India Electric Fuse Market Size, Share, Trends and Forecast by Type, Voltage, End Use, and Region, 2025-2033

India Electric Fuse Market Size and Share:

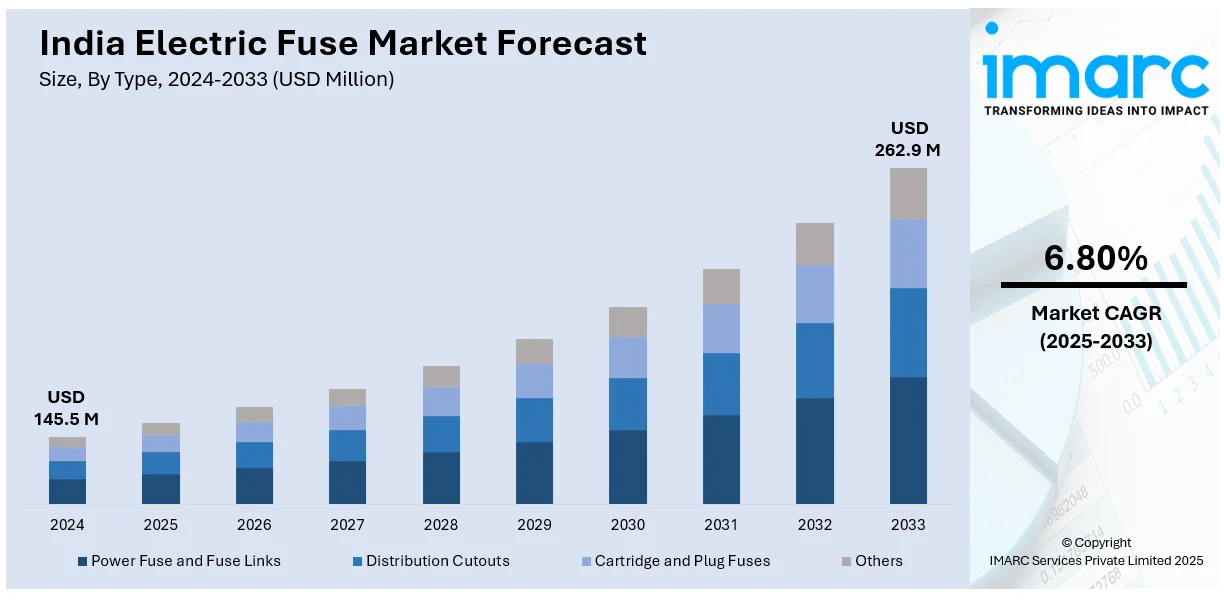

The India electric fuse market size reached USD 145.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 262.9 Million by 2033, exhibiting a growth rate (CAGR) of 6.80% during 2025-2033. The market is driven by increasing power infrastructure development, rising industrial automation, renewable energy integration, growing demand for electrical safety, expanding EV adoption, smart grid initiatives, and government policies promoting reliable and efficient power distribution systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 145.5 Million |

| Market Forecast in 2033 | USD 262.9 Million |

| Market Growth Rate 2025-2033 | 6.80% |

India Electric Fuse Market Trends:

Expansion of Renewable Energy Infrastructure

The government’s push to expand its renewable energy capacity is resulting in significant investments in solar and wind power projects. This rapid growth underscores the need for reliable electrical protection solutions, fueling the demand for electric fuses. For example, the PM Surya Ghar Muft Bijli Yojana is boosting the adoption of rooftop solar, providing households with clean energy access. As of January 2025, India has achieved its 100 GW solar energy production target, marking a significant milestone in its renewable energy transition. Looking ahead, the country aims to reach 500 GW of non-fossil fuel-based energy capacity by 2030. Over the past decade, the solar power sector has grown 3,450%, increasing from 2.82 GW in 2014 to 100 GW in 2025. With the growing integration of renewable energy into the national grid, advanced electrical components are essential for managing fluctuations and ensuring system stability. Electric fuses play a vital role in protecting these installations from current surges and short circuits, enhancing the safety and reliability of renewable energy systems.

To get more information on this market, Request Sample

Advancements in Smart Grid Technology

The modernization of India’s power infrastructure through smart grid initiatives is revolutionizing the country's electrical distribution system. By integrating digital technology, smart grids enable real-time monitoring and efficient electricity management, significantly improving reliability and operational efficiency. India has set an ambitious target of deploying 250 million smart meters by 2025 to enhance billing accuracy and minimize transmission losses. Additionally, the government has committed USD 44 Billion over the next decade to advance smart grid projects, reinforcing its dedication to power sector modernization and creating a favorable market outlook. A key benefit of smart grid implementation is the anticipated reduction of Aggregate Technical and Commercial (AT&C) losses from the current 22% to 15% by 2025. This shift is driving market growth, as smart grids necessitate advanced protection mechanisms to manage bidirectional power flows and real-time data analytics. In this context, electric fuses play a crucial role by providing rapid fault detection and response, ensuring the stability and resilience of the power network.

India Electric Fuse Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, voltage, and end use.

Type Insights:

- Power Fuse and Fuse Links

- Distribution Cutouts

- Cartridge and Plug Fuses

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes power fuse and fuse links, distribution cutouts, cartridge and plug fuses, and others.

Voltage Insights:

- Low Voltage

- Medium Voltage

A detailed breakup and analysis of the market based on the voltage have also been provided in the report. This includes low and medium voltage.

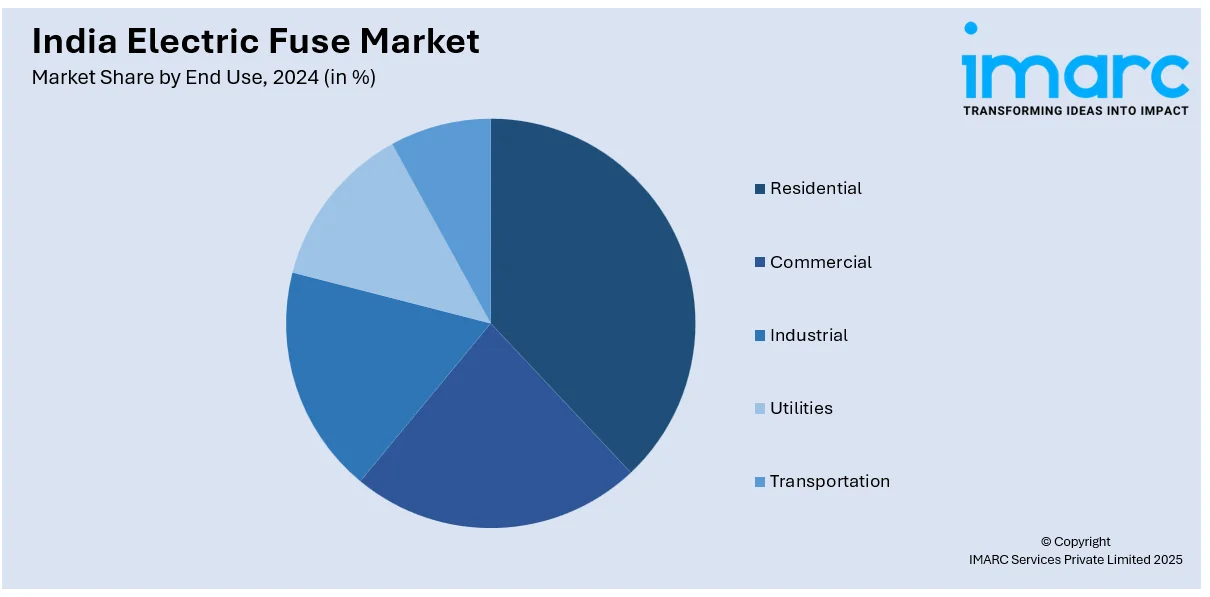

End Use Insights:

- Residential

- Commercial

- Industrial

- Utilities

- Transportation

The report has provided a detailed breakup and analysis of the market based on the end use. This includes residential, commercial, industrial, utilities, and transportation.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Electric Fuse Market News:

- March 2025: Tata Power-DDL partners with FSR Global to advance smart grid innovation. Their collaboration on clean energy, policy research, and capacity building will enhance power reliability, efficiency, and grid resilience in India, driving the demand for electric fuses.

- January 2025: Polycab introduced Infra Safety: Powering India's Electrical Future, a series of conclaves aimed at addressing the critical need for electrical safety across the country. The initiative highlights the importance of safety standards, system audits, and robust electrical infrastructure, along with advancements such as IoT integration and next-generation cabling solutions.

India Electric Fuse Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Power Fuse and Fuse Links, Distribution Cutouts, Cartridge and Plug Fuses, Others |

| Voltages Covered | Low Voltage, Medium Voltage |

| End Uses Covered | Residential, Commercial, Industrial, Utilities, Transportation |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India electric fuse market performed so far and how will it perform in the coming years?

- What is the breakup of the India electric fuse market on the basis of type?

- What is the breakup of the India electric fuse market on the basis of voltage?

- What is the breakup of the India electric fuse market on the basis of end use?

- What are the various stages in the value chain of the India electric fuse market?

- What are the key driving factors and challenges in the India electric fuse market?

- What is the structure of the India electric fuse market and who are the key players?

- What is the degree of competition in the India electric fuse market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India electric fuse market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India electric fuse market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India electric fuse industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)