India Energy Efficient HVAC Systems Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

India Energy Efficient HVAC Systems Market Overview:

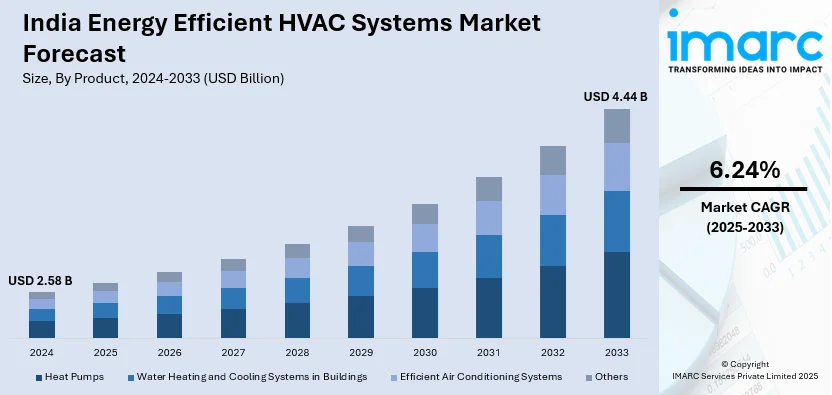

The India energy efficient HVAC systems market size reached USD 2.58 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.44 Billion by 2033, exhibiting a growth rate (CAGR) of 6.24% during 2025-2033. The market is growing as a result of increasing energy costs, smart climate control penetration, and more stringent efficiency standards. Moreover, inverter technology, AI-based automation, and environment-friendly refrigerants are on a growth path, driving innovation and sustainability in household, commercial, and industrial cooling applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.58 Billion |

| Market Forecast in 2033 | USD 4.44 Billion |

| Market Growth Rate 2025-2033 | 6.24% |

India Energy Efficient HVAC Systems Market Trends:

Rising Adoption of Smart Climate Control Solutions

The need for intelligent climate control solutions is growing in India's HVAC industry as customers and industries are looking for energy efficiency and automation. In line with this, there is a greater movement towards air conditioning systems with intelligent cooling, adaptive performance, and remote monitoring with urbanization and increasing electricity prices. Besides this, smart climate control solutions combine AI-powered sensors, IoT connectivity, and automated cooling adjustments, making it efficient while minimizing power wastage. Such systems prove to be especially useful in business premises, smart homes, and big residential complexes where centralized management can maximize energy consumption. For example, in April 2024, LG Electronics India launched its Energy Manager AC series, which features advanced energy optimization, dual inverter technology, and ThinQ Care diagnostics. These innovations enable users to monitor and control energy consumption efficiently while maintaining optimal cooling performance. LG's new range aligns with the increasing preference for smart air conditioning systems that adapt to usage patterns and environmental conditions by incorporating AI-powered features. Along with this, government initiatives promoting smart energy management, along with growing consumer awareness, are further propelling the adoption of intelligent HVAC solutions in India.

To get more information on this market, Request Sample

Increasing Demand for Energy Optimization

Energy optimization is becoming a crucial factor in India's HVAC industry as businesses and homeowners seek to lower electricity consumption while maintaining high-performance cooling. With rising environmental concerns and increasing power tariffs, air conditioning systems that maximize energy efficiency without compromising comfort are in high demand. The shift toward inverter-based technologies, optimized cooling mechanisms, and self-cleaning features are driving significant advancements in this sector. Energy-efficient air conditioners help reduce peak electricity loads, contributing to grid stability and overall sustainability. In April 2024, Haier India introduced its Super Heavy-Duty air conditioners, featuring Hexa Inverter technology that enables 65% energy savings and supersonic cooling. The inclusion of Intelli Convertible 7-in-1 and Frost Self-Clean enhances efficiency while minimizing power wastage. These innovations cater to Indian households and businesses by providing adaptable cooling and lower operational costs. As the government enforces stricter energy efficiency regulations, manufacturers are focusing on developing HVAC solutions that meet new efficiency benchmarks. The rising preference for inverter-driven compressors, eco-friendly refrigerants, and automated cooling adjustments will continue shaping the market.

India Energy Efficient HVAC Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Heat Pumps

- Water Heating and Cooling Systems in Buildings

- Efficient Air Conditioning Systems

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes heat pumps, water heating and cooling systems in buildings, efficient air conditioning systems, and others.

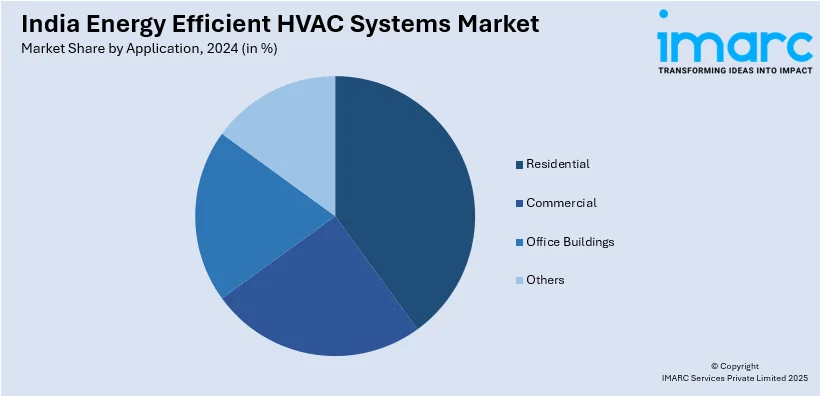

Application Insights:

- Residential

- Commercial

- Office Buildings

- Others

The report has provided a detailed breakup and analysis of the market based on the lease type. This includes residential, commercial, office buildings, and others.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Energy Efficient HVAC Systems Market News:

- February 2025: Panasonic Industry introduced AR-T Series BLDC Motors and Vacua Series Vacuum Insulation Panels at ACREX India 2025. These advancements improve energy efficiency, reduce noise, and enhance thermal insulation, driving sustainability, lowering power consumption, and accelerating the adoption of advanced technology in HVAC applications across India.

- April 2024: Voltas introduced energy-efficient HVAC solutions at ACREX India 2024 in Noida. The launch included IoT-enabled Inverter Scroll Chillers, SmartAir ACs, and upgraded cassette and ducted ACs with eco-friendly refrigerants, enhancing sustainability, reducing energy consumption, and advancing smart technology adoption in commercial and residential applications.

India Energy Efficient HVAC Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Covered | Heat Pumps, Water Heating and Cooling Systems in Buildings, Efficient Air Conditioning Systems, Others |

| Application Covered | Residential, Commercial, Office Buildings, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India energy efficient HVAC systems market performed so far and how will it perform in the coming years?

- What is the breakup of the India energy efficient HVAC systems market on the basis of product?

- What is the breakup of the India energy efficient HVAC systems market on the basis of application?

- What are the various stages in the value chain of the India energy efficient HVAC systems market?

- What are the key driving factors and challenges in the India energy efficient HVAC systems market?

- What is the structure of the India energy efficient HVAC systems market and who are the key players?

- What is the degree of competition in the India energy efficient HVAC systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India energy efficient HVAC systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India energy efficient HVAC systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India energy efficient HVAC systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)