India Electrical Capacitor Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2025-2033

India Electrical Capacitor Market Overview:

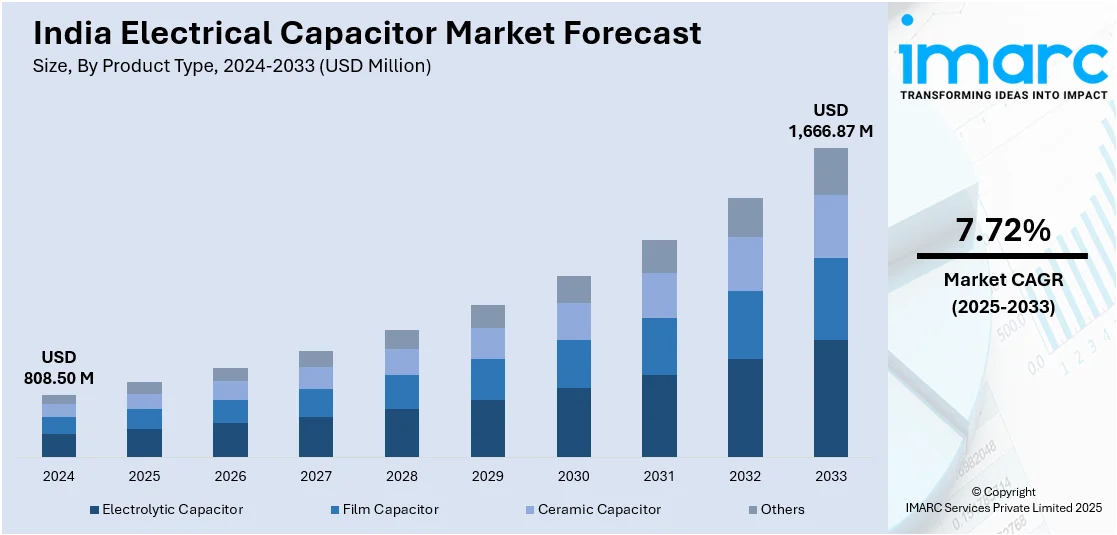

The India electrical capacitor market size reached USD 808.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,666.87 Million by 2033, exhibiting a growth rate (CAGR) of 7.72% during 2025-2033. The market is driven by increasing demand for efficient energy systems, accelerated industrialization, and growth in the renewable energy industry. Expansion in consumer electronics, greater rural electrification and favorable government policies for local manufacturing are also significantly contributing to the market. Growing end-user awareness about power quality management and the implementation of advanced technologies in automotive and power industries are further improveing the competitiveness and growth of the India electrical capacitor market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 808.50 Million |

| Market Forecast in 2033 | USD 1,666.87 Million |

| Market Growth Rate 2025-2033 | 7.72% |

India Electrical Capacitor Market Trends:

Integration of Smart Technologies and Automation

The market for Indian electrical capacitors is undergoing modification with the copious integration of automation and smart technologies. Industry 4.0 has increased the demand for self-reporting, self-diagnosing, and data reporting capacitors. Such capabilities enable predictive maintenance, improving system reliability and minimizing downtime. These innovations are particularly important in sectors like industrial automation, where system uptime is crucial. As per the IMARC Group, the India Industry 4.0 market size reached USD 5.6 Billion in 2024, and is further expected to reach USD 17.4 Billion by 2033, exhibiting a CAGR of 12.40% during 2025-2033. In addition, the increasing implementation of automated systems in manufacturing processes increases the need for capacitors that can withstand rapidly changing loads without compromising on supply stability. With the advancement of automation, the need for smart enabling capacitors will most likely encourage market growth and innovations.

To get more information on this market, Request Sample

Focus on Environmental Sustainability and Energy Efficiency

Environmental sustainability and energy efficiency are one of the top priorities in the Indian electrical capacitor industry. India has established bold objectives to reach net-zero emissions by 2070 and has pledged to obtain 50% of its overall energy capacity from renewable sources by 2030. The Indian government is making major investments in clean energy sources such as solar power, wind energy, green hydrogen, and battery storage to guarantee a sustainable and inclusive future. Hence, as the nation works towards achieving its clean energy goals and lowering its carbon footprint, there is an increasing focus on the design and implementation of environmentally friendly capacitors. The manufacturing companies are increasingly looking for alternative materials and manufacturing practices that have less environmental footprint, including the use of lead-free and RoHS-compliant materials. In addition, energy-saving capacitors are crucial in maximizing power consumption, minimizing energy wastage, and enhancing the overall efficiency of electrical devices. This is especially essential in industries such as manufacturing and lighting, where energy usage is high. Pressure for sustainability also comes from government policies and legislations that support the use of green technology, further propelling the India electrical capacitor market growth.

India Electrical Capacitor Market Segmentation:

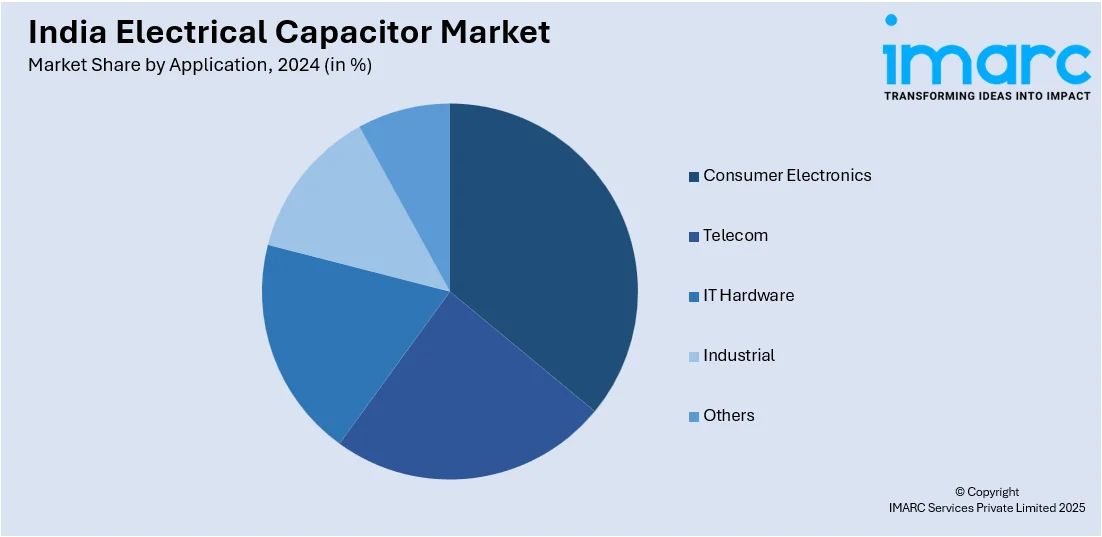

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and application.

Product Type Insights:

- Electrolytic Capacitor

- Film Capacitor

- Ceramic Capacitor

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes electrolytic capacitor, film capacitor, ceramic capacitor, and others.

Application Insights:

- Consumer Electronics

- Telecom

- IT Hardware

- Industrial

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes consumer electronics, telecom, IT hardware, industrial, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Electrical Capacitor Market News:

- In October 2024, signifying a significant advancement in its journey to be a top-tier manufacturer of electronic components, Keltron Component Complex Limited (KCCL) has established India’s inaugural super-capacitor production facility in Kannur. The initial stage of the ₹42-crore project has been finished at an expense of ₹18 crore. It encompasses vital infrastructure like dry rooms and manufacturing facilities that can produce 2,100 capacitors every day. The initiative is being carried out in partnership with the Indian Space Research Organisation.

- In September 2024, the IISc group created a super-capacitor that can be powered by directing light onto it. Supercapacitors are enhanced types of capacitors – they utilize electrochemical processes to hold greater amounts of energy.

India Electrical Capacitor Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Electrolytic Capacitor, Film Capacitor, Ceramic Capacitor, Others |

| Applications Covered | Consumer Electronics, Telecom, IT Hardware, Industrial, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India electrical capacitor market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India electrical capacitor market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India electrical capacitor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electrical capacitor market in India was valued at USD 808.50 Million in 2024.

The India electrical capacitor market is projected to exhibit a CAGR of 7.72% during 2025-2033, reaching a value of USD 1,666.87 Million by 2033.

The key drivers of India’s electrical capacitor market include rising energy demand and grid expansion with renewables integration, expanding automotive electrification, growth in consumer electronics and telecom, industrial automation in line with Industry 4.0, and government support via PLI/Make-in-India promoting local capacitor manufacturing.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)