India Electrolyzer Market Size, Share, Trends and Forecast by Product, Capacity, Application, and Region, 2025-2033

India Electrolyzer Market Overview:

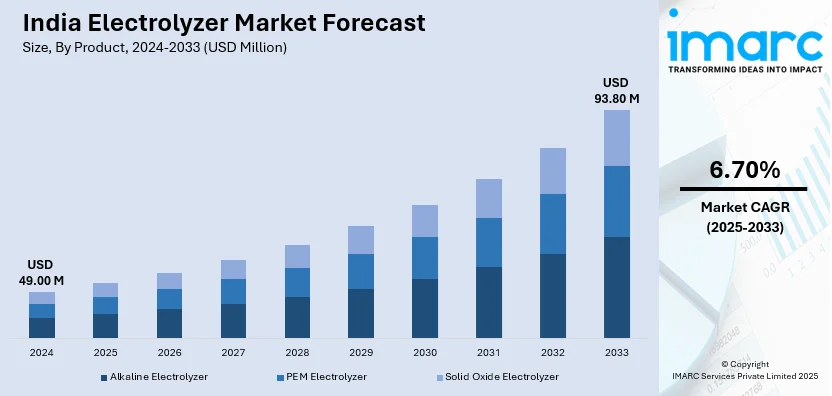

The India electrolyzer market size reached USD 49.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 93.80 Million by 2033, exhibiting a growth rate (CAGR) of 6.70% during 2025-2033. The growing demand for green hydrogen, implementation of government initiatives and policies supporting renewable energy, increasing investments in clean energy infrastructure, advancements in electrolyzer technology, rising industrial applications of hydrogen, decarbonization goals across sectors, and the push for energy security and sustainability are expanding India electrolyzer market share

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 49.00 Million |

| Market Forecast in 2033 | USD 93.80 Million |

| Market Growth Rate 2025-2033 | 6.70% |

India Electrolyzer Market Trends:

Growing Investments in Green Hydrogen Production Driving Electrolyzer Demand

The India electrolyzer market growth is driven by the increasing investments in green hydrogen production. For instance, in a news release on June 23, 2024, the Ministry of New and Renewable Energy highlighted the National Green Hydrogen Mission, which aims to establish India as a global leader in the production and export of green hydrogen. The goal of this mission is to produce 5 Million Tons of green hydrogen annually by 2030. This program lowers carbon emissions and promotes renewable energy sources, demonstrating the nation's dedication to sustainability. The implementation of supportive government initiatives such as the National Green Hydrogen Mission, with an allocated budget of INR 19,744 Crore (approximately USD 2.26 Billion), are encouraging large-scale deployment of electrolyzers. Companies are investing in electrolyzer technology to reduce dependence on fossil fuels and meet sustainability goals. Additionally, strategic partnerships between domestic and global firms are fostering innovation and localization of manufacturing. As industries shift towards cleaner energy alternatives, the demand for advanced and efficient electrolyzers is expected to rise significantly, thereby making India a key player in the global green hydrogen economy.

To get more information on this market, Request Sample

Technological Advancements Enhancing Electrolyzer Efficiency

The India electrolyzer market is benefiting from continuous technological advancements that are improving efficiency and reducing production costs. Innovations in alkaline, proton exchange membrane (PEM), and solid oxide electrolyzers are enabling higher hydrogen output with lower energy consumption. Research institutions and private enterprises are focusing on developing cost-effective and durable electrolyzers to support large-scale hydrogen production. Additionally, integration with renewable energy sources like solar and wind is improving the sustainability of hydrogen generation, which in turn is positively impacting India electrolyzer market outlook. With ongoing research and development (R&D) efforts and supportive government policies, India is poised to become a global hub for electrolyzer technology, accelerating the country’s transition to a low-carbon energy future. For instance, John Cockerill Hydrogen and AM Green reached a deal on October 30, 2024, for the supply of 1.3 GW of sophisticated pressurized alkaline electrolyzers for AM Green's green ammonia plant in Kakinada, Andhra Pradesh. The plant is expected to start producing one Million Tons of green ammonia a year in the second half of 2026. A 2 GW annual electrolyzer manufacturing unit will also be established in Kakinada as part of the partnership, demonstrating India's dedication to sustainable energy solutions.

India Electrolyzer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, capacity, and application.

Product Insights:

- Alkaline Electrolyzer

- PEM Electrolyzer

- Solid Oxide Electrolyzer

The report has provided a detailed breakup and analysis of the market based on the product. This includes alkaline electrolyzer, PEM electrolyzer, and solid oxide electrolyzer.

Capacity Insights:

- Less than 500 kW

- 500 kW to 2 MW

- Above 2 MW

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes Less than 500 kW, 500 kW to 2 MW, and above 2 MW.

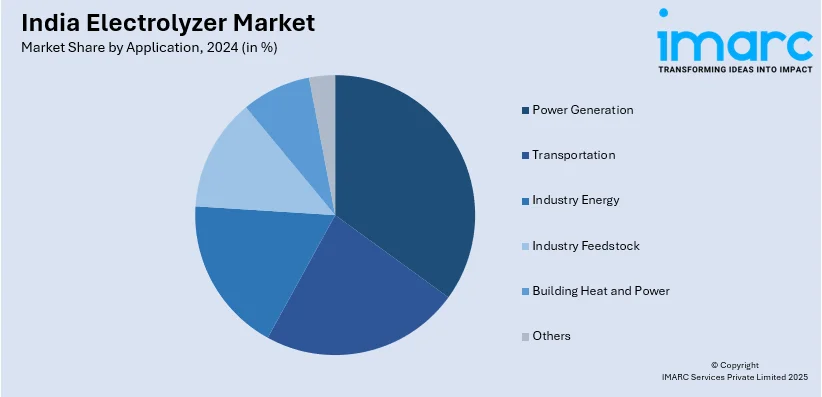

Application Insights:

- Power Generation

- Transportation

- Industry Energy

- Industry Feedstock

- Building Heat and Power

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes power generation, transportation, industry energy, industry feedstock, building heat and power, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Electrolyzer Market News:

- On November 25, 2024, Jakson Green's green hydrogen electrolyzer manufacturing branch, Jakson Green INFINITY, announced the shipment of its first batch of 3.8 MW electrolyzers. In the National Capital Region, these units will serve as India's first green hydrogen refueling station for urban mobility. Jakson Green's dedication to developing green hydrogen infrastructure and sustainable energy solutions is demonstrated by this endeavor.

- On October 3, 2024, GreenH Electrolysis, a joint venture between GR Promoter Group and H2B2 Electrolysis Technologies, revealed its first 1 MW proton exchange membrane (PEM) electrolyser at its Jhajjar, Haryana, production site. As part of the Indian Railways' "Hydrogen for Heritage" campaign, this electrolyzer will be installed at the hydrogen production and refueling station in Jind, Haryana, to enable India's first hydrogen train. With continuous operation, the electrolyzer is estimated to generate about 430 kg of hydrogen per day at a delivery pressure of 40 bar(g), supporting India's efforts to develop sustainable energy sources.

India Electrolyzer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Alkaline Electrolyzer, PEM Electrolyzer, Solid Oxide Electrolyzer |

| Capacities Covered | Less than 500 kW, 500 kW to 2 MW, Above 2 MW |

| Applications Covered | Power Generation, Transportation, Industry Energy, Industry Feedstock, Building Heat and Power, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India electrolyzer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India electrolyzer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India electrolyzer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India electrolyzer market was valued at USD 49.00 Million in 2024.

The India electrolyzer market is projected to exhibit a CAGR of 6.70% during 2025-2033, reaching a value of USD 93.80 Million by 2033.

The India electrolyzer market is driven by a growing push for clean energy, strong government support, and increasing focus on green hydrogen production. Advancements in technology, rising industrial demand, and the integration of renewable energy sources are also encouraging widespread adoption of electrolyzers across various sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)