India Electric Car Market Size, Share, Trends and Forecast by Type, Vehicle Class, Vehicle Drive Type, and Region, 2026-2034

India Electric Car Market Summary:

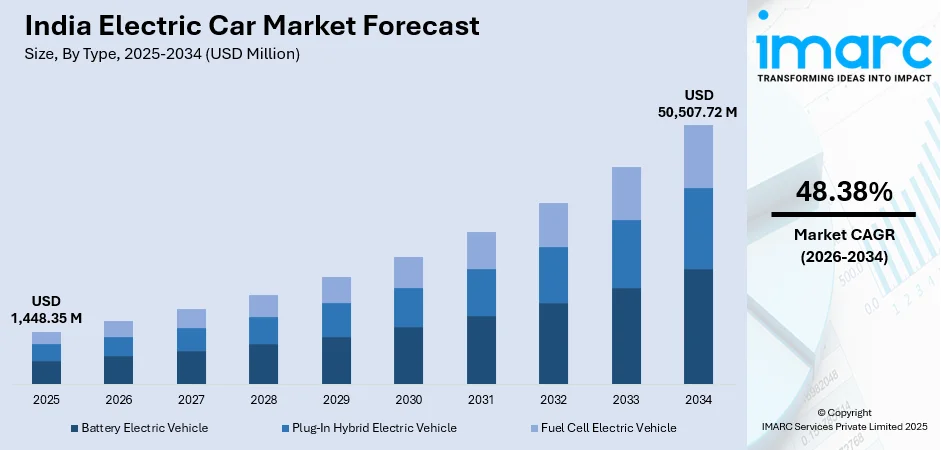

The India electric car market size was valued at USD 1,448.35 Million in 2025 and is projected to reach USD 50,507.72 Million by 2034, growing at a compound annual growth rate of 48.38% from 2026-2034.

The market is driven by supportive government policies promoting electric mobility, expanding charging infrastructure networks across major urban centers, and growing environmental consciousness among consumers. Rising fuel prices are encouraging the shift toward sustainable transportation solutions, while technological advancements in battery systems are improving vehicle performance and affordability. Indigenous manufacturing capabilities are strengthening, supported by favorable regulatory frameworks. The India electric car market share is witnessing substantial expansion as consumer adoption accelerates.

Key Takeaways and Insights:

-

By Type: Battery electric vehicle dominates the market with a share of 58% in 2025, driven by zero tailpipe emissions, superior government incentive allocations, advancing battery technology reducing range anxiety, and increasing consumer preference for fully electric solutions.

-

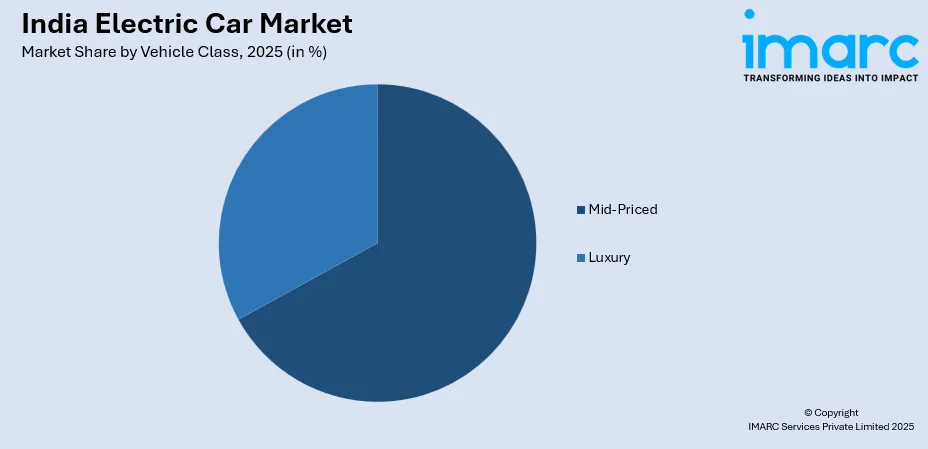

By Vehicle Class: Mid-priced leads the market with a share of 67% in 2025, owing to optimal affordability-feature balance, expanding middle-class purchasing power, manufacturer competitive pricing strategies, and alignment with government subsidy thresholds.

-

By Vehicle Drive Type: Front wheel drive represents the largest segment with a market share of 50% in 2025, driven by manufacturing cost efficiencies, superior fuel efficiency for urban commuting, lighter vehicle architecture improving range, and consumer familiarity.

-

By Region: South India leads the market with a share of 29% in 2025, owing to technology-forward metropolitan populations in Bangalore, Chennai, and Hyderabad, progressive state-level electrification policies, and robust charging infrastructure deployment.

-

Key Players: The India electric car market exhibits moderate competitive landscape, with domestic automobile manufacturers competing alongside international entrants across price segments, focusing on localized manufacturing, innovative launches, and charging network expansion.

To get more information on this market Request Sample

The India electric car market is experiencing transformative growth propelled by multiple converging factors that are reshaping the automotive landscape. Government initiatives aimed at reducing vehicular emissions and achieving carbon neutrality targets have created a favorable regulatory environment encouraging both manufacturers and consumers to embrace electric mobility. As per sources, in June 2025, India opened registrations under the SPMEPCI policy, inviting global OEMs like Tesla to invest in local electric car manufacturing with concessional 15% import duties on high-value EVs. Moreover, the strategic focus on reducing crude oil import dependency, which accounts for a significant portion of the nation's energy expenditure, is accelerating the transition toward domestically powered transportation solutions. Expanding urbanization has intensified concerns regarding air quality degradation in metropolitan areas, prompting consumers to seek cleaner mobility alternatives. Technological maturation in battery systems has addressed previous concerns regarding vehicle range and performance capabilities, while declining production costs are progressively improving price parity with conventional vehicles. The proliferation of charging infrastructure across urban corridors, supported by public-private partnerships, is alleviating range anxiety and enabling practical daily utilization.

India Electric Car Market Trends:

Accelerating Localized Manufacturing Ecosystem

The India electric car market is increasingly focusing on local manufacturing, with domestic and global automakers setting up assembly plants, battery production, and component fabrication facilities. According to sources, in August 2025, VinFast inaugurated its first Indian EV assembly plant in Thoothukudi, Tamil Nadu, with an initial capacity of 50,000 vehicles annually, marking its first facility outside Vietnam. Moreover, government incentives promoting domestic value addition are boosting local sourcing, reducing imports, and improving cost efficiency. Specialized manufacturing clusters in states with supportive policies are fostering employment, facilitating technology transfer, and enhancing competitiveness. This integrated ecosystem is strengthening India’s position in the EV sector while enabling affordable, high-quality electric vehicles (EVs) for the domestic market.

Premium Segment Expansion and Feature Enhancement

A notable trend emerging within the India electric car market involves progressive expansion toward premium vehicle offerings equipped with advanced technological features. According to sources, in September 2025, VinFast launched its premium electric SUVs VF 6 and VF 7 in India, featuring advanced connectivity, ADAS Level 2, and ARAIcertified ranges up to 532 km. Furthermore, manufacturers are introducing sophisticated models incorporating connected vehicle technologies, advanced driver assistance systems, premium interior appointments, and enhanced performance specifications targeting discerning urban consumers. This premiumization reflects evolving consumer expectations where environmental consciousness intersects with lifestyle aspirations, creating demand for vehicles delivering sustainability credentials and elevated ownership experiences.

Smart Charging Infrastructure Integration

The India electric car market is experiencing transformative developments in charging infrastructure with increasing emphasis on intelligent network integration and user convenience optimization. As per sources, in May 2025, India’s PM EDrive scheme accelerated EV charging rollout with approval for ~72,000 public chargers nationwide, including smart network features like realtime monitoring and booking. Moreover, smart charging solutions incorporating real-time availability monitoring, reservation capabilities, and dynamic pricing mechanisms are enhancing the overall electric vehicle (EV) ownership experience. The deployment of fast-charging corridors along major highway networks is enabling intercity travel while addressing range limitation concerns. Integration of renewable energy sources with charging infrastructure is strengthening the sustainability proposition.

Market Outlook 2026-2034:

The India electric car market revenue is positioned for substantial expansion throughout the forecast period, driven by sustained policy support, infrastructure maturation, and evolving consumer preferences favoring sustainable mobility solutions. Market revenue is anticipated to experience robust growth as manufacturing scale economies progressively improve vehicle affordability while advancing battery technologies enhance performance characteristics. The expanding charging network coverage across metropolitan areas and emerging Tier-II cities will significantly improve practical utility, encouraging broader consumer adoption. The market generated a revenue of USD 1,448.35 Million in 2025 and is projected to reach a revenue of USD 50,507.72 Million by 2034, growing at a compound annual growth rate of 48.38% from 2026-2034.

India Electric Car Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Battery Electric Vehicle | 58% |

| Vehicle Class | Mid-Priced | 67% |

| Vehicle Drive Type | Front Wheel Drive | 50% |

| Region | South India | 29% |

Type Insights:

- Battery Electric Vehicle

- Plug-In Hybrid Electric Vehicle

- Fuel Cell Electric Vehicle

Battery electric vehicle dominates with a market share of 58% of the total India electric car market in 2025.

Battery electric vehicles represent the dominant segment within the India electric car market, commanding the largest share due to their complete elimination of tailpipe emissions and alignment with national sustainability objectives. These vehicles operate exclusively on electric power stored in rechargeable battery systems, offering consumers zero direct emission transportation while delivering significantly lower operating costs compared to internal combustion alternatives. Government incentive programs have prioritized battery electric configurations, providing substantial purchase subsidies and registration benefits that enhance their value proposition.

The segment's dominance reflects advancing battery technology that has progressively addressed consumer concerns regarding driving range and charging infrastructure availability. According to sources, in 2025, Tata Motors launched the Harrier.ev in India with 65 kWh and 75 kW LFP batteries, offering up to 627 km range and advanced AWD/RWD configurations, enhancing consumer options in the battery electric vehicle segment. Further, improving energy density enables extended range capabilities while declining battery production costs are gradually improving purchase affordability. Manufacturers are expanding battery electric offerings across multiple price points and vehicle configurations, providing consumers diverse options matching various usage requirements and budget considerations. The growing environmental consciousness among urban consumers, combined with rising conventional fuel costs, continues strengthening battery electric vehicle appeal.

Vehicle Class Insights:

Access the comprehensive market breakdown Request Sample

- Mid-Priced

- Luxury

Mid-priced leads with a share of 67% of the total India electric car market in 2025.

Mid-priced commands substantial market share, reflecting the alignment between vehicle pricing and mainstream consumer purchasing capacity within the India electric car market. This segment encompasses vehicles positioned between entry-level offerings and premium luxury configurations, delivering comprehensive feature packages at accessible price points that resonate with middle-income consumers seeking electric mobility solutions. The segment benefits from manufacturer focus on optimizing value propositions through strategic feature inclusions while maintaining competitive pricing structures.

Mid-priced typically incorporate essential technological features including modern infotainment systems, adequate range capabilities for typical daily usage patterns, and contemporary design elements that appeal to aspiring consumers. According to sources, in September 2025, Tata Motors launched the Nexon EV 45 in India, featuring Level 2 ADAS, ambient cabin lighting, and premium touches, with prices starting at Rs 17.29 Lakh and deliveries commencing soon. Furthermore, government subsidy structures have been calibrated to maximize impact within this segment, enhancing affordability for target consumer demographics. Manufacturers are introducing diverse model configurations within this price band, expanding consumer choice while stimulating competitive innovation. The segment's continued dominance reflects the fundamental market reality where mass adoption requires vehicles that balance aspiration with accessibility.

Vehicle Drive Type Insights:

- Front Wheel Drive

- Rear Wheel Drive

- All-Wheel Drive

Front wheel drive exhibits a clear dominance with a 50% share of the total India electric car market in 2025.

Front wheel drive configurations dominate the India electric car market, reflecting engineering advantages that align with typical consumer usage patterns and manufacturer production economics. This drivetrain configuration positions the electric motor at the front axle, providing adequate traction and handling characteristics for urban and highway driving conditions that constitute most of the consumer usage scenarios. Manufacturing efficiencies associated with front wheel drive architectures enable competitive pricing that supports broader market accessibility.

The segment's leadership position reflects vehicle characteristics optimized for the Indian market context, including efficient packaging that maximizes interior space utilization and simplified mechanical complexity that reduces maintenance requirements. Front wheel drive EVs demonstrate superior energy efficiency characteristics particularly suited for stop-and-go urban traffic conditions prevalent in Indian metropolitan areas. Consumer familiarity with front wheel drive dynamics from conventional vehicle experience facilitates comfortable transition to electric mobility. The configuration's inherent advantages in weight distribution and regenerative braking effectiveness further enhance overall vehicle efficiency and driving range.

Regional Insights:

- South India

- North India

- West & Central India

- East India

South India dominates with a market share of 29% of the total India electric car market in 2025.

South India represents the leading regional market for electric cars, driven by the progressive state-level policies, technology-forward urban populations, and superior charging infrastructure development across major metropolitan centers. States within this region have implemented comprehensive EV promotion frameworks encompassing purchase incentives, registration benefits, and infrastructure investment programs that collectively stimulate market development. The concentration of technology industry employment and innovation creates consumer demographics with higher environmental awareness and digital adoption tendencies.

Metropolitan areas including Bangalore, Chennai, and Hyderabad demonstrate particularly strong EV adoption rates, supported by robust public and private charging infrastructure networks. According to sources, in June 2025, Telangana recorded 2.59 Lakh EV registrations, accounting for 4.2% of India’s total, supported by 100% road tax exemption and rising adoption of electric two- and four-wheelers. Moreover, state governments within South India have established ambitious electrification targets and implemented supportive policy frameworks that attract manufacturer investment and encourage consumer adoption. The region's relatively higher per capita income levels and exposure to global sustainability trends contribute to accelerated EV acceptance. Favorable climate conditions minimize battery performance degradation concerns while extensive urban development provides ideal operating environments for EVs.

Market Dynamics:

Growth Drivers:

Why is the India Electric Car Market Growing?

Comprehensive Government Policy Framework Supporting Electrification

The India electric car market benefits substantially from extensive government policy initiatives designed to accelerate EV adoption across consumer and commercial segments. National-level programs provide direct purchase incentives that significantly reduce acquisition costs, improving affordability for prospective buyers considering transition from conventional vehicles. According to sources, the Indian government under FAME Phase-II allocated Rs.10,000 Crore to incentivize adoption of 55,000 e-4W, 5 Lakh e-3W, 10 Lakh e-2W, and 7,000 e-buses. Moreover, state governments have supplemented central incentives with additional benefits including registration fee waivers, road tax exemptions, and preferential parking access that enhance the overall EV value proposition. Policy frameworks have evolved to encourage domestic manufacturing through production-linked incentives that attract investment while creating local employment opportunities. Infrastructure development receives dedicated funding allocations supporting charging network expansion.

Expanding Charging Infrastructure Network Accessibility

The proliferation of charging infrastructure across Indian urban centers and intercity corridors represents a fundamental driver enabling practical EV utilization and stimulating consumer adoption. Public charging stations are deploying rapidly across metropolitan areas, providing convenient access points that address range anxiety concerns previously limiting consumer consideration of electric alternatives. Fast-charging technology deployment along major highway networks enables intercity travel capabilities that expand EV utility beyond urban commuting applications. Workplace and residential charging solutions are proliferating, offering convenient overnight charging that aligns with typical usage patterns while reducing dependency on public infrastructure and improving overall ownership convenience.

Rising Environmental Consciousness and Air Quality Concerns

Increasing awareness regarding environmental sustainability and deteriorating urban air quality is fundamentally reshaping consumer transportation preferences within the India electric car market. Metropolitan populations experiencing persistent air quality challenges are actively seeking mobility alternatives that reduce personal contribution to atmospheric pollution. According to sources, in November 2025, Delhi CM launched 50 electric buses and Tehkhand ATS, enhancing public transport, enabling up to 72,000–73,000 vehicle fitness tests, and supporting cleaner air initiatives. Further, EVs provide tangible solutions enabling environmentally conscious consumers to align transportation choices with sustainability values while maintaining mobility requirements. Media coverage highlighting climate change implications and pollution health impacts has elevated environmental considerations within purchase decision frameworks. Corporate sustainability initiatives increasingly incorporate employee transportation programs favoring electric alternatives, stimulating adoption among professional demographics.

Market Restraints:

What Challenges the India Electric Car Market is Facing?

Premium Pricing Compared to Conventional Alternatives

Electric cars continue commanding price premiums compared to equivalent conventional vehicles, creating acquisition cost barriers that limit market accessibility for price-sensitive consumer segments. Battery systems represent significant cost components that elevate overall vehicle pricing despite progressive manufacturing cost reductions. The premium pricing positions EVs beyond typical family vehicle budgets, limiting adoption to higher-income demographics and constraining mass market penetration.

Charging Infrastructure Coverage Limitations

Despite substantial infrastructure development progress, charging network coverage remains concentrated within major metropolitan areas, limiting practical EV utility for consumers in smaller cities and rural locations. The uneven infrastructure distribution creates geographical adoption disparities that constrain overall market development potential. Charging station availability during peak demand periods occasionally creates waiting times that inconvenience users and diminish ownership experience quality.

Consumer Awareness and Perception Challenges

Limited consumer awareness regarding EV capabilities, ownership economics, and practical utilization aspects continues restraining market development within certain demographic segments. Misconceptions regarding vehicle performance, battery longevity, and maintenance requirements create hesitation among consumers considering electric alternatives. Range anxiety persists despite improving vehicle capabilities, reflecting information gaps regarding actual driving range adequacy for typical usage patterns.

Competitive Landscape:

The India electric car market competitive landscape features diverse participation from established domestic automobile manufacturers, international automotive corporations, and emerging electric-focused entrants pursuing market opportunities across multiple segments. Established domestic players leverage extensive distribution networks, brand recognition, and deep market understanding to maintain leadership positions while continuously expanding EV portfolios. International manufacturers are entering through strategic partnerships, joint ventures, and wholly owned subsidiaries, introducing globally developed technologies adapted for Indian market requirements. Competition intensifies across price segments as manufacturers introduce diverse offerings targeting various consumer demographics from entry-level to premium categories.

Recent Developments:

-

In September 2025, Volkswagen revealed plans to enter the Indian market with its all-electric small car lineup, including the ID. CROSS Concept SUV and ID. Polo. The strategy targets affordable entry-level EV adoption, aided by the recent GST reduction to 18 percent, enhancing cost-effectiveness and supporting sustainable urban mobility initiatives.

-

In April 2025, BYD India launched the 2025 BYD Seal electric sedan in India, starting at Rs 41 Lakh. The model features improved driving dynamics, cabin comfort, connectivity, advanced safety technologies, and a Lithium Iron Phosphate battery, offering enhanced efficiency and performance tailored for Indian EV consumers.

India Electric Car Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Battery Electric Vehicle, Plug-In Hybrid Electric Vehicle, Fuel Cell Electric Vehicle |

| Vehicle Classes Covered | Mid-Priced, Luxury |

| Vehicle Drive Types Covered | Front Wheel Drive, Rear Wheel Drive, All-Wheel Drive |

| Regions Covered | South India, North India, West and Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India electric car market size was valued at USD 1,448.35 Million in 2025.

The India electric car market is expected to grow at a compound annual growth rate of 48.38% from 2026-2034 to reach USD 50,507.72 Million by 2034.

Battery electric vehicle held the largest market share, driven by zero tailpipe emission advantages, superior government incentive allocations under national schemes, advancing battery technology reducing range anxiety, and increasing consumer preference for fully electric solutions over hybrid alternatives.

Key factors driving the India electric car market include comprehensive government policy frameworks providing purchase incentives, expanding charging infrastructure networks across urban centers, rising environmental consciousness among consumers, declining battery costs improving affordability, and supportive regulatory environment promoting domestic manufacturi

Major challenges include high upfront vehicle costs, limited charging infrastructure in remote areas, inconsistent government incentives, long battery replacement times, supply chain constraints, and low consumer awareness about electric mobility benefits.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)