India Edge Data Center Market Size, Share, Trends and Forecast by Component, Facility Size, Vertical, and Region, 2025-2033

India Edge Data Center Market Size and Share:

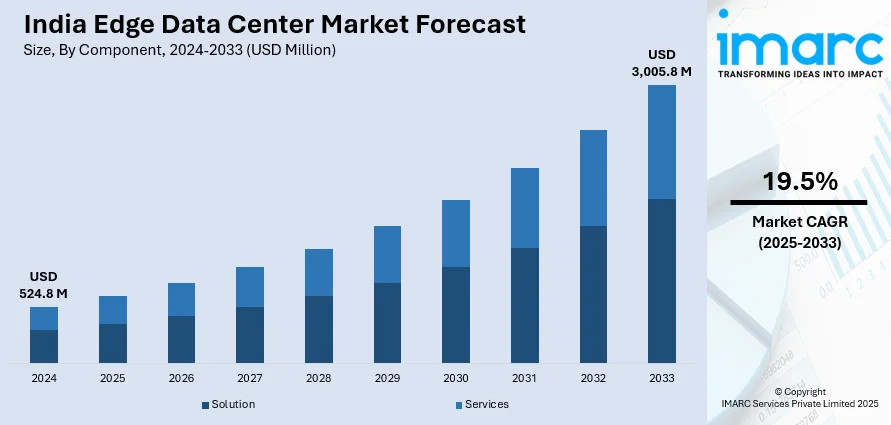

The India edge data center market size reached USD 524.8 Million in 2024. The market is expected to reach USD 3,005.8 Million by 2033, exhibiting a growth rate (CAGR) of 19.5% during 2025-2033. The market growth is attributed to the widespread adoption of IoT devices across various industries, the emergence of digital learning trends accelerated by remote education and e-learning platforms, rapid digital transformation initiatives driven by government policies and private sector investments, and the increasing deployment of 5G networks requiring ultra-low latency infrastructure.

Market Insights:

- On the basis of region, the market has been divided into North India, West and Central India, South India, and East and Northeast India.

- On the basis of component, the market has been divided into solution and services.

- On the basis of facility size, the market has been divided into small and medium facility and large facility.

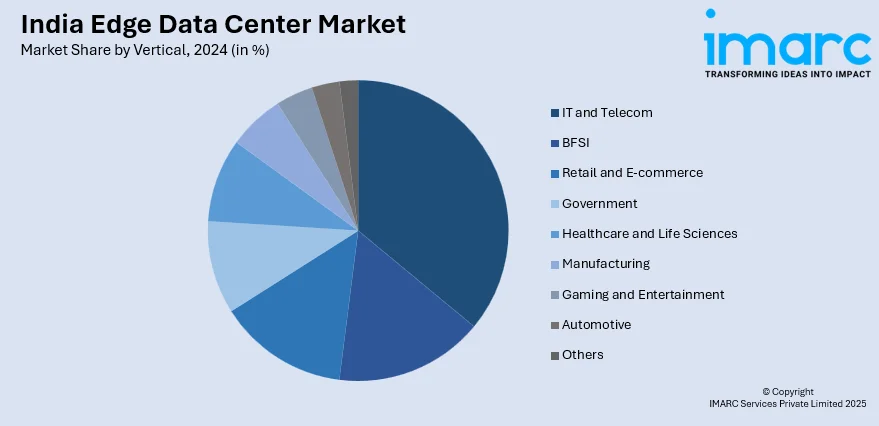

- On the basis of vertical, the market has been divided into IT and telecom, BFSI, retail and E-commerce, government, healthcare and life sciences, manufacturing, gaming and entertainment, automotive, and others.

Market Size and Forecast:

- 2024 Market Size: USD 524.8 Million

- 2033 Projected Market Size: USD 3,005.8 Million

- CAGR (2025-2033): 19.5%

An edge data center refers to a compact and geographically localized storage facility that facilitates expedited data processing and distribution by being in close proximity to the sources of data generation. Its purpose is to provide cloud computing resources and promptly deliver cached streaming content directly to end-users. The primary objective of an edge data center is to address latency concerns, diminish the need for extensive data transfers to and from the central server, and ensure the provision of a seamless and efficient data service. These data centers play a crucial role in handling the substantial volume of data generated by Internet of Things (IoT) devices, autonomous vehicles, and various other digital sources, enabling real-time analytics and the extraction of timely insights.

To get more information on this market, Request Sample

The edge data center market in India is experiencing significant growth, driven by the escalating demand for efficient data processing and distribution closer to the point of data generation. One of the key advantages of these centers in this country is their ability to address latency issues by minimizing the physical distance between data sources and processing facilities. Additionally, it not only ensures faster data processing but also reduces the need for extensive data transfers to and from centralized servers, resulting in a more seamless and responsive user experience. In the era of the Internet of Things (IoT) and increasing digitization, the demand for real-time analytics and insights has surged. Besides this, they enable organizations to extract valuable insights promptly, supporting informed decision-making and enhancing operational efficiency. Moreover, as India continues to witness rapid digital transformation across various sectors, the edge data center market is poised for continued expansion. Apart from this, the proliferation of IoT devices, the advent of 5G technology, and the growing need for low-latency applications are key drivers propelling the adoption of edge data centers in the country. Furthermore, with their strategic positioning and efficiency in handling localized data processing, the market growth across the country is expected to bolster over the forecasted period.

India Edge Data Center Market Trends:

5G Network Rollout and Ultra-Low Latency Applications

The accelerated deployment of 5G networks across India is creating unprecedented demand for edge data centers as telecom operators and enterprises seek to capitalize on ultra-low latency capabilities for mission-critical applications, augmenting the India edge data center market share. The transition from 4G to 5G technology requires a fundamental shift in network architecture, necessitating distributed computing infrastructure positioned at the network edge to support millisecond-level response times. Major telecommunications providers including Bharti Airtel, Reliance Jio, and Vodafone Idea are investing heavily in edge infrastructure to enable applications such as autonomous vehicles, industrial automation, augmented reality experiences, and real-time gaming. The integration of Multi-Access Edge Computing (MEC) with 5G networks is enabling new revenue streams for telecom operators while supporting innovative services including smart manufacturing, remote healthcare diagnostics, and immersive entertainment experiences, contributing to the India edge data center market growth. Government initiatives such as the National Digital Communications Policy 2018 and the Production Linked Incentive (PLI) scheme for telecommunications equipment manufacturing are accelerating 5G adoption and consequently driving edge data center deployment. The rollout of 5G networks in major metropolitan areas including Mumbai, Delhi, Bangalore, and Chennai is creating localized demand for edge computing resources, with operators planning micro data centers at cell tower sites and central offices. This infrastructure transformation is particularly crucial for supporting Industry 4.0 initiatives, where manufacturing plants require real-time data processing for predictive maintenance, quality control, and automated production optimization, thereby propelling the edge data center market size in India.

Smart City Initiatives and Government Digital Infrastructure Programs

India's ambitious Smart Cities Mission, encompassing 100 cities across the country, is generating substantial demand for edge data centers to support intelligent urban infrastructure and citizen services. The program's focus on implementing IoT-enabled traffic management systems, smart lighting, waste management, and water distribution networks requires localized data processing capabilities to ensure real-time responsiveness and operational efficiency. Government initiatives such as Digital India, BharatNet, and the National Optical Fiber Network are creating a robust digital backbone that necessitates edge computing infrastructure to deliver services directly to citizens, as per the India edge data center market analysis. The deployment of edge data centers in smart cities enables applications such as intelligent traffic optimization, real-time air quality monitoring, predictive maintenance of urban infrastructure, and enhanced public safety through video analytics and facial recognition systems. Partnership models between government entities and private data center operators are emerging, with initiatives such as the planned collaboration with RailTel Corporation of India to develop 102 edge facilities across the country, bringing low-latency computing closer to users in Tier II and III cities, which is creating a positive India edge data center market outlook. The integration of edge computing with government services is facilitating the digitization of citizen services, enabling real-time processing of applications, instant verification of documents, and seamless delivery of government benefits. Additionally, the push for data localization and sovereignty is driving government agencies to invest in domestic edge infrastructure, reducing dependence on centralized cloud services and ensuring compliance with data protection regulations. This trend is particularly evident in defense, healthcare, and financial services sectors where sensitive data processing requires secure, localized computing resources.

Enterprise Digital Transformation and Industry 4.0 Adoption

As per the India edge data center market research report, the widespread adoption of Industry 4.0 technologies across India's manufacturing and enterprise sectors is driving significant demand for edge data centers to support real-time operational intelligence and automated decision-making processes. Manufacturing companies in automotive, pharmaceuticals, textiles, and electronics sectors are implementing edge computing solutions to enable predictive maintenance, quality control, supply chain optimization, and real-time production monitoring capabilities. The integration of artificial intelligence, machine learning, and computer vision technologies at the edge is enabling manufacturers to achieve higher operational efficiency, reduce downtime, and improve product quality through immediate data processing and analysis. Enterprise adoption of edge computing is being driven by the need to process sensitive data locally, reducing latency for critical applications, and ensuring business continuity during network disruptions or connectivity issues. Financial services institutions are deploying edge data centers to support high-frequency trading, real-time fraud detection, and instant payment processing, where even millisecond delays can result in significant financial losses or security vulnerabilities. Healthcare organizations are leveraging edge infrastructure for telemedicine applications, real-time patient monitoring, medical imaging analysis, and AI-powered diagnostic tools that require immediate processing without relying on distant cloud resources. The retail and e-commerce sectors are implementing edge computing for inventory management, personalized customer experiences, real-time pricing optimization, and supply chain visibility across multiple locations. Energy and utilities companies are deploying edge infrastructure to support smart grid operations, renewable energy optimization, and real-time monitoring of power distribution networks. This enterprise-driven demand is creating opportunities for colocation providers and data center operators to develop specialized edge facilities tailored to specific industry requirements, including enhanced security, compliance certifications, and industry-specific connectivity options.

Growth, Opportunities, and Challenges in the India Edge Data Center Market:

- Growth Drivers of the India Edge Data Center Market: The rapid proliferation of IoT devices across industrial and consumer applications is generating massive volumes of data that require localized processing capabilities for optimal performance. Government initiatives including Smart Cities Mission and Digital India program are creating substantial infrastructure demand for edge computing resources in urban and rural areas. The accelerated adoption of 5G networks and emerging technologies such as autonomous vehicles, augmented reality, and industrial automation are driving requirements for ultra-low latency data processing solutions.

- Opportunities in the India Edge Data Center Market: The expansion into Tier II and Tier III cities presents significant growth potential as these regions develop digital infrastructure and attract technology investments. Strategic partnerships with telecommunications providers and government entities offer opportunities for large-scale edge deployment projects across the country. India edge data center market forecast indicates the growing enterprise adoption of AI, machine learning, and real-time analytics creates demand for specialized edge computing solutions tailored to specific industry requirements.

- Challenges in the India Edge Data Center Market: Limited availability of skilled technical workforce with expertise in edge computing technologies and data center operations constrains market expansion and operational efficiency. High initial capital investments and ongoing operational costs for maintaining distributed edge infrastructure create financial barriers for smaller market players. Regulatory complexities and data localization requirements pose compliance challenges while fragmented connectivity infrastructure in rural areas limits deployment opportunities.

India Edge Data Center Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, facility size, and vertical.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

Facility Size Insights:

- Small and Medium Facility

- Large Facility

A detailed breakup and analysis of the market based on the facility size have also been provided in the report. This includes small and medium facility and large facility.

Vertical Insights:

- IT and Telecom

- BFSI

- Retail and E-commerce

- Government

- Healthcare and Life Sciences

- Manufacturing

- Gaming and Entertainment

- Automotive

- Others

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes IT and telecom, BFSI, retail and E-commerce, government, healthcare and life sciences, manufacturing, gaming and entertainment, automotive, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In July 2025, NES Data Pvt Ltd announced the launch of edge and containerized data centers across Tier II cities and underserved regions in India. The new facilities, designed for low-latency and high-efficiency performance, aim to support AI, real-time applications, and remote deployments. With increasing demand for modular and energy-efficient solutions, NES Data is tapping into the growing need for distributed networks in semi-urban areas, targeting cities like Jaipur, Ahmedabad, and Kochi.

- In November 2024, ST Telemedia Global Data Centres (STT GDC) India broke ground on its first Edge data center in Jaipur, India. The facility will cover 165,000 sq ft and offer 6MW of IT capacity, with a focus on hosting AI workloads. This marks the company's first Edge deployment, with plans for further expansions in secondary markets across India. STT GDC, a majority-owned subsidiary of STT GDC, has an extensive network of 28 data centers in India and a USD 3.2 billion investment plan to expand its capacity by 550MW over the next 5-6 years.

- In August 2024, CtrlS Datacenters announced the acquisition of land in Patna’s Pataliputra Industrial Area for its second edge data center, with an investment of INR 400 crore. The facility will feature a 10MW IT load capacity and approximately 1,000 racks, further expanding CtrlS’s infrastructure in the region. This development is part of the company’s plan to establish over 20 edge data centers across Tier-2 and Tier-3 cities in India, addressing the increasing demand for scalable, reliable, and sustainable digital infrastructure driven by India’s digital transformation.

India Edge Data Center Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Facility Sizes Covered | Small and Medium Facility, Large Facility |

| Verticals Covered | IT and Telecom, BFSI, Retail and E-commerce, Government, Healthcare and Life Sciences, Manufacturing, Gaming and Entertainment, Automotive, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India edge data center market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India edge data center market?

- What is the breakup of the India edge data center market on the basis of component?

- What is the breakup of the India edge data center market on the basis of facility size?

- What is the breakup of the India edge data center market on the basis of vertical?

- What are the various stages in the value chain of the India edge data center market?

- What are the key driving factors and challenges in the India edge data center?

- What is the structure of the India edge data center market and who are the key players?

- What is the degree of competition in the India edge data center market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India edge data center market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India edge data center market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India edge data center industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)