India Enterprise Search Market Size, Share, Trends and Forecast by Enterprise Size, End User, and Region, 2025-2033

India Enterprise Search Market Overview:

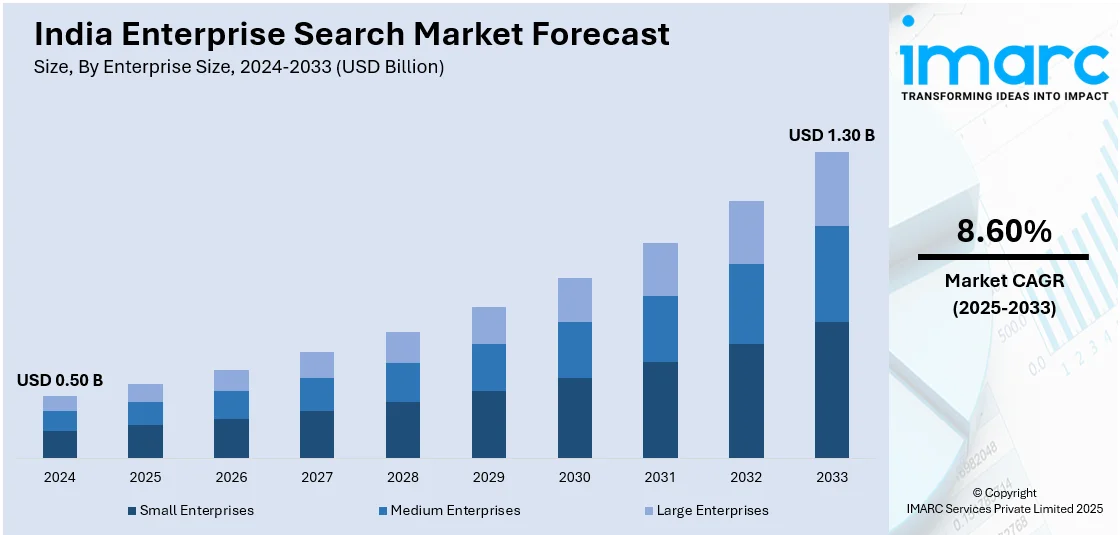

The India enterprise search market size reached USD 0.50 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.30 Billion by 2033, exhibiting a growth rate (CAGR) of 8.60% during 2025-2033. The India enterprise search market is being propelled by the Digital India initiative, data localization laws, rapid cloud adoption, AI-driven search advancements, expanding digital transformation in enterprises, large data volumes, growing enterprise automation, government-backed IT infrastructure investments, and the rising need for efficient information retrieval across industries to enhance productivity and decision-making.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.50 Billion |

| Market Forecast in 2033 | USD 1.30 Billion |

| Market Growth Rate 2025-2033 | 8.60% |

India Enterprise Search Market Trends:

Digital India Initiative

Launched on July 1, 2015, Digital India is a Government of India program that is aimed at making the country a digitally empowered society and a knowledge economy. The wide-ranging program deals with creating strong digital infrastructure, digital delivery of services, and digital literacy for citizens. The program has been effective in bringing technology into several aspects of public governance and services, hence making the environment favorable for the expansion of the enterprise search market. The initiative also focuses on the electronic delivery of services, and this has culminated in the digitization of many government services and processes. For example, the e-District Mission Mode Project is focused on electronic delivery of targeted high-volume citizen-centric services at the district or sub-district level. To date, approx. 4,600 e-services have been rolled out across 709 districts in India, according to recent reports. This enormous digitization process creates huge volumes of information that need effective search tools, thus elevating the need for enterprise search products. Additionally, the Digital India program has greatly enhanced internet penetration and affordability in urban and rural India, including tier-2 and tier-3 cities and villages. This extensive digital penetration has resulted in the development in the number of internet users, resulting in a bigger market for digital products and services, including enterprise search solutions. The increased digital literacy and awareness among citizens and businesses have also helped to drive the adoption of such technologies.

To get more information on this market, Request Sample

Data Localization Laws

Data localization refers to the requirement that data generated within a country is stored and processed within its borders. In recent years, India has introduced regulations mandating data localization to protect data sovereignty, enhance security, and ensure privacy. These laws have significant implications for enterprises operating in India, influencing their data management strategies and the adoption of related technologies. Implementation of data localization regulations requires the organization to process and store data locally, giving rise to the local establishment of data centers. This change reflects directly on the enterprise search market since organizations look for effective solutions to store and retrieve locally archived data. The availability of local data centers improves the performance of search applications by lowering latency and enhancing data access speeds, thus making enterprise search solutions more effective and desirable to businesses. As per the Telecom Regulatory Authority of India (TRAI), the size of the Indian data center market was around USD 1.5 billion by 2022, surging at a CAGR of 11.4%, and is likely to grow around USD 5 billion by the year 2025. This development is mainly because of factors like enhanced internet penetration, cloud deployment, government digitization plans, and the impetus toward data localization. The growth of data centers provides a solid foundation for the deployment of enterprise search solutions to meet organizations' upsurging data management requirements.

India Enterprise Search Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on enterprise size and end user.

Enterprise Size Insights:

- Small Enterprises

- Medium Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes small enterprises, medium enterprises, and large enterprises.

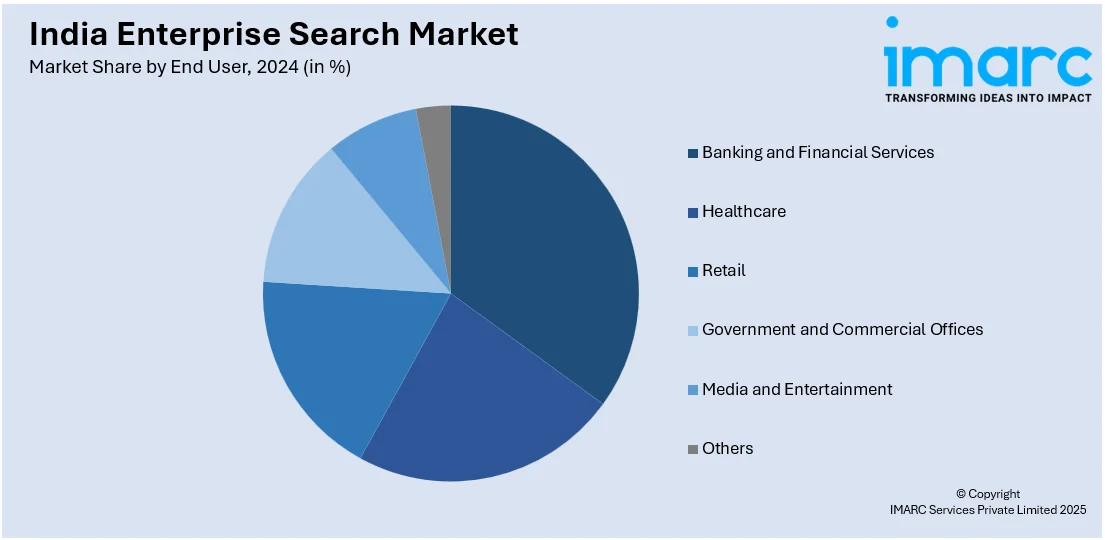

End User Insights:

- Banking and Financial Services

- Healthcare

- Retail

- Government and Commercial Offices

- Media and Entertainment

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes banking and financial services, healthcare, retail, government and commercial offices, media and entertainment, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Enterprise Search Market News:

- December 2024: IIIT Hyderabad's Subtl.ai released 'Subtl V2', an AI-driven information retrieval solution, that claims to better than OpenAI's retrieval-augmented generation (RAG) solutions by 15-20%. The improvement raises the effectiveness of enterprise search in India by retrieving more accurate and faster information. Its implementation in corporations such as the State Bank of India has provided considerable time and cost reduction, highlighting its value to spur the enterprise search business in India.

- November 2024: Moveworks extended its footprint in India with the new Bengaluru office to speed up AI-powered enterprise search and automation. This new presence adds local innovation, enhances AI talent, and reinforces enterprise search solutions for Indian enterprises. With its investment in AI building, Moveworks promotes superior search features, enhancing the operational efficiency of the Indian enterprise industry.

India Enterprise Search Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Enterprise Sizes Covered | Small Enterprises, Medium Enterprises, Large Enterprises |

| End Users Covered | Banking and Financial Services, Healthcare, Retail, Government and Commercial Offices, Media and Entertainment, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India enterprise search market performed so far and how will it perform in the coming years?

- What is the breakup of the India enterprise search market on the basis of enterprise size?

- What is the breakup of the India enterprise search market on the basis of end user?

- What are the various stages in the value chain of the India enterprise search market?

- What are the key driving factors and challenges in the India enterprise search?

- What is the structure of the India enterprise search market and who are the key players?

- What is the degree of competition in the India enterprise search market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India enterprise search market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India enterprise search market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India enterprise search industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)