India Engine Oils Market Size, Share, Trends and Forecast by Grade, Sales Channel, Engine Type, Vehicle Type, and Region, 2025-2033

India Engine Oils Market Overview:

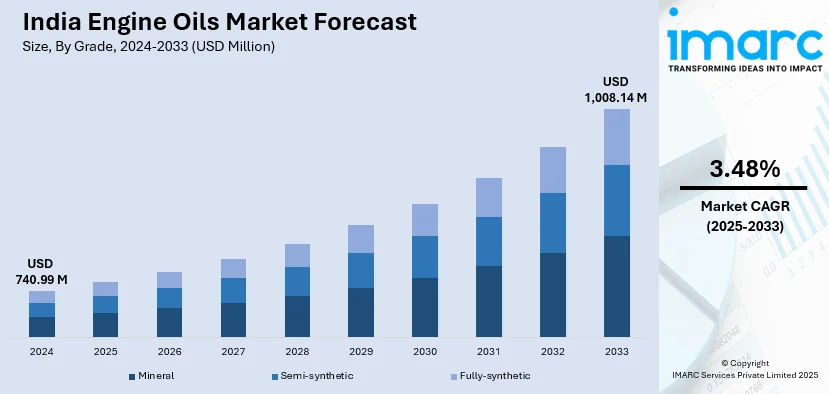

The India engine oils market size reached USD 740.99 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,008.14 Million by 2033, exhibiting a growth rate (CAGR) of 3.48% during 2025-2033. Surge in vehicle ownership, growth in transportation industry, rise in industrial operations, and heightened consumer concern for engine upkeep are propelling the market. Technological upgrades in lubricant composition, aggressive emission regulations, need for premium synthetic oils for high-performance operations, and wider e-commerce outlets also support business growth in the commercial and passenger vehicle segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 740.99 Million |

| Market Forecast in 2033 | USD 1,008.14 Million |

| Market Growth Rate 2025-2033 | 3.48% |

India Engine Oils Market Trends:

Growing Preference for Synthetic and Semi-Synthetic Engine Oils

The Indian market is witnessing a shift towards synthetic and semi-synthetic engine oils due to their superior lubrication properties, higher viscosity stability, and extended drain intervals. Consumers, especially in urban areas, are becoming more inclined towards premium lubricants that enhance fuel efficiency and reduce engine wear. With advancements in automotive technology, modern engines require high-performance oils that can withstand extreme temperatures and pressures. Additionally, OEM recommendations for synthetic oils in newer vehicles are influencing purchasing decisions. Lubricant manufacturers are focusing on formulating synthetic blends tailored to the Indian climate and driving conditions. For instance, in November 2024, EnerG Lubricants became the first Indian company to receive global approval from Mercedes-Benz for its EnerG G1 Xtreme Plus 5W-30 API SP/ACEA C3 fully synthetic engine oil, certified under MB 229.51 and MB 229.52. The lubricant enhances engine performance, improves fuel efficiency, and controls emissions. Additionally, EnerG Lubricants has partnered with German additive manufacturer GAT GmbH to launch GAT x EnerG in India, offering high-performance automotive additives, fuel system cleaners, and car care products, combining German engineering with Indian market expertise. As awareness about long-term cost savings grows, synthetic engine oils are steadily replacing conventional mineral-based oils, driving market demand across commercial and passenger vehicle categories.

To get more information on this market, Request Sample

Expansion of E-Commerce and Direct-to-Consumer Distribution Channels

The increasing penetration of digital platforms is reshaping the distribution landscape of the engine oils market in India. Consumers are increasingly purchasing lubricants through e-commerce platforms, automotive service aggregators, and direct-to-consumer (DTC) online channels. This shift is driven by competitive pricing, doorstep delivery, and access to a wide range of branded engine oils. Automotive aftermarket players and lubricant manufacturers are leveraging digital marketing strategies to enhance customer engagement and loyalty. For instance, in Sepetmber 2024, Motul launched a new commercial campaign on TV and digital platforms to promote its premium synthetic car engine oils, including 8000 Perfomax, 8000 SUV, and the iconic 300V. The campaign highlights Motul’s motorsport heritage, emphasizing race-like performance for everyday driving. Shot at the Buddh F1 Circuit, the commercial uses road obstacles to symbolize real-world driving challenges. Motul aims to expand its presence in India’s car engine oil segment by leveraging its reputation in motorcycle lubricants. Besides this, subscription-based lubricant delivery models and bundled service offerings are also gaining traction. With the growing digitalization of retail, major lubricant brands are optimizing their supply chains to cater to online demand efficiently. This transformation is particularly evident in urban and semi-urban regions where digital adoption is higher.

Rising Demand for Engine Oils in Two-Wheeler and Commercial Vehicle Segments

India’s two-wheeler and commercial vehicle segments significantly influence engine oil consumption due to high vehicle density and frequent maintenance requirements. The increasing adoption of motorcycles, particularly in tier-2 and tier-3 cities, is boosting demand for specialized lubricants tailored for varying engine capacities. For instance, in December 2023, DriveX, a pre-owned two-wheeler platform, launched DriveX Xplor, a specialized engine oil designed for BS IV and BS VI engines. Available in 10W30 and 20W40 semi-synthetic variants, it enhances two-wheeler performance. This launch aligns with DriveX’s mission to innovate and improve vehicle efficiency in the growing two-wheeler segment. Similarly, the expansion of logistics and last-mile delivery services is driving demand for heavy-duty engine oils used in commercial fleets. Fleet operators are focusing on optimizing vehicle uptime, leading to greater reliance on high-performance engine oils that enhance durability and efficiency. Government initiatives to promote electric mobility may impact the market in the long term, but in the near future, the demand for engine oils in conventional internal combustion engine vehicles remains strong, sustaining market growth.

India Engine Oils Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on grade, sales channel, engine type, vehicle type.

Grade Insights:

- Mineral

- Semi-synthetic

- Fully-synthetic

The report has provided a detailed breakup and analysis of the market based on the grade. This includes mineral, semi-synthetic, and fully-synthetic.

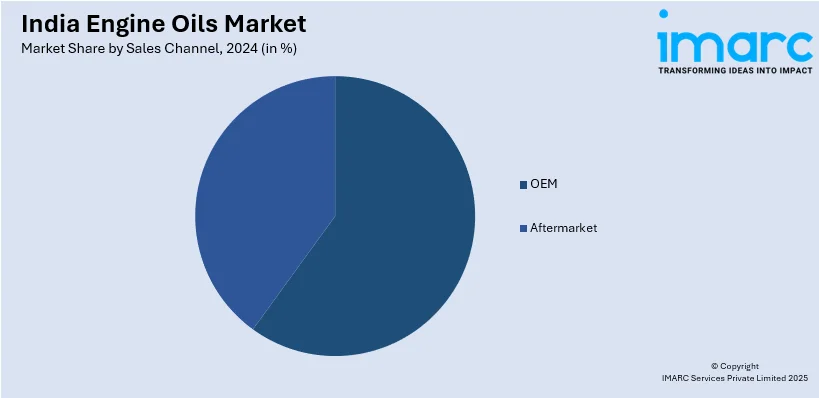

Sales Channel Insights:

- OEM

- Aftermarket

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes OEM and aftermarket.

Engine Type Insights:

- Gasoline

- Diesel

A detailed breakup and analysis of the market based on the engine type have also been provided in the report. This includes gasoline and diesel.

Vehicle Type Insights:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Two Wheelers

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger cars, light commercial vehicles, heavy commercial vehicles, and two wheelers.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Engine Oils Market News:

- In November 2024, TotalEnergies and Oil India Limited (OIL) signed an agreement to conduct methane emissions detection using TotalEnergies’ AUSEA drone technology at OIL sites in India. This collaboration aligns with OIL’s commitment to the Oil and Gas Decarbonization Charter (OGDC), aiming for net-zero operations by 2050 and near-zero upstream methane emissions by 2030. AUSEA’s advanced gas analysis improves emissions monitoring and mitigation. OIL reinforces India’s decarbonization efforts, leveraging innovative technologies to enhance sustainability in the energy sector.

- In June 2024, Castrol India launched new variants under the Castrol EDGE line, designed for enhanced engine performance. The range includes EDGE Hybrid for hybrid engines, EDGE Euro Car for premium European brands like Audi, BMW, and Mercedes, and EDGE SUV for high-performance SUVs. The new formulations offer 30% improved performance compared to industry standards and meet the latest OEM specifications. Castrol aims to strengthen its market presence with PowerBoost Technology, ensuring better power and acceleration for modern passenger vehicles.

- In January 2023, Goodyear Lubricants, under Assurance Intl Limited, launched a new range of engine oils in India, expanding distribution across South Asia, Southeast Asia, Australia, and New Zealand. The products meet BSVI (EURO VI) standards, reducing carbon footprint while enhancing performance. The lineup includes engine oils, gear oils, greases, and coolants with upgraded formulations and packaging using 15% less plastic. Assurance Intl aims to strengthen its sustainable lubricants portfolio, leveraging advanced technology to meet national and international environmental standards.

- In October 2023, Gulf Oil Lubricants India partnered with S-Oil, a South Korean lubricant major, to supply lubricants for KIA franchisee workshops in India and launch the S-Oil Seven brand. This marks the first time S-Oil products will be manufactured outside South Korea. The collaboration leverages Gulf’s distribution network and S-Oil’s advanced technology, offering synthetic and mineral oils for passenger and diesel vehicles. This partnership strengthens Gulf’s market position and brings Korean lubricant innovation to the Indian automotive sector.

India Engine Oils Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Grades Covered | Mineral, Semi-Synthetic, Fully-Synthetic |

| Sale Channels Covered | OEM, Aftermarket |

| Engine Types Covered | Gasoline, Diesel |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Two Wheelers |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India engine oils market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India engine oils market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India engine oils industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The engine oils market in India was valued at USD 740.99 Million in 2024.

The India engine oils market is projected to exhibit a (CAGR) of 3.48% during 2025-2033, reaching a value of USD 1,008.14 Million by 2033.

Rapid expansion of the automotive industry, particularly in the two-wheeler and passenger car segments, is contributing significantly to the market growth. Increased awareness about vehicle performance, fuel efficiency, and engine life is encouraging timely oil changes and the use of quality engine oils. The growth of industrial and agricultural machinery is also driving the demand for specialized lubricants.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)