India Electric Scooter Market Size, Share, Trends and Forecast by Drive, Battery, Product, Battery Fitting, End Use, and Region, 2025-2033

India Electric Scooter Market Summary:

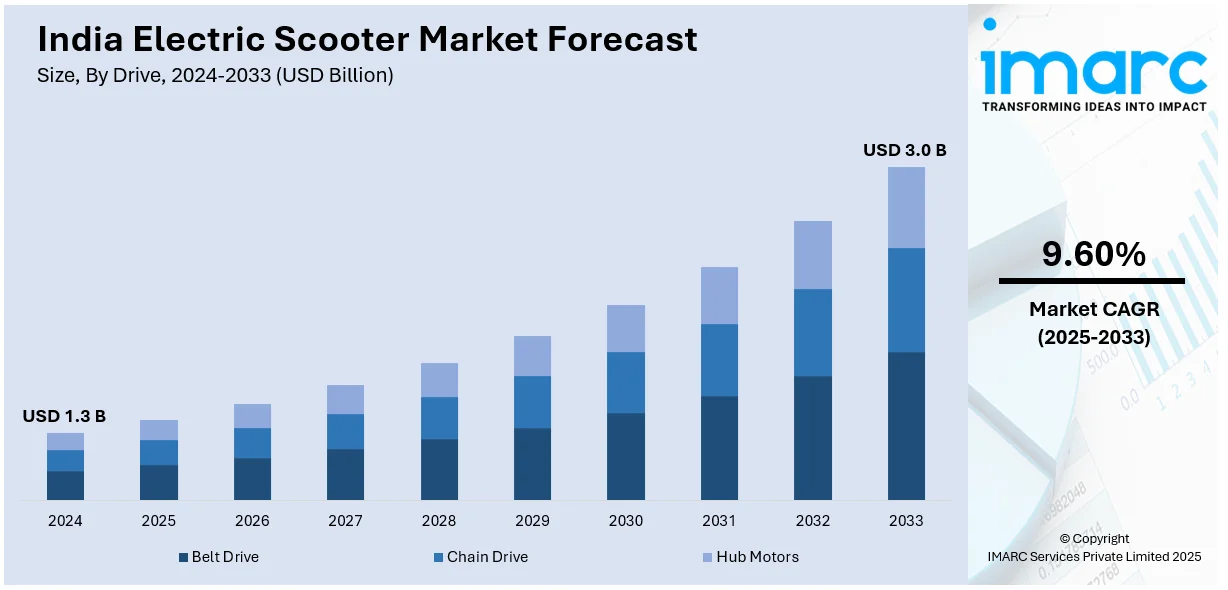

The India electric scooter market size is estimated at USD 1.3 Billion in 2024, and is expected to reach USD 3.0 Billion by 2033, at a CAGR of 9.60% during the forecast period (2025-2033). Government incentives such as the FAME II scheme, rising fuel prices, growing environmental awareness, advancements in battery technology, and increasingly charging infrastructure are driving the market, making EVs more affordable, sustainable, and convenient for consumers while encouraging major automakers to expand their electric two-wheeler offerings. In addition to this, the growing adoption of electric scooters in urban areas due to their cost-effectiveness, ease of maneuverability in traffic, and lower maintenance costs compared to traditional vehicles is further propelling the India electric scooters market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.3 Billion |

| Market Forecast in 2033 | USD 3.0 Billion |

| Market Growth Rate (2025-2033) | 9.60% |

Growth Potential of Electric Scooters Market in India:

The Indian market for electric scooters is on the growth path with a combination of driving factors, but there are also some challenges that have to be addressed. Nevertheless, the intense growth in the adoption of electric scooters, particularly in cities, reflects intense market opportunities in the future.

Growth Drivers of the India Electric Scooter Market:

A number of important growth drivers are helping the Indian electric scooter market grow. One of the main growth drivers is the increasing fuel costs that are making gasoline-powered scooters less cost-effective, leading customers to look for affordable options such as electric scooters, thus increasing the size of the electric scooter market in India. Also, the move by the government through incentives such as the FAME II policy, which incentivizes people to shift to electric vehicles by offering subsidies and tax credits. Further, improvements in battery technology have increased the efficiency and price competitiveness of electric scooters, making them more appealing to a broader buyer base. The establishment of improved charging networks also contributes towards the increase in the market, tackling one of the key issues surrounding range anxiety.

Challenges and Restraints in the India Electric Scooter Market:

It has positive trends despite a number of challenges and restraints that are still hampering the electric scooter market growth in India. The key issue is that electric scooters are more expensive than conventional scooters at the initial stage, although long-term cost savings can balance this out. Furthermore, the sparsity of charging facilities in rural and semi-urban parts of the country continues to be an important issue, since customers are concerned about the ease of refueling their vehicles. Although battery technology has become better, the relatively short range of certain electric scooters continues to pose a concern for riders who seek long-distance mobility. In addition, the problems of battery lifespan and replacement cost are among the issues that must be addressed to ensure the market grows faster.

The Rapid Adoption of Electric Scooters:

The sudden adoption of electric scooters is best observed in cities, where young urban professionals and city residents alike are increasingly embracing these environmentally sustainable and cost-effective means of transportation. Electric scooters are an effective way of solving urban traffic congestion, with fast and easy mobility being made available to a densely packed city. The increased concern about the environment, combined with increasing fuel prices, has driven the transition towards electric vehicles. Moreover, the reduced cost of maintenance compared to conventional two-wheelers, as well as the convenience of recharging at home, has made electric scooters a convenient option for daily commuting. As increasingly more automobile manufacturers come into the market and consumers familiarize themselves with the advantages of electric scooters, adoption will continue to expand exponentially, ensuring the market's future even stronger.

India Electric Scooter Market Trends:

Government Incentives and Policies

The Government of India has rolled out a set of policies for encouraging electric mobility, which have had a strong impact on the electric scooter market. One of the pillars of these policies is the Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India (FAME India) Scheme. Introduced in 2015, the scheme is now in its second phase (FAME II), which began in April 2019, with a budgetary outlay of INR10,000 crore. FAME II targets to promote public and shared transport electrification and subsidize 1 million electric two-wheelers, among others. The program provides incentives to lower the initial purchase price of electric vehicles, thereby making them affordable to consumers. According to the Indian electric scooter industry analysis, such policy interventions have played a critical role in shaping consumer demand and fostering industry growth. Along with FAME II, the government launched the Electric Mobility Promotion Scheme 2024 (EMPS 2024) with an outlay of INR 500 crore for four months from April 2024 to July 2024. This scheme was introduced with the aim to boost the acceptance of electric two-wheelers and three-wheelers by offering additional financial incentives to customers. The duration of the scheme was subsequently extended by two months with an escalating expenditure of INR 778 crore, testifying to the government's eagerness to advance electric mobility. These are supplemented by other incentives like interest-free loans, top-up subsidies, waiver of road tax and registration charges, and income tax relief for individual buyers of electric vehicles. Overall, these have greatly brought down the cost of ownership of electric scooters, making them a more desirable choice for consumers.

To get more information on this market, Request Sample

Environmental Awareness and Sustainable Transportation

Increased environmental awareness among Indian consumers has been one of the main drivers for the adoption of EVs, particularly electric scooters, which is augmenting the the electric scooter market share in India 2025. Rising concerns among the masses regarding air pollution, especially in cities, have prompted consumers to seek cleaner and greener ways of mobility. Electric scooters emit zero tailpipe emissions, providing an effective means to lower the carbon footprint of personal mobility. The addition of smart features to electric scooters has also gained popularity. Contemporary electric scooters are equipped with sophisticated technologies like IoT connectivity, GPS, and smartphone connectivity, offering a hassle-free and intelligent riding experience. These features not only help with convenience but also cater to the tech-friendly tastes of young individuals, thus expanding the consumer base of the India e-scooter market. Additionally, the cost-effectiveness of electric scooters, due to reduced operating and maintenance expenses over traditional vehicles, has drawn cost-sensitive consumers. With rising fuel prices, the economic benefits of electric scooters have gained momentum, promoting the transition toward electric mobility. In summary, the intersection of proactive government initiatives and rising awareness toward environmental sustainability has provided a conducive environment for the development of the electric scooter market in India. As these trends persist, the use of electric scooters is likely to grow, leading to a cleaner and more sustainable transport environment in the country.

India Electric Scooter Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on drive, battery, product, battery fitting, and end use.

Drive Insights:

- Belt Drive

- Chain Drive

- Hub Motors

The report has provided a detailed breakup and analysis of the market based on the drive. This includes belt drive, chain drive, and hub motors.

Battery Insights:

- Lead Acid

- Lithium Ion

- Others

A detailed breakup and analysis of the market based on the battery have also been provided in the report. This includes lead acid, lithium ion, and others.

Product Insights:

- Standard

- Folding

- Self-Balancing

- Maxi

- Three Wheeled

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes standard, folding, self-balancing, maxi, and three wheeled.

Battery Fitting Insights:

- Detachable

- Fixed

A detailed breakup and analysis of the market based on the battery fitting have also been provided in the report. This includes detachable and fixed.

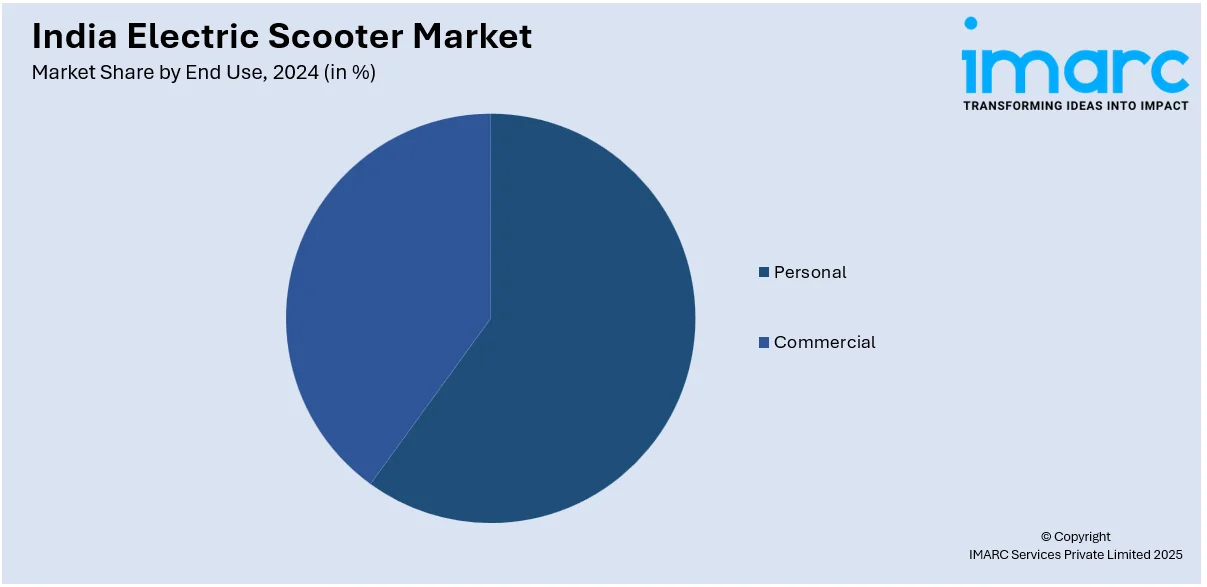

End Use Insights:

- Personal

- Commercial

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes personal and commercial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Electric Scooter Market News:

- May 2025: Ather Energy and Infineon Technologies announced a strategic partnership to advance semiconductor innovation supporting India's electric two-wheeler ecosystem. The collaboration will focus on deploying Infineon’s cutting-edge semiconductor technologies, including SiC and GaN solutions, to improve energy efficiency, charging speed, and system reliability in Ather’s electric scooters and infrastructure. This initiative strengthens India's goal of achieving 30% EV sales by 2030, contributing to the growth of the e-scooter market in India.

- March 2025: Kinetic Green launched an industry-first ‘Assured Buy Back Offer’ on its E-Luna electric scooters, guaranteeing a buyback value of INR 36,000 (USD 433) after three years of ownership with unlimited kilometer coverage. This initiative aims to enhance customer confidence by addressing resale value concerns in India’s electric two-wheeler segment. The offer, available through all Kinetic Green dealerships nationwide, further strengthens the brand’s position in India’s growing electric scooter market.

- March 2025: Tata Motors announced its foray into the electric scooter market in India, looking to grow its share in the EV segment. The entry is likely to increase competition and spur innovation, providing consumers with more options in the electric two-wheeler segment. The move comes in line with the rapid adoption of electric scooters in India by boosting the market presence of established automakers.

- November 2024: The Government of India launched the PM E-DRIVE Scheme with a financial outlay of INR 10,900 crore (USD 1.31 billion) to accelerate electric vehicle (EV) adoption and charging infrastructure, valid until March 2026. The scheme aims to incentivize 24.79 lakh electric two-wheelers and 3.2 lakh electric three-wheelers, along with dedicated allocations for e-buses, e-ambulances, and e-trucks. As a result of this initiative, electric two-wheeler sales surged to 5,71,411 units in 2024–25, supporting the growth of India’s electric scooter market.

- November 2024: Honda introduced the Activa E and QC1 electric scooters in India, with swappable battery technology and enhanced motor system. The introduction boosts consumer choice in the expanding EV market, providing greater accessibility and convenience. This move fortifies India's electric scooter market through maximized competition and faster EV penetration.

- March 2024: The Indian government introduced the Electric Mobility Promotion Scheme (EMPS) 2024, allocating INR 500 crore (USD 60.3 million) to subsidize electric two-wheelers and three-wheelers for four months starting April 1, 2024. The scheme offers subsidies of INR 10,000 (USD 120) per two-wheeler, INR 25,000 (USD 300) for light three-wheelers, and INR 50,000 (USD 600) for heavy three-wheelers. EMPS 2024 replaces the FAME II program, signaling continued government efforts to bolster India’s electric scooter market amid rising demand and transition towards sustainable urban mobility.

India Electric Scooter Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drives Covered | Belt Drive, Chain Drive, Hub Motors |

| Batteries Covered | Lead Acid, Lithium Ion, Others |

| Products Covered | Standard, Folding, Self-Balancing, Maxi, Three Wheeled |

| Battery Fittings Covered | Detachable, Fixed |

| End Uses Covered | Personal, Commercial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India electric scooter market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India electric scooter market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India electric scooter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India electric scooter market was valued at USD 1.3 Billion in 2024.

The India electric scooter market is expected to exhibit a CAGR of 9.60% during 2025-2033, reaching a value of USD 3.0 Billion by 2033.

Government incentives such as the FAME II scheme, rising fuel prices, growing environmental awareness, advancements in battery technology, and expanding charging infrastructure are propelling the market. These factors make electric scooters more affordable, sustainable, and convenient for consumers while encouraging major automakers to broaden their electric two-wheeler portfolios.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)