India Enterprise Data Management Market Size, Share, Trends and Forecast by Component, Deployment, Enterprise Size, Industries, and Region, 2025-2033

Market Overview:

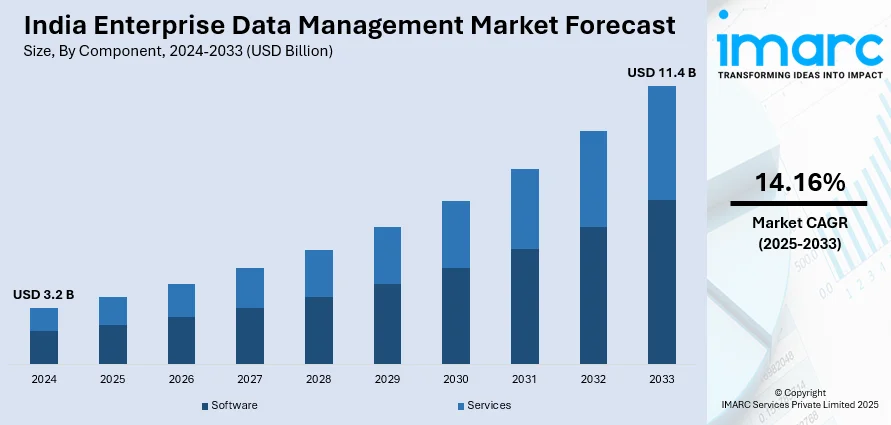

India enterprise data management market size reached USD 3.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.4 Billion by 2033, exhibiting a growth rate (CAGR) of 14.16% during 2025-2033. The increasing prevalence of digital transformation initiatives, which often involve integrating data from various sources to gain insights, improve decision-making, and enhance overall operational efficiency, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.2 Billion |

| Market Forecast in 2033 | USD 11.4 Billion |

| Market Growth Rate 2025-2033 | 14.16% |

Enterprise data management (EDM) refers to the comprehensive strategies and practices employed by organizations to effectively collect, store, organize, and utilize their data assets. It involves the systematic governance, integration, and quality assurance of data throughout its lifecycle, ensuring consistency and reliability across diverse sources. EDM encompasses data architecture, data modeling, metadata management, data quality control, and master data management to create a unified and accurate view of information. By implementing EDM, businesses can enhance decision-making processes, reduce data silos, comply with regulatory requirements, and promote a data-driven culture. It acts as a foundation for analytics, business intelligence, and digital transformation initiatives, enabling organizations to derive meaningful insights and maintain a competitive edge in today's data-centric business landscape.

To get more information on this market, Request Sample

India Enterprise Data Management Market Trends:

The enterprise data management market in India is witnessing unprecedented growth fueled by a myriad of interconnected factors. Firstly, the escalating volume of data generated across diverse industries is a key catalyst, propelling organizations to adopt robust EDM solutions. In tandem with this surge in data, the imperative to derive meaningful insights has driven the demand for advanced data management tools. Additionally, the increasing complexity of regulatory compliance mandates underscores the necessity for meticulous data governance, acting as a pivotal driver for EDM market expansion. Moreover, the accelerating pace of digital transformation initiatives across enterprises further accentuates the need for efficient data management strategies. This is intricately linked with the growing adoption of cloud computing, as organizations seek scalable and flexible solutions to manage their expanding datasets. Furthermore, the integration of artificial intelligence and machine learning applications into business processes demands a sophisticated EDM infrastructure, amplifying the market's momentum. In conclusion, the convergence of escalating data volumes, regulatory pressures, digital transformation endeavors, and the integration of cutting-edge technologies collectively propel the EDM market forward, presenting a landscape ripe with opportunities for innovative solutions and transformative strategies.

India Enterprise Data Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, deployment, enterprise size, and industries.

Component Insights:

- Software

- Data Security

- Master Data Management

- Data Integration

- Data Migration

- Data Warehousing

- Data Governance

- Data Quality

- Others

- Services

- Managed Services

- Professional Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes software (data security, master data management, data integration, data migration, data warehousing, data governance, data quality, and others) and services (managed services and professional services).

Deployment Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment have also been provided in the report. This includes cloud-based and on-premises.

Enterprise Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes small and medium-sized enterprises and large enterprises.

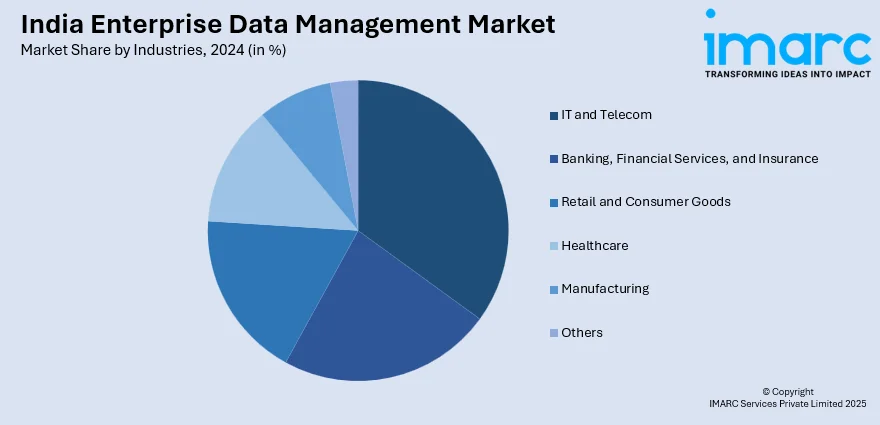

Industries Insights:

- IT and Telecom

- Banking, Financial Services, and Insurance

- Retail and Consumer Goods

- Healthcare

- Manufacturing

- Others

A detailed breakup and analysis of the market based on the industries have also been provided in the report. This includes IT and telecom, banking, financial services, and insurance, retail and consumer goods, healthcare, manufacturing, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Enterprise Data Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployments Covered | Cloud-based, On-premises |

| Enterprise Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Industries Covered | IT and Telecom, Banking, Financial Services, and Insurance, Retail and Consumer Goods, Healthcare, Manufacturing, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India enterprise data management market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India enterprise data management market?

- What is the breakup of the India enterprise data management market on the basis of component?

- What is the breakup of the India enterprise data management market on the basis of deployment?

- What is the breakup of the India enterprise data management market on the basis of enterprise size?

- What is the breakup of the India enterprise data management market on the basis of industries?

- What are the various stages in the value chain of the India enterprise data management market?

- What are the key driving factors and challenges in the India enterprise data management?

- What is the structure of the India enterprise data management market and who are the key players?

- What is the degree of competition in the India enterprise data management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India enterprise data management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India enterprise data management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India enterprise data management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)