India Elastomers Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

India Elastomers Market Size and Share:

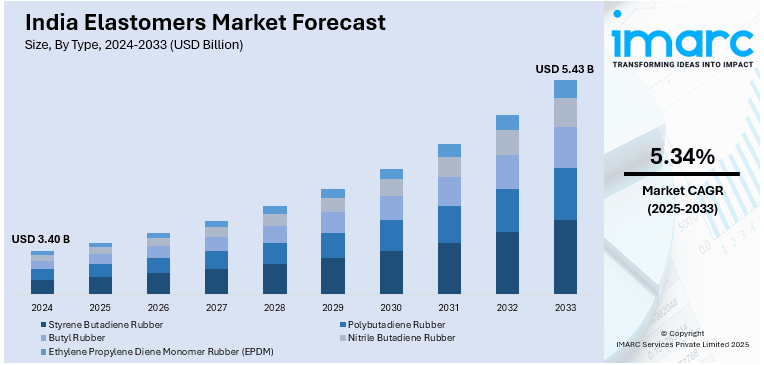

The India elastomers market size reached USD 3.40 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.43 Billion by 2033, exhibiting a growth rate (CAGR) of 5.34% during 2025-2033. The increasing demand from automotive, industrial, and construction sectors, rising investments in infrastructure, expanding consumer electronics industry, continual advancements in manufacturing technologies, growing preference for sustainable materials, and government initiatives promoting domestic production and innovation are some of the major factors expanding India elastomers market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.40 Billion |

| Market Forecast in 2033 | USD 5.43 Billion |

| Market Growth Rate 2025-2033 | 5.34% |

India Elastomers Market Trends:

Growing Demand from the Automotive Sector

The rising demand from the automotive sector drives the India elastomers market growth. With increasing vehicle production and the shift toward electric vehicles (EVs), elastomers such as styrene-butadiene rubber (SBR) and ethylene propylene diene monomer (EPDM) are being widely used for tire manufacturing, seals, and gaskets. For instance, the Indian government is actively encouraging the adoption of electric vehicles (EVs) through several policies, such as the FAME II scheme, which has a budget of INR 11,500 Crore, and the PLI scheme for the automotive sector, which has a budget of INR 25,938 Crore. As of July 8, 2024, EV registrations in India increased by 16% in the first half of 2024, reaching 8,42,396 units compared to 7,23,492 in the same period in 2023. The nation has also set up 16,344 public charging stations. This rise in EV manufacturing and infrastructure is expected to drive demand for advanced elastomers used in components like seals, gaskets, tires, and thermal insulation materials, particularly those that can withstand higher temperatures and electrical loads in EVs. In addition to this, elastomers offer a great replacement for lightweight materials due to their flexibility and durability. Furthermore, research on bio-based elastomers is expanding due to the drive for sustainability. Demand is also increasing with government programs encouraging domestic auto manufacturing under the "Make in India" initiative. Consumers' increasing desire for high-performance and fuel-efficient automobiles is leading to innovations in elastomer-based components. The market for premium elastomers in India is anticipated to increase gradually over the next several years due to the development of automotive technology.

To get more information on this market, Request Sample

Expanding Applications in the Medical and Healthcare Industry

The medical and healthcare industry is emerging as a key driver of the Indian elastomers market, fueled by the increasing demand for medical-grade rubber materials. Elastomers such as nitrile butadiene rubber (NBR) and silicone-based elastomers are extensively used in medical devices, gloves, tubing, and seals due to their superior chemical resistance and biocompatibility. The rise in healthcare infrastructure, coupled with growing awareness of infection control, leads to an increase in demand for disposable medical products made from elastomers. In addition to this, implementation of favorable government initiatives is facilitating the market expansion. According to an industry report, India's healthcare sector is projected to reach USD 320 Billion by 2028. This expansion is expected to support growth in the country's elastomers market, especially in medical-grade applications such as tubing, gloves, catheters, and seals. Elastomers like silicone and thermoplastic elastomers are increasingly used in diagnostic devices, wearable medical tech, and drug delivery systems due to their flexibility, durability, and biocompatibility. The rise in healthcare infrastructure, diagnostics, and medical manufacturing will likely increase demand for these materials across both domestic production and exports. Additionally, advancements in 3D printing and flexible medical implants e further expand elastomer applications in the sector. The COVID-19 pandemic accelerated the adoption of elastomer-based protective gear, which continues to drive market demand post-pandemic. With increasing healthcare investments and technological innovations, the medical industry's reliance on high-performance elastomers is set to strengthen, thereby positively impacting the India elastomers market outlook.

India Elastomers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and end-user.

Type Insights:

- Styrene Butadiene Rubber

- Polybutadiene Rubber

- Butyl Rubber

- Nitrile Butadiene Rubber

- Ethylene Propylene Diene Monomer Rubber (EPDM)

The report has provided a detailed breakup and analysis of the market based on the type. This includes styrene butadiene rubber, polybutadiene rubber, butyl rubber, nitrile butadiene rubber, and Ethylene Propylene Diene Monomer Rubber (EPDM).

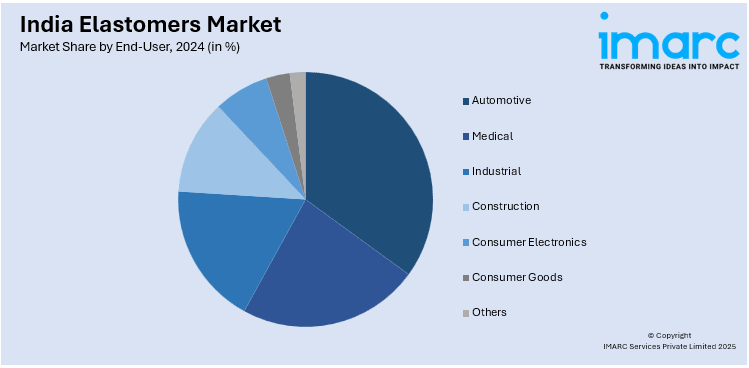

End-User Insights:

- Automotive

- Medical

- Industrial

- Construction

- Consumer Electronics

- Consumer Goods

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes automotive, medical, industrial, construction, consumer electronics, consumer goods, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Elastomers Market News:

- On February 24, 2025, BASF India Limited started building a new factory in Dahej to increase production of its Cellasto® microcellular polyurethane (MCU) elastomers in order to satisfy the growing demand in the Indian automobile industry. In the second half of 2026, the facility, which will include automation systems and cutting-edge technologies is expected to open. This initiative demonstrates BASF's dedication to "Producing in India for India," bolstering its position in the Indian market and reaffirming its support for OEMs' expansion strategies.

India Elastomers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Styrene Butadiene Rubber, Polybutadiene Rubber, Butyl Rubber, Nitrile Butadiene Rubber, Ethylene Propylene Diene Monomer Rubber (EPDM) |

| End-Users Covered | Automotive, Medical, Industrial, Construction, Consumer Electronics, Consumer Goods, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India elastomers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India elastomers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India elastomers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The elastomers market in India was valued at USD 3.40 Billion in 2024.

The India elastomers market is projected to exhibit a (CAGR) of 5.34% during 2025-2033, reaching a value of USD 5.43 Billion by 2033.

Key factors driving the India elastomers market include increasing demand from automotive and construction sectors, growth in industrial manufacturing, advancements in medical and consumer goods applications, and government initiatives supporting infrastructure development. Additionally, the rising demand for durable, cost-effective materials and technological innovations further boost market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)