India Electrical Conduit Market Size, Share, Trends and Forecast by Type, Material, Application, and Region, 2025-2033

India Electrical Conduit Market Size and Share:

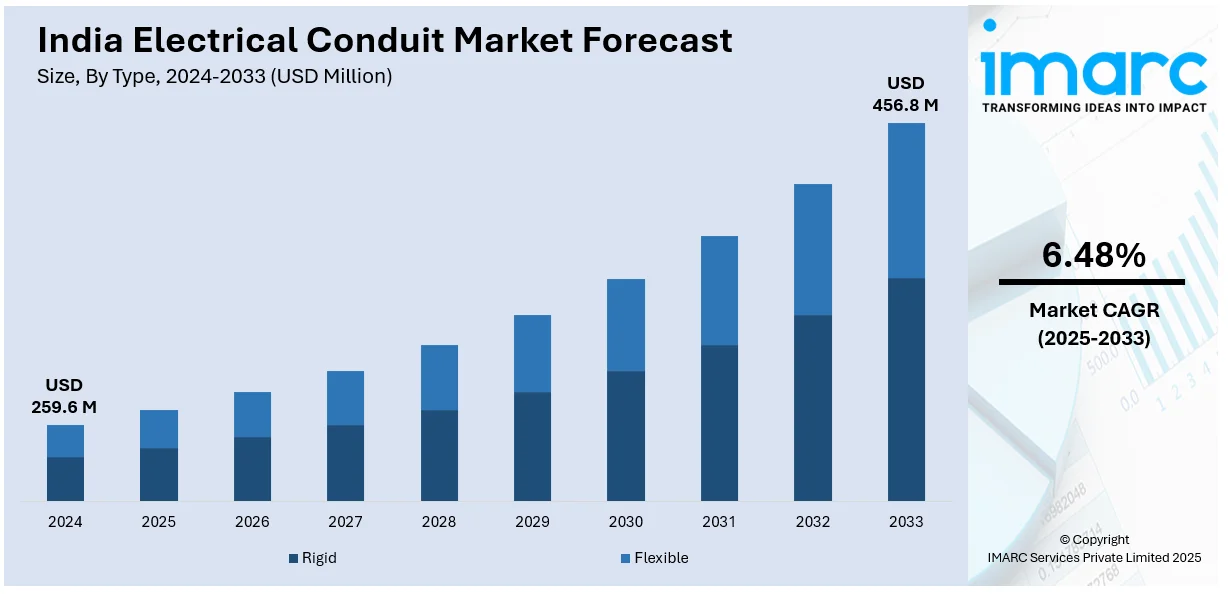

The India electrical conduit market size reached USD 259.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 456.8 Million by 2033, exhibiting a growth rate (CAGR) of 6.48% during 2025-2033. The market is driven by growing infrastructure projects under government initiatives like Smart Cities Mission, rapid adoption of smart technologies in industrial and residential spaces, rising demand for safe and durable wiring solutions, and expanding renewable energy installations requiring efficient electrical distribution systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 259.6 Million |

| Market Forecast in 2033 | USD 456.8 Million |

| Market Growth Rate 2025-2033 | 6.48% |

India Electrical Conduit Market Trends:

Government Initiatives Promoting Infrastructure Development

The Indian government's emphasis on infrastructure growth has been a primary catalyst for the electrical conduit market. The Smart Cities Mission is one such initiative that seeks to revamp urban spaces by upgrading infrastructure, including electrical systems. It not only develops urban life but also generates demand for electrical conduits to facilitate safe and efficient electrical installations. Apart from this, the Revamped Distribution Sector Scheme (RDSS) has also been initiated to improve and modernize distribution infrastructure, with a focus on enhancing the quality and dependability of the electrical supply. With a massive budget assigned toward this initiative, the RDSS is generating unprecedented demand for cables and conductors in the power industry as the utilities upgrade their networks. In addition, the focus of the government on renewable energy schemes, including solar and wind power, makes the development of electrical infrastructure necessary, subsequently raising the demand for conduits. The schemes need strong electrical systems to support additional capacities of power generation, which further supports the market for conduits.

To get more information on this market, Request Sample

Rapid Urbanization and Industrialization

India's urbanization percentage keeps on growing steadily, and more than 480 million Indians live in cities as of 2024. This expansion is driven by significant investments in infrastructure schemes like roads, airports, and residential constructions. The explosion in the population of cities creates a demand for residential and commercial buildings, thereby increasing the need for electrical conduits to provide secure electrical wiring and installations. Additionally, fast industrialization has created new industrial units and manufacturing facilities. Such developments necessitate a large amount of electrical infrastructure, such as conduits, to accommodate machinery and operations. Growth in industries like IT and telecommunication also leads to an upsurge in the demand for electrical conduits since these industries need safe and reliable electrical systems to function optimally. In addition, the expanding penetration of intelligent technologies and automation in different industries has also escalated the need for modern electrical conduit systems. As Industry 4.0 advances, manufacturing plants and factories are adopting automated production lines, robots, and IoT-enabled devices, which all demand effective and secure electrical wiring solutions. This has created huge demand for well-built conduits to shield electric systems from damage, moisture, and external factors to maintain steady operations. In the commercial and residential property market, the use of energy-efficient and green buildings is picking up pace, consistent with India's green building movement. Electrical conduits are important in contemporary building design, especially in high-rise structures, data centers, and smart homes, where structured cabling, high-density power distribution, and hidden wiring systems are required for safety and aesthetics.

India Electrical Conduit Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, material, and application.

Type Insights:

- Rigid

- Flexible

The report has provided a detailed breakup and analysis of the market based on the type. This includes rigid and flexible.

Material Insights:

- Metallic

- Non-Metallic

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes metallic and non-metallic.

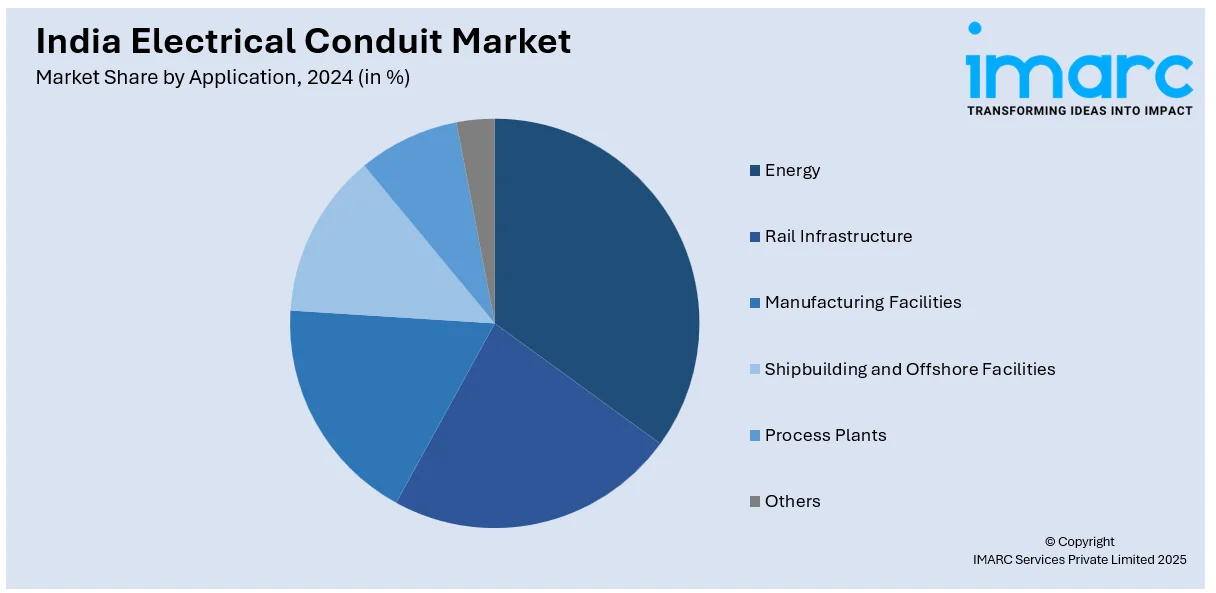

Application Insights:

- Energy

- Rail Infrastructure

- Manufacturing Facilities

- Shipbuilding and Offshore Facilities

- Process Plants

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes energy, rail infrastructure, manufacturing facilities, shipbuilding and offshore facilities, process plants, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Electrical Conduit Market News:

- March 2024: India and Sri Lanka are cooperating on an undersea electrical grid interconnectivity project to develop cross-border power exchange and energy security. Large-scale electrical infrastructure development is the focus of the project, demanding sophisticated conduit systems for safe transmission of power. The project develops the India electrical conduit market through rising demand for efficient and resilient conduit solutions.

- September 2023: Panasonic Life Solutions India introduced a flexible electrical wiring solution that improves safety, durability, and ease of installation in domestic and business environments. Additional annealing enhances flexibility, which is another benefit of the COPAPRO-FR wire. Greater flexibility makes conduit laying easier and more convenient. The innovation targets the growing need for sophisticated electrical infrastructure in contemporary buildings. This innovation is propelling the India electrical conduit market by enhancing the use of superior wiring systems, enabling safer and more efficient electrical installations.

India Electrical Conduit Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Rigid, Flexible |

| Materials Covered | Metallic, Non-Metallic |

| Applications Covered | Energy, Rail Infrastructure, Manufacturing Facilities, Shipbuilding and Offshore Facilities, Process Plants, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India electrical conduit market performed so far and how will it perform in the coming years?

- What is the breakup of the India electrical conduit market on the basis of type?

- What is the breakup of the India electrical conduit market on the basis of material?

- What is the breakup of the India electrical conduit market on the basis of application?

- What are the various stages in the value chain of the India electrical conduit market?

- What are the key driving factors and challenges in the India electrical conduit market?

- What is the structure of the India electrical conduit market and who are the key players?

- What is the degree of competition in the India electrical conduit market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India electrical conduit market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India electrical conduit market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India electrical conduit industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)