India Electric Commercial Vehicles Market Size, Share, Trends and Forecast by Vehicle Type, Propulsion Type, Battery Capacity, End User, and Region, 2025-2033

India Electric Commercial Vehicles Market Size and Share:

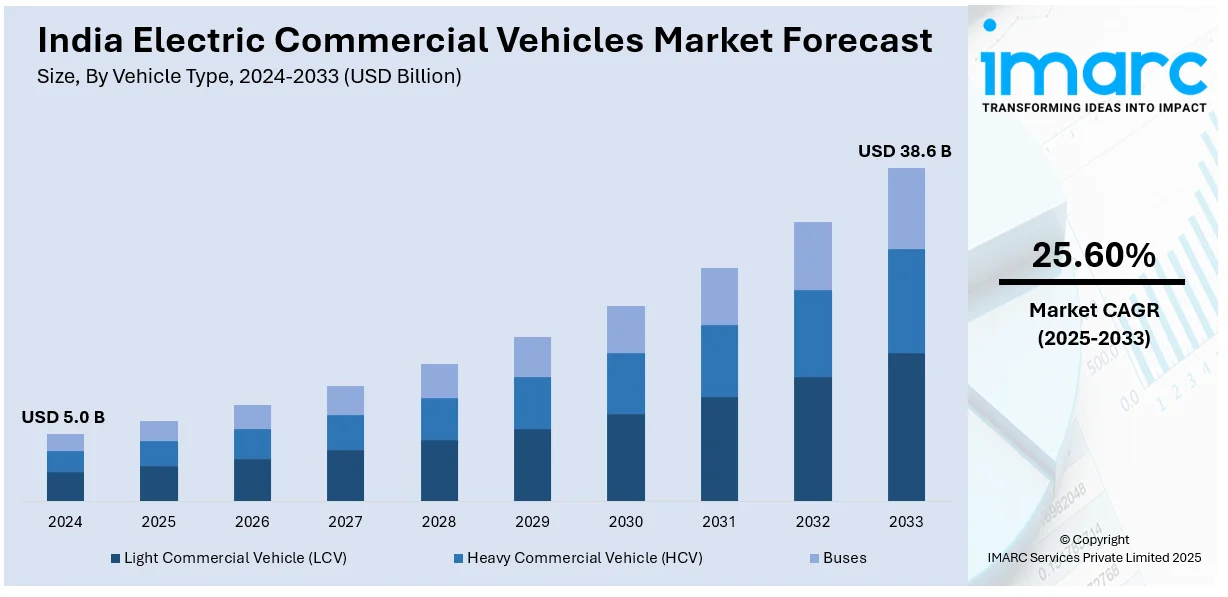

The India electric commercial vehicles market size reached USD 5.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 38.6 Billion by 2033, exhibiting a growth rate (CAGR) of 25.60% during 2025-2033. The implementation of supportive government incentives, stricter emission norms, rising fuel costs, advancements in battery technology, expanding charging infrastructure, increasing e-commerce logistics demand, corporate sustainability goals, and growing investments in domestic electric vehicle (EV) manufacturing and R&D.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.0 Billion |

| Market Forecast in 2033 | USD 38.6 Billion |

| Market Growth Rate 2025-2033 | 25.60% |

India Electric Commercial Vehicles Market Trends:

Government Incentives and Policy Support

The proactive measures by the Government of India to promote electric mobility fueling the adoption of electric commercial vehicles (ECVs). Key initiatives include financial incentives, policy reforms, and infrastructure development aimed at creating a conducive environment for ECV proliferation. In September 2024, the Indian government approved a ₹109 billion ($1.3 billion) incentive package under the PM E-DRIVE program to accelerate electric vehicle adoption. This includes ₹36.79 billion in subsidies for e-two-wheelers, e-three-wheelers, e-ambulances, and e-trucks, with ₹5 billion specifically designated for e-trucks. Additionally, ₹43.91 billion has been allocated to public transport agencies for the procurement of around 14,028 electric buses, supporting the expansion of electrified public transportation. The government also aims to boost EV sales from under 2% to 30% by 2030, reinforcing its commitment to sustainable mobility. These incentives have significantly lowered the total cost of ownership for ECVs, making them increasingly attractive to fleet operators and logistics firms.

To get more information on this market, Request Sample

Entry of New Market Players and Increased Investments

The Indian ECV industry is seeing new entrants and significant investments from both domestic and foreign enterprises. This influx has increased competition, fueled innovation, and broadened the variety of electric commercial vehicles available on the market. For example, in December 2024, Indian giant JSW announced intentions to develop its own electric car brand, with a production facility in Aurangabad, Maharashtra. This move places JSW alongside major EV producers like Tata Motors and Mahindra, signaling a strong competitive landscape. In addition, Blue Energy Motors, a company that specializes in liquefied natural gas (LNG)-powered vehicles, intends to fund $100 million by January 2025 to increase its production capacities. The company also announced the launch of its first electric truck, signaling a strategic shift towards electrification in the commercial vehicle sector. Furthermore, the entry of new players and increased investments have led to technological advancements, improved vehicle performance, and cost reductions, making electric commercial vehicles more viable for a broader range of applications.

India Electric Commercial Vehicles Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on vehicle type, propulsion type, battery capacity, and end user.

Vehicle Type Insights:

- Light Commercial Vehicle (LCV)

- Heavy Commercial Vehicle (HCV)

- Buses

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes light commercial vehicle (LCV), heavy commercial vehicle (HCV), and buses.

Propulsion Type Insights:

- Battery Electric Vehicle (BEV)

- Plug in Hybrid Vehicle (PHEV)

- Fuel Cell Electric Vehicle (FCEV)

A detailed breakup and analysis of the market based on the propulsion type have also been provided in the report. This includes battery electric vehicle (BEV), plug in hybrid vehicle (PHEV), and fuel cell electric vehicle (FCEV).

Battery Capacity Insights:

- <50kwh

- 50-150 kwh

- >150kwh

The report has provided a detailed breakup and analysis of the market based on the battery capacity. This includes <50kwh, 50-150 kwh, and >150kwh.

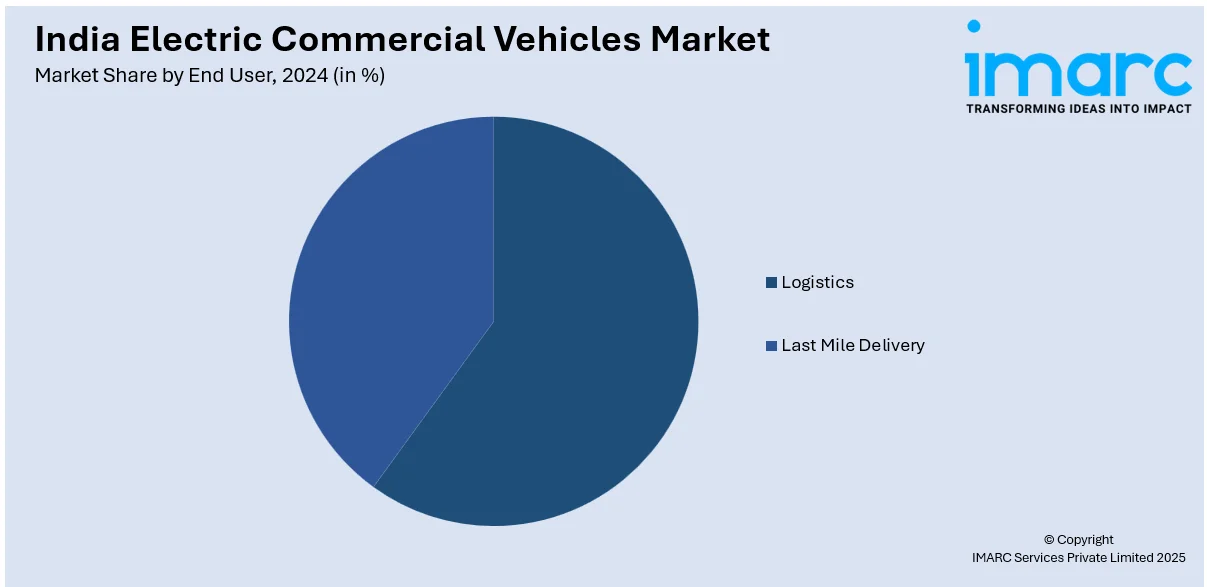

End User Insights:

- Logistics

- Last Mile Delivery

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes logistics and last mile delivery.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Electric Commercial Vehicles Market News:

- March 2025: Jupiter Group unveiled its first electric light commercial vehicle, the JEM TEZ, developed with support from leading OEMs such as Tata Motors and Volvo. The one-ton EV offers a class-leading on-road range of approximately 190 kilometers and features fast-charging technology, enabling a full charge in just one hour.

- January 2025: TVS introduced India’s first Bluetooth-connected electric three-wheeler, the King EV MAX, priced at Rs 2.95 lakh (ex-showroom). The vehicle is now available at select dealerships in Uttar Pradesh, Bihar, Jammu & Kashmir, Delhi, and West Bengal.

India Electric Commercial Vehicles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Light Commercial Vehicle (LCV), Heavy Commercial Vehicle (HCV), Buses |

| Propulsion Types Covered | Battery Electric Vehicle (BEV), Plug in Hybrid Vehicle (PHEV), Fuel Cell Electric Vehicle (FCEV) |

| Battery Capacities Covered | <50kwh, 50-150 kwh,>150kwh |

| End Users Covered | Logistics, Last Mile Delivery |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India electric commercial vehicles market from 2019-2033

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India electric commercial vehicles market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India electric commercial vehicles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electric commercial vehicles market in India was valued at USD 5.0 Billion in 2024.

The India electric commercial vehicles market is projected to exhibit a CAGR of 25.60% during 2025-2033, reaching a value of USD 38.6 Billion by 2033.

The India electric commercial vehicles market is driven by government incentives, rising fuel costs, and growing environmental concerns. Increased adoption of sustainable transport solutions, advancements in battery technology, and favorable policies promoting electric vehicle infrastructure are impelling the market growth. Additionally, the shift towards cleaner, cost-effective transportation and urbanization contributes to the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)