India Eco-Friendly Home Hygiene Products Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2025-2033

India Eco-Friendly Home Hygiene Products Market Overview:

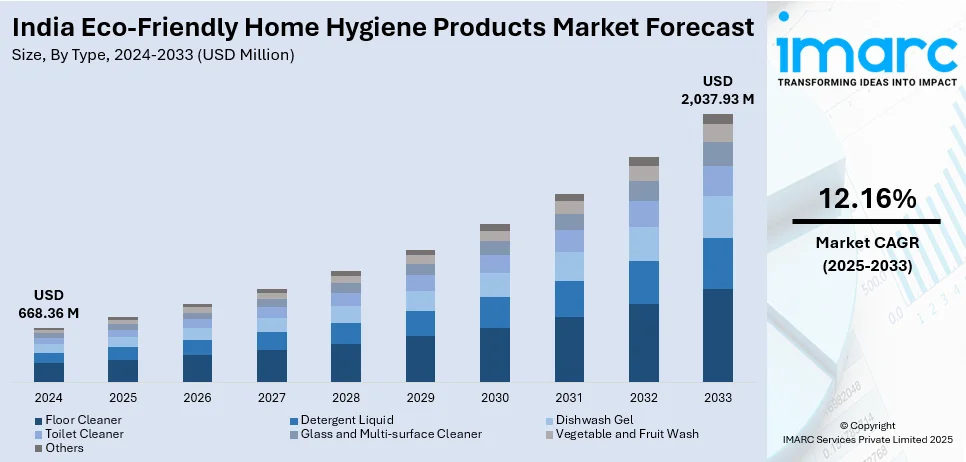

The India eco-friendly home hygiene products market size reached USD 668.36 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,037.93 Million by 2033, exhibiting a growth rate (CAGR) of 12.16% during 2025-2033. Rising environmental awareness, increasing health consciousness, and expanding urbanization are driving the India eco-friendly home hygiene products market share. Additionally, product innovation and wider availability is further strengthening the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 668.36 Million |

| Market Forecast in 2033 | USD 2,037.93 Million |

| Market Growth Rate 2025-2033 | 12.16% |

India Eco-Friendly Home Hygiene Products Market Trends:

Expanding Urbanization

Rapid urbanization and inflating disposable income levels are significantly influencing the India eco-friendly home hygiene products market outlook. The Economic Survey 2023-24 projects that by 2030, over 40% of India's population will reside in urban areas, leading to greater awareness regarding hygiene and cleanliness. As urban dwellers gain better access to information, they are increasingly adopting sustainable and eco-friendly alternatives to conventional cleaning products. In addition, urban lifestyles emphasize convenience, driving the demand for ready-to-use (RTU), eco-friendly home hygiene solutions that align with modern living standards. Rising disposable income allows individuals to prioritize premium and sustainable products over conventional, cost-effective alternatives. Higher income levels are shifting preferences toward environment friendly, biodegradable, and chemical-free home hygiene products, with buyers willing to pay a premium for safer and more sustainable choices. Moreover, the expanding middle-class population in India is fueling the demand for branded and high-quality cleaning solutions that cater to both health-conscious and environmentally aware individuals. As urbanization continues to accelerate, the adoption of eco-friendly home hygiene products is expected to rise further, driven by greater purchasing power and an increasing emphasis on sustainable living.

To get more information on this market, Request Sample

Product Innovation and Availability

Product innovation and enhanced availability are major drivers propelling the India eco-friendly home hygiene products market growth. Organizations are constantly formulating sophisticated, eco-friendly alternatives to traditional cleaning agents as per plant-based ingredients, biodegradable packs, and reusable containers. Enzyme-based cleaners, herbal disinfectants, and probiotic cleaning agents are becoming increasingly popular as customers are looking for safer, chemical-free products for home cleanliness. Tabbsz introduced a chemical-free cleaning tablet in October 2024 to address environmental and health issues associated with conventional cleaners. Formulated using natural products, it is effective in cleaning without chemicals, thus lowering pollution and health hazards. These developments not only increase the effectiveness of products but also reflect increasing demand for sustainability. Increasing availability through various distribution channels such as supermarkets, specialty outlets, and online shopping, is further fueling market growth. Online platforms, specifically, are increasing the availability of environmentally friendly home hygiene products, with doorstep delivery and subscription purchase options. In addition to this, companies are embracing eco-certifications and sustainable branding practices to enhance customer trust and consciousness. Through ongoing product innovations and increased availability, users have more options than ever before for environmentally friendly home hygiene products, creating sustainable living easier. With increasing demand, additional innovation and distribution growth will fuel market development, further consolidating the transition toward sustainable cleaning practices.

India Eco-Friendly Home Hygiene Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Floor Cleaner

- Detergent Liquid

- Dishwash Gel

- Toilet Cleaner

- Glass and Multi-surface Cleaner

- Vegetable and Fruit Wash

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes floor cleaner, detergent liquid, dishwash gel, toilet cleaner, glass and multi-surface cleaner, vegetable and fruit wash, and others.

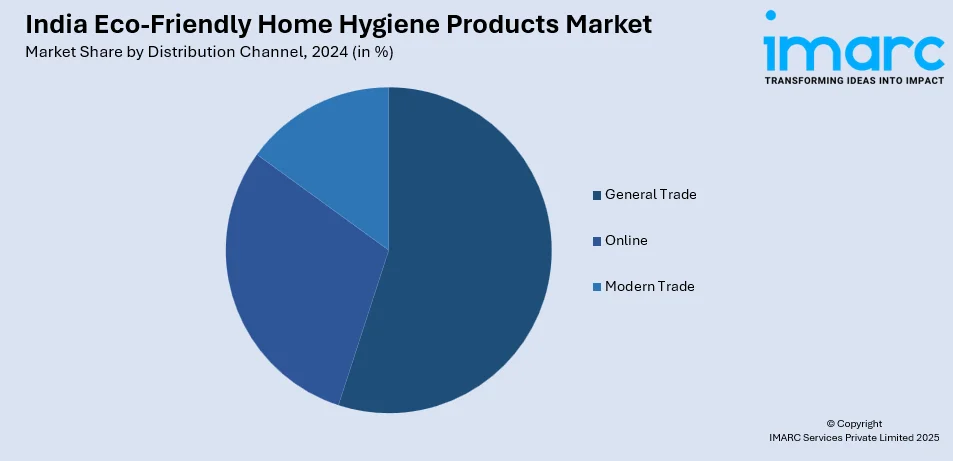

Distribution Channel Insights:

- General Trade

- Online

- Modern Trade

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes general trade, online, and modern trade.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Eco-Friendly Home Hygiene Products Market News:

- In December 2024, Pipper Standard, known for its natural and hypoallergenic home cleaning products, expanded its presence in India with nationwide distribution. The brand’s products are now available on Amazon India, marking a key milestone in its Asian market expansion.

- In July 2024, Klin Space launched a new range of organic cleaning products to promote healthier living spaces. Made with natural ingredients, these products provide effective cleaning without harsh chemicals. This initiative supports the rising demand for sustainable and health-conscious alternatives in the cleaning industry.

India Eco-Friendly Home Hygiene Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Floor Cleaner, Detergent Liquid, Dishwash Gel, Toilet Cleaner, Glass and Multi-surface Cleaner, Vegetable and Fruit Wash, Others |

| Distribution Channels Covered | General Trade, Online, Modern Trade |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India eco-friendly home hygiene products market performed so far and how will it perform in the coming years?

- What is the breakup of the India eco-friendly home hygiene products market on the basis of type?

- What is the breakup of the India eco-friendly home hygiene products market on the basis of distribution channel?

- What are the various stages in the value chain of the India eco-friendly home hygiene products market?

- What are the key driving factors and challenges in the India eco-friendly home hygiene products market?

- What is the structure of the India eco-friendly home hygiene products market and who are the key players?

- What is the degree of competition in the India eco-friendly home hygiene products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India eco-friendly home hygiene products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India eco-friendly home hygiene products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India eco-friendly home hygiene products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)