India Electric Vehicle Market Size, Share, Trends and Forecast by Vehicle Type, Price Category, Propulsion Type, and Region, 2026-2034

India Electric Vehicle Market Summary:

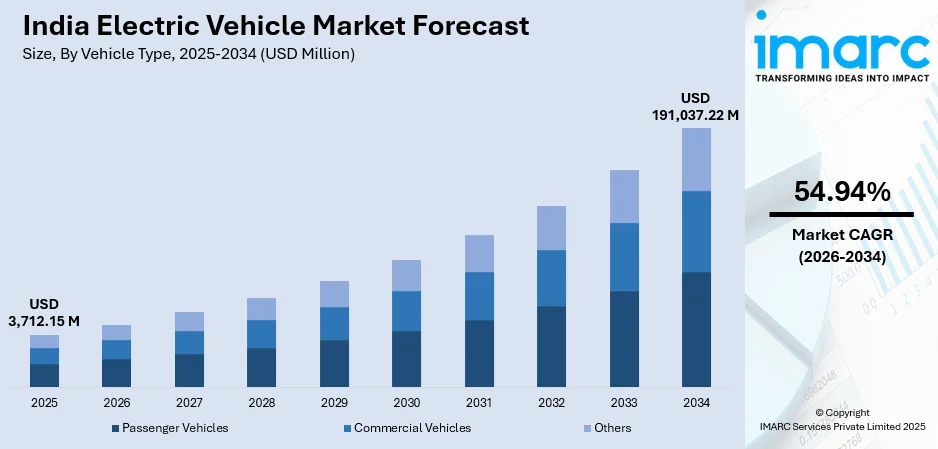

The India electric vehicle market size was valued at USD 3,712.15 Million in 2025 and is projected to reach USD 191,037.22 Million by 2034, growing at a compound annual growth rate of 54.94% from 2026-2034.

The market is driven by supportive government policies including demand incentives and infrastructure development initiatives, rising environmental consciousness among consumers, increasing fuel prices, and continuous advancements in battery and electric vehicle (EV) technologies. Growing urbanization and the need for sustainable transportation solutions are accelerating EV adoption across passenger and commercial segments, contributing to India electric vehicle market share.

Key Takeaways and Insights:

-

By Vehicle Type: Passenger vehicles dominate the market with a share of 55% in 2025, driven by rising personal mobility demand, diverse model options, improved range, and expanding urban charging infrastructure.

-

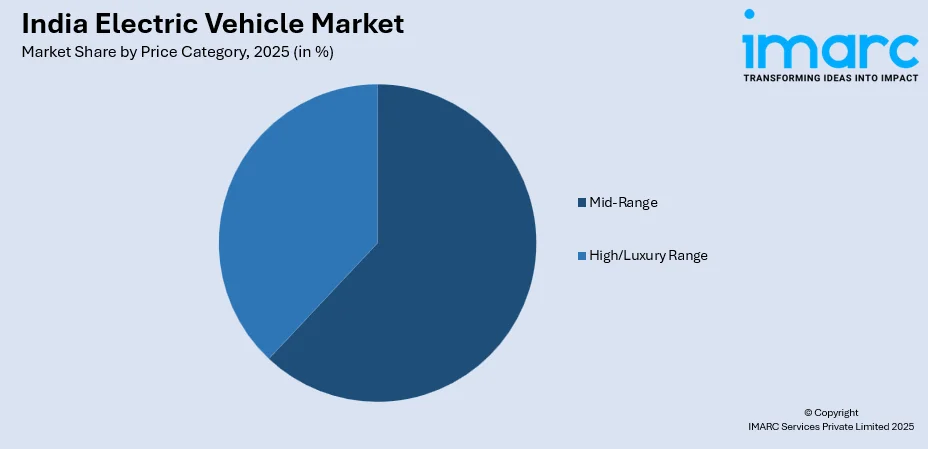

By Price Category: Mid-range leads the market with a share of 62% in 2025, owing to affordability with advanced features, strong financing access, and appealing value for middle-class consumers seeking economical, feature-rich electric mobility options.

-

By Propulsion Type: Battery electric vehicle represents the largest segment with a market share of 48% in 2025, driven by zero-emission advantages, lower operating costs, government subsidies, and lithium-ion battery improvements enhancing performance, efficiency, and consumer adoption.

-

By Region: North India dominates the market with a share of 29% in 2025, owing to manufacturing hubs, progressive state EV policies, higher metropolitan incomes, and well-developed charging infrastructure, particularly in the Delhi-NCR region.

-

Key Players: The India electric vehicle market is moderately consolidated, with established manufacturers and emerging specialists expanding production, developing local battery technologies, strengthening dealer networks, and forming strategic partnerships to enhance competitive positioning. Some of the key players operating in the market include Ather Energy Limited, Atul Auto LIMITED, Bajaj Auto Ltd, Electrotherm (India) Limited, Greaves Electric Mobility Limited, Hyundai Motor India, JBM Group, JSW MG Motor India Pvt Ltd, Mahindra Electric Automobile Ltd, Okinawa Autotec Private Limited, Ola Electric Mobility Ltd., Olectra Greentech Limited, Piaggio Vehicles Pvt. Ltd, TATA Motors, and TVS Motor Company.

To get more information on this market Request Sample

India electric vehicle market is experiencing transformative growth propelled by a confluence of favorable factors reshaping the automotive landscape. Government initiatives including demand incentives, manufacturing subsidies, and charging infrastructure development programs are creating a conducive ecosystem for electric mobility adoption. According to reports, in August 2025, Vietnam’s VinFast began production at its $500 Million electric vehicle plant in Thoothukudi, Tamil Nadu, initially targeting 50,000 electric vehicles annually, with plans to triple output. Moreover, rising environmental awareness among consumers, coupled with concerns regarding urban air quality and carbon emissions, is driving preference towards cleaner transportation alternatives. The escalating cost of conventional fuels and volatile petroleum prices are making electric vehicles (EVs) increasingly attractive from an economic perspective. Technological advancements in battery systems, including improved energy density and faster charging capabilities, are addressing consumer concerns regarding range anxiety. Additionally, the expanding network of public charging stations and battery swapping facilities is enhancing convenience for EV owners across urban and semi-urban regions.

India Electric Vehicle Market Trends:

Expansion of Domestic Manufacturing Ecosystem

The India electric vehicle market is witnessing significant expansion in domestic manufacturing capabilities as automotive manufacturers establish dedicated production facilities for EVs and components. This trend is characterized by increased investments in research and development for indigenous battery technologies suited to local climatic conditions. As per sources, in May 2025, Mobis India inaugurated its EV battery system assembly plant in Sriperumbudur, Tamil Nadu, with an initial capacity of 36,000 units per annum, supporting locally manufactured electric vehicles. Moreover, manufacturing localization initiatives are reducing dependence on imported components, particularly in battery and powertrain segments. The production-linked incentive schemes are attracting both domestic and international manufacturers to establish assembly lines and component manufacturing units across industrial corridors.

Integration of Smart Connectivity Features

EVs in India are increasingly incorporating advanced connectivity and telematics features that enhance user experience and vehicle management capabilities. Manufacturers are integrating smartphone applications enabling remote monitoring of battery status, charging schedules, and vehicle diagnostics. As per sources, in February 2025, PURE EV partnered with JioThings to integrate IoT-enabled smart digital clusters and telematics into electric two-wheelers, enabling real-time performance monitoring and enhanced connectivity features. Moreover, Internet of Things (IoT) enabled solutions are facilitating predictive maintenance and over-the-air software updates for performance optimization. Connected vehicle technologies are also supporting integration with smart charging infrastructure, allowing users to locate available charging stations, reserve slots, and make digital payments seamlessly.

Rise of Fleet Electrification Programs

Corporate and commercial fleet operators are increasingly transitioning towards EVs driven by lower total cost of ownership and sustainability commitments. Logistics and delivery companies are deploying electric three-wheelers and light commercial vehicles for last-mile operations in urban areas. Public transport authorities are expanding electric bus fleets under government-supported programs focusing on cleaner urban mobility. Ride-hailing and taxi aggregators are also incentivizing drivers to adopt EVs through preferential pricing and dedicated charging infrastructure partnerships. According to sources, Uber partnered with Refex Green Mobility to deploy 1,000 electric vehicles across Chennai, Hyderabad, Bengaluru, and Mumbai, accelerating fleet electrification and supporting cleaner urban mobility.

Market Outlook 2026-2034:

The India electric vehicle market revenue is projected to exhibit robust expansion during the forecast period, driven by sustained government support, improving charging infrastructure, and increasing consumer acceptance of electric mobility. The market is expected to witness accelerated adoption across passenger vehicles, two-wheelers, and commercial segments as manufacturers introduce diverse model options across price ranges. Revenue growth will be supported by declining battery costs, enhanced vehicle range capabilities, and expanding network of fast-charging stations along highways and urban centers. The market generated a revenue of USD 3,712.15 Million in 2025 and is projected to reach a revenue of USD 191,037.22 Million by 2034, growing at a compound annual growth rate of 54.94% from 2026-2034.

India Electric Vehicle Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Vehicle Type | Passenger Vehicles | 55% |

| Price Category | Mid-Range | 62% |

| Propulsion Type | Battery Electric Vehicle | 48% |

| Region | North India | 29% |

Vehicle Type Insights:

- Passenger Vehicles

- Commercial Vehicles

- Others

Passenger vehicles dominate with a market share of 55% of the total India electric vehicle market in 2025.

The passenger vehicles command the leading position in India electric vehicle market, driven by increasing consumer preference for personal electric mobility solutions offering convenience and independence. This segment encompasses electric cars ranging from compact hatchbacks to premium sedans and sport utility vehicles, catering to diverse consumer requirements across urban and suburban regions. The availability of multiple model options with varying price points, driving ranges, and feature configurations is attracting first-time EV buyers transitioning from conventional alternatives. According to sources, in July 2025, Kia India launched its first made-in-India electric vehicle, the Carens Clavis EV, offering up to 490 km range, fast charging, and advanced connected features.

The growth in this segment is also supported by the rising number of charging points being developed around residential, commercial, and public areas in urban regions. Additionally, factors such as subsidies provided by the government, exemption from road taxes, and exemption from registration fees are also making EVs more affordable and leading to mainstream adoption among the middle-class population. Furthermore, the development of service centers and comprehensive warranty programs has been addressing consumer concerns related to EVs.

Price Category Insights:

Access the comprehensive market breakdown Request Sample

- Mid-Range

- High/Luxury Range

Mid-range leads with a share of 62% of the total India electric vehicle market in 2025.

The mid-range dominates India electric vehicle market by offering an optimal combination of affordability, advanced features, and reliable performance specifications appealing to mainstream consumers. Vehicles in this category attract the expanding middle-class consumer base seeking economical yet technologically advanced electric mobility solutions for daily transportation needs. This segment benefits significantly from attractive financing schemes offered by banks, extended warranty offerings from manufacturers, and competitive total cost of ownership compared to equivalent conventional internal combustion engine vehicles.

Manufacturers are strategically positioning their mid-range offerings with adequate driving range capabilities, modern connectivity features, and comprehensive safety technologies to effectively capture the mass market opportunity. According to sources, in September 2024, Tata Motors launched the updated Nexon EV 45 at Rs. 13.99 Lakh, featuring a new 45 kWh battery, faster charging, enhanced energy density, and improved real-world driving range for mid-range EV buyers. Moreover, the segment witnesses strong demand from first-time car buyers, urban professionals, and families seeking practical EVs suitable for daily commuting requirements within city limits. Competitive pricing strategies implemented by automakers and periodic promotional offers during festive seasons are further stimulating consumer interest and accelerating purchase decisions in this growing segment.

Propulsion Type Insights:

- Battery Electric Vehicle

- Hybrid Electric Vehicle

- Plug-In Hybrid Electric Vehicle

Battery electric vehicle exhibits a clear dominance with a 48% share of the total India electric vehicle market in 2025.

Battery electric vehicle represents the largest propulsion type segment, offering zero tailpipe emissions and significantly lower operating costs compared to internal combustion engine vehicles operating on conventional fuels. These vehicles operate exclusively on electric power stored in rechargeable lithium-ion battery packs, completely eliminating dependence on petroleum-based fuels. Government policies specifically incentivizing battery-powered vehicles through direct purchase subsidies, preferential registration benefits, and reduced road taxes are driving strong consumer preference towards this environmentally sustainable propulsion segment. As of August 2025, India is promoting EV adoption through schemes like PM E-DRIVE, FAME India, and multiple PLI programs, supporting electric vehicles, charging infrastructure, battery manufacturing, and domestic localization initiatives.

Advancements in lithium-ion battery technology are significantly improving energy density, charging speed, and thermal management, specifically optimized for Indian climatic conditions. The rapid expansion of public charging stations, coupled with convenient home charging solutions, is effectively alleviating range anxiety for prospective buyers. Battery EVs also benefit from lower maintenance requirements due to fewer moving components and energy-efficient regenerative braking systems. These factors collectively reduce total ownership costs, making battery EVs increasingly attractive to cost-conscious Indian consumers seeking sustainable and efficient mobility solutions.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India dominates with a market share of 29% of the total India electric vehicle market in 2025.

North India leads the regional market share driven by concentration of automotive manufacturing facilities, progressive state-level EV policies, and higher purchasing power prevalent in metropolitan areas. The Delhi-National Capital Region represents a significant demand center owing to stringent emission regulations addressing air quality concerns, extensive charging infrastructure development initiatives, and proactive government incentives supporting EV adoption. States including Haryana, Punjab, and Uttar Pradesh are witnessing growing EV registrations supported by favorable policy frameworks and awareness campaigns.

The region benefits substantially from established dealer and service networks of major EV manufacturers ensuring convenient access to sales consultations and comprehensive after-sales support services. Industrial corridors throughout the region host multiple component manufacturing facilities contributing significantly to the localized supply chain ecosystem and reducing production costs. Investments in highway charging infrastructure connecting major cities including Delhi, Chandigarh, and Lucknow are facilitating intercity EV travel and addressing range concerns for long-distance commuters traveling across states.

Market Dynamics:

Growth Drivers:

Why is the India Electric Vehicle Market Growing?

Comprehensive Government Policy Support and Incentive Programs

The Indian government has implemented a multi-pronged approach to accelerate EV adoption through demand-side incentives, manufacturing subsidies, and infrastructure development programs. Central schemes provide direct purchase subsidies for electric two-wheelers, three-wheelers, buses, ambulances, and trucks, making EVs more accessible to diverse consumer segments. Production-linked incentive programs are attracting investments in domestic manufacturing of vehicles, batteries, and critical components, strengthening the indigenous supply chain ecosystem. State governments are complementing central initiatives with additional incentives including road tax exemptions, registration fee waivers, and concessional electricity tariffs for charging operations. Policy frameworks are also facilitating land allocation for charging stations and simplifying approval processes for infrastructure deployment.

Rapid Expansion of Charging and Battery Swapping Infrastructure

The EV charging infrastructure in India is experiencing significant expansion driven by government funding, private sector investments, and strategic partnerships between stakeholders. Public charging stations are being deployed across highways, urban centers, commercial complexes, and residential developments to enhance accessibility for EV owners. As per sources, in November 2025, Mahindra & Mahindra announced plans to set up 250 EV charging stations with 1,000 charging points by 2027, strengthening India’s public fast-charging infrastructure. Moreover, the charging network includes both alternating current slow chargers suitable for overnight charging and direct current fast chargers enabling rapid top-ups during travel. Battery swapping facilities are emerging as a complementary solution, particularly for two-wheelers and three-wheelers, offering quick battery replacement services that minimize vehicle downtime. Energy companies and charge point operators are forming alliances to establish integrated charging networks with standardized payment systems and mobile application-based station discovery features.

Increasing Environmental Awareness and Sustainability Focus

Growing consciousness regarding environmental sustainability and urban air quality is significantly influencing consumer preferences towards EVs in India. According to reports, MoEFCC reported that the National Clean Air Programme targets up to 40% PM10 reduction by 2025–26 across 131 cities, reinforcing policy support for cleaner mobility solutions. Furthermore, major metropolitan areas facing elevated pollution levels are witnessing stronger adoption trends as consumers recognize the environmental benefits of zero-emission transportation. Corporate sustainability commitments are driving fleet electrification programs across logistics, delivery, and employee transportation applications. Educational campaigns and awareness initiatives are helping consumers understand the lifecycle environmental advantages of EVs compared to conventional alternatives. The younger generation of vehicle buyers demonstrates heightened sensitivity towards environmental impact, viewing EV ownership as a statement of responsible consumption and contribution towards cleaner air quality.

Market Restraints:

What Challenges the India Electric Vehicle Market is Facing?

Higher Upfront Vehicle Acquisition Costs

Electric vehicles continue to command price premiums compared to equivalent internal combustion engine vehicles, primarily due to expensive battery systems and limited economies of scale in manufacturing. This cost differential presents a significant barrier for price-sensitive consumers, particularly in the mass-market segments where affordability remains a primary purchase consideration. Despite government subsidies and declining battery costs, the initial investment requirement restricts adoption among budget-conscious buyers.

Insufficient Charging Infrastructure in Non-Urban Areas

While charging infrastructure is expanding rapidly in metropolitan areas, significant gaps persist in tier-two cities, tier-three towns, and rural regions. This uneven distribution creates range anxiety concerns for consumers residing outside major urban centers or those requiring frequent intercity travel. The limited availability of charging points along certain highway stretches and in smaller towns constrains EV adoption among consumers who cannot rely primarily on home charging solutions.

Dependency on Imported Battery Components and Materials

India electric vehicle market remains significantly dependent on imported battery cells and critical materials including lithium, cobalt, and nickel. This reliance on external supply chains creates vulnerability to international price fluctuations, geopolitical disruptions, and currency variations. The limited domestic mining and processing capabilities for battery materials constrain manufacturing cost reductions and expose the industry to supply chain uncertainties affecting production planning and pricing stability.

Competitive Landscape:

The India electric vehicle market features a dynamic competitive landscape characterized by the participation of established automotive manufacturers alongside emerging electric mobility specialists. Market participants are pursuing diverse strategies including capacity expansion, technology development, distribution network enhancement, and strategic collaborations to strengthen their competitive positioning. Domestic manufacturers are leveraging their understanding of local consumer preferences and extensive service networks to capture market share across segments. International entrants are bringing advanced technologies and design capabilities while establishing localized manufacturing operations to meet regulatory requirements and achieve cost competitiveness. The competitive environment is witnessing increased focus on indigenous battery development, charging infrastructure investments, and digital ecosystem creation to deliver comprehensive mobility solutions beyond vehicle sales.

Some of the key players include:

- Ather Energy Limited

- Atul Auto LIMITED

- Bajaj Auto Ltd

- Electrotherm (India) Limited

- Greaves Electric Mobility Limited

- Hyundai Motor India

- JBM Group

- JSW MG Motor India Pvt Ltd

- Mahindra Electric Automobile Ltd

- Okinawa Autotec Private Limited

- Ola Electric Mobility Ltd.

- Olectra Greentech Limited

- Piaggio Vehicles Pvt. Ltd

- TATA Motors

- TVS Motor Company

Recent Developments:

-

In November 2025, Yamaha Motor launched two new electric scooters in India: the AEROX E, an in-house premium sport model, and the EC-06, developed with River Mobility for broader urban customers. These launches strengthen Yamaha’s presence in India’s EV market while supporting the company’s long-term carbon neutrality and sustainability objectives.

-

In January 2025, Hyundai launched its Creta Electric SUV in India, starting at just over $20,000. With a driving range up to 473 km and four available trims, the Creta EV is Hyundai’s first locally manufactured electric SUV, strengthening its presence in India’s EV market and promoting sustainable, zero-emission mobility solutions.

India Electric Vehicle Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD, ‘000 Units |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Vehicle Types Covered | Passenger Vehicles, Commercial Vehicles, Others |

| Price Categories Covered | Mid-Range, High/Luxury Range |

| Propulsion Types Covered | Battery Electric Vehicle, Hybrid Electric Vehicle, Plug-In Hybrid Electric Vehicle |

| Regions Covered | North India, West and Central India, South India, East India |

| Companies Covered | Ather Energy Limited, Atul Auto LIMITED, Bajaj Auto Ltd, Electrotherm (India) Limited, Greaves Electric Mobility Limited, Hyundai Motor India, JBM Group, JSW MG Motor India Pvt Ltd, Mahindra Electric Automobile Ltd, Okinawa Autotec Private Limited, Ola Electric Mobility Ltd., Olectra Greentech Limited, Piaggio Vehicles Pvt. Ltd, TATA Motors, TVS Motor Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India electric vehicle market size was valued at USD 3,712.15 Million in 2025.

The India electric vehicle market is expected to grow at a compound annual growth rate of 54.94% from 2026-2034 to reach USD 191,037.22 Million by 2034.

Passenger vehicles held the largest market share in the India electric vehicle market, driven by increasing consumer preference for personal electric mobility solutions, diverse model availability across price segments, and expanding charging infrastructure supporting daily commuting requirements.

Key factors driving the India electric vehicle market include supportive government policies with demand incentives, expanding charging infrastructure network, rising environmental consciousness among consumers, declining battery costs, and increasing fuel prices making EVs economically attractive.

Major challenges include high upfront vehicle costs, limited charging infrastructure in remote areas, inconsistent government incentives, long battery replacement times, supply chain constraints, and low consumer awareness about electric mobility benefits.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)