India Electrical Materials Market Size, Share, Trends, and Forecast by Type, End User, and Region, 2025-2033

India Electrical Materials Market Overview:

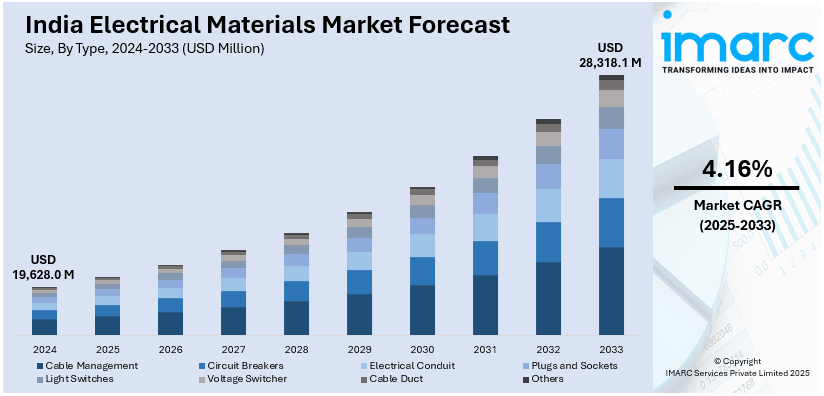

The India electrical materials market size reached USD 19,628.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 28,318.1 Million by 2033, exhibiting a growth rate (CAGR) of 4.16% during 2025-2033. The market is growing rapidly, driven by urbanization, infrastructure expansion, and industrial development. Additionally, government initiatives like RDSS and smart city projects are boosting the demand for switchgear, wiring devices, and automation solutions, thereby driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 19,628.0 Million |

| Market Forecast in 2033 | USD 28,318.1 Million |

| Market Growth Rate 2025-2033 | 4.16% |

India Electrical Materials Market Trends:

Growing Investments in Power Infrastructure and Renewable Energy

India’s electrical materials sector is benefiting from large-scale investments in power transmission and distribution (T&D) networks, alongside rapid expansion in renewable energy. Government initiatives like the Revamped Distribution Sector Scheme (RDSS) is modernizing the grid to improve efficiency and reduce transmission losses. For instance, as per industry reports, as of November 2024, projects worth ₹2.77 lakh crore have been sanctioned under RDSS, focusing on loss reduction and the implementation of smart metering. These initiatives have achieved a physical progress of approximately 17%. The integration of solar and wind power into the grid is also driving the need for advanced substations, power inverters, and grid automation technologies. Additionally, rural electrification programs are boosting sales of durable and high-performance electrical wiring and components. Private sector investments in power generation and industrial electrification are reinforcing this growth, pushing the market towards more resilient and sustainable electrical infrastructure. Furthermore, manufacturers are responding with specialized materials that enhance grid reliability, withstand harsh environments, and support renewable energy applications.

To get more information on this market, Request Sample

Rapid Urbanization and Rising Construction Activities Driving Demand

Urban expansion and infrastructure development are key growth drivers in India’s electrical materials market. Large-scale residential, commercial, and industrial projects are fueling the demand for electrical wiring, switchgear, and distribution systems. For instance, in December 2024, India's electricity sector recorded a growth rate of 6.2%. The government's Housing for All initiative, metro rail expansions, and smart city programs are accelerating the installation of modern electrical systems. In urban and semi-urban areas, demand for aesthetic and modular electrical fittings is rising as consumers seek high-quality, design-oriented products. Real estate developers are incorporating premium electrical materials that offer enhanced safety features, fire resistance, and durability. In industrial and commercial spaces, advanced electrical panels and automation-driven solutions are improving energy management and operational efficiency. As disposable incomes rise, consumers are increasingly investing in high-performance electrical appliances and accessories, further driving market expansion. With a push for sustainable and future-ready infrastructure, manufacturers are innovating in material composition, safety standards, and energy efficiency to meet evolving industry needs.

India Electrical Materials Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and end user.

Type Insights:

- Cable Management

- Circuit Breakers

- Electrical Conduit

- Plugs and Sockets

- Light Switches

- Voltage Switcher

- Cable Duct

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes cable management, circuit breakers, electrical conduit, plugs and sockets, light switches, voltage switcher, cable duct, and others.

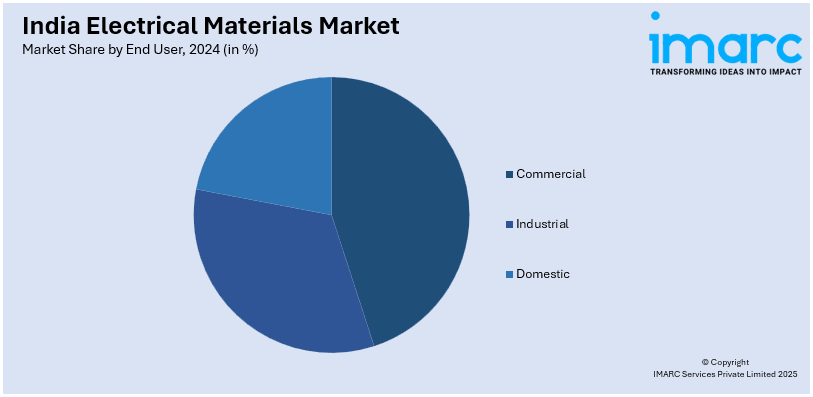

End User Insights:

- Commercial

- Industrial

- Domestic

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes commercial, industrial, and domestic.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Electrical Materials Market News:

- In January 2024, Panasonic Electric Works India (PEWIN) announced plans to capture 50% of India’s wiring devices market by 2030. The company aims to expand its market share, along with investments in automation at its Sri City facility, and strengthen its presence in switchgear, lighting, and infrastructure projects.

- In February 2025, UltraTech Cement announced an investment of ₹18 Billion to establish a wires and cables business, expanding its building materials portfolio. The new venture aims to diversify the market, enhance competition, and meet the increasing demand across residential, commercial, infrastructure, and industrial applications.

India Electrical Materials Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Cable Management, Circuit Breakers, Electrical Conduit, Plugs and Sockets, Light Switches, Voltage Switcher, Cable Duct, Others |

| End Users Covered | Commercial, Industrial, Domestic |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India electrical materials market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India electrical materials market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India electrical materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India electrical materials market size reached USD 19,628.0 Million in 2024.

The India electrical materials market is expected to reach USD 28,318.1 Million by 2033, exhibiting a CAGR of 4.16% during 2025-2033.

Market growth is driven by increasing infrastructure development, rising investments in power generation and distribution, growing demand for energy-efficient electrical systems, and government initiatives supporting electrification in rural and urban areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)