India Electric Two-Wheeler Market Size, Share, Trends and Forecast by Vehicle Type, Battery Type, Voltage Type, Peak Power, Battery Technology, Motor Replacement, and Region, 2025-2033

Market Overview:

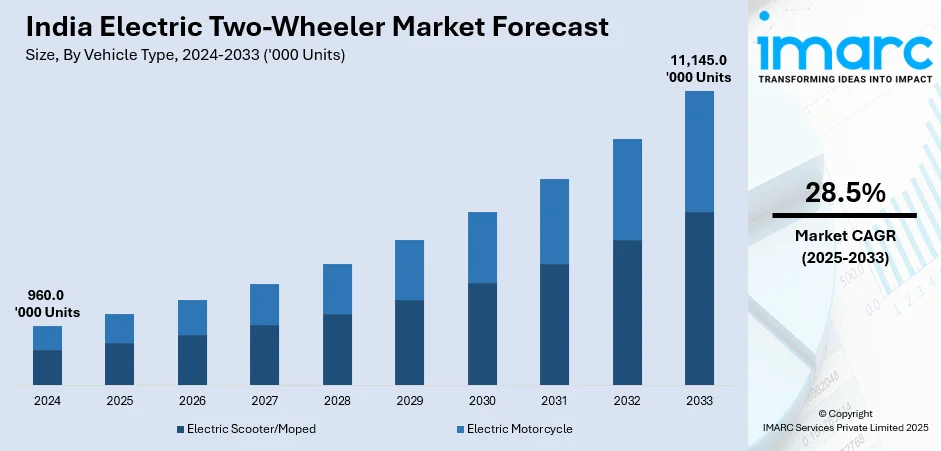

India electric two-wheeler market size reached 960.0 Thousand Units in 2024. Looking forward, IMARC Group expects the market to reach 11,145.0 Thousand Units by 2033, exhibiting a growth rate (CAGR) of 28.5% during 2025-2033. The rising integration of smart features is propelling the need for sustainable and efficient urban mobility, which is primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 960.0 Thousand Units |

| Market Forecast in 2033 | 11,145.0 Thousand Units |

| Market Growth Rate (2025-2033) | 28.5% |

Electric two-wheelers, propelled by electric motors and rechargeable batteries, are gaining extensive popularity recently, primarily owing to their various advantages. These vehicles serve as an environmentally friendly mode of transportation, producing no tailpipe emissions and thereby mitigating air pollution, fostering a more sustainable environment. Moreover, electric two-wheelers prove cost-effective, demanding lower maintenance and operational expenses compared to their traditional counterparts. As fuel prices escalate, these vehicles emerge as an economical alternative for daily commuting and short-distance journeys. Noteworthy advancements in battery technology have bolstered the performance and extended the ranges of electric two-wheelers. Beyond economic benefits, these vehicles provide a practical solution to urban congestion. Their compact design and maneuverability enable easy navigation through traffic, simplifying the search for parking spaces.

To get more information on this market, Request Sample

India Electric Two-Wheeler Market Trends:

The India electric two-wheeler market is undergoing a transformative shift driven by key drivers and emerging trends that highlight the nation's commitment to sustainable and efficient transportation. A primary driver is the growing consumer environmental concerns. Additionally, the increasing emphasis on reducing carbon footprints has fueled a surge in demand for electric two-wheelers as an eco-friendly alternative to traditional petrol-powered bikes. Besides this, government incentives and policies are playing a pivotal role in shaping the market dynamics. Substantial subsidies, tax benefits, and initiatives like the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme encourage consumers to adopt electric two-wheelers. These policies align with India's broader vision of transitioning to cleaner and greener mobility solutions. Furthermore, technological advancements are propelling the market forward, with continuous improvements in battery technology, increased range, and enhanced performance. The evolution of battery-swapping stations and innovative charging solutions further addresses concerns about range anxiety, making electric two-wheelers more accessible and convenient for consumers. Moreover, there is an emerging trend towards the integration of smart features in electric two-wheelers, including connectivity, navigation, and remote monitoring. This enhances the overall user experience and aligns with the digitalization trend in the automotive industry, which is projected to fuel the India electric two-wheeler market size over the forecasted period.

India Electric Two-Wheeler Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on vehicle type, battery type, voltage type, peak power, battery technology, and motor replacement.

Vehicle Type Insights:

- Electric Scooter/Moped

- Electric Motorcycle

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes electric scooter/moped and electric motorcycle.

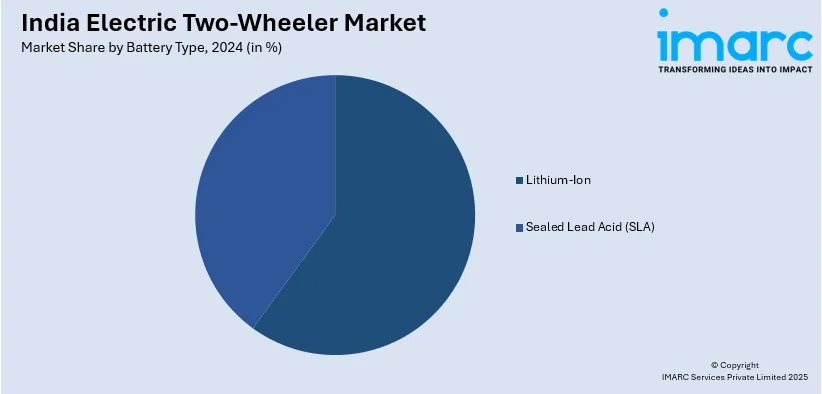

Battery Type Insights:

- Lithium-Ion

- Sealed Lead Acid (SLA)

A detailed breakup and analysis of the market based on battery type have also been provided in the report. This includes lithium-ion and sealed lead acid (SLA).

Voltage Type Insights:

- <48V

- 48-60V

- 61-72V

- 73-96V

- >96V

The report has provided a detailed breakup and analysis of the market based on the voltage type. This includes <48V, 48-60V, 61-72V, 73-96V, and >96V.

Peak Power Insights:

- <3 kW

- 3-6 kW

- 7-10 kW

- >10 kW

A detailed breakup and analysis of the market based on peak power have also been provided in the report. This includes <3 kW, 3-6 kW, 7-10 kW, and >10 kW.

Battery Technology Insights:

- Removable

- Non-Removable

The report has provided a detailed breakup and analysis of the market based on the battery technology. This includes removable and non-removable.

Motor Replacement Insights:

- Hub Type

- Chassis Mounted

A detailed breakup and analysis of the market based on motor replacement have also been provided in the report. This includes hub type and chassis mounted.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. The companies in the market are adopting various strategic initiatives including new product launches and business alliances to gain a significant India electric two-wheeler market share.

India Electric Two-Wheeler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Thousand Units |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Electric Scooter/Moped, Electric Motorcycle |

| Battery Types Covered | Lithium-Ion, Sealed Lead Acid (SLA) |

| Voltage Types Covered | <48V, 48-60V, 61-72V, 73-96V, >96V |

| Peak Powers Covered | <3 kW, 3-6 kW, 7-10 kW, >10 kW |

| Battery Technologies Covered | Removable, Non-Removable |

| Motor Replacements Covered | Hub Type, Chassis Mounted |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India electric two-wheeler market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India electric two-wheeler market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India electric two-wheeler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India electric two-wheeler market reached 960.0 Thousand Units in 2024.

The India electric two-wheeler market is projected to exhibit a CAGR of 28.5% during 2025-2033, reaching 11,145.0 Thousand Units by 2033.

The India electric two-wheeler market is driven by rising fuel costs, government subsidies, and increasing environmental concerns. Urbanization, improved battery technology, and growing charging infrastructure also support product adoption. Consumer preference for cost-effective, sustainable transport and initiatives under schemes like FAME further accelerate market growth across urban and semi-urban regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)