India E-Waste Management Market Size, Share, Trends and Forecast by Material Type, Source Type, Application and Region, 2025-2033

India E-Waste Management Market Size and Share:

The India e-waste management market size reached USD 2.96 Billion in 2024. The market is expected to reach USD 8.92 Billion by 2033, exhibiting a growth rate (CAGR) of 12.07% during 2025-2033. The growth of the market is due to increasing electronic usage, rapid urbanization at a high speed, increasing awareness for the environment, initiatives by the government, and the need for green disposal options. A growing need for used electronics and the development of recycling infrastructure are also encouraging safe e-waste management practices.

Market Insights:

- On the basis of region, the market is divided into North India, South India, East India, and West India.

- Based on the material type, the market is categorized as metal, plastic, glass, others.

- On the basis of the source type, the market is segmented into consumer electronics, industrial electronics, and others.

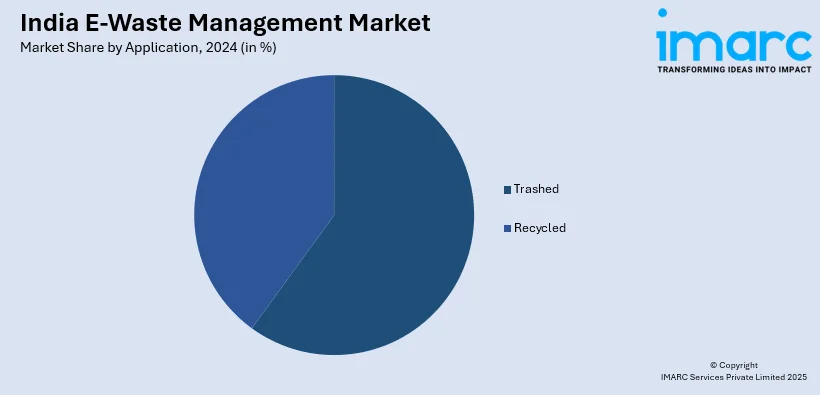

- Based on the application, the market is categorized as trashed and recycled.

Market Size and Forecast:

- 2024 Market Size: USD 2.96 Billion

- 2033 Projected Market Size: USD 8.92 Billion

- CAGR (2025-2033): 12.07%

India E-Waste Management Market Trends:

Increasing Adoption of E-Waste Recycling Technologies

The India e-waste management market outlook is witnessing the speedy adoption of innovative recycling technologies. As more electronic waste is generated, companies are investing in new-age technologies to recycle and recover valuable materials like gold, silver, copper, and plastics efficiently. Automated processes, robots, and AI-driven sorting machines are increasingly being employed to make e-waste collection, sorting, and processing more efficient. These technologies enhance operational efficiency while also reducing environment risks associated with unsafe disposal. Additionally, the technology for disassembling e-waste and recycling ensures proper disposal of poisonous substances like lead, mercury, and cadmium. This corresponds with India's growing emphasis on reducing e-waste pollution as well as rising recycling levels, as reflected through the implementation of the Extended Producer Responsibility (EPR) programme. The shift toward the adoption of cutting-edge recycling methods is a significant contributor to the environmentally friendly development of the e-waste industry in India.

To get more information on this market, Request Sample

Government Initiatives and Policy Support

The Indian Government has a crucial role to play through its initiatives and actions in the area of policies regarding e-waste management. As per reports by the industry, India is the 3rd largest producer of e-waste in the world. Growth estimation of E-waste in India is approximately 26% comprising around 10% of the world's total production of E-waste, that too at a compound annual growth rate (CAGR). Stricter laws such as the E-Waste (Management) Rules, 2016, and Enhanced Producer Responsibility (EPR) policy have made manufacturers accountable for their products' lifecycles. These laws require producers to establish e-waste collection centers and provide recycling means, so that it won't burden local authorities, and guarantees environmentally friendly disposal methods. Next, the government launched many public awareness programs to sensitize citizens about e-waste disposal and appropriate recycling. Moreover, it is National E-Waste Management and Disposal Policy that benefits infrastructure development and investments regarding e-waste recycling companies. These tighter regulations of the government are proactive to making room for the expansion of e-waste management market size in India to answer global sustainability goals.

Integration of Artificial Intelligence in E-Waste Management

Artificial Intelligence (AI) is beginning to reshape the way e-waste is e-waste is gathered, sorted, and processed in India. Robotic arms and vision systems empowered by AI can detect and sort out electronic components with much higher accuracy than traditional techniques, minimizing contamination and enhancing recovery rates. The technologies are especially beneficial in treating intricate devices that have a combination of metals, plastics, and toxic constituents. Additionally, AI facilitates predictive waste generation, enabling recycling companies to forecast volumes through sales of electronics and product life cycles. This enables improved logistics planning, workforce allocation, and facility capacity. Firms are testing AI-based platforms that directly link customers with certified recyclers, enhancing collection efficiency and traceability. While adoption is presently in its initial phases, the declining cost of AI solutions and the government's thrust towards digital innovation mean that this trend is likely to accelerate. It offers economic and environmental dividends to India's e-waste landscape.

Some of the other factors influencing the market include:

- Consumer Behavior and Awareness: Indian customers are slowly becoming aware of the adverse health impacts and environmental damage caused by e-waste. Public awareness programs and education campaigns are making consumers switch to sustainable disposal systems. Customers increasingly prefer to return old devices to designated collection points. This change is generating increased possibilities for organized recycling systems.

- Technological Innovations Beyond Recycling: Companies are now placing greater emphasis on modular product designs that help devices be more repairable, upgradeable, and recyclable. IoT-based collection systems are being piloted to monitor and streamline waste collection processes. Digital platforms and smart bins are making e-waste collection more efficient within urban hotspots. These advancements are eliminating inefficiencies in current waste management.

- Economic Value of E-Waste: E-waste is seen as a rich source of precious and rare metals like gold, silver, and copper. The recovery of these materials provides strong economic incentives for recyclers. This potential for resource recovery is encouraging investments in advanced processing facilities. The rising market value of recovered metals is driving growth in the sector.

- International E-Waste Trade: As per the India e-waste management market statistics, India faces challenges from illegal e-waste imports that add to domestic waste volumes. Regulations have been introduced to restrict such practices and ensure accountability. Enforcement remains a concern, as some shipments bypass formal checks. Addressing this issue is crucial for protecting local recycling industries.

- Startups and Entrepreneurship: The industry has also witnessed the emergence of a number of startups that are providing collection, recycling, and refurbishment services. These startups are applying technology to connect consumers with authorized recyclers. Startups are also adopting buy-back models to promote responsible disposal. Their creative strategies are infusing energy into the e-waste market.

- Urban Mining and Circular Economy: Urban mining refers to extracting valuable materials from discarded electronic products. This practice supports circular economy goals by reducing reliance on virgin resources. In India, pilot projects on urban mining are gaining traction in major cities. Such initiatives align e-waste management with broader sustainability targets.

- Health and Environmental Impacts: Improper handling of e-waste exposes workers and communities to toxic substances like lead and mercury. Soil and water contamination is a growing concern near informal recycling hubs. These risks underline the urgency of establishing safer disposal and recycling methods. Public health has become a strong driver for regulatory action.

- Policy Evolution: India has updated its e-waste rules to strengthen extended producer responsibility (EPR). The amendments aim to increase accountability among manufacturers and producers. Policies now encourage greater participation of formal recyclers. The regulatory push is reshaping industry practices across the value chain.

- Impact of Digitalization Rapid digital adoption is fueling demand for IT hardware and consumer electronics, which is positively impacting the e-waste management industry in India. Shorter product lifecycles lead to higher volumes of discarded devices. Smartphones, laptops, and other gadgets dominate the e-waste stream. This surge highlights the need for efficient recycling infrastructure.

- Formalizing the Informal Sector: A large portion of e-waste in India is processed by informal recyclers under unsafe conditions. Efforts are being made to integrate them into formal recycling networks. Training and certification programs are helping to upgrade skills and safety standards. This inclusion benefits both workers and the environment.

Growth, Opportunities, and Barriers in the India E-Waste Management Market:

- Growth Drivers: The growing adoption of electronic devices across households and businesses is expanding e-waste volumes, thereby augmenting the e-waste management market share in India. Rising environmental concerns and health risks are pushing authorities to enforce stricter regulations. Producer responsibility schemes are creating structured recycling networks. Public awareness campaigns are further driving sustainable disposal practices.

- Market Opportunities: The economic value of precious metals in e-waste is attracting investment in advanced recycling technologies. Startups and digital platforms are enabling scalable collection and recycling models. Urban mining offers a promising avenue for resource recovery. International collaborations can enhance technical expertise and capacity.

- Market Challenges: The dominance of the informal sector poses risks of unsafe disposal and inefficient recovery. Enforcement gaps make it difficult to curb illegal imports and unregulated practices. Limited infrastructure in smaller towns hampers nationwide e-waste management. High costs of advanced recycling technologies remain a barrier to scaling.

India E-Waste Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on material type, source type and application.

Material Type Insights:

- Metal

- Plastic

- Glass

- Others

The report has provided a detailed breakup and analysis of the market based on the material type. This includes metal, plastic, glass, others.

Source Type Insights:

- Consumer Electronics

- Industrial Electronics

- Others

The report has provided a detailed breakup and analysis of the market based on the source type. This includes consumer electronics, industrial electronics, and others.

Application Insights:

- Trashed

- Recycled

The report has provided a detailed breakup and analysis of the market based on the application. This includes trashed, and recycled.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India E-Waste Management Market News:

- In July 2025, Eco Recycling Ltd announced plans to establish a dedicated mineral recovery facility aimed at extracting critical minerals from complex e-waste, including printed circuit boards, hard disk drives, and lithium-ion batteries, thereby strengthening India’s circular economy. The facility is designed to support Production Linked Incentive (PLI) scheme beneficiaries and facilitate exports, reducing import dependence while contributing to foreign exchange earnings. Through this initiative, Eco Recycling reinforces its role in advancing sustainable resource management and building self-reliant supply chains.

- In June 2025, Delhi announced the establishment of India’s first e-waste Eco Park in Holambi Kalan. The 11.4-acre facility is designed under a DBFOT model and to operate via a 15-year Public-Private Partnership. With a capital investment of approximately INR 150 Crore, the park will process up to 51,000 metric tonnes of e-waste across all 106 categories defined under the E-Waste Management Rules and is slated for completion within 18 months. Such initiatives are propelling the expansion of e-waste management market size in India.

- In June 2025, Recyclekaro, the largest lithium-ion battery recycler in India, launched ReLoop, a new digital platform designed to transform e-waste recycling into a routine habit nationwide. The platform enables users to schedule pickups of old electronics for donation or sale easily, offers community engagement features, and incentivizes participation through branded rewards and vouchers. Initially rolled out in Hyderabad, ReLoop has since expanded to major urban centers, with features such as CSR-enabled bulk collection, verified data certificates, and dashboards for organizations to track recycling progress.

- In January 2025, Namo eWaste, a leading electronic waste management firm, revealed its growth into South India by launching a cutting-edge facility in Telangana. This center is poised to transform e-waste recycling in the area, highlighting the company's commitment to innovation and sustainable methods.

- In November 2024, the Greater Noida Industrial Development Authority announced its intention to establish an advanced e-waste management facility designed to scientifically treat and recycle electronic waste in alignment with the Swachh Bharat Mission and the E-Waste (Management) Rules. The initiative, currently seeking Expressions of Interest, will include citywide collection points, digitized monitoring systems, land provision by the authority, and operational management. This facility aims to comprehensively handle Greater Noida’s electronic waste stream, incentivize collection, and enhance transparency in recycling operations.

- In July 2024, the electronic waste and battery recycling company Attero has made its entry into the direct-to-consumer (D2C) market with the launch of a comprehensive e-waste consumer return platform named Selsmart.

India E-Waste Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Metal, Plastic, Glass, Others |

| Source Types Covered | Consumer Electronics, Industrial Electronics, Others |

| Applications Covered | Trashed, Recycled |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India e-waste management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India e-waste management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India e-waste management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The e-waste management market in India was valued at USD 2.96 Billion in 2024.

The India e-waste management market is projected to exhibit a CAGR of 12.07% during 2025-2033, reaching a value of USD 8.92 Billion by 2033.

Key factors driving India’s e-waste management market include the rapid adoption of electronics, shorter product lifecycles, stringent government regulations (EPR rules), rising consumer and environmental awareness, and increasing investments in formal collection infrastructure and advanced recycling technologies, fueled by growth in the IT sector and urbanization.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)