India Electric Bus Market Size, Share, Trends and Forecast by Propulsion Type, Battery Type, Length, Range, Battery Capacity, and Region, 2026-2034

India Electric Bus Market Summary:

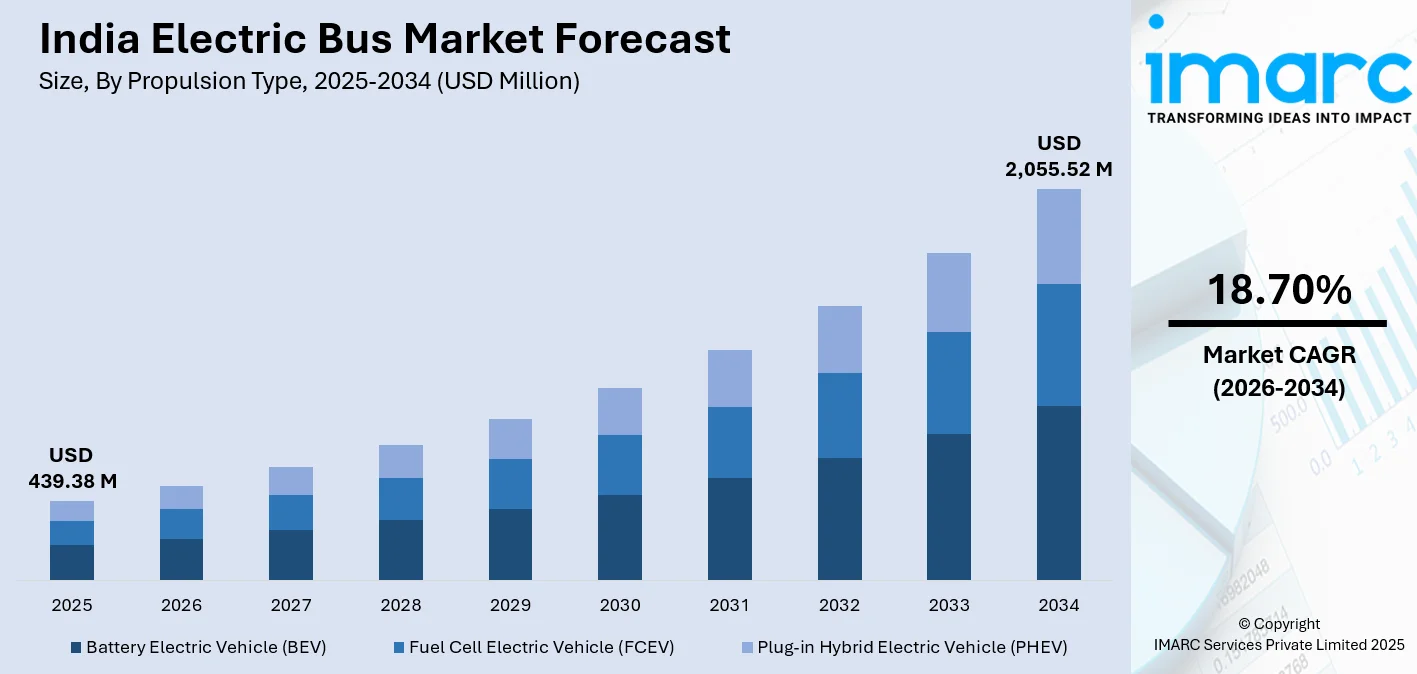

The India electric bus market size was valued at USD 439.38 Million in 2025 and is projected to reach USD 2,055.52 Million by 2034, growing at a compound annual growth rate of 18.70% from 2026-2034.

The India electric bus market is undergoing a revolution in terms of rapid development, thanks to ambitious electrification plans initiated by the Indian Government, along with increasing urban transport networks. With sustainability objectives of a green environment, reduced costs of batteries, and development of favorable policies such as PM E-DRIVE, there has been widespread adoption. State transport organizations of major cities are increasingly opting for emission less transportation, making electric buses integral to India’s green transport model.

Key Takeaways and Insights:

-

By Propulsion Type: Battery Electric Vehicle (BEV) dominates the market with a share of 64.96% in 2025, driven by superior operational efficiency, lower running costs, and strong government subsidy support under national electric mobility programs favoring pure battery-powered transit solutions.

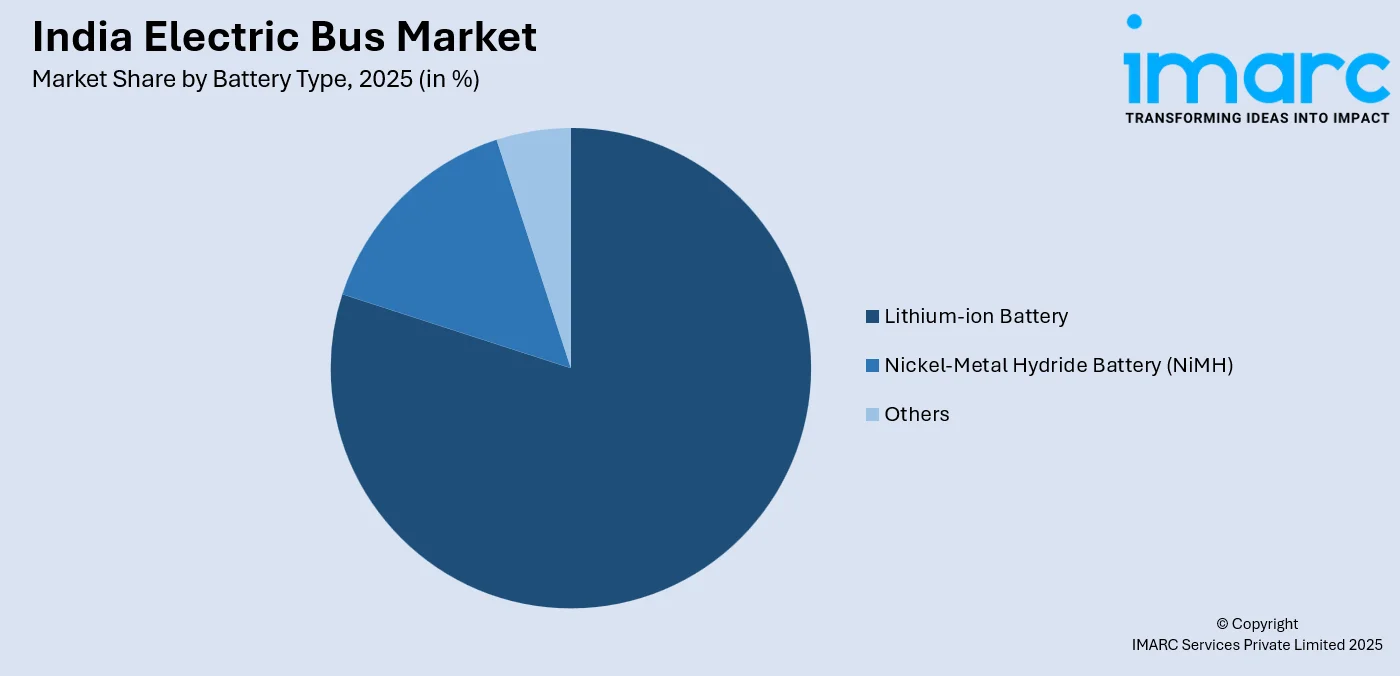

- By Battery Type: Lithium-ion battery leads the market with a share of 79.92% in 2025, owing to its high energy density, longer lifespan, faster charging capabilities, and declining manufacturing costs making it the preferred choice for electric bus manufacturers nationwide.

- By Length: 9-14 meters represents the largest segment with a market share of 68.95% in 2025, reflecting optimal passenger capacity for urban and intercity routes while maintaining maneuverability in congested traffic conditions prevalent across Indian metropolitan areas.

- By Range: More than 200 miles dominates the market with a share of 56.96% in 2025, addressing operational requirements of state transport undertakings requiring extended route coverage with minimal charging interruptions during peak service hours.

- By Battery Capacity: Up to 400 kWh leads the market with a share of 54.94% in 2025, providing adequate energy storage for standard urban routes while balancing vehicle weight, charging infrastructure requirements, and total cost of ownership considerations.

- By Region: North India dominates the market with a share of 36% in 2025, driven by extensive fleet deployments in Delhi, robust state transport undertaking initiatives, and well-established charging infrastructure supporting large-scale electric bus operations.

- Key Players: The India electric bus market exhibits moderate competitive intensity with a relatively concentrated structure. Domestic manufacturers with purpose-built electric vehicle platforms compete alongside established commercial vehicle makers that are gradually transitioning their portfolios toward electric mobility solutions.

To get more information on this market Request Sample

The India electric bus market represents a critical component of the nation's transportation electrification strategy aimed at achieving net-zero emissions targets. Public transport authorities across major cities are implementing fleet modernization programs prioritizing zero-emission vehicles, creating substantial demand. In February 2025, JBM Ecolife Mobility secured a major contract to supply, operate, and maintain over 1,021 electric buses under the Government of India’s PM-eBus Sewa Scheme-2, expanding its order book to more than 11,000 buses and underscoring OEM involvement in large-scale deployments. Urban air quality concerns and rising fuel costs are compelling state transport undertakings to accelerate procurement through gross cost contract models that transfer operational risks to private operators. The market benefits from increasing localization of critical components including battery packs, motors, and power electronics, while technological advancements in fast-charging infrastructure and battery management systems further support expansion.

India Electric Bus Market Trends:

Expansion of Gross Cost Contract Procurement Model

The gross cost contract model is emerging as the preferred procurement mechanism for electric buses across Indian cities. Under this arrangement, private operators assume responsibility for vehicle supply, maintenance, charging infrastructure development, and energy management while transport authorities pay fixed per-kilometer fees. In December 2025, state-owned Convergence Energy Services Ltd (CESL) concluded a tender for 10,900 electric buses under the PM E-Drive/National Electric Bus Programme, allocating fleets to cities including Bengaluru, Delhi, and Hyderabad with private operators accountable for operations and maintenance under the gross cost contract framework. This model reduces operational risks for public agencies, ensures service quality standards, and attracts private investment into the electric bus ecosystem while enabling scalable fleet expansion.

Integration of Smart Technologies and Connected Features

Electric bus manufacturers are increasingly incorporating advanced telematics, real-time monitoring systems, and predictive maintenance capabilities into their vehicles. These smart technologies enable fleet operators to optimize route planning, monitor energy consumption, track vehicle health parameters, and improve passenger experience through features like automated announcements and mobile ticketing integration. For example, at Busworld 2025, JBM Electric Vehicles unveiled its new ECOLIFE e12 city bus equipped with advanced telematics and Intelligent Transport System-compliant real-time vehicle health monitoring to support predictive maintenance and operational analytic. The digital transformation is enhancing operational efficiency across public transport networks.

Focus on Domestic Manufacturing and Component Localization

Indian electric bus manufacturers are intensifying efforts toward vertical integration and localization of high-value components including battery packs, electric motors, wiring harnesses, and control units. This strategic approach reduces import dependence, improves supply chain resilience, and enables competitive pricing in tender processes. In May 2025, EKA Mobility was awarded the Automotive Production Linked Incentive (PLI) certificate by the Automotive Research Association of India (ARAI) for its indigenously developed electric bus platform, validating its localization efforts and making it eligible for government PLI support aimed at boosting domestic electric vehicle technology production. Government policies supporting domestic manufacturing through production-linked incentives are accelerating this localization trend across the electric mobility value chain.

Market Outlook 2026-2034:

The prospects for the electric bus market in India continue to remain highly favorable, with the government doubling down on their deployment plans under the PM E-DRIVE initiative with an aim at having fifty thousand electric buses in operation by the end of this decade. State transport departments are actively placing large orders, finalizing the procurement of tens of thousands of electric buses for major cities. The market generated a revenue of USD 439.38 Million in 2025 and is projected to reach a revenue of USD 2,055.52 Million by 2034, growing at a compound annual growth rate of 18.70% from 2026-2034.

India Electric Bus Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Propulsion Type |

Battery Electric Vehicle (BEV) |

64.96% |

|

Battery Type |

Lithium-ion Battery |

79.92% |

|

Length |

9-14 Meters |

68.95% |

|

Range |

More than 200 Miles |

56.96% |

|

Battery Capacity |

Up to 400 kWh |

54.94% |

|

Region |

North India |

36% |

Propulsion Type Insights:

- Battery Electric Vehicle (BEV)

- Fuel Cell Electric Vehicle (FCEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

Battery Electric Vehicle (BEV) dominates with a market share of 64.96% of the total India electric bus market in 2025.

Battery electric vehicles have established clear dominance in the India electric bus market owing to their zero tailpipe emissions, lower operational costs compared to diesel alternatives, and strong alignment with government electrification mandates. In 2025, over 4,400 electric buses were registered across India, with battery-electric models comprising the overwhelming majority of these deployments as states like Maharashtra and Delhi expanded their zero-emission fleets. State transport undertakings prefer BEVs for urban routes where charging infrastructure can be strategically deployed at depots, enabling overnight charging cycles that maximize vehicle utilization during peak hours.

The declining cost of lithium-ion battery packs and increasing energy density have significantly improved the total cost of ownership proposition for battery electric buses. Manufacturers are offering extended warranties and performance guarantees that address concerns around battery degradation, further boosting operator confidence. The gross cost contract model prevalent in public tenders transfers technology risk to operators who invest in maintaining optimal battery health throughout vehicle lifecycles.

Battery Type Insights:

Access the comprehensive market breakdown Request Sample

- Lithium-ion Battery

- Nickel-Metal Hydride Battery (NiMH)

- Others

The lithium-ion battery leads with a share of 79.92% of the total India electric bus market in 2025.

Lithium-ion batteries have emerged as the technology of choice for electric buses due to their superior energy density enabling extended range, faster charging capabilities reducing depot turnaround times, and longer cycle life ensuring reliable performance throughout operational periods. The variants including lithium iron phosphate and lithium nickel manganese cobalt oxide offer different optimization points for range, safety, and cost considerations.

Domestic battery manufacturing capacity is expanding with government incentives under production-linked incentive schemes encouraging localization of cell production. This growth in indigenous manufacturing is reducing import dependence, improving supply chain security, and enabling competitive pricing that supports broader market adoption. Advanced battery management systems are enhancing safety and extending pack longevity through optimized thermal regulation.

Length Insights:

- Less Than 9 Meters

- 9-14 Meters

- Above 14 Meters

The 9-14 meters dominates with a market share of 68.95% of the total India electric bus market in 2025.

The 9-14 meters length category represents the sweet spot for urban and intercity electric bus deployments in India, offering optimal passenger capacity typically ranging from thirty to fifty seated passengers while maintaining maneuverability in congested traffic conditions. These buses are well-suited for trunk routes connecting major transit hubs and delivering high-frequency services across metropolitan areas.

Electric buses in the 9–14-meter segment account for a significant share of deployments in India, as this size range balances passenger capacity, operational efficiency, and route flexibility. These buses can accommodate larger battery systems while maintaining adequate interior space, enabling them to meet daily range requirements across urban and intercity operations. Variants within this segment are increasingly offered with enhanced comfort features, including air-conditioning, to support higher-quality public and premium transport services.

Range Insights:

- Less Than 200 Miles

- More Than 200 Miles

The more than 200 miles leads with a share of 56.96% of the total India electric bus market in 2025.

Extended range capabilities are essential for state transport undertakings operating intercity and long-distance urban routes requiring uninterrupted service throughout operational hours. Buses with ranges exceeding two hundred miles minimize charging frequency, maximizing fleet utilization during peak demand periods. This extended range addresses operational requirements of transport agencies managing extensive route networks across metropolitan areas where depot-based overnight charging must sustain full-day operations without intermediate recharging stops.

Advancements in battery energy density and thermal management systems enable manufacturers to deliver extended range without compromising passenger capacity or vehicle performance. High-capacity lithium-ion battery packs optimized for Indian climatic conditions ensure consistent range delivery across varying temperatures and terrain. In January 2025, Olectra Greentech rolled out new electric buses equipped with blade battery technology that offers up to 30% more energy storage and a range of up to 500 km per charge, reflecting how advanced battery systems are extending operational range for public transport fleets. The preference for extended range vehicles reflects operator priorities for route flexibility and scheduling efficiency, reducing dependency on opportunity charging infrastructure while maintaining service reliability across diverse urban and intercity transit applications throughout the country.

Battery Capacity Insights:

- Up To 400 kWh

- Above 400 kWh

The up to 400 kWh dominates with a market share of 54.94% of the total India electric bus market in 2025.

Battery capacities up to four hundred kilowatt-hours provide optimal balance between range requirements and vehicle weight considerations for standard urban and intercity routes. This capacity range enables buses to complete full operational shifts on single overnight charges, aligning with depot-based charging strategies preferred by state transport undertakings. The segment offers cost-effective solutions meeting typical daily distance requirements without excessive battery investment increasing vehicle acquisition costs.

Lower capacity batteries reduce overall vehicle weight, improving energy efficiency and passenger carrying capacity while minimizing structural stress on roads and bridges. The charging infrastructure requirements for this segment are more manageable, with standard depot chargers capable of replenishing batteries during off-peak hours. Transport operators benefit from predictable energy consumption patterns and simplified fleet management. This capacity range represents the practical sweet spot balancing upfront costs, operational range, charging time requirements, and total cost of ownership considerations for mainstream public transport deployments across Indian cities.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

North India exhibits a clear dominance with a 36% share of the total India electric bus market in 2025.

North India leads electric bus adoption driven primarily by Delhi's aggressive fleet electrification initiatives and substantial procurement under central government schemes. The National Capital Region benefits from strong policy support, established charging infrastructure networks, and proactive state transport undertakings committed to zero-emission public transport. Major cities including Delhi, Chandigarh, Lucknow, and Jaipur are actively expanding electric bus operations across intracity and intercity routes serving densely populated urban corridors.

The region's dominance reflects concentrated government investment in public transport modernization addressing severe air quality challenges in northern metropolitan areas. Delhi Transport Corporation operates one of India's largest electric bus fleets, serving as a model for other cities nationwide. Favorable electricity tariffs, dedicated depot infrastructure, and streamlined procurement processes through gross cost contract models have accelerated deployments. The presence of multiple electric bus manufacturers in northern states further strengthens regional supply chains, enabling faster delivery timelines and localized after-sales support for fleet operators throughout the region.

Market Dynamics:

Growth Drivers:

Why is the India Electric Bus Market Growing?

Robust Government Policy Support and Financial Incentives

The Government of India has implemented comprehensive policy frameworks to accelerate electric bus adoption through dedicated national schemes allocating substantial funding for deploying electric buses across major metropolitan cities. Under the PM-eBus Sewa scheme, the Union Cabinet approved support for augmenting city bus operations with around 10,000 electric buses on a public-private partnership basis, backed by central assistance and payment security mechanisms to de-risk investments for operators and authorities. State-level incentives complement central initiatives through road tax exemptions, registration fee waivers, and favorable electricity tariffs for charging infrastructure. The gross cost contract procurement model enables private sector participation while ensuring service quality, creating attractive investment opportunities for fleet operators and manufacturers. Customs duty exemptions on capital goods for battery manufacturing are reducing costs and boosting domestic production capabilities.

Declining Total Cost of Ownership and Operational Efficiency

Electric buses are demonstrating compelling total cost of ownership advantages over diesel alternatives when evaluated across their operational lifespan. Lower per-kilometer energy costs compared to diesel fuel, reduced maintenance requirements due to fewer moving parts in electric drivetrains, and decreasing battery pack prices are improving economic viability for transport operators. According to reports, the cost to operate electric buses was discovered to be about 29% lower than the cost of operating diesel buses on a per-kilometer basis, even before subsidies, highlighting the strong TCO advantage electric models have achieved in India. Regenerative braking systems extend range while reducing brake wear, further lowering maintenance expenditure over vehicle lifecycles. The operational efficiency gains are particularly pronounced in urban stop-and-go traffic conditions where electric propulsion outperforms conventional powertrains significantly. Fleet operators are increasingly recognizing these long-term economic benefits, driving procurement decisions toward electric alternatives despite higher upfront capital requirements associated with vehicle acquisition.

Environmental Concerns and Urban Air Quality Mandates

Indian cities face significant air pollution challenges, creating urgent imperatives for transportation sector decarbonization across metropolitan regions. Electric buses produce zero tailpipe emissions, directly addressing air quality concerns in densely populated urban areas where public transport operates extensively throughout daily schedules. In June 2025, the Commission for Air Quality Management (CAQM) mandated that from November 1, 2026, only clean‑fuel buses, including electric, CNG, or BS‑VI diesel, will be permitted to enter Delhi, reinforcing a regulatory push to curtail emissions from older, high‑polluting buses and accelerate the shift toward zero‑emission mobility. Judicial interventions and environmental regulations are compelling state transport authorities to transition fleets toward cleaner alternatives meeting emission standards. India's commitment to achieving net-zero emissions targets requires transformative changes in public transportation systems over coming decades.

Market Restraints:

What Challenges the India Electric Bus Market is Facing?

High Upfront Capital Investment Requirements

Electric buses require substantially higher initial capital investment compared to conventional diesel alternatives, creating procurement barriers for budget-constrained state transport undertakings. The additional infrastructure costs for charging stations, grid upgrades, and depot modifications further increase project outlays. Although total cost of ownership favors electric solutions over operational lifespans, securing upfront financing remains challenging for many public transport agencies. Limited access to favorable lending terms and lengthy approval processes for capital expenditure compound these financial constraints.

Charging Infrastructure Gaps and Grid Limitations

The expansion of electric bus fleets requires corresponding investment in charging infrastructure that currently lags deployment targets in many cities. Electricity grid capacity in certain areas may be inadequate to support simultaneous charging of large bus fleets, necessitating expensive upgrades. The coordination between transport authorities, electricity distribution companies, and urban planning agencies presents administrative complexities. Standardization of charging protocols and interoperability concerns create additional challenges for multi-vendor fleet operations. Rural and semi-urban routes face particular infrastructure constraints limiting electric bus penetration beyond major metropolitan centers.

Supply Chain Dependencies and Component Availability

The electric bus manufacturing ecosystem continues to depend significantly on imported components particularly battery cells and certain electronic systems. Global supply chain disruptions can impact production schedules and increase costs unpredictably. Domestic battery cell manufacturing capacity remains limited despite government incentives, creating vulnerability to international market dynamics. Rare earth materials essential for electric motors face concentrated global supply chains posing strategic concerns. Building resilient localized supply networks requires sustained investment over extended timeframes.

Competitive Landscape:

The India electric bus market exhibits a moderately concentrated competitive structure with domestic manufacturers holding predominant positions. Five established players account for the majority of annual registrations, reflecting barriers to entry including technology requirements, manufacturing capabilities, and track record demands in public tenders. The market is witnessing competitive realignment as newer entrants with dedicated electric vehicle platforms gain share against traditional commercial vehicle manufacturers transitioning from diesel production. Vertical integration covering battery packs, motors, and control systems has emerged as a competitive differentiator enabling cost leadership in price-sensitive tender processes. Strategic partnerships between domestic manufacturers and international technology providers are facilitating capability building. The gross cost contract model rewards operational excellence and service reliability, shifting competitive dynamics beyond vehicle pricing toward lifecycle performance. Government procurement frameworks emphasizing domestic content requirements are shaping market access conditions favoring locally established manufacturing operations.

Recent Developments:

- In January 2026, The Delhi government announced plans to induct 3,330 new electric buses under Phase 2 of the PM E-DRIVE programme to strengthen last-mile connectivity and reduce vehicular emissions. The fleet will include mini and mid-size air-conditioned buses, supporting route diversification and cleaner urban mobility across the capital.

India Electric Bus Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Propulsion Types Covered | Battery Electric Vehicle (BEV), Fuel Cell Electric Vehicle (FCEV), Plug-in Hybrid Electric Vehicle (PHEV) |

| Battery Types Covered | Lithium-ion Battery, Nickel-Metal Hydride Battery (NiMH), Others |

| Lengths Covered | Less Than 9 Meters, 9-14 Meters, Above 14 Meters |

| Ranges Covered | Less Than 200 Miles, More Than 200 Miles |

| Battery Capacities Covered | Up To 400 kWh, Above 400 kWh |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India electric bus market size was valued at USD 439.38 Million in 2025.

The India electric bus market is expected to grow at a compound annual growth rate of 18.70% from 2026-2034 to reach USD 2,055.52 Million by 2034.

Battery Electric Vehicle (BEV) dominated with a market share of 64.96%, driven by superior operational efficiency, zero tailpipe emissions, strong government subsidy support, and declining battery costs making pure electric solutions the preferred choice for public transport electrification initiatives.

Key factors driving the India electric bus market include robust government policy support through the PM E-DRIVE scheme, declining total cost of ownership compared to diesel alternatives, environmental concerns driving urban air quality mandates, expanding charging infrastructure, and increasing domestic manufacturing capabilities reducing import dependence.

Major challenges include high upfront vehicle costs compared to conventional diesel buses, limited charging infrastructure coverage beyond major metropolitan areas, inconsistent electricity grid capacity in certain regions, supply chain dependencies for battery components, extended vehicle delivery timelines, and evolving technology standards requiring continuous adaptation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)