India E-Commerce Warehousing Market size, Share, Trends and Forecast by Product, Business Type, Component, and Region, 2026-2034

India E-Commerce Warehousing Market Overview:

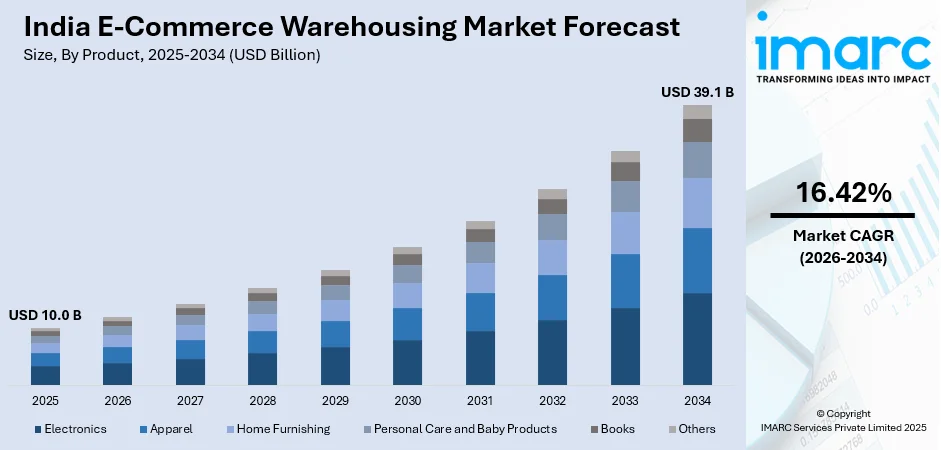

The India e-commerce warehousing market size reached USD 10.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 39.1 Billion by 2034, exhibiting a growth rate (CAGR) of 16.42% during 2026-2034. The market is driven by rising online shopping, rapid urbanization, increased foreign direct investment (FDI), growing demand for same-day delivery, smart inventory management, omnichannel retail expansion, infrastructural upgrades, and the surge in third-party logistics (3PL) services.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 10.0 Billion |

| Market Forecast in 2034 | USD 39.1 Billion |

| Market Growth Rate 2026-2034 | 16.42% |

India E-Commerce Warehousing Market Trends:

Expansion of Quick Commerce and the Rising Proliferation of Dark Stores

The rapid growth of quick commerce, which is delivering goods within minutes, has revolutionized consumer expectations in India. To meet this demand, companies are increasingly investing in strategically located micro-warehouses, known as dark stores, which cater exclusively to online orders. For instance, in 2025, Swiggy expanded its quick commerce segment by opening larger warehouses, averaging 4,000 square feet, i.e., 42% larger than the previous year. This expansion aims to enhance inventory capacity and reduce delivery times. The quick commerce division now accounts for 40% of Swiggy's food delivery business, which is projected to boost the demand for warehousing. Besides this, Mukesh Ambani's Reliance shifted its retail strategy to capitalize on India's rapidly growing quick commerce business, which is a part of the e-commerce sector. By utilizing its network of 3,000 supermarkets across 1,150 cities, the company plans to set up dedicated in-store kiosks for quick commerce operations. This trend underscores a shift towards localized e-commerce warehousing solutions, enabling faster deliveries and reshaping the traditional supply chain to prioritize immediacy.

To get more information on this market, Request Sample

Integration with the Open Network for Digital Commerce (ONDC)

Supportive initiatives by the Government of India to democratize digital commerce through the ONDC are transforming the e-commerce warehousing sector. ONDC aims to create an open, interoperable network, allowing sellers and logistics providers to connect seamlessly, thereby enhancing efficiency and reducing operational costs. Leading logistics providers, like Ekart, Dunzo, and Delhivery, have integrated with ONDC, expanding their reach and streamlining operations. For example, Dunzo partnered with ONDC as a Logistics Network Partner (LNP) to facilitate last-mile delivery for business-to-business transactions. By May 2023, ONDC had expanded to over 236 cities across India, featuring around 36,000 sellers and more than 45 network participants. This widespread adoption indicates a significant shift towards standardized digital commerce practices, impacting warehousing strategies nationwide. Furthermore, the integration with ONDC facilitates better inventory management, real-time tracking, and optimized warehouse utilization, which is contributing to the growth and modernization of e-commerce warehousing in India.

India E-Commerce Warehousing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product, business type, and component.

Product Insights:

- Electronics

- Apparel

- Home Furnishing

- Personal Care and Baby Products

- Books

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes electronics, apparel, home furnishing, personal care and baby products, books, and others.

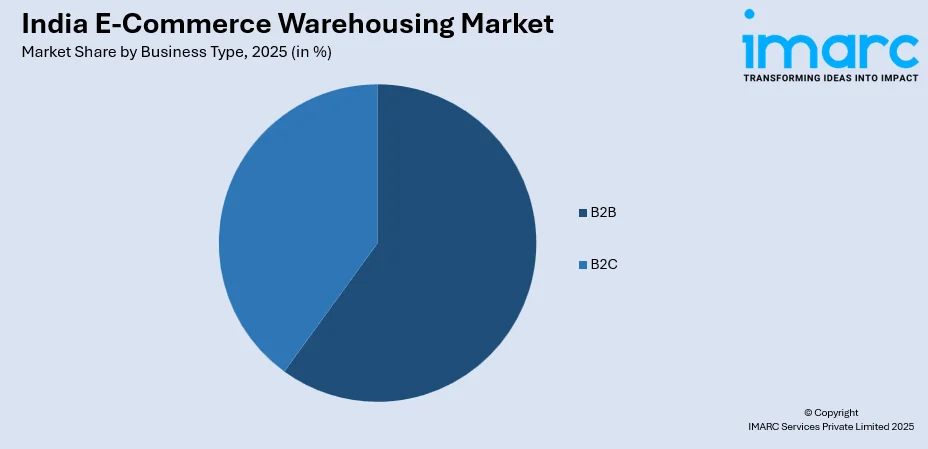

Business Type Insights:

- B2B

- B2C

A detailed breakup and analysis of the market based on the business type have also been provided in the report. This includes B2B and B2C.

Component Insights:

- Hardware Equipment

- Software

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware equipment and software.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India E-Commerce Warehousing Market News:

- February 2025: Zomato Hyperpure secured a lease for a 253,421 sq ft warehouse at Lodha Industrial and Logistics Park in Palava, Mumbai, for a period of five years. The company which operates a B2B platform for kitchen solutions will pay a monthly rent exceeding Rs 85.3 lakh, with an annual rent increase of 5%.

- December 2025: The International Finance Corporation (IFC) invested Rs 630 crore in NDR InvIT, an Infrastructure Investment Trust, to support the development of sustainable warehousing infrastructure and strengthen the logistics sector.

- December 2025: Pristine Value Logistics entered into a long-term lease agreement with Antariksh Group for a 165,000 sq ft warehousing facility in Bhiwandi. The Grade A built-to-suit multi-client warehouse is projected to become operational by March 2025.

India E-Commerce Warehousing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Electronics, Apparel, Home Furnishing, Personal Care and Baby Products, Books, Others |

| Business Types Covered | B2B, B2C |

| Components Covered | Hardware Equipment, Software |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India e-commerce warehousing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India e-commerce warehousing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India e-commerce warehousing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The e-commerce warehousing market in India was valued at USD 10.0 Billion in 2025.

The India e-commerce warehousing market is projected to exhibit a CAGR of 16.42% during 2026-2034, reaching a value of USD 39.1 Billion by 2034.

The e-commerce warehousing market is growing in India because of rapid growth of online retail, increased demand for faster delivery, technological advancements in supply chain management, and rising user expectations for quick and efficient service. Additionally, improvements in infrastructure, logistics, and government initiatives support the expansion of warehousing facilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)