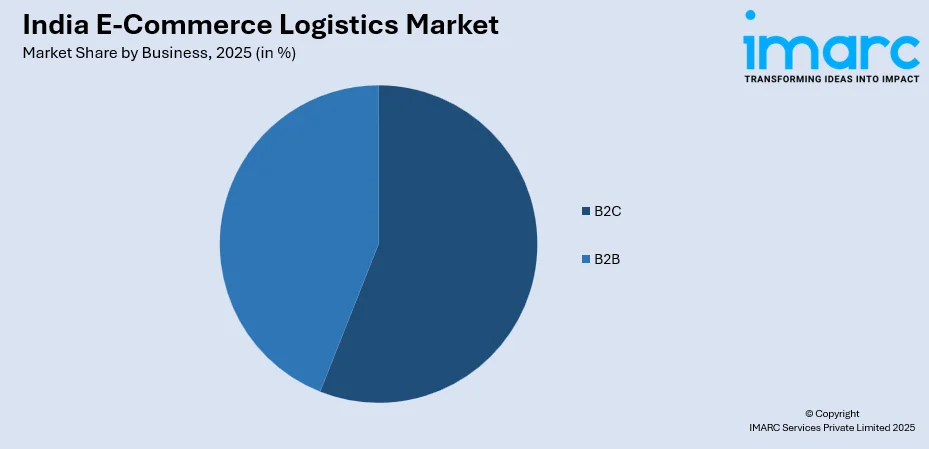

By Business: B2C leads the market with a share of 56% in 2025, driven by exponential growth in direct-to-consumer e-commerce platforms and rising demand for doorstep delivery services across urban and rural areas.

-

By Destination: Domestic represent the largest segment with a market share of 69% in 2025, owing to massive internal consumption patterns and expanding e-commerce penetration in smaller cities and towns across India.

-

By Product: Fashion and apparel dominate with a share of 26% in 2025, benefiting from high online shopping frequency, extensive product variety, and consumer preference for convenient returns and exchanges.

-

By Region: North India leads with a share of 30% in 2025, fueled by concentration of population centers, established manufacturing clusters, and multimodal logistics corridors connecting major commercial hubs.

-

Key Players: The India e-commerce logistics market features a competitive landscape with established third-party logistics providers and captive logistics arms of major e-commerce platforms. Market participants leverage technology integration, extensive delivery networks, and strategic partnerships to capture diverse consumer segments across express delivery and fulfillment services.

To get more information on this market Request Sample

The Indian e-commerce logistics industry is driven by a strong combination of rapid digital adoption and ongoing infrastructure development, supporting sustained market growth. In 2025, Amazon pledged ₹2,000 crore to expand India’s warehousing, sortation, and delivery network, enhancing automation, delivery speed, and service reliability nationwide. Government-led initiatives are reshaping the competitive landscape while improving logistics reach in previously underserved and rural regions. The rise of quick commerce and hyperlocal delivery models is transforming last-mile operations, increasing demand for micro-warehousing, dark stores, and technology-enabled route optimization. At the same time, logistics providers are increasingly adopting advanced technologies such as artificial intelligence, machine learning, and automated warehouse management systems. These innovations enhance operational efficiency, reduce delivery timelines, and support faster, more reliable order fulfillment across varied consumption patterns nationwide.

India E-Commerce Logistics Market Trends:

Hyperlocal Delivery and Quick Commerce Expansion

Indian consumers increasingly demand ultra-fast delivery services driving substantial investments in quick commerce infrastructure and dark store networks across metropolitan areas. For example, Swiggy Instamart added 316 new dark stores in Q4 FY25, bringing its total to over 1,000 locations across 124 cities as competition in quick commerce intensifies. Logistics companies shift focus toward last-mile connectivity within urban centers leveraging route optimization and real-time tracking technologies. Hyperlocal delivery networks address diverse segments ranging from groceries and food delivery to personal care and electronics, fueled by consumer expectations for instant gratification and superior digital ecosystem capabilities across the nation.

Technology Integration and Automation Advancement

Integration of artificial intelligence, machine learning, and Internet of Things in logistics operations revolutionizes supply chains through real-time tracking, predictive analytics, and automated inventory management capabilities. At IICS 2025, Softlink Global showcased an AI‑driven roadmap for its Logi‑Sys platform, emphasizing predictive insights and real‑time shipment visibility to optimize freight forwarding and supply chain decisions. Warehousing solutions embrace robotics and automation to streamline sorting, packaging, and dispatching operations significantly enhancing throughput. Automation in last-mile deliveries through emerging technologies represents growing emphasis on technology-intensive solutions that enhance consumer experience through efficient and reliable deliveries nationwide.

Sustainable Logistics and Green Transportation

Environmental consciousness drives adoption of sustainable practices including electric vehicle fleets, optimized packaging materials, and carbon emission reduction initiatives across logistics networks throughout India. In 2025, GreenLine Mobility Solutions committed ₹46 million to expand its electric truck fleet for Hindustan Zinc and develop battery‑swap and charging infrastructure for net‑zero goals. Government policy support promotes clean transportation adoption and waste reduction while consumers increasingly prefer brands demonstrating eco-friendly credentials. This sustainability trend redefines supply chain operations and strategic planning as logistics providers invest in green infrastructure to maintain competitive positioning and regulatory compliance.

Market Outlook 2026-2034:

The India e-commerce logistics market demonstrates exceptional growth prospects throughout the forecast period, supported by expanding digital consumer base, infrastructure development, and technology-enabled fulfillment ecosystems. The market benefits from value-added services expansion, quick-commerce infrastructure development, and multimodal connectivity reshaping competitive parameters. Government programs continue lowering structural cost barriers while digital commerce platforms open capacity for logistics providers across various scales. The market generated a revenue of USD 19.54 Billion in 2025 and is projected to reach a revenue of USD 103.83 Billion by 2034, growing at a compound annual growth rate of 20.39% from 2026-2034.

India E-Commerce Logistics Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Service |

Transportation |

41% |

|

Business |

B2C |

56% |

|

Destination |

Domestic |

69% |

|

Product |

Fashion and Apparel |

26% |

|

Region |

North India |

30% |

Service Insights:

- Transportation

- Warehousing and Inventory Management

- Value-added Services

- Labeling

- Packaging

The transportation dominates with a market share of 41% of the total India e-commerce logistics market in 2025.

Transportation maintains commanding market leadership driven by exponential surge in e-commerce shipments and growing demand for faster last-mile delivery solutions across urban and semi-urban markets. In 2025, Delhivery managed 107 million shipments during the festive season, delivering 29.57 million within 48 hours and 13.59 million within 24 hours, reflecting growing logistics speed and volume. The segment benefits significantly from expanding road infrastructure development, multimodal connectivity enhancement, and technology integration enabling real-time shipment tracking and route optimization. Rising quick commerce expectations and same-day delivery requirements fuel substantial investments in express delivery networks serving diverse consumer segments efficiently throughout India.

The transportation segment experiences continuous transformation through adoption of electric vehicles, advanced fleet management systems, and automated sorting technologies that enhance operational efficiency and reduce delivery times substantially. Growing partnerships between e-commerce platforms and logistics providers strengthen transportation networks while infrastructure improvements enhance intercity connectivity nationwide. Rising demand from smaller cities necessitates expansion of transportation infrastructure to reach previously underserved markets ensuring comprehensive coverage across the nation.

Business Insights:

Access the comprehensive market breakdown Request Sample

- B2B

- B2C

The B2C leads with a share of 56% of the total India e-commerce logistics market in 2025.

Business-to-consumer (B2C) logistics dominates the market driven by explosive growth in direct-to-consumer e-commerce platforms and widespread smartphone adoption enabling seamless mobile commerce transactions throughout India. In 2025, Shiprocket, serving D2C and online brands, filed for a ₹2,342 crore IPO to expand its technology, fulfillment, and delivery capabilities in B2C logistics. This reflects heightened investor confidence and expansion focus for players supporting ecommerce delivery networks. Growing quick commerce demands amplify requirements for scalable micro-fulfillment solutions that meet individualized consumer requirements across diverse product categories efficiently.

The B2C segment continues setting service-level benchmarks as consumers increasingly demand transparency, flexibility, and convenience in their delivery experiences across all regions. Social commerce expansion through digital platforms creates additional logistics complexity requiring professional tracking and support solutions for individual sellers and entrepreneurs. Rising online penetration across smaller cities expands the B2C consumer base while necessitating infrastructure investments in previously underserved regions to maintain competitive delivery timelines.

Destination Insights:

- Domestic

- International/Cross Border

The domestic dominates with a market share of 69% of the total India e-commerce logistics market in 2025.

Domestic shipments maintain substantial market leadership reflecting India's vast internal consumption patterns and rapidly expanding e-commerce penetration beyond traditional metropolitan areas into smaller cities and towns nationwide. The segment benefits from growing demand in emerging markets demonstrating successful digital penetration outside established urban centers. Infrastructure improvements through government initiatives significantly enhance domestic connectivity and delivery efficiency while reducing logistics costs across the entire supply chain network.

The domestic logistics segment experiences transformation through multimodal integration combining road, rail, and air transportation for optimized delivery networks across India's diverse geography efficiently. Growing investments in warehousing infrastructure across strategic locations enable faster order fulfillment and reduced delivery times for domestic shipments nationwide. Digital commerce platforms facilitate standardized logistics operations benefiting smaller sellers and logistics providers while expanding domestic e-commerce accessibility across previously underserved postal codes throughout the country.

Product Insights:

- Fashion and Apparel

- Consumer Electronics

- Home Appliances

- Furniture

- Beauty and Personal Care Products

- Others

The fashion and apparel leads with a share of 26% of the total India e-commerce logistics market in 2025.

Fashion and apparel maintain market leadership through high online shopping frequency and extensive product variety attracting price-conscious Indian consumers across all demographic segments nationwide. According to reports, in 2025 quick fashion delivery startups are using AI virtual try‑on and “try‑and‑buy” features to reduce costly returns, boosting conversions and easing reverse logistics challenges in online fashion sales. The segment experiences substantial reverse logistics requirements due to sizing-related returns triggering significant investments in dedicated processing hubs and quality assessment systems. Growing direct-to-consumer fashion brands and seasonal shopping events during festivals and sales periods amplify logistics demands requiring flexible fulfillment solutions.

The fashion logistics segment demands specialized handling capabilities including proper packaging, garment-specific storage conditions, and efficient returns processing infrastructure across distribution networks. Rising consumer expectations for free returns and easy exchange policies increase operational complexity while impacting profitability margins for logistics providers significantly. Quick commerce platforms increasingly include fashion accessories and essentials in their offerings, creating new delivery speed requirements that challenge traditional fashion logistics models nationwide.

Regional Insights:

- North India

- South India

- East India

- West India

North India exhibits a clear dominance with a 30% share of the total India e-commerce logistics market in 2025.

North India commands market leadership benefiting from established manufacturing clusters, dense population centers, and multimodal logistics corridors connecting major commercial hubs across the region efficiently. The national capital region serves as the central gateway with newly developed logistics parks substantially strengthening throughput capacity and operational efficiency. Dedicated freight corridor sections reduce transit times and enhance capacity while the region's extensive retail infrastructure supports both traditional e-commerce and emerging quick commerce operations.

The North India region benefits from significant investments in warehousing infrastructure development across key metropolitan areas creating comprehensive fulfillment networks for diverse product categories. High consumer density and strong purchasing power drive substantial e-commerce order volumes requiring extensive last-mile delivery networks throughout the region continuously. Growing expansion into emerging cities creates additional logistics opportunities while challenging providers to extend coverage beyond established metropolitan delivery zones to capture untapped market potential.

Market Dynamics:

Growth Drivers:

Why is the India E-Commerce Logistics Market Growing?

Rising Internet Penetration and Smartphone Adoption

India's expanding digital infrastructure drives increased e-commerce consumption creating sustained demand for logistics services across urban and rural areas nationwide. Rising internet connectivity especially in smaller cities broadens the consumer base substantially while smartphone adoption enabling mobile commerce transactions accelerates online shopping frequency significantly. The India smartphone market reached 153.3 million units in 2024, and is projected to grow to 277.1 million units by 2033, reflecting increasing mobile penetration that fuels e‑commerce activity. Mobile commerce increasingly dominates e-commerce transactions driving demand for last-mile deliveries and efficient logistics solutions throughout the country across all consumer segments.

Government Infrastructure Initiatives and Policy Support

Strategic government programs and infrastructure development initiatives significantly enhance logistics infrastructure and operational efficiency across the nation substantially. According to reports, India’s National Logistics Policy, launched in 2022, enabled over 160 crore digital transactions via ULIP by August 2025, enhancing nationwide logistics integration and operational visibility. National logistics policies aim to reduce logistics costs and improve delivery networks enabling faster and more reliable services across the country effectively. Digital commerce platforms open capacity for smaller logistics providers reducing platform dependency while raising service quality expectations and reshaping competitive dynamics across the industry significantly.

Quick Commerce Revolution and Consumer Expectations

Rapid growth of quick commerce platforms offering ultra-fast deliveries transforms consumer expectations and logistics operations across metropolitan areas substantially. For instance, Amazon Now plans to expand to 300+ dark stores by end‑2025, investing in micro‑fulfillment centers and sortation hubs to offer 10–15 minute deliveries in major cities. Companies invest significantly in dark store networks and micro-warehousing infrastructure to meet hyperlocal delivery demands effectively. This segment expansion drives innovation in route optimization, real-time tracking, and automated fulfillment systems while creating competitive pressure for traditional e-commerce logistics providers to enhance delivery speed significantly.

Market Restraints:

What Challenges the India E-Commerce Logistics Market is Facing?

Infrastructure Gaps in Rural and Emerging Markets

Inadequate road infrastructure and limited warehousing facilities in rural areas increase delivery costs and complicate reverse logistics workflows substantially. Reaching dispersed populations in smaller cities requires significant investment in fulfillment center expansion and last-mile connectivity development continuously. These infrastructure challenges create operational inefficiencies that impact profitability while serving price-sensitive consumers in emerging markets across the nation.

High Return Rates and Reverse Logistics Complexity

Fashion and apparel segments experience particularly high sizing-related returns creating expensive reverse logistics requirements that impact overall profitability significantly. Managing product returns efficiently demands dedicated processing infrastructure, quality inspection systems, and inventory management solutions continuously. The cost of reverse logistics combined with cash-on-delivery payment preferences adds operational complexity and working capital requirements for logistics providers across the industry.

Market Consolidation and Captive Logistics Competition

Growing dominance of captive logistics arms operated by major e-commerce platforms creates significant competitive pressure on third-party logistics providers substantially. Rising share of in-house shipment handling by major platforms reduces volume availability for independent logistics companies continuously. This consolidation trend challenges smaller providers requiring strategic repositioning toward specialized services and diversified customer bases beyond major e-commerce platforms nationwide.

Competitive Landscape:

The India e-commerce logistics market operates within a highly competitive environment characterized by presence of captive logistics arms of major e-commerce platforms, established third-party logistics providers, and emerging quick commerce operators. Market consolidation intensifies as scale players integrate automated sorting, predictive analytics, and sustainable fleets to protect margins and deepen regional coverage substantially. Competition drives investments in route optimization, warehouse robotics, and last-mile delivery innovation targeting improved operational metrics. Digital commerce platforms enable smaller logistics providers to serve multiple seller ecosystems through standardized integrations reducing operational costs and elevating asset utilization while reshaping competitive dynamics.

Recent Developments:

-

In December 2025, Allcargo Logistics rolls out Allcargo Extended Reach (AER) network to cover 100% of India’s PIN codes, significantly boosting its e-commerce logistics footprint with deeper last-mile reach and faster delivery access across remote and rural areas. The upgraded AER replaces the earlier ESS model and doubles directly serviceable PIN codes.

India E-commerce Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered |

|

| Businesses Covered | B2B, B2C |

| Destinations Covered | Domestic, International/Cross Border |

| Product Covered | Fashion and Apparel, Consumer Electronics, Home Appliances, Furniture, Beauty and Personal Care Products, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India e-commerce logistics market size was valued at USD 19.54 Billion in 2025.

The India e-commerce logistics market is expected to grow at a compound annual growth rate of 20.39% from 2026-2034 to reach USD 103.83 Billion by 2034.

Transportation dominated the India e-commerce logistics market with a share of 41%, driven by the surge in e-commerce shipments and growing need for faster last-mile delivery solutions across urban and rural markets.

Key factors driving the India e-commerce logistics market include rising internet penetration and smartphone adoption, government infrastructure initiatives, quick commerce revolution, expanding demand from smaller cities, and technology integration including automation and real-time tracking systems.

Major challenges include infrastructure gaps in rural and emerging markets, high return rates creating reverse logistics complexity, market consolidation pressure from captive logistics operations, and operational cost management amid rising quick commerce competition demanding faster delivery capabilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)