India Energy-Efficient Transformers Market Size, Share, Trends and Forecast by Type, Cooling Type, Efficiency Level, Application, and Region, 2025-2033

India Energy-Efficient Transformers Market Overview:

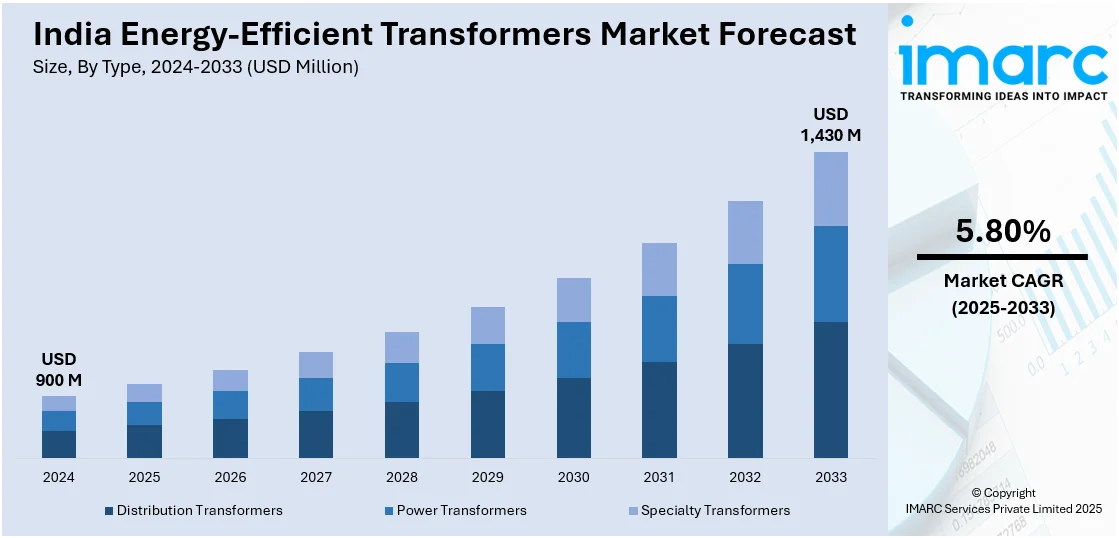

The India energy-efficient transformers market size reached USD 900 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,430 Million by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. The rapid adoption of electric vehicles (EVs) in India is driving the demand for energy-efficient transformers to support EV charging infrastructure, ensuring stable electricity supply and minimizing energy loss. Additionally, rural electrification efforts are increasing the need for efficient transformers to address power quality issues, voltage fluctuations, and energy losses in underserved areas. Both sectors highlight the expansion of India energy-efficient transformers market share for enhancing power distribution, supporting sustainability, and meeting growing energy demands.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 900 Million |

| Market Forecast in 2033 | USD 1,430 Million |

| Market Growth Rate 2025-2033 | 5.80% |

India Energy-Efficient Transformers Market Trends:

Rising Demand for EVs

The growing adoption of EVs in India is driving the need for energy-efficient transformers. With the growth of the EV market, the demand for strong power distribution systems to facilitate EV charging infrastructure is increasing swiftly. Energy-efficient transformers are vital in EV charging stations as they provide a stable electricity supply while reducing energy loss, which is crucial for the effective operation of expanding EV networks. As per the India Brand Equity Foundation (IBEF), EV sales in India skyrocketed in January 2025, showing a 19.4% month-on-month (MoM) and 17.1% year-on-year (YoY) increase, reaching 1,69,931 units. Additionally, the uptake of EVs is not restricted to a certain category, as more than 50% of three-wheelers, around 5% of two-wheelers, and 2% of cars sold in 2024 are EVs. The increasing presence of EVs is driving the need for enhanced charging infrastructure in residential, commercial, and industrial zones, where energy-efficient transformers are crucial. These transformers guarantee that the electricity provided is dependable, economical, and capable of managing the high load requirements of EV charging stations. The growing incorporation of EVs into India's transport network emphasizes the demand for effective, sustainable energy solutions, positioning energy-efficient transformers as an essential element of the nation's developing energy grid.

To get more information on this market, Request Sample

Increasing Electrification in Rural Areas

The push for rural electrification in India is catalyzing the demand for energy-efficient transformers. Various programs are being implemented to provide electricity to rural households and improve power distribution networks in underserved areas. As power lines are extended to remote villages, energy-efficient transformers are essential to minimize energy losses and ensure reliable electricity distribution. These rural areas often face challenges such as power quality issues and voltage fluctuations, which makes the use of energy-efficient transformers crucial for maintaining a stable and efficient power supply. A recent example of this initiative is the solar microgrid project launched in Tripura under the PM-DEVINE scheme in 2025, aimed at electrifying remote villages. The project involved installing 274 solar microgrid systems, benefiting nearly 2,000 families by providing reliable electricity access. This highlights the increasing importance of energy-efficient solutions as rural electrification projects expand. As new infrastructure is developed, energy-efficient transformers are needed to enhance the efficiency and reliability of power systems. The growing emphasis on rural electrification, along with the government's commitment to providing 24/7 electricity to all households, is catalyzing the demand for transformers that are both cost-effective and environment-friendly. This rising focus on rural power access is contributing to the India energy-efficient transformers market growth to ensure sustainable and equitable electricity distribution across India.

India Energy-Efficient Transformers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, cooling type, efficiency level, and application.

Type Insights:

- Distribution Transformers

- Power Transformers

- Specialty Transformers

The report has provided a detailed breakup and analysis of the market based on the type. This includes distribution transformers, power transformers, and specialty transformers.

Cooling Type Insights:

- Oil-Cooled Transformers

- Dry-Type Transformers

A detailed breakup and analysis of the market based on the cooling type have also been provided in the report. This includes oil-cooled transformers and dry-type transformers.

Efficiency Level Insights:

- Low-Efficiency Transformers

- High-Efficiency Transformers

- Ultra-High-Efficiency Transformers

The report has provided a detailed breakup and analysis of the market based on the efficiency level. This includes low-efficiency transformers, high-efficiency transformers, and ultra-high-efficiency transformers.

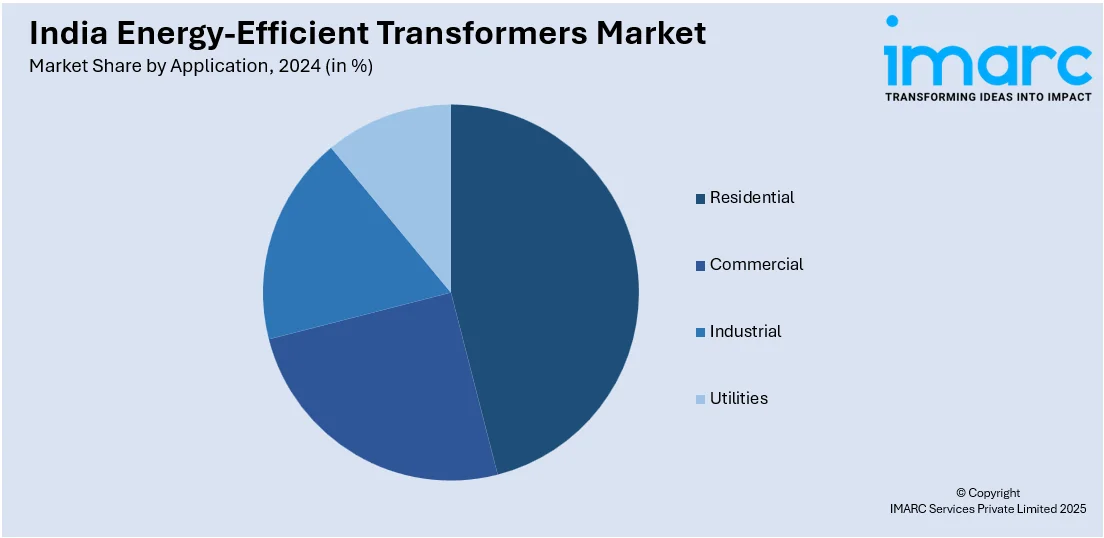

Application Insights:

- Residential

- Commercial

- Industrial

- Utilities

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, commercial, industrial, and utilities.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Energy-Efficient Transformers Market News:

- In September 2024, Tata Power-DDL and Japan's Nissin Electric announced a demonstration project using India's first micro substation with Power Voltage Transformer (PVT) technology. The 100-kVA system converted high-voltage transmission line power to residential-level electricity in remote areas. The project, supported by Japan's NEDO, aimed to provide stable, cost-effective power without full grid infrastructure.

India Energy-Efficient Transformers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Distribution Transformers, Power Transformers, Specialty Transformers |

| Cooling Types Covered | Oil-Cooled Transformers, Dry-Type Transformers |

| Efficiency Levels Covered | Low-Efficiency Transformers, High-Efficiency Transformers, Ultra-High-Efficiency Transformers |

| Applications Covered | Residential, Commercial, Industrial, Utilities |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India energy-efficient transformers market performed so far and how will it perform in the coming years?

- What is the breakup of the India energy-efficient transformers market on the basis of type?

- What is the breakup of the India energy-efficient transformers market on the basis of cooling type?

- What is the breakup of the India energy-efficient transformers market on the basis of efficiency level?

- What is the breakup of the India energy-efficient transformers market on the basis of application?

- What is the breakup of the India energy-efficient transformers market on the basis of region?

- What are the various stages in the value chain of the India energy-efficient transformers market?

- What are the key driving factors and challenges in the India energy-efficient transformers?

- What is the structure of the India energy-efficient transformers market and who are the key players?

- What is the degree of competition in the India energy-efficient transformers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India energy-efficient transformers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India energy-efficient transformers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India energy-efficient transformers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)