India Engineering Services Outsourcing Market Size, Share, Trends, and Forecast by Service, Location, Application, and Region, 2025-2033

India Engineering Services Outsourcing Market Size and Share:

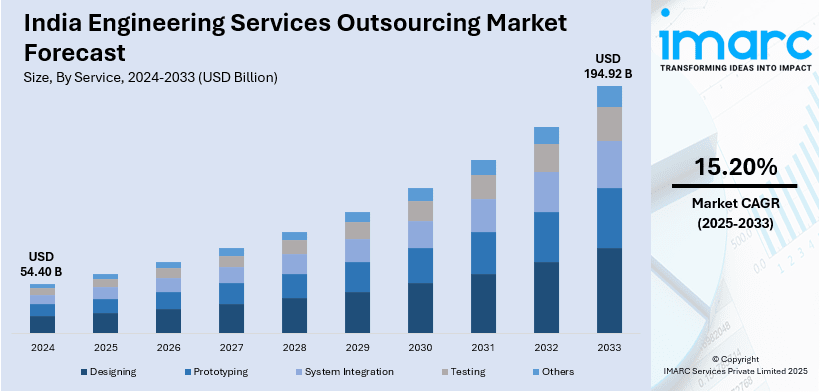

The India engineering services outsourcing market size reached USD 54.40 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 194.92 Billion by 2033, exhibiting a growth rate (CAGR) of 15.20% during 2025-2033. The market is expanding due to the rising demand for digital engineering solutions, sustainable practices, and expertise in aerospace, automotive, and renewable energy sectors. Additionally, India’s skilled workforce and cost-effective services make it a global leader in providing advanced engineering solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 54.40 Billion |

| Market Forecast in 2033 | USD 194.92 Billion |

| Market Growth Rate (2025-2033) | 15.20% |

India Engineering Services Outsourcing Market Trends:

Increased Adoption of Digital Engineering Solutions

The Indian engineering services outsourcing (ESO) market is witnessing an increased demand for digital engineering solutions. Organizations in a range of industries, such as automotive, aerospace, defense, and manufacturing, are increasingly utilizing digital technologies such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) to improve product design, development, and testing operations. For instance, in March 2025, Zoid Tech, a research and development startup based in Delhi, announced the successful creation of an AI-powered Foreign Object Debris (FOD) Detection System. This system has successfully completed the Single Stage Composite Trials and is slated for induction by the Indian Navy, representing a significant step forward in defense technology. In addition, these technologies enable greater accuracy, quicker time-to-market, and cost savings, leading companies to look for outsourcing partners capable of delivering specialized digital engineering expertise. India's immense talent pool of engineers, combined with leading-edge capabilities in fields such as simulation, product lifecycle management (PLM), and virtual prototyping, makes it a prime location for outsourcing such digital engineering services. As industries adopt digital transformation to remain competitive, the need for engineering services facilitating these developments will continue to increase, making India a global leader in delivering next-generation engineering services.

To get more information on this market, Request Sample

Growing Focus on Sustainability and Green Engineering

Sustainability is becoming an increasingly important factor in the India engineering services outsourcing market. As industries worldwide concentrate on minimizing their carbon footprint and complying with environmental standards, there is increasing need for green engineering solutions. This involves energy-efficient product design, sustainable materials use, and devising waste management, renewable energy, and carbon capture solutions. For instance, as per industry reports, the country's renewable energy capacity reached 209.44 GW by December 2024, a 15.84% increase from 180.80 GW in December 2023, representing the green engineering market growth. India’s engineering services sector is responding to this trend by offering expertise in sustainable product development and eco-friendly manufacturing processes. Many Indian engineering service providers are investing in capabilities to support green engineering practices, helping clients from industries such as automotive, construction, and energy to meet environmental sustainability goals. The Indian government’s initiatives to promote clean energy and green technologies are also driving this shift, making the country an attractive destination for outsourcing sustainable engineering services. The trend towards sustainability is expected to intensify, further expanding India’s role in global green engineering solutions.

India Engineering Services Outsourcing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on service, location, and application.

Service Insights:

- Designing

- Prototyping

- System Integration

- Testing

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes designing, prototyping, system integration, testing, and others.

Location Insights:

- Onshore

- Offshore

A detailed breakup and analysis of the market based on the location have also been provided in the report. This includes onshore and offshore.

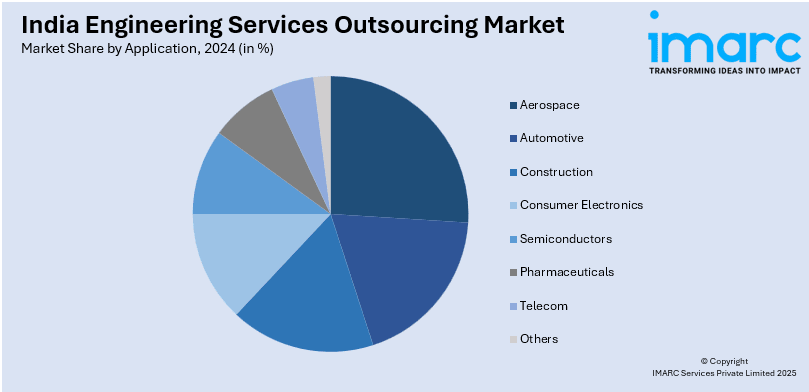

Application Insights:

- Aerospace

- Automotive

- Construction

- Consumer Electronics

- Semiconductors

- Pharmaceuticals

- Telecom

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes aerospace, automotive, construction, consumer electronics, semiconductors, pharmaceuticals, telecom, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Engineering Services Outsourcing Market News:

- In December 2024, the Government of India (GOI) announced the launch of the National Green Hydrogen Mission, with an initial allocation of ₹600 crore for FY 2024-25, which aims to establish India as a global hub for green hydrogen production by 2030. The mission projects potential investments exceeding ₹8 lakh crore and the creation of approximately 600,000 jobs.

- In January 2025, Bellatrix Aerospace announced the successful firing of its green monopropellant propulsion system, Rudra 1N, for the second time in space during the ISRO PSLV C60 POEM-4 mission. This accomplishment highlights the company’s leadership in sustainable propulsion technology and reliable performance.

India Engineering Services Outsourcing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Designing, Prototyping, System Integration, Testing, Others |

| Locations Covered | Onshore, Offshore |

| Applications Covered | Aerospace, Automotive, Construction, Consumer Electronics, Semiconductors, Pharmaceuticals, Telecom, Others |

| Regions Covered | North India, South India, East India, and West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India engineering services outsourcing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India engineering services outsourcing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India engineering services outsourcing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The engineering services outsourcing market in India was valued at USD 54.40 Billion in 2024.

The India engineering services outsourcing market is projected to exhibit a CAGR of 15.20% during 2025-2033, reaching a value of USD 194.92 Billion by 2033.

The India engineering services outsourcing market is driven by the availability of a large, skilled engineering workforce and cost advantages compared to global markets. Increasing demand for faster product development, design optimization, and digital engineering solutions from global firms further boosts outsourcing. Rising R&D investments and adoption of Industry 4.0 technologies also contribute to market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)