India Energy Efficiency Consulting Market Size, Share, Trends and Forecast by Service Type, Consulting Approach, End User, Industry Vertical, and Region, 2025-2033

India Energy Efficiency Consulting Market Overview:

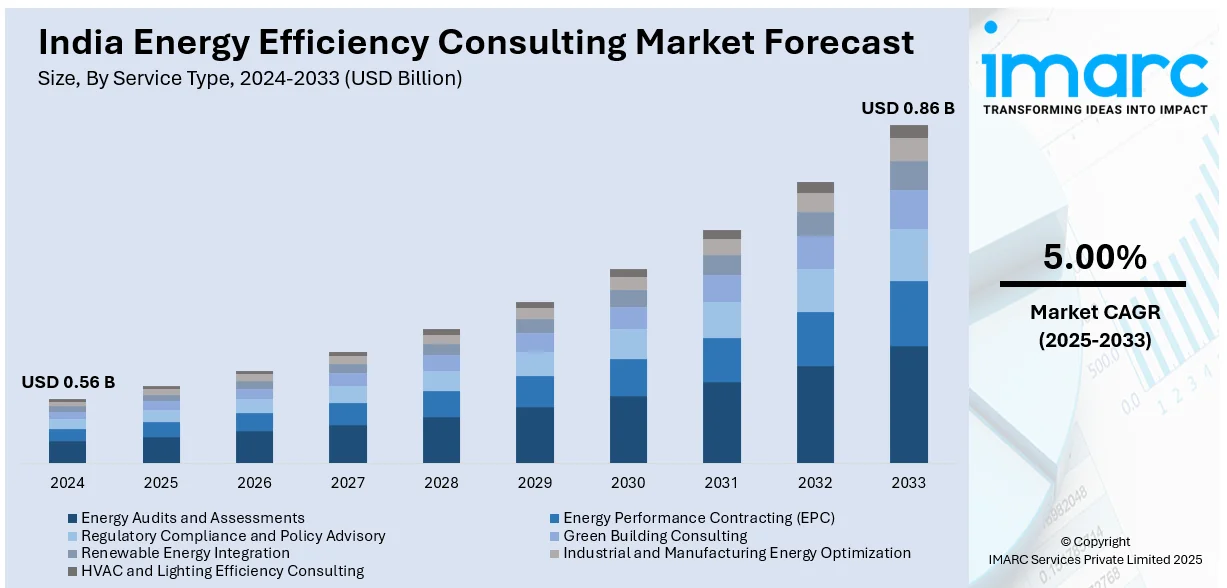

The India energy efficiency consulting market size reached USD 0.56 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.86 Billion by 2033, exhibiting a growth rate (CAGR) of 5.00% during 2025-2033. Rising energy costs and tightening regulations, surging demand across industries, commercial real estate, and public infrastructure are propelling the market growth. Key drivers include the high energy costs in heavy industries, rising electricity tariffs, green building certifications, digital metering rollouts, and government retrofitting programs. Furthermore, escalating demand-side management needs and international climate-linked funding are factors providing a thrust to the India energy efficiency consulting market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.56 Billion |

| Market Forecast in 2033 | USD 0.86 Billion |

| Market Growth Rate 2025-2033 | 5.00% |

India Energy Efficiency Consulting Market Trends:

Regulatory Push through PAT Scheme

The Perform, Achieve and Trade (PAT) scheme rolled out by the Bureau of Energy Efficiency has played a key role in driving energy efficiency efforts in India’s industrial sector. It sets energy-saving targets for major industries, including cement, steel, textiles, and paper. If these targets are met, companies can earn Energy Saving Certificates (ESCerts), which they can trade with other firms. This system has created strong financial and regulatory pressure on companies to improve their energy performance. Additionally, umpteen firms do not have the internal resources or expertise to fully understand and meet these targets. As a result, they turn to consultants who can help with audits, strategy, reporting, and documentation. Consulting firms offer practical guidance on how to save energy without hurting productivity. As more sectors are added under PAT, the demand for such expert support is expected to grow steadily across the country.

To get more information on this market, Request Sample

Industrial Cost Pressures in Energy-Intensive Sectors

Industries like steel, cement, and fertilizers use massive amount of energy in their operations, and energy costs often make up a big chunk of their expenses. With raw material prices changing and global competition increasing, these companies are under pressure to cut down on costs. Improving energy efficiency is one of the most effective ways to reduce spending. However, most companies lack the in-house skills to identify and apply the best energy-saving options, which has further surged the demand for consulting firms. They help with on-site audits, identify gaps, suggest upgrades, and calculate cost savings. Their advice helps companies invest in the right technology and processes. As energy costs have such a direct impact on profits, especially in these sectors, companies are more willing to invest in consulting support, which is helping to grow the energy efficiency consulting market among industrial clients.

Digitalization and Smart Energy Management Adoption

India's energy efficiency consulting industry is going through a huge change, fueled by the infusion of digital technologies like the Internet of Things (IoT), Artificial Intelligence (AI), and data analytics. These technologies are being used by consultants to track, analyze, and optimize the usage of energy in real time. Smart meters, Building Management Systems (BMS), and cloud platforms are now the norm within the consultants' arsenal, enabling clients to access detailed information regarding their energy use patterns and spotting inefficiencies within operations. With the use of digital twin models and predictive maintenance, energy saving is further facilitated through simulation-informed decision-making. As the cost of digital infrastructure decreases and becomes more mainstream, small and medium enterprises (SMEs) are similarly adopting smart energy solutions. This digital transformation not only enhances the precision and scalability of consulting services but also generates demand for consultants who have the ability to integrate engineering knowledge with software and data science skills. Proof of this digital revolution is India's ambitious initiative to deploy 250 million smart meters by 2027, which offers a $20 billion energy management opportunity. As of October 2024, around 14.5 million smart meters have been deployed, with 117.7 million meters being awarded under the Advanced Metering Infrastructure Service Provider (AMISP) program.

India Energy Efficiency Consulting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service type, consulting approach, end user, and industry vertical.

Service Type Insights:

- Energy Audits and Assessments

- Energy Performance Contracting (EPC)

- Regulatory Compliance and Policy Advisory

- Green Building Consulting

- Renewable Energy Integration

- Industrial and Manufacturing Energy Optimization

- HVAC and Lighting Efficiency Consulting

The report has provided a detailed breakup and analysis of the market based on the service type. This includes energy audits and assessments, energy performance contracting (EPC), regulatory compliance and policy advisory, green building consulting, renewable energy integration, industrial and manufacturing energy optimization, and HVAC and lighting efficiency consulting.

Consulting Approach Insights:

- On-Site Energy Audits

- Remote Monitoring and Data Analytics

- AI and IoT-Based Smart Energy Solutions

- Implementation and Retrofitting Services

A detailed breakup and analysis of the market based on the consulting approach have also been provided in the report. This includes on-site energy audits, remote monitoring and data analytics, AI and IoT-based smart energy solutions, and implementation and retrofitting services.

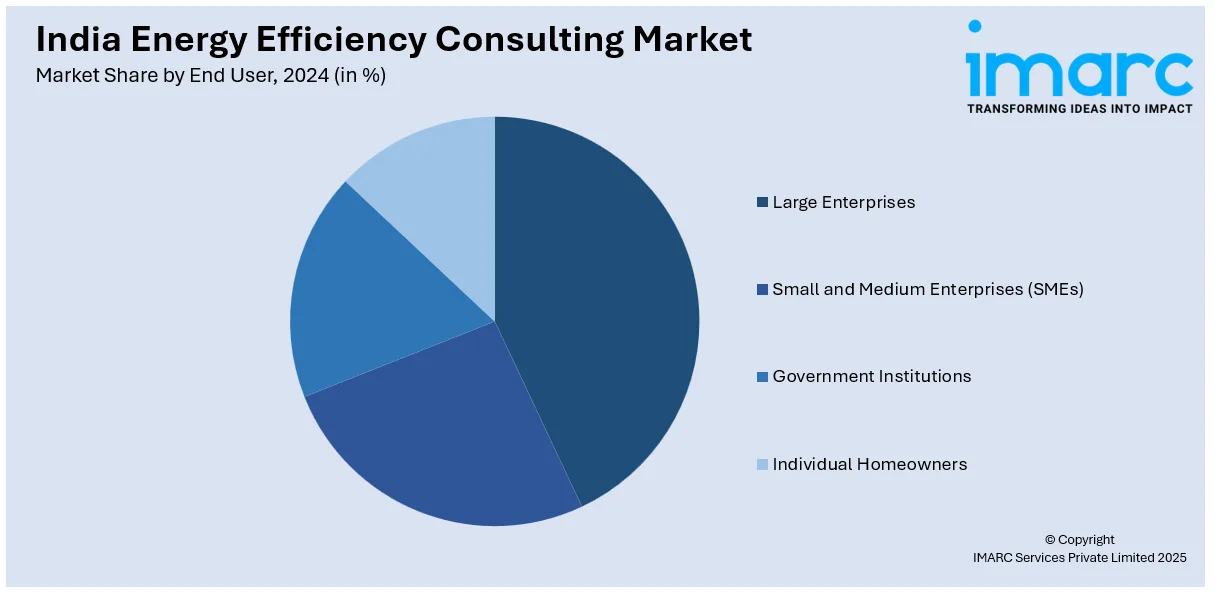

End User Insights:

- Large Enterprises

- Small and Medium Enterprises (SMEs)

- Government Institutions

- Individual Homeowners

The report has provided a detailed breakup and analysis of the market based on the end user. This includes large enterprises, small and medium enterprises (SMEs), government institutions, and individual homeowners.

Industry Vertical Insights:

- Commercial and Residential Buildings

- Industrial and Manufacturing Sector

- Transportation and Logistics

- Healthcare and Educational Institutions

- Data Centers and IT Infrastructure

- Government and Public Sector

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes commercial and residential buildings, industrial and manufacturing sector, transportation and logistics, healthcare and educational institutions, data centers and IT infrastructure, and government and public sector.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Energy Efficiency Consulting Market News:

- In 2024, Energy Efficiency Services Limited (EESL) signed Memoranda of Understanding valued at USD 60 million with key state bodies and industry partners during the India Energy Week 2024. The agreements focus on energy efficiency initiatives in lighting, clean cooking, space heating, renewables, e-mobility, cooling, and consultancy services.

- In 2024, Keppel Ltd. entered into three Memoranda of Understanding with Indian partners at the CII Partnership Summit. These collaborations aim to advance India's energy transition by focusing on decarbonizing urban infrastructure, enhancing e-mobility solutions, and improving energy efficiency in commercial and industrial sectors.

India Energy Efficiency Consulting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Energy Audits and Assessments, Energy Performance Contracting (EPC), Regulatory Compliance and Policy Advisory, Green Building Consulting, Renewable Energy Integration, Industrial and Manufacturing Energy Optimization, HVAC and Lighting Efficiency Consulting |

| Consulting Approaches Covered | On-Site Energy Audits, Remote Monitoring and Data Analytics, AI and IoT-Based Smart Energy Solutions, Implementation and Retrofitting Services |

| End Users Covered | Large Enterprises, Small and Medium Enterprises (SMEs), Government Institutions, Individual Homeowners |

| Industry Verticals Covered | Commercial and Residential Buildings, Industrial and Manufacturing Sector, Transportation and Logistics, Healthcare and Educational Institutions, Data Centers and IT Infrastructure, Government and Public Sector |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India energy efficiency consulting market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India energy efficiency consulting market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India energy efficiency consulting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The energy efficiency consulting market in India was valued at USD 0.56 Billion in 2024.

The India energy efficiency consulting market is projected to exhibit a CAGR of 5.00% during 2025-2033, reaching a value of USD 0.86 Billion by 2033.

The India energy efficiency consulting market is driven by government mandates like the PAT scheme and rising industrial energy costs. Key trends also include the growing adoption of energy-as-a-service (EaaS) models and a strong focus on digitalization and integrating renewable energy sources.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)