India Electric Actuators Market Size, Share, Trends and Forecast by Type, End-User, and Region, 2025-2033

India Electric Actuators Market Overview:

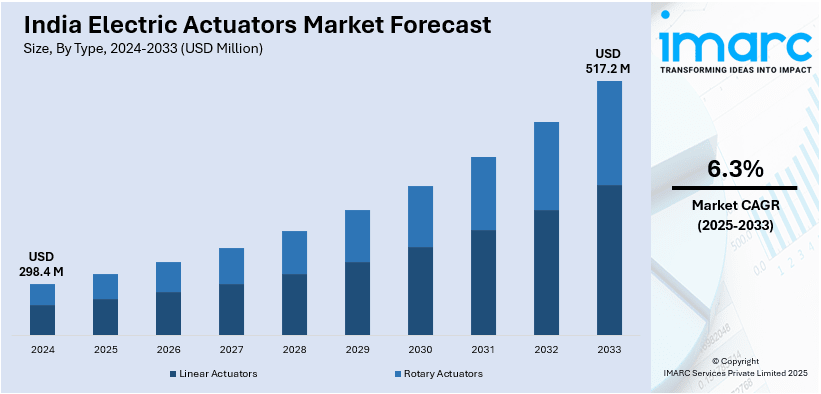

The India electric actuators market size reached USD 298.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 517.2 Million by 2033, exhibiting a growth rate (CAGR) of 6.3% during 2025-2033. The rising industrial automation, increasing adoption in automotive and aerospace sectors, government initiatives for smart manufacturing, demand for energy-efficient solutions, advancements in robotics, and expanding applications in oil and gas, water treatment, and healthcare are some of the key factors positively impacting the India electric actuators market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 298.4 Million |

| Market Forecast in 2033 | USD 517.2 Million |

| Market Growth Rate 2025-2033 | 6.3% |

India Electric Actuators Market Trends:

Rising Industrial Automation and Smart Manufacturing Initiatives

The increasing adoption of industrial automation across manufacturing sectors is driving India electric actuators market growth. According to the India Brand Equity Foundation, by 2030, India is set to be the third most desirable manufacturing hub in the world, with an export target of USD 1 Trillion. The automotive, aerospace, and electronics sectors are rapidly implementing manufacturing lines with robotic systems, CNC machines, and automated assembly lines, all of which utilize electric actuators for motion control. Additionally, government schemes are motivating industries towards implementing smart manufacturing, including precision control, efficiency, and scalability with automated systems. The development of Industry 4.0 makes manufacturers implement actuators with IoT-integrated sensors, providing real-time performance data, predictive maintenance, and energy consumption. This increases operating efficiency and reduces downtime and maintenance expenses. The shift towards automated systems is notably evident in food processing, pharmaceuticals, and textiles, where movement accuracy, hygiene standards, and consistency are essential to mass production.

To get more information on this market, Request Sample

Expanding Adoption in Renewable Energy and Energy-Efficient Systems

Electric actuators are also gaining pace in India's renewable energy industry, specifically in solar tracking systems and wind turbine drives, where accurate positioning is a requirement to maximize energy generation. As per PIB, by 2030, the Indian government wants to have 500 GW of non-fossil fuel energy capacity. Therefore, in achieving maximum energy conversion, solar and wind power projects are employing top-of-the-line actuator technology, which is positively influencing the India electric actuators market outlook. Solar farm actuators are made to alter panel angles based on real-time sun tracking to achieve efficiency. Wind turbines use electric actuators for pitch and yaw control, ensuring optimal blade positioning and stability under varying wind conditions. In addition to this, increased focus on energy-efficient building management systems (BMS) is also promoting the installation of electric actuators in HVAC systems, where electric actuators are made to regulate air dampers, valves, and louvers for achieving optimal indoor climate and ensure reduced energy consumption and minimizing the operating cost in commercial and industrial buildings.

India Electric Actuators Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and end -user.

Type Insights:

- Linear Actuators

- Rotary Actuators

The report has provided a detailed breakup and analysis of the market based on the type. This includes linear actuators and rotary actuators.

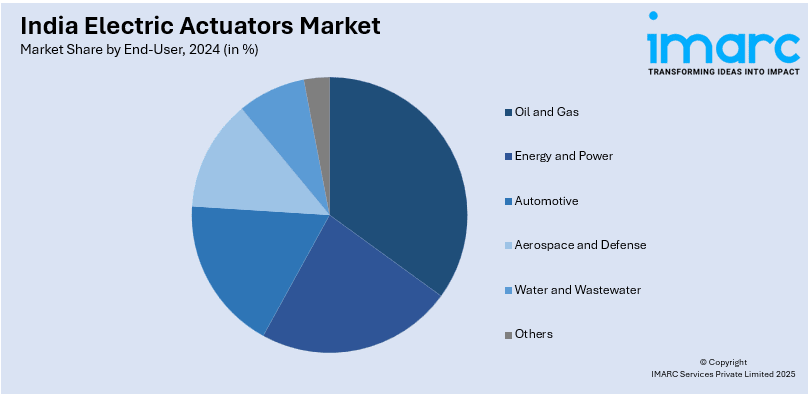

End-User Insights:

- Oil and Gas

- Energy and Power

- Automotive

- Aerospace and Defense

- Water and Wastewater

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes oil and gas, energy and power, automotive, aerospace and defense, water and wastewater, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Electric Actuators Market News:

- On July 12, 2024, Metal Work introduced the compact rotary actuator Series Elektro RBA, designed for continuous bi-directional rotation. This actuator features a toothed belt with adjustable tension and a through-hole for seamless integration of pipes and cables. It offers compatibility with both brushless and stepping motors, is available with holding brakes, and provides flexible mounting options to accommodate diverse application requirements.

- On September 26, 2024, the Kerala State Electronics Development Corporation (Keltron) and Norwegian firm Eltorque signed a MoU to collaborate on the design and manufacturing of electric, hydraulic, and electro-hydraulic actuators in the control and instrumentation sector. This partnership aims to enhance Keltron's capabilities in producing advanced actuators, building upon its four-decade legacy of delivering control and instrumentation systems to major industrial establishments in India.

India Electric Actuators Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Linear Actuators, Rotary Actuators |

| End-Users Covered | Oil and Gas, Energy and Power, Automotive, Aerospace and Defense, Water and Wastewater, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India electric actuators market performed so far and how will it perform in the coming years?

- What is the breakup of the India electric actuators market on the basis of type?

- What is the breakup of the India electric actuators market on the basis of end-user?

- What is the breakup of the India electric actuators market on the basis of region?

- What are the various stages in the value chain of the India electric actuators market?

- What are the key driving factors and challenges in the India electric actuators market?

- What is the structure of the India electric actuators market and who are the key players?

- What is the degree of competition in the India electric actuators market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India electric actuators market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India electric actuators market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India electric actuators industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)