India Electric Three-Wheeler Market Size, Share, Trends and Forecast by Vehicle Type, Battery Type, Drive Type, Motor Type, Power Output, Voltage Capacity, and Region, 2025-2033

India Electric Three-Wheeler Market Size and Share:

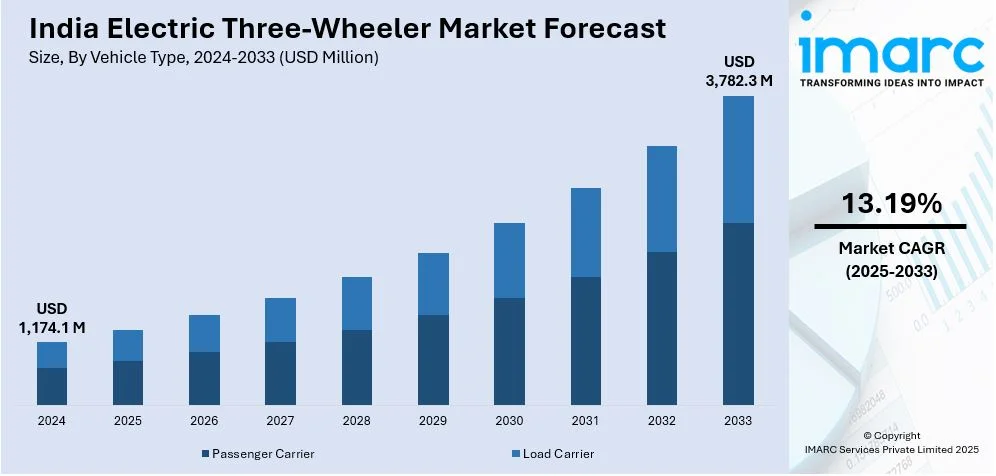

The India electric three-wheeler market size was valued at USD 1,174.1 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 3,782.3 Million by 2033, exhibiting a CAGR of 13.19% from 2025-2033. North India currently dominates the India electric three-wheeler market share, in 2024 owing to the growing urbanization, environmental concerns, and supportive government policies. They provide affordable and green transport solutions, and hence increasingly used for passenger and goods mobility. Improved battery technology and the growth of charging infrastructure further support the trend. The growth of the market is also propelled by new business models and rising investments by key players, solidifying the India electric three-wheeler market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,174.1 Million |

|

Market Forecast in 2033

|

USD 3,782.3 Million |

| Market Growth Rate 2025-2033 | 13.19% |

Environmental issues have become a significant motivator of India's electric three-wheeler market. As urban air pollution levels increase, consumers and governments alike are turning to alternatives that help promote cleaner and greener modes of transport. Electric cars, including three-wheelers, are an ideal solution to address the environmental drawbacks of traditional gasoline and diesel-fueled cars. In contrast to conventional vehicles, electric three-wheelers emit no tailpipe emissions, which lowers air pollution and greenhouse gas emissions. As India's attention to the fight against climate change and enhancing air quality has grown, electric three-wheelers are becoming a critical component of the solution. For instance, in March 2025, Omega Seiki Mobility and Clean Electric launched the NRG electric three-wheeler with a range of 300 km, equipped with DCLC battery technology, fast charging, swappable batteries, and smart telematics integration. Moreover, electric three-wheelers also decrease reliance on fossil fuels primarily leading to energy security and minimizing the carbon footprint. Heightened concern over climate change and the pressing necessity for green solutions are forcing consumers towards green mobility options such as electric three-wheelers.

To get more information on this market, Request Sample

The rising fuel price in India has turned electric three-wheelers into a more and more appealing choice for consumers and businesses. For example, in August 2023, Mahindra Last Mile Mobility introduced the e-Alfa Super electric three-wheeler powered by a 1.64 kW motor, 140Ah lead-acid battery, and has a 95 km range and is for urban use. Furthermore, with the petrol and diesel price varying and increasing over the years, the running cost of operating traditional three-wheelers has become prohibitive for many, particularly in the context of India's price-sensitive market. Electric three-wheelers provide a much lower cost per kilometer, which is attractive to private as well as fleet owners. Charging an electric vehicle costs much less than filling up a gasoline or diesel-powered car. Electric vehicles also have fewer moving parts, which lowers the maintenance costs as well as the lifespan of the vehicle. These economic advantages are especially alluring to firms running fleets, like delivery operations, that need affordable and trustworthy vehicles for ordinary use. While the cost of traditional fuels climbs, the prospect of electric three-wheelers expands as a better value transportation method.

India Electric Three-Wheeler Market Trends:

Rapid Growth and Market Share Expansion

India's electric three-wheeler (e-3W) segment has seen impressive growth, with sales reaching 699,073 units in FY2025, an 11% growth over the previous year. The growth indicates the rising popularity of electric vehicles in India, driven by both a change in consumer behavior and the improved availability of electric variants. Electric three-wheelers now constitute 57% of the overall three-wheeler sales in India, a testament to their expanding market share. This upward trajectory is being driven by both government policies, like the PM E-DRIVE programme, under which a subsidy is given for the purchase of an electric vehicle, and advances in battery technology. The market is expected to grow more with a compound annual growth rate (CAGR) of 13.19%, potentially taking the market value to USD 3.78 billion by 2033. The outlook for electric three-wheelers in India is good as they find acceptance in both urban and rural areas.

Government Schemes and Incentives Driving Adoption

Government initiatives are also contributing toward driving the expansion of India's electric three-wheeler segment. Major efforts such as the PM E-DRIVE program, which provides huge subsidies to buy electric vehicles, have reduced the initial burden for buyers and hence increased take-up. The Indian government has been making strong efforts in popularizing the move towards electric mobility as a part of its larger vision of minimizing emissions and levels of pollution, particularly in the larger urban cities. Besides direct incentives, the government initiative in promoting charging infrastructure development as well as support in terms of regulations is influencing companies to enhance their electric vehicle lines. Moreover, these efforts are complementary to India's attempts to counter climate change by decreasing fossil fuel dependence. With changing policies and increasing scope, the affordability and availability of electric vehicles will likely rise, boosting India electric three-wheeler market growth.

Technological Advancements and Innovations

Technological advancements are one of the major drivers of the success and popularity of India's electric three-wheeler industry. The mass use of lithium-ion batteries has played a crucial role in enhancing the performance, range, and cost-effectiveness of electric vehicles. Improvements in battery technology have resulted in lower production costs and improved vehicle efficiency, making electric three-wheelers more desirable to customers. In addition, advances in vehicle technology and telematics are also changing the market, especially for fleet operators. Telematics solutions allow real-time tracking of vehicle performance, enhancing operational efficiency and reducing maintenance costs. These technologies are essential in propelling the next wave of growth in India electric three-wheeler market outlook. Leading companies in the sector, such as Mahindra Last Mile Mobility and YC Electric Vehicles, are investing in these technologies to enhance their offerings and ensure that their electric three-wheelers are not only environmentally friendly but also cost-effective and efficient.

India Electric Three-Wheeler Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India electric three-wheeler market, along with forecast at the country and regional levels from 2025-2033. The market has been categorized based on vehicle type, battery type, drive type, motor type, power output, and voltage capacity.

Analysis by Vehicle Type:

- Passenger Carrier

- Load Carrier

Electric three-wheeler passenger carriers are gaining popularity in India owing to their affordability, eco-friendliness, and appropriateness for short-distance urban mobility. The vehicles offer a perfect solution for last-mile connectivity through a cost-effective and sustainable means that replaces traditional gasoline or diesel-powered rickshaws. With urbanization increasing demand for effective public transport solutions, electric passenger carriers are becoming popular among fleet operators who enjoy lower operating costs, such as lower fuel and maintenance costs. Passenger carriers also help in curbing air pollution, a major concern in cities. With governments offering incentives and encouraging clean mobility solutions, the demand for electric passenger carriers will continue to increase. Such cars are highly becoming part of urban mobility plans that help cleaner, more efficient public transport systems lead to a decrease in the carbon footprint of cities.

Analysis by Battery Type:

.webp)

- Lithium Ion

- Lead Acid

Lithium-ion batteries are the first choice for electric three-wheeler vehicles in India due to several inherent benefits over other battery technologies. Characterized by high energy density and longevity, lithium-ion batteries deliver a high driving range per charge, which is well suited for city commuting and passenger transport. These batteries are lighter, more efficient, and compact than others such as lead-acid batteries, which means that electric three-wheelers will perform better and have lower maintenance expenses. The increased charging speed and longer life while in operation make them even more attractive to fleet operators since they minimize downtime and maximize vehicle availability. With declining battery prices and continued technological improvements, lithium-ion batteries are becoming more affordable, pushing the implementation of electric three-wheelers in India even further. Support by the Indian government for electric vehicles, in terms of subsidies and tax rebates, contributes even further to the superiority of lithium-ion battery-fitted electric three-wheelers in the marketplace.

Analysis by Drive Type:

- Hub Type

- Chassis Mounted

Hub motors are fitted directly in the wheel hub and do not require a transmission system. This saves energy and is less mechanically complicated. They have a silent run, are easy to maintain, and deliver a better power transfer, and therefore they suit electric three-wheelers for city commute.

Chassis-mounted motors are mounted on the vehicle frame, providing greater design flexibility and greater torque output. This motor design provides improved heat management and effective power distribution, commonly utilized in commercial electric three-wheelers for heavier applications and longer travel distances.

Analysis by Motor Type:

- BLDC Motor (Brushless DC Motor)

- PMSM (Permanent Magnet Synchronous Motor)

BLDC motors provide efficiency, dependability, and low maintenance because they are in great demand when it comes to electric three-wheelers. The motors provide excellent smoothness with high torque while being more long-lasting as compared to other types of motors. BLDC motors are specifically better for use when steady, predictable power output is needed.

PMSM motors offer high power density and efficiency, which is suitable for electric three-wheelers with increased power and range needs. The motors yield a better performance at higher speeds and are renowned for smooth operation, less energy loss, and improved durability. PMSM motors are preferred in vehicles that need higher torque and improved acceleration.

Analysis by Power Output:

- <3 kW

- 3 – 6 kW

- 7 – 10 kW

- >10 kW

Less than 3 kW power output is appropriate for light electric three-wheelers that are intended for short-distance urban travel. These vehicles usually emphasize cost savings, reduced speed, and efficiency of energy. They are designed for low-speed conditions with sufficient performance for short daily trips using little energy.

The 3 – 6 kW range is most suitable for medium-duty electric three-wheelers, striking a balance between speed and energy usage. Three-wheelers in this segment are meant for city and semi-city applications, having a moderate top speed and satisfactory range. They are both suitable for carrying passengers and cargo, striking a balance between performance and price.

7 – 10 kW power output electric three-wheelers offer more speed and performance and are, therefore, capable of handling higher loads and over longer distances. These vehicles have the ability to function effectively on semi-urban and rural terrain with a better top speed and more power to climb inclines or transport more load.

Power output above 10 kW is generally employed for high-performance electric three-wheelers, intended for commercial or heavy-duty use. These three-wheelers provide aggressive acceleration, increased speeds, and are able to support heavy payloads. They are often employed for long-distance travel, logistics, or passenger transport in more demanding conditions.

Analysis by Voltage Capacity:

- 48 – 59V

- 60 – 72V

- 73 – 96V

- Above 96V

The 48 – 59V range is generally employed in low-end electric three-wheelers, providing an optimal solution for short-distance, low-speed transportation. These vehicles are light load and designed for city commuting, focusing on being cost-effective, energy-efficient, and having an easy-to-manage charging network. They tend to be seen in small cities and towns.

60 – 72V voltage is the best range for mid-range electric three-wheelers, which will provide better power management at moderate speed and more range. This type of vehicle is well adapted to urban as well as suburban conditions and is a balance between performance, battery life, and cost of running. They are found widely in semi-urban areas.

Vehicles within the 73 – 96V range have higher performance levels, carry more loads, and provide better speeds and longer travel distances. These are normally used in commercial three-wheelers in electric form in semi-urban and rural areas, where power is needed in greater amounts.

Voltage capacities higher than 96V find applications in high-performance electric three-wheelers to deliver maximum power, range, and speed. The vehicles are commonly utilized in tough conditions, such as inter-city transport and heavy commercial usage, to operate efficiently and reliably even under extreme stress conditions.

Regional Analysis:

- North India

- East India

- West and Central India

- South India

North India is experiencing high rates of adoption of electric three-wheelers due to urbanization, air pollution, and promotion by the government of clean mobility alternatives. Electric three-wheelers are becoming popular in Uttar Pradesh, Punjab, Haryana, and Delhi because they are cost-effective and environmentally friendly. The vast population of the region and reliance on three-wheelers for short-distance travel make the market look very promising for electric vehicles. Moreover, urban centers such as Delhi, struggling with acute air pollution, have introduced policies supporting electric mobility, including incentives for the purchase of electric vehicles and the establishment of charging infrastructure. These initiatives, coupled with increasing fuel prices, have provided a conducive climate for the expansion of electric three-wheelers in North India. With the focus on sustainable urban mobility solutions continuing in the region, North India is well set to lead the overall transition of electric three-wheelers in the country.

Competitive Landscape:

The environment in the India electric three-wheeler market forecast is changing drastically with an increased focus on innovation and sustainability. As people look to adopt environmentally friendly and affordable modes of transport, firms are looking to improve vehicle performance, efficiency, and cost. Producers are exploring the development of high-end battery technologies, such as lithium-ion batteries, and fine-tuning motor systems to improve energy efficiency and minimize operating costs. This has translated into the existence of numerous vehicle types catering to both passengers and cargo demands. Moreover, the focus is predominantly on an even larger roll-out of support infrastructures like service stations and network infrastructure in charge of accommodating global acceptance on a larger scale. Competition also revolves around intense upsurges of new competitors who aim to get in on the market's promising prospects, given the already well-established nature of old-timer players alongside fledgling concerns. In order to differentiate, companies are taking advantage of partnerships, strategic alliances, and local tailoring, seeking to address the diverse needs of customers and fuel the development of electric mobility solutions.

The report provides a comprehensive analysis of the competitive landscape in the India electric three-wheeler market with detailed profiles of all major companies, including:

- Mahindra Electric Mobility Limited

- TVS Motors

- Bajaj Auto Limited

- Kinetic Green

- Piaggio

- Lohia Auto (The Lohia Group of Industries)

- Saera Electric Auto

- Altigreen Propulsion Labs

- Terra Motors India

- Ceeon India.

Latest News and Developments:

- February 2025: Bajaj Auto launched GoGo, its electric three-wheeler brand, featuring a 251 km range and three passenger variants (P5009, P5012, P7012). Priced from INR 3,26,797, models include Hill Hold Assist, Auto Hazard Detection, and a 5-year battery warranty. Cargo variants are set to launch soon.

- January 2025: TVS Motor Company launched the TVS King EV MAX, its first electric three-wheeler, priced at INR 2,95,000. It features a 179 km range, fast charging (0-80% in 2.25 hours), Bluetooth connectivity, fleet management, and three drive modes. Nationwide rollout is planned within four to six months.

- December 2024: Baxy Mobility launched new electric three-wheelers, including Lion, Chotu, Cub, Boss, Taksy, e-Magnate, and ShakteE. These models feature high-range efficiency, lithium-ion batteries, safety features like fire extinguishers and reverse cameras, and payload capacities up to 417 kg, catering to last-mile mobility and cargo transport.

- December 2024: Lohia Auto launched Youdha, its electric three-wheeler brand, at the EV Expo. Initial models include E5 Passenger and E5 Cargo, targeting urban mobility and last-mile logistics. Production in Kashipur supports expansion, with plans for 150 dealers by March 2025 and 200 by Diwali 2025.

- December 2024: Greenway Mobility launched E-Vi, introducing Chhota Otto, Chhota Bull, and Rydan electric three-wheelers. Targeting market leadership by December 2025, it plans 100 dealerships and offers L5-grade durability, IoT tracking, swappable batteries, and 400 kg payload capacity, catering to urban and rural mobility needs.

India Electric Three-Wheeler Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD, '000 Units |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Passenger Carrier, Load Carrier |

| Battery Types Covered | Lithium Ion, Lead Acid |

| Drive Types Covered | Hub Type, Chassis Mounted |

| Motor Types Covered | BLDC Motor (Brushless DC Motor), PMSM (Permanent Magnet Synchronous Motor) |

| Power Outputs Covered | <3 kW, 3 – 6 kW, 7 – 10 kW, >10 kW |

| Voltage Capacities Covered | 48 – 59V, 60 – 72V, 73 – 96V, Above 96V |

| Regions Covered | North India, East India, West and Central India, South India |

| Companies Covered | Mahindra Electric Mobility Limited, TVS Motors, Bajaj Auto Limited, Kinetic Green, Piaggio, Lohia Auto (The Lohia Group of Industries), Saera Electric Auto, Altigreen Propulsion Labs, Terra Motors India and Ceeon India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India electric three-wheeler market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India electric three-wheeler market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India electric three-wheeler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India electric three-wheeler market was valued at USD 1,174.1 Million in 2024.

The India electric three-wheeler market is projected to exhibit a CAGR of 13.19% during 2025-2033, reaching a value of USD 3,782.3 Million by 2033.

The India electric three-wheeler market is spurred by government policies, incentives, and subsidies for green transport. Increased prices of traditional fuel, green issues, and the requirement of affordable, last-mile delivery mechanisms further boost market expansion. Technological improvements in the efficiency of batteries, extended driving range, and urbanization also fuel demand for electric three-wheelers.

North India currently dominates the India electric three-wheeler, with high urbanization, growing last-mile connectivity demand, and positive government policies contributing to its success. The wide network of roads in the region, combined with environmental consciousness and rising use of electric vehicles, supports market growth.

Some of the major players in the India electric three-wheeler market include Mahindra Electric Mobility Limited, TVS Motors, Bajaj Auto Limited, Kinetic Green, Piaggio, Lohia Auto (The Lohia Group of Industries), Saera Electric Auto, Altigreen Propulsion Labs, Terra Motors India and Ceeon India, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)