India Electroplating Market Size, Share, Trends and Forecast by Type, Metal Type, End Use Industry, and Region, 2025-2033

India Electroplating Market Overview:

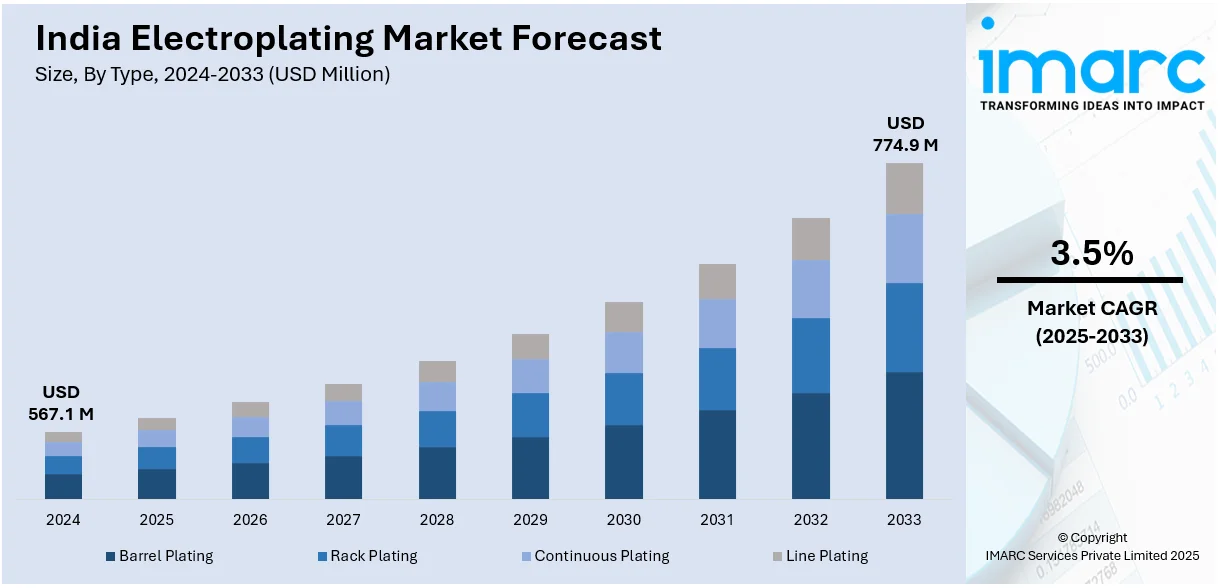

The India electroplating market size reached USD 567.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 774.9 Million by 2033, exhibiting a growth rate (CAGR) of 3.5% during 2025-2033. The market is driven by the rapid expansion of the automotive, electronics, and medical device industries, coupled with government initiatives like Make in India and rising investments in manufacturing infrastructure, which are increasing demand for corrosion-resistant coatings, enhanced conductivity solutions, and aesthetic metal finishing across various industrial applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 567.1 Million |

| Market Forecast in 2033 | USD 774.9 Million |

| Market Growth Rate 2025-2033 | 3.5% |

India Electroplating Market Trends:

Expansion of the Automotive and Electronics Industries

The expanding automotive and electronics industries in India have played a key role in fueling the demand for electroplating services. Electroplating is crucial in these industries to improve the durability, corrosion resistance, and appearance of different components. In the automotive sector, electroplating is widely applied to plate parts like engine parts, fasteners, and decorative trim. This operation not only enhances the look of automobiles but also extends the life span of key components by guarding against wear and corrosion. A growing output of automobiles in India, has therefore contributed to increased demand for electroplating services. As per the Ministry of Heavy Industries, the contribution of India's GDP by the auto industry was 7.1% in 2020-21, with major contribution coming from the production of components that involve electroplating. In the same way, electronics manufacturing is equally dependent on electroplating in the production of connectors, PCBs, and other components. The process offers consistent electrical conduction and resistance to natural elements, a factor that largely determines the use and lifespan of electronic devices. The Ministry of Electronics and Information Technology stated that domestic manufacture of electronic items rose from INR 2,43,263 crore (USD 37 billion) in 2015-16 to INR 5,54,461 crore (USD 74.7 billion) during 2020-21 at a Compound Annual Growth Rate (CAGR) of 17.9%. This sharp growth reflects the growing need for electroplating services in the electronics manufacturing industry.

To get more information on this market, Request Sample

Government Initiatives Boosting Manufacturing

The Government of India has rolled out a number of schemes to strengthen the manufacturing industry, which has subsequently contributed positively to the electroplating industry. The Production-Linked Incentive (PLI) Scheme is one of the prominent programs that has been introduced to promote India's manufacturing capacity and exports in several sectors, such as electronics and auto parts. The PLI Scheme provides monetary incentives to producers in terms of their incremental sales and investment levels, thus stimulating local production and minimizing import dependence. The scheme has attracted substantial investments in the production of components that are subject to electroplating, including electronic components and automotive parts. Through the stimulation of local manufacturing, the scheme has provided a favorable environment for the development of the electroplating sector. Further, the 'Make in India' movement also seeks to position India as a global manufacturing center by inviting multinational and local firms to make their products in the country. This movement has spurred new factory setup and growth in existing ones, thus creating a higher demand for electroplating services. The efforts of the government to enhance infrastructure, ease regulatory procedures, and offer fiscal supports have further fueled the development of the manufacturing industry. In addition, the Ministry of Micro, Small, and Medium Enterprises (MSME) has initiated several schemes to promote small-scale industries, which form a major part of the electroplating industry. These schemes offer financial support, skill development training, and technology upgrade assistance to MSMEs, thus making them competitive and capable of fulfilling the increasing demand for electroplating services.

India Electroplating Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, metal type, and end use industry.

Type Insights:

- Barrel Plating

- Rack Plating

- Continuous Plating

- Line Plating

The report has provided a detailed breakup and analysis of the market based on the type. This includes barrel plating, rack plating, continuous plating, and line plating.

Metal Type Insights:

- Gold

- Zinc

- Platinum

- Copper

- Nickel

- Chromium

- Others

A detailed breakup and analysis of the market based on the metal type have also been provided in the report. This includes gold, zinc, platinum, copper, nickel, chromium, and others.

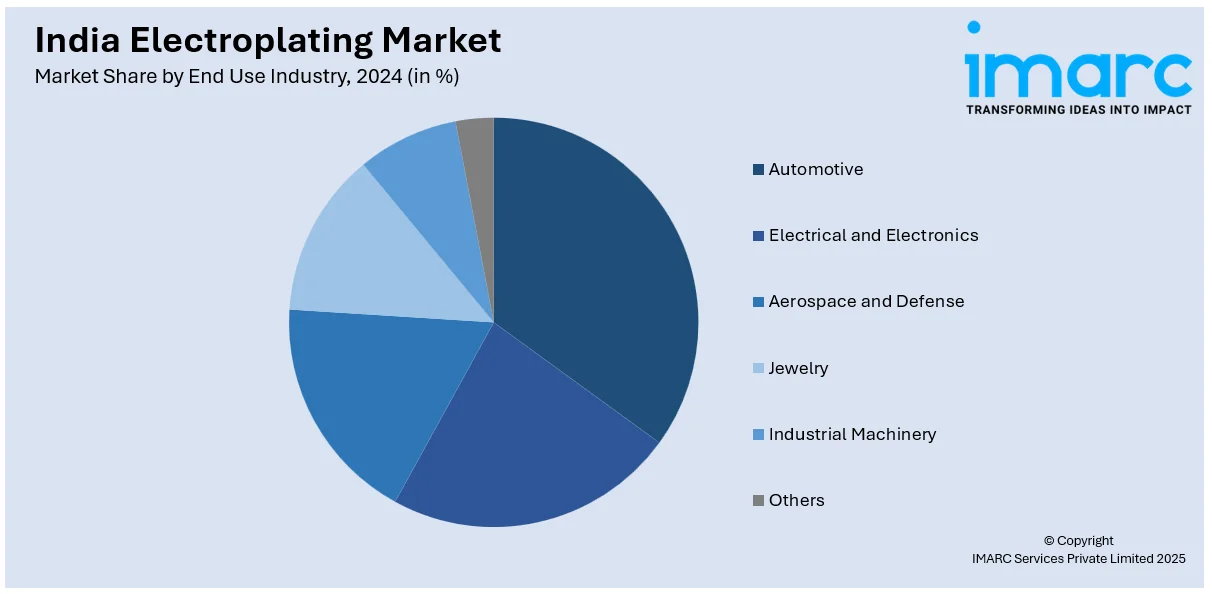

End Use Industry Insights:

- Automotive

- Electrical and Electronics

- Aerospace and Defense

- Jewelry

- Industrial Machinery

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes automotive, electrical and electronics, aerospace and defense, jewelry, industrial machinery, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Electroplating Market News:

- January 2025: Amphenol introduced DuraSwap Concentric Connectors and a Type 6 Charging Gun Solution to improve electric vehicle (EV) charging infrastructure. These solutions are centered on durability, high-power transfer efficiency, and long-term reliability in high-usage applications. The India electroplating market is pushing such innovations by offering corrosion-resistant and high-conductivity coatings for EV connectors, which will provide improved performance and longer lifespan.

- November 2024: Abbott introduced a leadless pacemaker in India to correct sluggish heart rhythms, providing a minimally invasive solution over conventional pacemakers. The product hopes to enhance patient results by not using leads, cutting down complications. The need for sophisticated medical implants is growing, propelling India's electroplating market as high-quality coatings are vital to ensure durability and biocompatibility.

India Electroplating Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Barrel Plating, Rack Plating, Continuous Plating, Line Plating |

| Metal Types Covered | Gold, Zinc, Platinum, Copper, Nickel, Chromium, Others |

| End Use Industries Covered | Automotive, Electrical and Electronics, Aerospace and Defense, Jewelry, Industrial Machinery, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India electroplating market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India electroplating market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India electroplating industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electroplating market in India was valued at USD 567.1 Million in 2024.

The India electroplating market is projected to exhibit a CAGR of 3.5% during 2025-2033, reaching a value of USD 774.9 Million by 2033.

The India electroplating market is primarily driven by the expanding automotive and electronics industries, which require enhanced corrosion resistance and electrical conductivity. Additionally, "Make in India" initiatives are boosting domestic manufacturing, while a growing demand for decorative finishes, wear resistance, and technological advancements in surface finishing further propel market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)