India Electrical Enclosure Market Size, Share, Trends and Forecast by Type, Material Type, Mounting Type, Form Factor, Product Type, Design, End-User, and Region, 2025-2033

India Electrical Enclosure Market Overview:

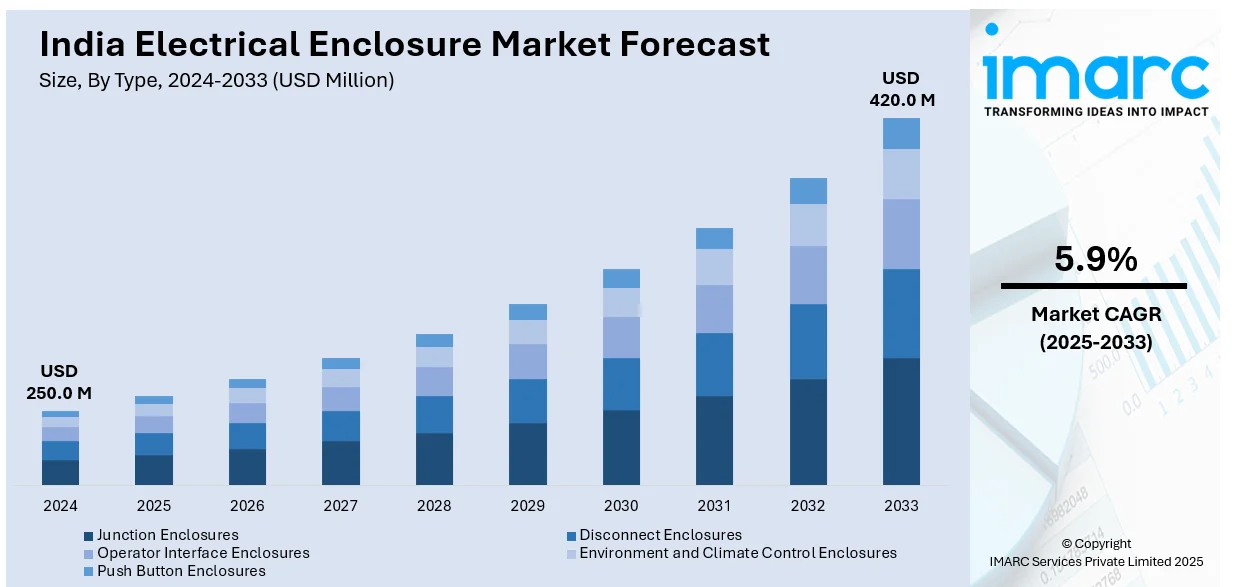

The India electrical enclosure market size reached USD 250.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 420.0 Million by 2033, exhibiting a growth rate (CAGR) of 5.9% during 2025-2033. The market is driven by rapid industrialization, expansion of electrical equipment manufacturing, increasing investments in renewable energy infrastructure, rising adoption of smart grid technologies, government initiatives like ‘Make in India,’ and growing demand for enclosures in sectors such as power, telecommunications, transportation, and commercial construction.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 250.0 Million |

| Market Forecast in 2033 | USD 420.0 Million |

| Market Growth Rate 2025-2033 | 5.9% |

India Electrical Enclosure Market Trends:

Expansion of Electrical Equipment Manufacturing Sector

The manufacturing industry of electrical equipment in India has grown very rapidly, directly influencing the demand for electrical enclosures. Electrical enclosures are a crucial piece of equipment used to insulate electrical equipment from the environment and provide safety for users. As reported by the Annual Survey of Industries (ASI) for the 2021-22 year, the manufacturing industry, including electrical equipment, reflected remarkable development. The ASI presents in-depth statistics of different industries that manufacture things, displaying the progress of the sector and enhanced production capabilities. The Ministry of Statistics and Programme Implementation stated that the manufacturing industry is likely to expand by 12.5% in 2021-22. This expansion reflects a strong rise in manufacturing activities, resulting in escalating demand for electrical equipment and, by extension, electrical enclosures. The Department of Heavy Industry dashboard shows that the electrical equipment sector is strategically critical to the power and manufacturing industries. The development of the sector enables the supply of energy networks and essential needs, which in turn elevates the demand for electrical enclosures. The government's emphasis on programs such as 'Make in India' and the PLI schemes further pushed the manufacturing sector. The initiatives are targeted toward enhancing local manufacturing capacity, such as production of electrical equipment, thus promoting the demand for electrical enclosures.

To get more information on this market, Request Sample

Increasing Demand for Renewable Energy Infrastructure

India's push for renewable energy has resulted in a huge boom in renewable energy infrastructure projects, which demand high usage of electrical enclosures. These enclosures are crucial to accommodate control systems, inverters, and other electrical equipment in renewable energy setups. The Ministry of Statistics and Programme Implementation has indicated that the cumulative installed capacity of grid-connected renewable power went up from 95,803 MW in 2021 to 109,885 MW in 2022, showing an upsurge of 14.70% over the year. The drastic change in renewable energy capacity requires electrical enclosures for the protection and control of electrical systems. The efforts of the government, like the National Solar Mission, and the offering of incentives for wind energy schemes, have helped speed up the installation of renewable energy sources. These installations need stable electrical infrastructure, like enclosures, to provide efficiency in operation and safety. The increasing incorporation of renewable energy into the national grid also requires sophisticated electrical enclosures for grid management systems. Such enclosures shield sensitive equipment utilized in monitoring and controlling the distribution of renewable energy to provide stability and reliability in power supply.

India Electrical Enclosure Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, material type, mounting type, form factor, product type, design, and end-user.

Type Insights:

- Junction Enclosures

- Disconnect Enclosures

- Operator Interface Enclosures

- Environment and Climate Control Enclosures

- Push Button Enclosures

The report has provided a detailed breakup and analysis of the market based on the type. This includes junction enclosures, disconnect enclosures, operator interface enclosures, environment and climate control enclosures, and push button enclosures.

Material Type Insights:

- Metallic

- Nonmetallic

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes metallic and nonmetallic.

Mounting Type Insights:

- Wall-Mounted Enclosure

- Floor-Mounted/Free-Standing Enclosure

- Underground

A detailed breakup and analysis of the market based on the mounting type have also been provided in the report. This includes wall-mounted enclosure, floor-mounted/free-standing enclosure, and underground.

Form Factor Insights:

- Small

- Compact

- Full-Size

A detailed breakup and analysis of the market based on the form factor have also been provided in the report. This includes small, compact, and full size.

Product Type Insights:

- Drip-Tight

- Hazardous Environment

- Flame/Explosion Proof

- Dust-Tight

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes drip-tight, hazardous environment, flame/explosion proof, dust-tight, and others.

Design Insights:

- Standard Type

- Custom Type

A detailed breakup and analysis of the market based on the design have also been provided in the report. This includes standard type and custom type.

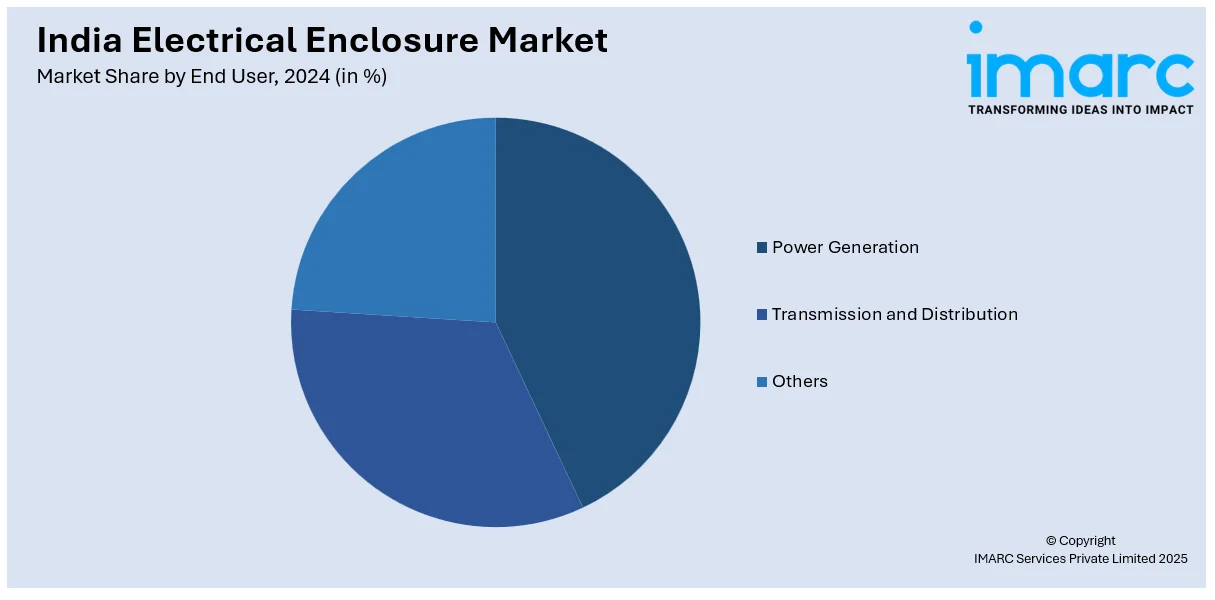

End User Insights:

- Power Generation

- Transmission and Distribution

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes power generation, transmission and distribution, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East Inda, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Electrical Enclosure Market News:

- June 2024: India's RMC Switchgears received a USD 6.8 Million order for smart meter enclosures, a sign of growing demand for electrical enclosures in India. The advancement in the use of smart metering infrastructure propels the demand for strong and secure enclosures to house advanced metering systems. The rise in product use solidifies the electrical enclosure market in support of India's efforts to digitize power distribution.

- April 2024: Schneider Electric introduced an all-in-one Battery Energy Storage System (BESS) for microgrids that improved energy reliability and sustainability. This development created a higher demand for electrical enclosures to shield and integrate power management systems. The rapid popularity of microgrid solutions in India fuels the demand for sophisticated electrical enclosures in renewable energy infrastructure.

India Electrical Enclosure Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Junction Enclosures, Disconnect Enclosures, Operator Interface Enclosures, Environment and Climate Control Enclosures, Push Button Enclosures |

| Material Types Covered | Metallic, Nonmetallic |

| Mounting Types Covered | Wall-Mounted Enclosure, Floor-Mounted/Free-Standing Enclosure, Underground |

| Form Factors Covered | Small, Compact, Full-Size |

| Product Types Covered | Drip-Tight, Hazardous Environment, Flame/Explosion Proof, Dust-Tight, Others |

| Designs Covered | Standard Type, Custom Type |

| End Users Covered | Power Generation, Transmission and Distribution, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India electrical enclosure market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India electrical enclosure market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India electrical enclosure industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India electrical enclosure market was valued at USD 250.0 Million in 2024.

The India electrical enclosure market is projected to exhibit a CAGR of 5.9% during 2025-2033, reaching a value of USD 420.0 Million by 2033.

The India electrical enclosure market is driven by rapid industrialization, infrastructure development, and growing demand for safety in electrical systems. Expansion of power distribution networks, automation in manufacturing, and increased construction activities also boost demand. Government initiatives in smart cities and renewable energy projects further support market growth across sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)