India Electronic Security Market Size, Share, Trends and Forecast by Product Type, Service Type, End-Use Sector, and Region, 2025-2033

India Electronic Security Market Overview:

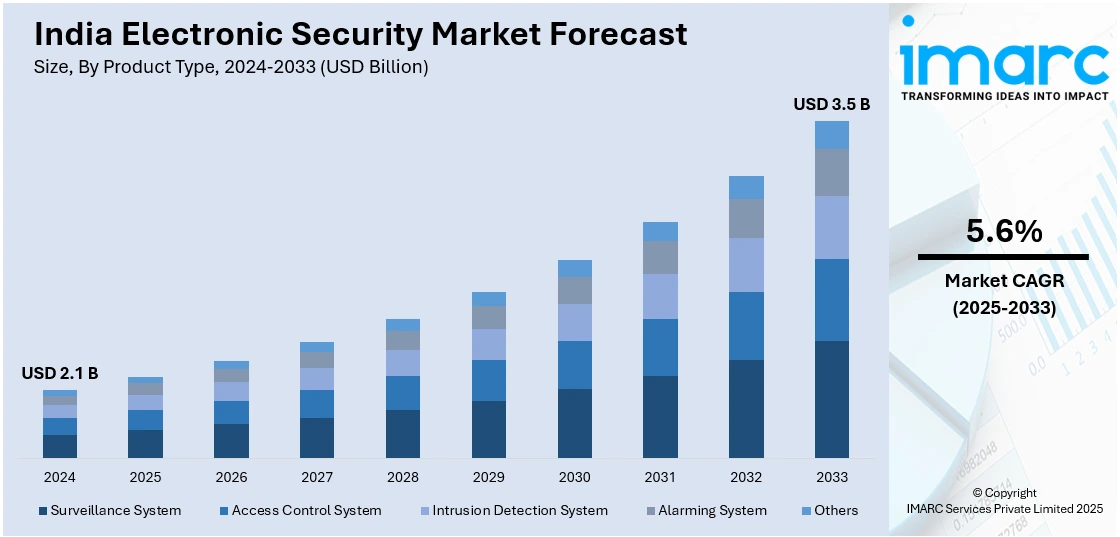

The India electronic security market size reached USD 2.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.5 Billion by 2033, exhibiting a growth rate (CAGR) of 5.6% during 2025-2033. The market is driven by rapid technological advancements in AI and IoT, increased urban infrastructure development, rising demand for surveillance in smart cities, and growing adoption of cloud-based security solutions by enterprises to safeguard digital assets, ensuring a secure and resilient security ecosystem.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.5 Billion |

| Market Growth Rate 2025-2033 | 5.6% |

India Electronic Security Market Trends:

Rising Urbanization and Escalating Crime Rates

India's fast-paced urbanization has resulted in a massive surge in population density in urban areas. The demographic change has increased focus on safety and security issues since highly populated areas tend to have higher rates of crimes, such as thefts, burglaries, and assaults. Therefore, there is an increased need for sophisticated electronic security solutions both among individuals and organizations who want to protect their valuables and provide public safety. The link between urbanization and crime rates has necessitated a proactive security strategy. Surveillance systems, especially Closed-Circuit Television (CCTV) cameras, have become widespread in urban areas, acting as deterrents as well as means of detecting crime. The use of intrusion detection systems has also increased significantly, offering real-time notifications and improving the responsiveness of security personnel. The rapid urbanization in India has also seen the growth of informal settlements and congested residential areas, where the police department is confronted with challenges in ensuring security. With an increase in the size of the cities, pressures on police units mount, rendering it impossible to keep watch over every location effectively. The lack of surveillance has, therefore, contributed to an uptrend of property-related offenses like burglaries and vandalism, pushing government authorities and private institutions to invest in sophisticated security systems.

To get more information on this market, Request Sample

Increasing Adoption of Smart and AI-Driven Security Systems

The increasing technological developments in artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) have strongly influenced India's electronic security industry. With conventional security systems changing, there is a rising demand for intelligent surveillance solutions that provide real-time analysis, automated threat identification, and predictive security features. Companies, government organizations, and residential communities are increasingly spending on AI-driven security systems that improve monitoring effectiveness and response time. Among the major drivers for this trend is the growing sophistication of criminal operations. Traditional security solutions, like simple CCTV cameras, are not enough to detect or deter organized crime, unauthorized access, and cyber threats. AI-based surveillance cameras with facial recognition, behavioral analysis, and automated notifications assist authorities and organizations in detecting possible threats before crimes take place. In high-security areas like airports, metro stations, and corporate offices, these sophisticated security solutions are being combined with biometric access controls to provide multi-layered security.

India Electronic Security Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, service type, and end-use sector.

Product Type Insights:

- Surveillance System

- Access Control System

- Intrusion Detection System

- Alarming System

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes surveillance system, access control system, intrusion detection system, alarming system, and others.

Service Type Insights:

- Installation Services

- Managed Services

- Consulting Services

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes installation services, managed services, and consulting services.

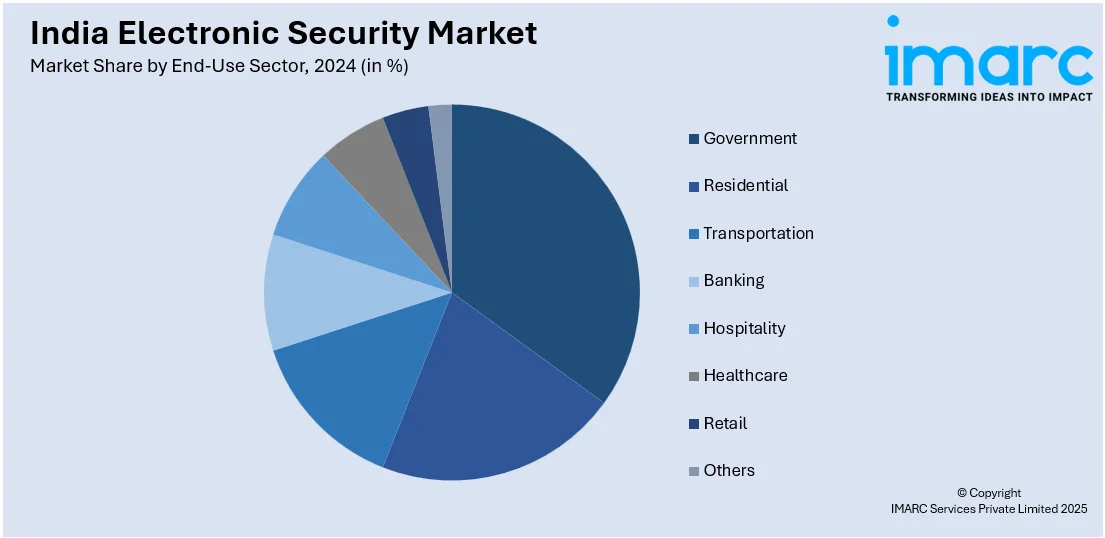

End-Use Sector Insights:

- Government

- Residential

- Transportation

- Banking

- Hospitality

- Healthcare

- Retail

- Others

A detailed breakup and analysis of the market based on the end-use sector have also been provided in the report. This includes government, residential, transportation, banking, hospitality, healthcare, retail, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Electronic Security Market News:

- December 2024: Panasonic Life Solutions India launched AI-driven surveillance solutions, such as the High Zoom Bullet Camera and X-series Camera with on-site learning analytics, at IFSEC India 2024. These solutions improve security features, addressing the increasing need for sophisticated surveillance in India's electronic security industry. The use of AI technology in surveillance systems is fueling the implementation of smart security solutions in different industries in India.

- September 2024: Sparsh CCTV, a top government security solutions company in India, ventured into the retail sector with cutting-edge security solutions such as AI-based analytics and cloud-based surveillance systems. This expansion fortifies the electronic security industry by providing high-quality, locally produced surveillance products to businesses and consumers. The company's countrywide infrastructure and alliances drive security adoption, aligning with India's self-reliance initiatives.

- March 2024: Prama Hikvision India expands domestic production in the "Make-in-India" program, enhancing local manufacturing of security solutions. Investment in sophisticated surveillance technologies and workforce development by the company complements the demand for electronic security systems of high quality. This program boosts India's indigenous capability in security infrastructure, propelling the market.

India Electronic Security Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Surveillance System, Access Control System, Intrusion Detection System, Alarming System, Others |

| Service Types Covered | Installation Services, Managed Services, Consulting Services |

| End-Use Sectors Covered | Government, Residential, Transportation, Banking, Hospitality, Healthcare, Retail, Others, Commercial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India electronic security market performed so far and how will it perform in the coming years?

- What is the breakup of the India electronic security market on the basis of product type?

- What is the breakup of the India electronic security market on the basis of service type?

- What is the breakup of the India electronic security market on the basis of end-use sector?

- What are the various stages in the value chain of the India electronic security market?

- What are the key driving factors and challenges in the India electronic security market?

- What is the structure of the India electronic security market and who are the key players?

- What is the degree of competition in the India electronic security market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India electronic security market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India electronic security market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India electronic security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)