India Electric Two-Wheeler Batteries Market Size, Share, Trends and Forecast by Battery Type, Vehicle Type, and Region, 2025-2033

India Electric Two-Wheeler Batteries Market Overview:

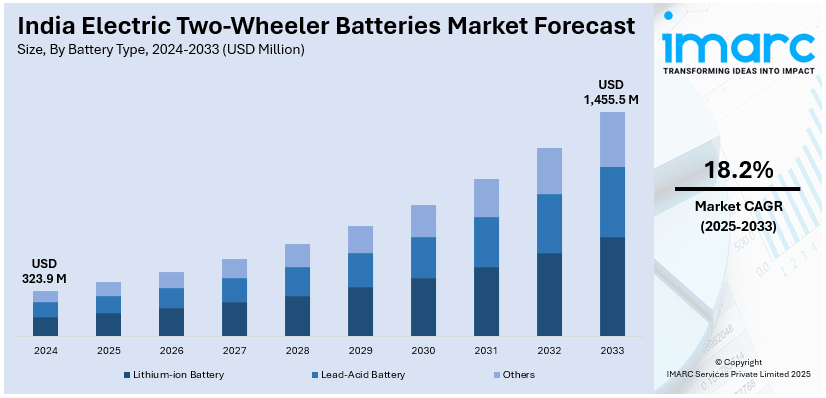

The India electric two-wheeler batteries market size reached USD 323.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,455.5 Million by 2033, exhibiting a growth rate (CAGR) of 18.2% during 2025-2033. The market is driven by rising electric vehicle (EV) adoption, increasing government incentives, continuous advancements in lithium-ion technology, strong investments, and expanding infrastructure development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 323.9 Million |

| Market Forecast in 2033 | USD 1,455.5 Million |

| Market Growth Rate (2025-2033) | 18.2% |

India Electric Two-Wheeler Batteries Market Trends:

Growing Adoption of Lithium-Ion Batteries Over Lead-Acid Batteries

The India electric two-wheeler batteries market growth is expanding, driven by the widespread adoption of lithium-ion (Li-ion) batteries over lead-acid batteries, as these batteries provide improved performance and extended lifespans while offering quick charging times. According to reports, in 2024, electric two-wheeler sales in India reached 1,107,976 units, marking a 34% increase from 827,892 units in 2023. This surge underscores the growing consumer preference for electric mobility solutions. Manufacturers and consumers choose Li-ion batteries because of their superior energy performance and minimal maintenance requirements. Moreover, government policies that offer subsidies and incentives for domestic manufacturing operations are fueling the adoption of these batteries in the country. The improvement of battery chemistry also leads to better safety and lower costs of electric two-wheelers, making them more acceptable for widespread use. Besides this, national efforts to produce batteries locally improve supply chain stability, despite material acquisition and recycling obstacles. Furthermore, the India electric two-wheeler batteries market share is growing because Li-ion batteries maintain their market leadership through expanding charging infrastructure and decreasing battery costs.

To get more information on this market, Request Sample

Expansion of Battery Swapping and Fast-Charging Infrastructure

The construction of stations for battery replacement and rapid charging stations tackles two major impediments for electric two-wheelers, including limited range anxiety and lengthy charging durations. This is significantly enhancing the India electric two-wheeler batteries market outlook. In addition to this, the battery swapping system enables users to exchange empty batteries for fully charged ones at specific stations, thus minimizing the time lost between charges. Concurrently, fast-charging solutions are advancing to allow battery charging in just a few minutes while the development of battery-swapping infrastructure provides better convenience to urban commuters. For instance, in December 2023, Gogoro introduced its battery-swapping network and unveiled the India-made CrossOver GX250 Smartscooter. Initially targeting B2B customers in Delhi and Goa, Gogoro plans to expand to Mumbai and Pune, enhancing the accessibility of electric two-wheelers. Moreover, government initiatives together with incentives aim to build extensive charging networks by seeking collaboration between private companies and public agencies. Also, standardization projects for batteries and charging protocols conducted resolve the present interoperability and high initial spending roadblocks. Apart from this, the expansion of infrastructure investment establishes battery-swapping along with fast-charging solutions as essential factors which enable electric two-wheelers to become practical and accessible for day-to-day use across India.

India Electric Two-Wheeler Batteries Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on battery type and vehicle type.

Battery Type Insights:

- Lithium-ion Battery

- Lead-Acid Battery

- Others

The report has provided a detailed breakup and analysis of the market based on the battery type. This includes lithium-ion battery, lead-acid battery, and others.

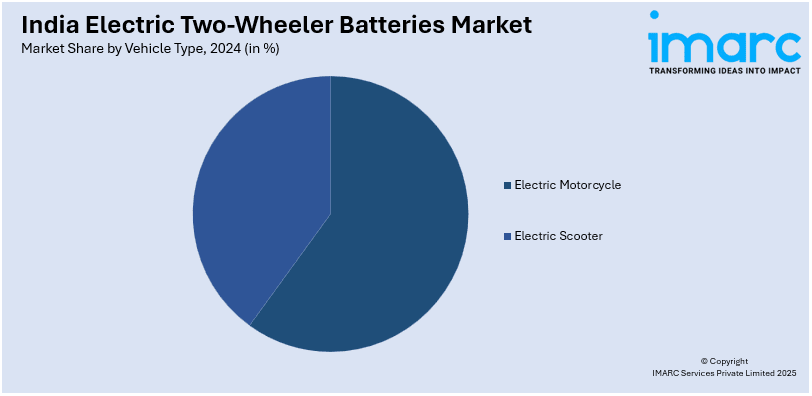

Vehicle Type Insights:

- Electric Motorcycle

- Electric Scooter

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes electric motorcycle and electric scooter.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Electric Two-Wheeler Batteries Market News:

- In August 2024, Ola Electric introduced a new line of electric motorcycles and announced plans to manufacture its own batteries. This strategy aims to reduce costs and enhance competitiveness in India's expansive two-wheeler market, challenging established manufacturers.

- In November 2023, Hindustan Petroleum Corporation Ltd. (HPCL) partnered with Gogoro to deploy battery swapping stations across HPCL's retail outlets in India. This collaboration aims to enhance the battery-swapping infrastructure, addressing range anxiety and promoting electric two-wheeler adoption.

India Electric Two-Wheeler Batteries Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Battery Types Covered | Lithium-ion Battery, Lead-Acid Battery, Others |

| Vehicle Types Covered | Electric Motorcycle, Electric Scooter |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India electric two-wheeler batteries market performed so far and how will it perform in the coming years?

- What is the breakup of the India electric two-wheeler batteries market on the basis of battery type?

- What is the breakup of the India electric two-wheeler batteries market on the basis of vehicle type?

- What is the breakup of the India electric two-wheeler batteries market on the basis of region?

- What are the various stages in the value chain of the India electric two-wheeler batteries market?

- What are the key driving factors and challenges in the India electric two-wheeler batteries?

- What is the structure of the India electric two-wheeler batteries market and who are the key players?

- What is the degree of competition in the India electric two-wheeler batteries market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India electric two-wheeler batteries market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India electric two-wheeler batteries market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India electric two-wheeler batteries industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)