India Edtech Market Size, Share, Trends and Forecast by Sector, Type, Deployment Mode, End User, and Region, 2026-2034

India Edtech Market Summary:

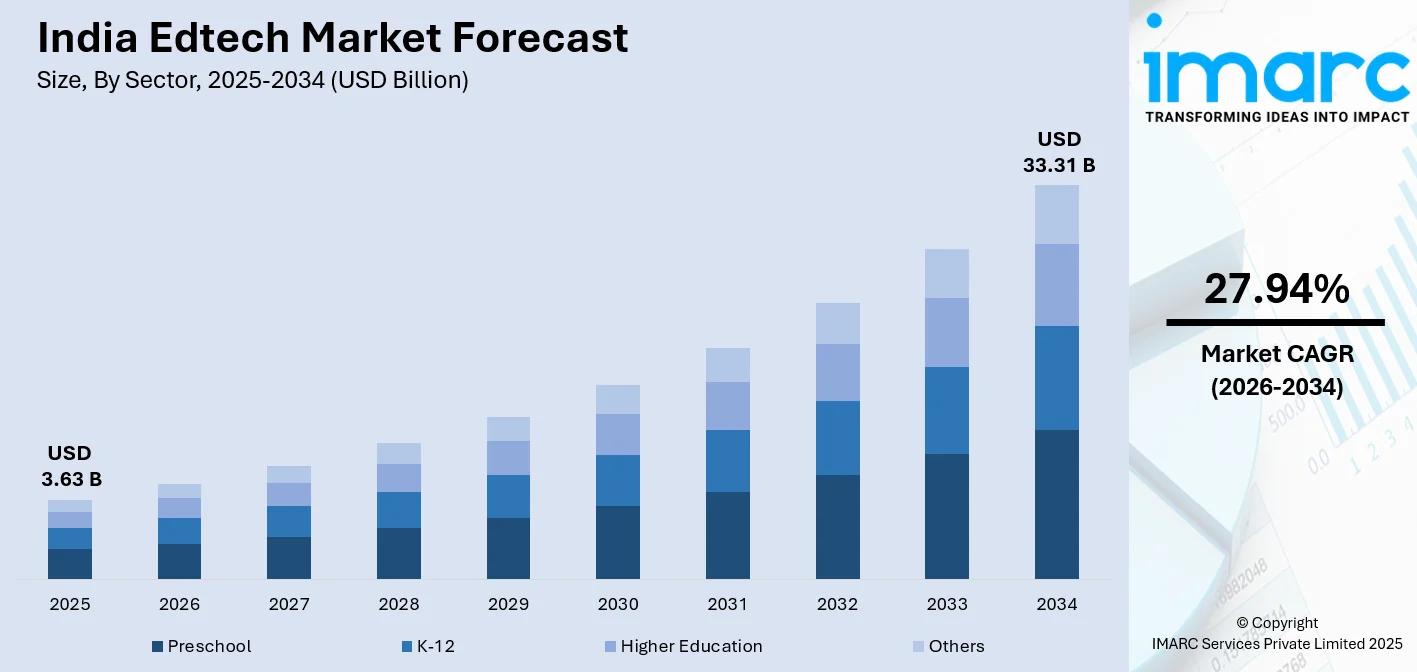

The India edtech market size was valued at USD 3.63 Billion in 2025 and is projected to reach USD 33.31 Billion by 2034, growing at a compound annual growth rate of 27.94% from 2026-2034.

The market is driven by increasing smartphone penetration, growing internet accessibility across urban and rural areas, rising demand for personalized learning experiences, and supportive government initiatives promoting digital education. Additionally, the shift toward skill-based learning and professional development platforms is accelerating adoption among diverse learner demographics. The integration of artificial intelligence (AI) for adaptive learning solutions further enhances engagement, contributing significantly to India edtech market share.

Key Takeaways and Insights:

- By Sector: K-12 dominates the market with a share of 43% in 2025, driven by extensive student population requiring supplementary digital learning resources and increased parental investment in quality education.

- By Type: Software leads the market with a share of 58% in 2025, owing to its scalability, comprehensive learning management capabilities, and seamless integration with existing educational infrastructure.

- By Deployment Mode: Cloud-based represents the largest segment with a market share of 81% in 2025, driven by decreasing infrastructure requirements, better accessibility across various devices, and subscription models that remain economical.

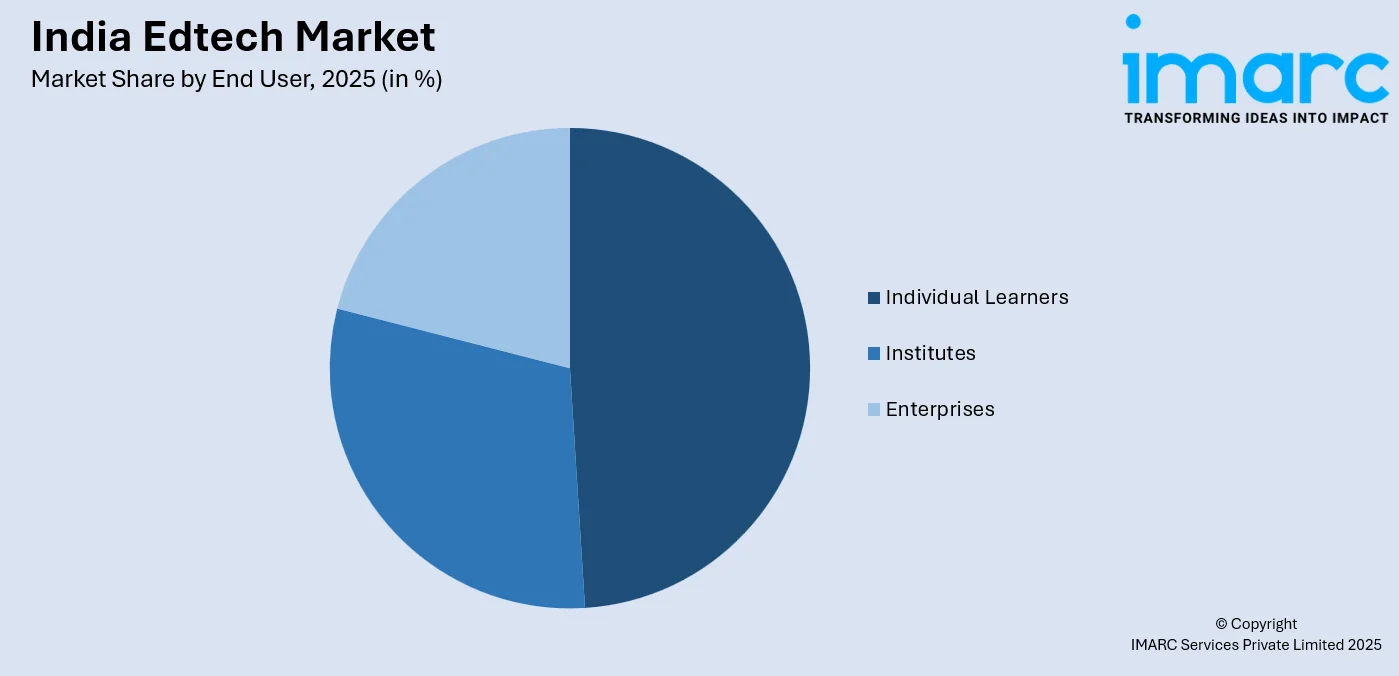

- By End User: Individual learners dominate the market with a share of 49% in 2025, owing to growing self-paced learning preferences and competitive examination preparation needs.

- By Region: North India leads the market with a share of 30% in 2025, driven by high population density, concentration of educational institutions, and strong digital infrastructure.

- Key Players: The India edtech market exhibits a moderately fragmented competitive landscape, with established platforms competing alongside emerging startups. Market participants focus on content diversification, technological innovation, and strategic partnerships to strengthen market positioning. Some of the key players operating in the market include Physicswallah Limited, BYJU's, Unacademy, Vedantu, LEAD School, Udemy, UpGrad, and Coursera.

To get more information on this market Request Sample

The India edtech market is experiencing robust expansion driven by transformative digital adoption across educational segments. In September 2025, Bengaluru-based Educational Initiatives acquired Open Door Education for an undisclosed amount, integrating its thinking-focused assessment tools and 150-school network to strengthen Ei’s K-12 B2B learning solutions in India and overseas. Moreover, increasing government focus on digital literacy programs, coupled with rising aspirations for quality education among the middle-class population, continues to fuel demand. The proliferation of vernacular language content has expanded market reach into tier-two and tier-three cities, enabling platforms to serve diverse linguistic communities effectively. Hybrid learning models combining online and offline approaches are gaining traction among educational institutions seeking comprehensive solutions that maximize learner engagement. Furthermore, the integration of AI and adaptive learning technologies is enhancing personalization capabilities, creating immersive educational experiences that cater to individual learning patterns and preferences. Growing smartphone penetration and affordable data plans are democratizing access to quality educational resources across socioeconomic segments nationwide.

India Edtech Market Trends:

Rising Adoption of Vernacular Language Learning Platforms

The India edtech market is witnessing substantial growth in regional language content delivery as platforms expand beyond English and Hindi to include Tamil, Telugu, Marathi, Bengali, and other vernacular languages. In October 2025, SpeakX.ai announced plans to expand support to Telugu, Tamil, Marathi, Bengali, and other regional languages following a $16 Million funding round to enhance its AI-powered language platform and scale vernacular engagement. This linguistic diversification addresses the learning needs of students in non-metropolitan regions who prefer instruction in their native languages. Educational platforms are investing in localized content development, voice-based interfaces, and culturally relevant curriculum design to enhance engagement and comprehension among diverse learner populations across different states.

Integration of Artificial Intelligence and Adaptive Learning Technologies

AI is revolutionizing personalized education delivery through intelligent tutoring systems that analyze learner behaviour, identify knowledge gaps, and customize content recommendations. As per sources, in October 2025, Infinity Learn by Sri Chaitanya launched AINA, a voice-first AI mentor with Google Cloud, achieving 96.7% response accuracy, resolving doubts monthly across nine Indian languages. Moreover, machine learning (ML) algorithms enable real-time assessment adjustments, automated doubt resolution, and predictive analytics for student performance optimization. These technologies facilitate differentiated instruction approaches, allowing educators to address individual learning styles while platforms benefit from improved learner outcomes and enhanced retention rates through data-driven pedagogical interventions.

Expansion of Skill-Based and Professional Development Programs

The market is experiencing significant growth in vocational training and professional certification programs addressing workforce skill requirements. Platforms are developing industry-aligned curricula in emerging fields including data science, digital marketing, cybersecurity, and cloud computing. In February 2025, Oracle launched Project Vidya in collaboration with NSDC to train 500,000 youth and women in AI, cybersecurity, cloud computing, data science, and other digital technologies, offering certifications to boost employability across India. Furthermore, collaborations with corporate entities for employee upskilling initiatives and university partnerships for credit-bearing courses are expanding market reach. This trend reflects shifting learner priorities toward career-oriented education that enhances employability and addresses evolving industry demands.

Market Outlook 2026-2034:

The India edtech market is driven by sustained revenue growth throughout the forecast period, driven by continued digital infrastructure expansion and increasing acceptance of online learning methodologies. Rising disposable incomes among middle-class families, combined with growing emphasis on competitive examination preparation, will sustain demand for supplementary educational services. Government initiatives promoting digital education in rural areas and institutional adoption of hybrid learning models will further accelerate market expansion. Additionally, integration of AI and vernacular language content will enhance platform accessibility and learner engagement nationwide. The market generated a revenue of USD 3.63 Billion in 2025 and is projected to reach a revenue of USD 33.31 Billion by 2034, growing at a compound annual growth rate of 27.94% from 2026-2034.

India Edtech Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Sector | K-12 | 43% |

| Type | Software | 58% |

| Deployment Mode | Cloud-based | 81% |

| End User | Individual Learners | 49% |

| Region | North India | 30% |

Sector Insights:

- Preschool

- K-12

- Higher Education

- Others

K-12 dominates with a market share of 43% of the total India edtech market in 2025.

K-12 leads the India edtech market owing to the substantial student population requiring supplementary academic support and examination preparation resources. Digital platforms offer interactive video lessons, practice assessments, and doubt-clearing sessions that complement traditional classroom instruction. In September 2025, NCERT launched DIKSHA 2.0 with AI-enabled adaptive learning, structured lessons, and multilingual tools in 12 Indian languages, improving accessibility and personalized learning for school students nationwide. The competitive nature of board examinations and entrance tests drives parental investment in quality educational technology solutions that provide comprehensive curriculum coverage and performance tracking capabilities.

Growing emphasis on foundational learning and early childhood development is expanding preschool segment adoption among urban families seeking quality preparatory education. Higher education platforms are gaining traction through university collaborations, professional degree programs, and certification courses targeting working professionals. The sector benefits from increasing institutional digitization initiatives and government support for technology-enabled learning environments that enhance educational accessibility across socioeconomic segments. Continuous curriculum innovation and pedagogical advancements further strengthen market positioning across all educational levels.

Type Insights:

- Hardware

- Software

- Content

Software leads with a share of 58% of the total India edtech market in 2025.

The software dominates market expansion through learning management systems, mobile applications, and interactive platforms that facilitate seamless educational delivery across diverse user segments. Software solutions offer scalability advantages, enabling platforms to serve millions of concurrent users while providing personalized learning experiences tailored to individual requirements. In October 2025, Uprio, an AI‑led edtech platform focused on personalized tutoring aligned with school curricula, was launched, highlighting continued innovation in adaptive educational software.

The segment benefits from continuous technological advancements including AI integration and adaptive learning algorithms that optimize educational outcomes. Cross-platform compatibility enables learners to access content seamlessly across smartphones, tablets, and desktop devices without disruption. Subscription-based revenue models provide predictable income streams while offering affordable access to quality educational resources. Furthermore, analytics capabilities embedded within software solutions enable performance tracking and personalized recommendation generation enhancing overall learning effectiveness.

Deployment Mode Insights:

- Cloud-based

- On-premises

Cloud-based exhibits a clear dominance with 81% share of the total India edtech market in 2025.

Cloud-based leads market adoption through accessibility advantages, enabling learners to access educational content across multiple devices without significant infrastructure investments or technical expertise requirements. Subscription-based pricing models reduce entry barriers for individual learners and smaller institutions seeking cost-effective solutions. According to reports, Cisco announced it aims to train one million students in India by 2025 through its Networking Academy, having already trained over 3.5 Lakh learners in digital skills. Furthermore, cloud infrastructure supports seamless content updates, real-time collaboration features, and scalable computing resources that accommodate fluctuating user demand during peak examination seasons and enrolment periods.

Reduced maintenance requirements and automatic software updates ensure platform reliability and security compliance throughout operational cycles. Multi-tenant architecture enables efficient resource utilization while maintaining data segregation between different user groups effectively. Integration capabilities with third-party applications including payment gateways and communication tools enhance platform functionality comprehensively. Furthermore, disaster recovery mechanisms and data backup protocols ensure business continuity and protect valuable educational content and user information.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Individual Learners

- Institutes

- Enterprises

Individual learners lead with a market share of 49% of the total India edtech market in 2025.

Individual learners constitute the largest end user segment driven by self-paced learning preferences and competitive examination preparation requirements across academic and professional domains. Students and working professionals utilize edtech platforms for academic supplementation, skill development, and certification programs that enhance career prospects significantly. As per sources, in January 2025, 98% of teachers and 69% of parents in India recognized EdTech’s role in overcoming geographical barriers, providing quality learning access to students across rural and underserved regions nationwide.

Growing awareness regarding online learning effectiveness and increasing acceptance of digital credentials among employers strengthen market positioning. Personalized learning pathways and flexible scheduling options accommodate diverse learner requirements and time constraints effectively. Mobile-first platform designs enable learning during commute times and other previously unproductive periods maximizing educational engagement. Furthermore, community features fostering peer interaction and doubt resolution enhance the overall learning experience and improve knowledge retention outcomes.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

North India dominates with a market share of 30% of the total India edtech market in 2025.

North India leads market development through high population concentration in major metropolitan areas including Delhi-NCR and surrounding states with substantial student demographics. The region benefits from established digital infrastructure, higher internet penetration rates, and strong awareness of online education platforms among students and parents. Concentration of competitive examination coaching centers and prestigious educational institutions creates substantial demand for supplementary digital learning resources that complement traditional instruction methodologies.

The region benefits from strong entrepreneurial ecosystem supporting edtech startup development and innovation initiatives across multiple educational verticals. Higher disposable income levels among urban middle-class families enable investment in premium educational technology solutions and subscription services. Proximity to government policy centers facilitates early adoption of digital education initiatives and regulatory compliance frameworks. Furthermore, extensive vernacular content availability in Hindi and regional languages expands platform accessibility across diverse linguistic communities throughout the region.

Market Dynamics:

Growth Drivers:

Why is the India Edtech Market Growing?

Expanding Digital Infrastructure and Internet Accessibility

The proliferation of affordable smartphones and declining mobile data costs has dramatically expanded internet accessibility across urban and rural India. As per sources, 95.15% of India’s 6.44 Lakh villages have 3G/4G mobile connectivity, with 398.35 Million rural internet subscribers, reflecting substantial digital inclusion under the Digital India initiative. Moreover, government initiatives focused on digital connectivity, including broadband expansion programs and public Wi-Fi deployments, are bridging the digital divide and enabling educational technology adoption in previously underserved regions. Improved network coverage supports video streaming, live interactive sessions, and real-time collaboration features essential for effective online learning. This infrastructure development creates favorable conditions for edtech platforms to reach diverse learner populations across geographical and socioeconomic segments.

Growing Demand for Competitive Examination Preparation

India's examination-oriented education system drives substantial demand for supplementary learning resources that enhance academic performance and competitive test outcomes. Students preparing for engineering, medical, civil services, and other professional entrance examinations increasingly rely on digital platforms offering comprehensive study materials, mock assessments, and personalized mentorship. In September 2025, Infinity Learn introduced AINA, India’s first voice-first AI mentor, resolving over 2 Lakh student doubts monthly within five seconds and providing guidance in nine Indian languages plus English. The convenience of anytime-anywhere learning, combined with access to expert instruction previously limited to metropolitan coaching centers, democratizes quality examination preparation. This demand pattern sustains strong market growth across K-12 and higher education segments.

Rising Focus on Skill Development and Employability Enhancement

Economic transformation and evolving workforce requirements are driving increased investment in skill-based education programs. Learners recognize the importance of acquiring relevant competencies in emerging technology domains, business management, and professional certifications to enhance career prospects. Edtech platforms are addressing this demand through industry-aligned curricula, practical project-based learning, and corporate partnership programs that improve employability outcomes. Government skill development initiatives and employer recognition of online certifications further validate digital learning credentials and accelerate market adoption.

Market Restraints:

What Challenges the India Edtech Market is Facing?

Digital Literacy Gaps Among Rural and Older Populations

Despite infrastructure improvements, significant portions of the population lack digital literacy skills necessary for effective online learning engagement. First-generation internet users, particularly in rural areas and among older demographics, face challenges navigating digital platforms and utilizing interactive features. This limitation restricts market penetration potential and requires platforms to invest in user education and simplified interfaces.

Quality Concerns and Content Standardization Issues

The rapid proliferation of edtech platforms has created inconsistencies in content quality and pedagogical effectiveness across market offerings. Lack of standardized accreditation frameworks and quality assurance mechanisms makes it difficult for learners to differentiate between credible platforms and inferior alternatives. These concerns affect consumer trust, long-term retention rates, and overall market credibility.

Screen Fatigue and Learning Outcome Effectiveness

Extended digital screen exposure raises concerns about learner attention spans, physical health impacts, and overall educational effectiveness compared to traditional instruction methods. Parents and educators’ express reservations about an excessive technology dependence among younger students, potentially limiting adoption in certain demographic segments and prompting demand for balanced hybrid learning approaches.

Competitive Landscape:

The India edtech market features a dynamic competitive environment characterized by diverse players ranging from well-established platforms to innovative startups targeting niche segments. Market participants compete across multiple dimensions including content quality, technological innovation, pricing strategies, and user experience optimization. Strategic differentiation efforts focus on vernacular language expansion, AI integration, and hybrid learning model development. Partnerships with educational institutions and corporate entities represent key growth strategies enabling market penetration and credibility enhancement. Venture capital investment continues supporting market expansion through platform development, content creation, and geographical reach extension.

Some of the key players include:

- Physicswallah Limited

- BYJU's

- Unacademy

- Vedantu

- LEAD School

- Udemy

- UpGrad

- Coursera

Recent Developments:

- In March 2025, AASOKA by MBD Group partnered with over 4,000 schools, benefiting 9.5 lakh students and 70,000 teachers across 438 cities. The platform offers multidisciplinary content, AASOKA WizKids for foundational literacy and numeracy, and AI STEAM Lab for coding and robotics, supporting interactive, play-based, and NEP 2020-aligned learning.

- In January 2025, Motzoid India launched LearningRO, an AI-powered edtech platform delivering personalized learning for students of all ages. The platform features AI tutoring, interactive quizzes, accessibility tools, and curriculum-aligned content, aiming to enhance learning outcomes and make education more engaging, inclusive, and effective across key subjects.

India EdTech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Preschool, K-12, Higher Education, Others |

| Types Covered | Hardware, Software, Content |

| Deployment Modes Covered | Cloud-based, On-premises |

| End Users Covered | Individual Learners, Institutes, Enterprises |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Companies Covered | Physicswallah Limited, BYJU's, Unacademy, Vedantu, LEAD School, Udemy, UpGrad, Coursera, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India edtech market size was valued at USD 3.63 Billion in 2025.

The India edtech market is expected to grow at a compound annual growth rate of 27.94% from 2026-2034 to reach USD 33.31 Billion by 2034.

K-12 held the largest market share, driven by extensive student population requiring supplementary digital learning resources, competitive examination preparation needs, increased parental investment in quality education, and integration of interactive multimedia content enhancing learning outcomes.

Key factors driving the India edtech market include expanding digital infrastructure and internet accessibility, growing demand for competitive examination preparation, rising focus on skill development, and increasing adoption of vernacular language platforms.

Major challenges include digital literacy gaps among rural populations, content quality and standardization concerns, screen fatigue affecting learning effectiveness, infrastructure limitations in remote areas, and consumer trust issues regarding platform credibility.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)