India Energy Drinks Market Size, Share, Trends and Forecast by Type, End User, Distribution Channel, and Region, 2026-2034

India Energy Drinks Market Size and Share:

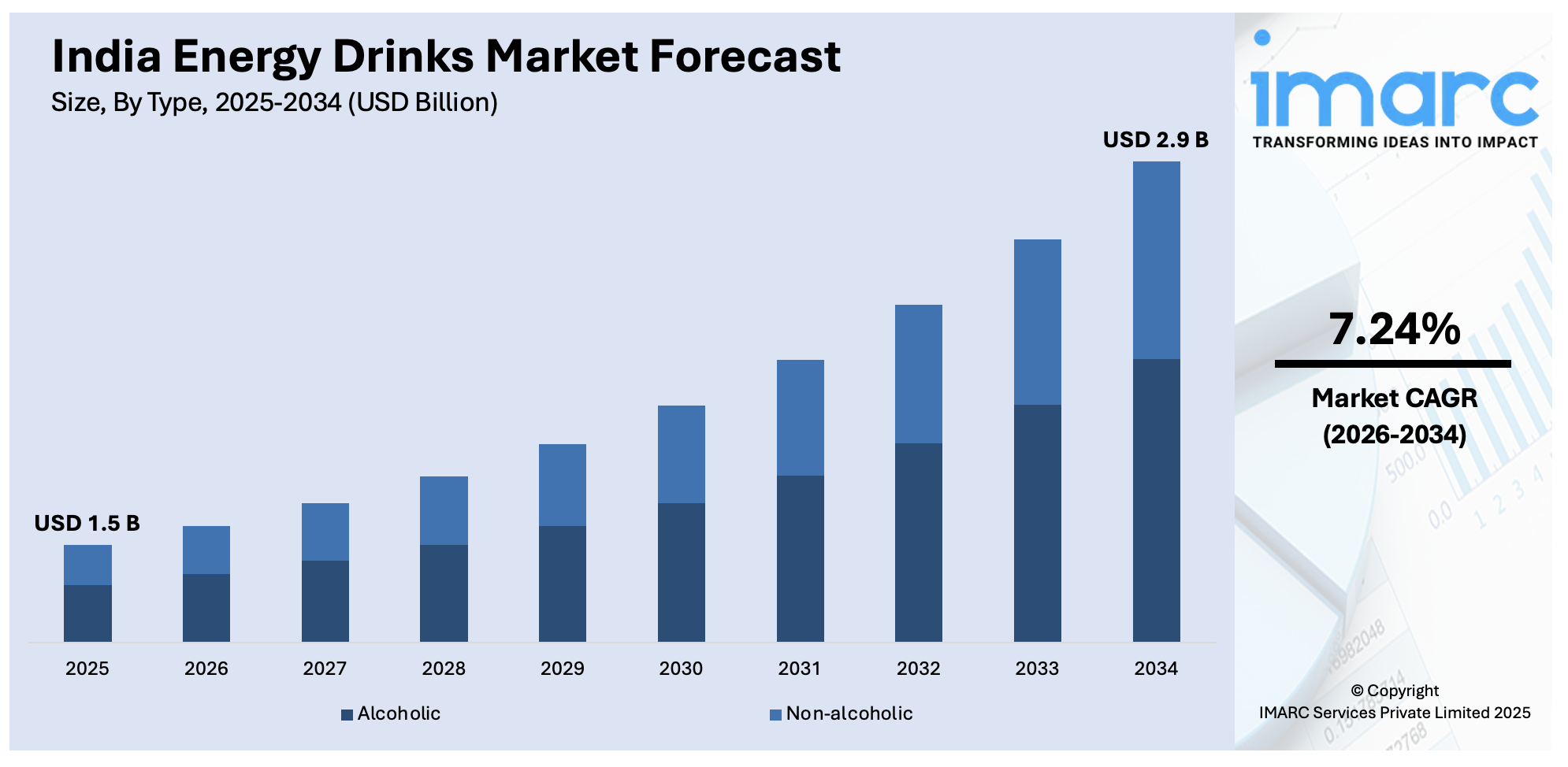

The India energy drinks market size was valued at USD 1.5 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 2.9 Billion by 2034, exhibiting a CAGR of 7.24% from 2026-2034. The market is growing at a fast pace, led by rising urbanization, a youth population, and fitness awareness. Growing demand for convenient energy beverages among working professionals, students, and sports persons is driving market growth. Sports marketing strategies of aggressive sort, such as event sponsorships and celebrity endorsements, increase brand visibility. Moreover, amplifying product availability through modern trade and e-commerce channels supports market penetration. Evolving lifestyles and rising disposable incomes continue to drive the India energy drinks market share in the competitive beverage market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.5 Billion |

| Market Forecast in 2034 | USD 2.9 Billion |

| Market Growth Rate (2026-2034) | 7.24% |

The India energy drinks market is driven primarily by the changing urban lifestyle marked by growing work pressures, longer working hours, and a need to restore energy quickly. In this busy lifestyle, consumers perceive energy drinks as convenient alternatives that maintain their vigilance and combat fatigue during their hectic days. The increasing young population, especially students and working professionals, actively looks for products that enhance concentration and stamina for exams, overnight project deadlines, or rigorous work schedules. Moreover, increasing health awareness has driven the intake of energy drinks among gym enthusiasts and sportspersons, who use these products to stimulate physical performance and recovery. These trends are further backed up by intense marketing campaigns, such as celebrity endorsements and social media campaigns, that successfully reach out to younger demographics and position energy drinks as lifestyle improvers. For instance, in September 2023, PepsiCo India introduced limited-edition Sting® Blue Current in 200ml single-serve packs, accompanied by a humorous TVC and 360° communication program across TV, digital, outdoor, and social media. Moreover, the synergy of convenience, functional attributes, and lifestyle appeal fuels a consistent boost in demand across various consumer segments in India.

To get more information on this market Request Sample

The accelerating availability and accessibility of energy drinks also contribute significantly to India energy drinks market growth. Heightening penetration of contemporary retail channels like supermarkets, convenience stores, specialty stores, and particularly online portals has rendered these products easily accessible in urban and semi-urban areas. For example, in February 2025, Coca-Cola announced the introduction of BodyArmorLyte in India, providing hydration both in carton and PET bottle packs, with the mission to expand operations and build its beverage portfolio this summer. Furthermore, as people get more exposed to international lifestyle patterns driven by Western influence, the popularity of energy drinks as a sign of a contemporary, dynamic lifestyle has grown significantly. Increasing levels of disposable incomes have enabled more consumers to purchase these high-end functional beverages, fueling mounted consumption. Heightening consumer awareness campaigns promoting the value of energy drinks in terms of enhanced energy and concentration has welcomed new consumers into the market. The successful combination of changing lifestyles among consumers, wider distribution networks, and effective marketing continues to drive the strong growth of India's energy drinks market.

India Energy Drinks Market Trends:

Urbanization and Evolving Lifestyle Drive Energy Drink Consumption

The growth of India's energy drinks market is primarily driven by fast-paced lifestyle and swift urbanization. As of now, an estimated 37.08% of India's population, or some 542.74 million individuals, reside in urban cities where hectic worklife and hectic schedules are the norms. In such a setting, energy drinks are seen as quick fixes for fighting tiredness, enhancing concentration, and staying awake over prolonged periods of work. The urban labor force and students often use these products for instant shots of energy, and energy drinks become a part of their regular lifestyle. The transition to busier lifestyles, along with growing health and wellness awareness, is driving demand. Moreover, the ease of on-the-go consumption also suits the needs of urban shoppers. As urbanization proceeds and lifestyles become increasingly hectic, energy drink consumption will be on the rise steadily, providing growth opportunities to manufacturers reaching out to this segment.

Youth Population and Fitness Enthusiasm Drive Market Expansion

India's young population and increasing fitness trend are key drivers of India energy drinks market outlook. As much as 65% of the population falls below the age of 35, students and young adults constitute a big consumer group actively in search of products that keep them awake and alert during exams, project submission deadlines, and long working hours. Additionally, sports and fitness activities have gained popularity, and hence energy drink consumption by athletes and fitness enthusiasts has seen an upsurge. These users consume energy drinks to enhance endurance, enhance workout performance, and assist in post-exercise recovery. Indians drank more than 570 million liters of energy drinks in 2023, as per recent reports, demonstrating high demand from this group. The synergistic impact of consumption by young people and a fitness lifestyle is driving the market past casual use, making energy drinks integral supplements for improving physical and mental performance.

Marketing Strategies, Cultural Impact, and Increased Accessibility Drive Growth

Intensive marketing strategies, cultural factors, and amplified availability are prime drivers fueling the energy drinks industry in India. Energy drink companies utilize celebrity endorsements, social media marketing, and sports and entertainment event sponsorship to create strong brand presence and youth appeal. Also, Western cultural influences, particularly European and North American, have promoted energy drinks as an icon of a contemporary, dynamic lifestyle. Concurrently with this, the swift expansion of contemporary retail formats, such as supermarkets, convenience stores, and e-commerce channels, has enormously expanded product availability in urban and semi-urban areas. Growing disposable income levels, to reach USD 4.34 thousand per capita by 2029, also favor consumption expansion. Greater consumer awareness of energy drinks and their uses, along with these dynamics, is expanding the market opportunity and driving further growth in India's beverage industry.

India Energy Drinks Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India energy drinks market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type, end user, and distribution channel.

Analysis by Type:

- Alcoholic

- Non-alcoholic

Alcoholic energy drinks combine stimulants such as caffeine with alcohol to appeal to consumers looking for both alertness and relaxation. Trendy among young adults, this category experiences modest growth due to lifestyle trends, in spite of regulatory attention and health issues curbing wider acceptance in India's changing beverage market.

Non-alcoholic energy drinks offer instant energy and improved concentration without alcohol, targeting students, working professionals, and health-conscious fitness enthusiasts. Urbanization, hectic lifestyles, and growing health awareness drive consumption. Ready availability through contemporary retail and digital media also facilitates consistent growth in India's non-alcoholic energy drink market.

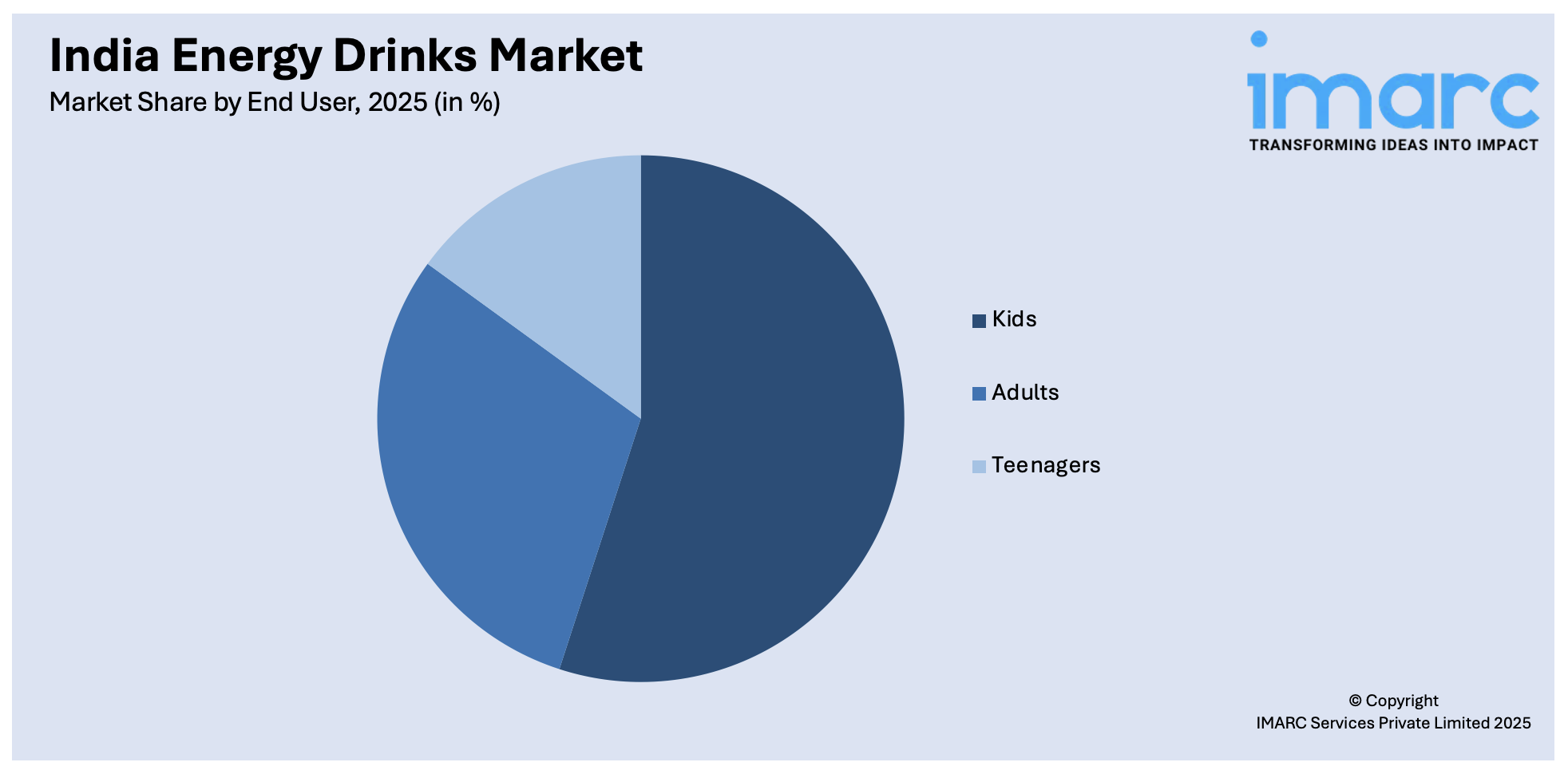

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Kids

- Adults

- Teenagers

Kids consumption of energy drinks in India is minimal because of health reasons and parental restrictions. Children are also not targeted by any marketing, which keeps demand low. Parents opt for healthier versions, thus causing little effect from this segment on the total energy drinks market relative to adults and teens.

Indian adults are prominent energy drink users, consuming them to increase alertness and energy levels after extensive work shifts or exercise. Convenience and performance optimization are important to this group. Growing awareness of health and fitness is boosting demand among corporate professionals and fitness enthusiasts, making adults a significant contributor in India energy drinks market forecast.

Teenagers constitute a burgeoning demographic of energy drink consumers in India, driven by societal trends and advertising. They consume these drinks to remain alert throughout school, sports, and social lives. Rising disposable income and changing lifestyles drive their consumption, thus becoming a crucial segment in the growth of the market.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Stores

- Others

Supermarkets and hypermarkets are instrumental in the distribution of energy drinks because they have a very wide reach and can provide large numbers of products at affordable prices. They are visited by various consumer groups on account of the convenience, volume buying opportunity, and regular promotions, thus emerging as a shopper's stop for most urban and semi-urban customers, fueling the market growth.

Specialty stores target selling carefully selected ranges of high-end and health-focused energy drinks, where the target customers are health enthusiasts and healthy consumers. Specialty stores offer professional service and expert guidance, forming solid brand loyalty. Their niche approach appeals to specialist markets looking for quality and specialty products, making a large contribution to the energy drinks market by meeting specific consumer needs and improving the overall purchasing experience.

Convenience stores prosper by serving impulse purchasers and time-conscious consumers looking for speedy buys. Strategically placed in city centers with long business hours, convenience stores provide convenient access to energy drinks for immediate consumption. Their capacity to provide instant wants services the busy lifestyle of most consumers, making them a valuable distribution platform in the market for energy drinks.

Retailers have quickly become popular as an avenue of distribution for energy drinks, taking advantage of rising internet penetration and mobile payment usage. They provide customers with a wide product range along with the facility of doorstep delivery. Tailored promotions, subscription plans, and customer reviews further enrich the experience of online shopping, making a crucial contribution to the expansion of the energy drinks market in India.

Other channels, including vending machines, small local retailers, and kirana stores, offer critical access points in both urban and rural locations. These channels complement large retail outlets by providing localized convenience and availability. While their market share is less, they are critical to reaching consumers in less accessible geographic areas, facilitating sustained growth in the energy drinks category.

Regional Analysis:

- South India

- North India

- West and Central India

- East India

The energy drinks market in South India is expanding fast driven by growing urbanization and developing health consciousness among young students and professionals. The growing IT industries and educational centers in the region power demand for energy drinks. Apart from this, rising fitness culture and sports activities power market growth further, as it is backed by rising availability through modern trade and e-commerce platforms.

North India sees high demand for energy drinks stimulated by high youth populations and growing urban areas. The consumer base in the region is also diverse, comprising students and corporate workers, which demands easy solutions to stay energized amidst hectic schedules. Increasing disposable incomes and more efficient distribution networks in cities and towns fuel the consistent growth of the energy drinks market.

West and Central India are supported by a combination of urbanization and changing consumer habits. Growing health and wellness awareness drives consumption among sports players and youth, fueling energy drink sales. Having metropolitan cities and industrial centers makes the product easily accessible through supermarkets, specialty outlets, and internet, speeding up market penetration.

East India's market is slowly building up with increasing urbanization and growing domination of Western lifestyles. Heightened awareness among youth and working professionals, coupled with growing retail infrastructure and digital connectivity, facilitates market expansion. New fitness trends and growth of organized retail led to a growing consumption of energy drinks in the region.

Competitive Landscape:

The energy drinks industry in India is characterized by stiff competition and ongoing innovation. Players are particularly concerned with product differentiation based on innovative flavors, formulations, and functional characteristics to appeal to varied consumer tastes. Strategic marketing is also crucial, where firms utilize digital channels, celebrity endorsements, and event sponsorships to boost exposure and consumer interaction. Distribution channels have grown considerably with a wide presence in retailing, offering convenience stores and online platforms, facilitating increased consumer coverage. Pricing is diversified in order to reach different income groups, helping brands gain entry into the premium and mass markets. Ongoing research and development investment facilitates the launch of healthier and natural ingredients, appealing to the expanding health-conscious population. In general, the market is dominated by active competition in which firms compete aggressively to innovate and develop strong brand loyalty, quickly responding to changing consumer trends and wants to secure and expand their market share in India's fast-growing energy drinks market.

The report provides a comprehensive analysis of the competitive landscape in the India energy drinks market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Centrum introduced Centrum Recharge, an energy drink mix that replaces vital vitamins and minerals depleted through everyday activities. The drink aims to promote energy, hydration, and immunity in users.

- April 2025: 28 BLACK announced that it would launch in India in mid-2025. 28 BLACK is already available in 26 countries.

- April 2025: Varun Beverages announced the commencement of commercial manufacturing of energy drinks and soft drinks at its manufacturing plant in Gorakhpur, Uttar Pradesh. The company had allotted a total investment of INR 1,100 crore for this project.

- February 2025: Huckleberry Beverages Pvt. Ltd. launched its flagship beverage, the Huckleberry Stamina Spike Energy Drink. Huckleberry blends high-quality ingredients to provide a distinctive and sustainable answer to the energy demands of users.

- January 2025: Reliance Consumer Products Limited (RCPL) made its debut in the rehydration sector with the introduction of RasKik Gluco Energy, an energy drink that contains glucose, electrolytes, and lemon juice. The product is intended for consumers who require energy and hydration when engaging in sporting activities.

India Energy Drinks Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Alcoholic, Non-Alcoholic |

| End Users Covered | Kids, Adults, Teenagers |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Stores, Others |

| Regions Covered | South India, North India, West and Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India energy drinks market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India energy drinks market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the energy drinks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The energy drinks market in the India was valued at USD 1.5 Billion in 2025.

The India energy drinks market is projected to exhibit a CAGR of 7.24% during 2026-2034, reaching a value of USD 2.9 Billion by 2034.

The market is dominated by heightening health awareness and an emerging fitness trend among young people. Urbanization and hectic lifestyles drive demand for rapid energy solutions. Increasing disposable incomes and growing middle-class populations enable higher consumption. Moreover, intensive marketing campaigns and the launching of varied flavors and functional ingredients grab more customers, driving market expansion further.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)