India Endoscopes Market Size, Share, Trends and Forecast by Product, Application, End Use, and Region, 2025-2033

India Endoscopes Market Overview:

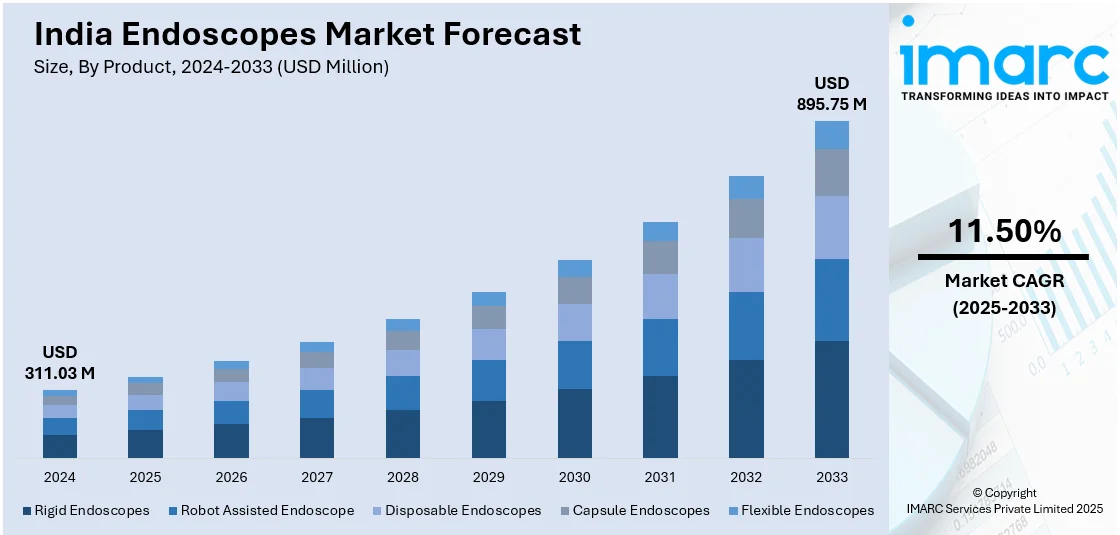

The India endoscopes market size reached USD 311.03 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 895.75 Million by 2033, exhibiting a growth rate (CAGR) of 11.50% during 2025-2033. The rising demand for minimally invasive surgeries (MIS), increasing prevalence of gastrointestinal and chronic diseases, and advancements in endoscopic technology are bolstering the market growth. Additionally, expanding healthcare infrastructures and favorable government initiatives supporting early diagnosis and treatment are further propelling the India endoscopes market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 311.03 Million |

| Market Forecast in 2033 | USD 895.75 Million |

| Market Growth Rate 2025-2033 | 11.50% |

India Endoscopes Market Trends:

Technological Advancements in Endoscopic Imaging and Robotics

The integration of advanced imaging technologies and robotics is transforming endoscopic procedures in India, enhancing the precision and effectiveness of minimally invasive diagnostics and surgeries. Innovations like high-definition (HD) video endoscopy, narrow-band imaging (NBI), and 3D visualization have significantly improved diagnostic accuracy, especially in oncology and gastrointestinal applications. Robot-assisted endoscopic surgeries are increasingly adopted in major Indian hospitals, particularly in urology, gynecology, and ENT, enabling greater precision, reduced complications, and quicker patient recovery. In 2023, FUJIFILM India unveiled cutting-edge tools, FushKnife and ClutchCutter, while Medtronic introduced the GI Genius, an AI-powered endoscopy module designed to enhance real-time visualization and support colorectal cancer detection. Reflecting broader trends, over 70% of innovations by med-tech startups in India are now reportedly digitally driven. The adoption of HD endoscopes in tertiary hospitals surged by 28% between 2022 and 2024, while more than 150 hospitals had incorporated AI-enhanced endoscopic systems by late 2024. These advancements are driving early diagnosis and reducing long-term treatment costs across urban and semi-urban healthcare settings.

To get more information on this market, Request Sample

Expanding Private Healthcare Infrastructures and Medical Tourism

India’s rapidly expanding private healthcare sector, alongside its thriving medical tourism industry, is significantly propelling the growth of the endoscope market. Increased investments by private players in multispecialty and super-specialty hospitals have led to broader availability of advanced diagnostic tools, including high-end endoscopes. The country is fast becoming a global hub for medical tourism, driven by its cost-effective treatment options and highly skilled healthcare professionals. Endoscopic procedures, favored for being less invasive and more affordable than conventional surgeries, are increasingly sought after by international patients, particularly in gastroenterology, gynecology, and orthopedics. In 2023, over 1.4 million international patients traveled to India for treatment, with more than 40% opting for minimally invasive procedures like endoscopy. The medical tourism market in India is projected to reach USD 70.9 billion by 2033, exhibiting a growth rate (CAGR) of 13.78% during 2025-2033, supported by around 2 million annual medical and wellness visits. Between 2022 and 2024, the number of private hospitals offering advanced endoscopic services rose by 35%. Collaborations with global med-tech firms are further accelerating the adoption of innovative endoscopic technologies.

India Endoscopes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, application, and end use.

Product Insights:

- Rigid Endoscopes

- Laparoscopes

- Arthroscopes

- Urology Endoscopes

- Cystoscopes

- Gynecology Endoscopes

- Neuroendoscopes

- Others

- Robot Assisted Endoscope

- Disposable Endoscopes

- Capsule Endoscopes

- Flexible Endoscopes

- Upper Gastrointestinal Endoscopes

- Colonoscopes

- Bronchoscopes

- Sigmoidoscopes

- Laryngoscopes

- Pharyngoscopes

- Duodenoscopes

- Nasopharyngoscopes

- Rhinoscopes

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes rigid endoscopes (laparoscopes, arthroscopes, urology endoscopes, cystoscopes, gynecology endoscopes, neuroendoscopes, and others), robot assisted endoscope, disposable endoscopes, capsule endoscopes, and flexible endoscopes (upper gastrointestinal endoscopes, colonoscopes, bronchoscopes, sigmoidoscopes, laryngoscopes, pharyngoscopes, duodenoscopes, nasopharyngoscopes, rhinoscopes, and others).

Application Insights:

.webp)

- Gastrointestinal (GI) Endoscopy

- Laparoscopy

- Obstetrics/Gynecology Endoscopy

- Arthroscopy

- Urology Endoscopy (Cystoscopy)

- Bronchoscopy

- Mediastinoscopy

- Otoscopy

- Laryngoscopy

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes gastrointestinal (GI) endoscopy, laparoscopy, obstetrics/gynecology endoscopy, arthroscopy, urology endoscopy (cystoscopy), bronchoscopy, mediastinoscopy, otoscopy, laryngoscopy, and others.

End Use Insights:

- Hospitals

- Ambulatory Surgery Centers/Clinics

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes hospitals, ambulatory surgery centers/clinics, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Endoscopes Market News:

- December 2024: AIG Hospital in Hyderabad launched the PillBot, a disposable endoscopy device developed by US-based Endiatx. The device, which resembles an ordinary pill, has a miniature camera and sensors that allow it to traverse the digestive system, capturing and transmitting images and videos to detect conditions such as ulcers, bleeding, and other abnormalities.

- July 2024: FUJIFILM opened a new endoscopy center in Mumbai. The facility focuses on the fast repair of gastroscopes, bronchoscopes, and advanced processors, with the goal of minimizing service turnaround times and quickly returning the refurbished equipment.

India Endoscopes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Applications Covered | Gastrointestinal (GI) Endoscopy, Laparoscopy, Obstetrics/Gynecology Endoscopy, Arthroscopy, Urology Endoscopy (Cystoscopy), Bronchoscopy, Mediastinoscopy, Otoscopy, Laryngoscopy, Others |

| End Uses Covered | Hospitals, Ambulatory Surgery Centers/Clinics, Other |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India endoscopes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India endoscopes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India endoscopes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The endoscopes market in India was valued at USD 311.03 Million in 2024.

The India endoscopes market is projected to exhibit a CAGR of 11.50% during 2025-2033, reaching a value of USD 895.75 Million by 2033.

Advancements in endoscopic technologies, such as high-definition imaging and flexible scopes, are improving diagnostic accuracy and patient outcomes, encouraging broader adoption in both public and private healthcare settings. The market is also benefiting from the growing awareness about early disease detection and a shift towards less invasive treatments that reduce hospital stays and recovery time. Expanding healthcare infrastructure and the rise in specialty clinics and day-care centers are further supporting the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)