India Erectile Dysfunction Drugs Market Size, Share, Trends and Forecast by Product, Mode of Administration, and Region, 2026-2034

India Erectile Dysfunction Drugs Market Summary:

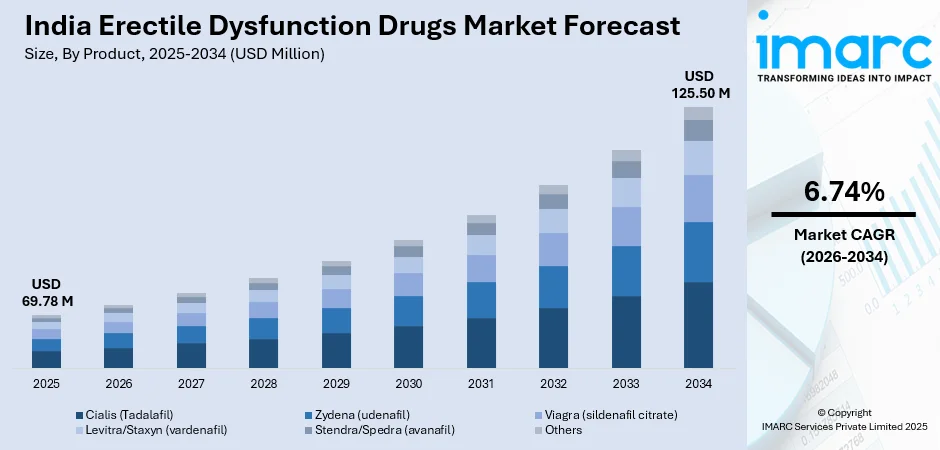

The India erectile dysfunction drugs market size was valued at USD 69.78 Million in 2025 and is projected to reach USD 125.50 Million by 2034, growing at a compound annual growth rate of 6.74% from 2026-2034.

The India erectile dysfunction drugs market is experiencing robust growth, driven by the escalating prevalence of lifestyle-related conditions, including diabetes, hypertension, and cardiovascular diseases that contribute significantly to erectile dysfunction among Indian men. The rising burden of chronic health conditions, coupled with expanding telemedicine platforms that address traditional social stigma surrounding male sexual health issues, is accelerating market penetration across urban and semi-urban regions.

Key Takeaways and Insights:

-

By Product: Viagra (sildenafil citrate) dominates the market with a share of 32% in 2025, owing to its established clinical efficacy, widespread brand recognition, and extensive availability through both retail pharmacies and digital health platforms.

-

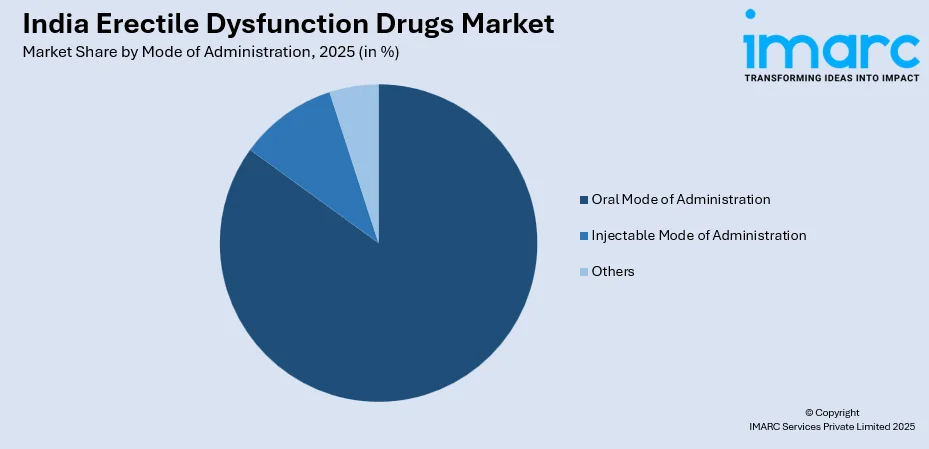

By Mode of Administration: Oral mode of administration leads the market with a share of 85% in 2025. This dominance is driven by patient preference for non-invasive treatment options, convenient self-administration capabilities, and the widespread availability of oral phosphodiesterase type 5 inhibitor medications across pharmacy networks nationwide.

-

By Region: South India represents the largest region with 36% share in 2025, driven by the concentration of major pharmaceutical manufacturing hubs in Hyderabad, Chennai, and Bangalore, advanced healthcare infrastructure, higher healthcare awareness, and greater willingness among the urban population to seek professional treatment for sexual health concerns.

-

Key Players: Key players drive the India erectile dysfunction drugs market by expanding product portfolios, improving formulation technologies, and strengthening nationwide distribution networks. Their investments in telemedicine partnerships, digital marketing campaigns, and collaborations with healthcare providers boost awareness and ensure consistent product availability.

To get more information on this market Request Sample

The India erectile dysfunction drugs market represents a significant and evolving segment within the broader pharmaceutical landscape, characterized by increasing patient awareness and declining stigma surrounding male sexual health issues. The market benefits from India's position as a global pharmaceutical manufacturing hub, with numerous domestic companies producing high-quality generic versions of established PDE5 inhibitors at competitive price points. The expanding middle class population with rising disposable incomes is increasingly seeking professional healthcare solutions for previously unaddressed conditions. Telemedicine platforms have emerged as transformative market facilitators, enabling discreet consultations and medication delivery that overcome traditional barriers to treatment seeking. In January 2025, Raaz, a Bengaluru-based digital health startup, raised USD 1 Million in pre-seed funding led by Fireside Ventures and Campus Fund to expand its telemedicine platform addressing male reproductive health, demonstrating strong investor confidence in this market segment. The platform provided tailored, research-supported treatment strategies for issues like erectile dysfunction and premature ejaculation.

India Erectile Dysfunction Drugs Market Trends:

Digital Health Platforms Revolutionizing Treatment Access

India is witnessing explosive growth in telemedicine and digital health platforms, specifically targeting male sexual health, fundamentally transforming how men access erectile dysfunction treatment. As per IMARC Group, the India telemedicine market size was valued at USD 3.10 Billion in 2024. These platforms eliminate traditional barriers by offering anonymous online consultations, home delivery of medications, and comprehensive treatment protocols combining pharmaceuticals with behavioral techniques and psychological counseling. The integration of evidence-based treatment programs with doctor-led teleconsultations has created scalable healthcare delivery models that serve patients across urban and rural regions while maintaining complete confidentiality.

Shifting Societal Attitudes Towards Male Sexual Health

India is experiencing a gradual but significant shift in societal attitudes towards male sexual health, driven by public health campaigns, celebrity endorsements, and increased media coverage of erectile dysfunction as a treatable medical condition rather than a taboo subject. In November 2025, Asian Institute of Nephrology and Urology (AINU), Chennai, has initiated a thorough men's health awareness initiative to tackle the increasing challenges of male infertility, sexual health concerns, and urological disorders linked to lifestyle. Healthcare providers and advocacy groups are actively working to normalize conversations about erectile dysfunction through educational initiatives targeting both patients and medical professionals. The entry of prominent personalities into the men's health space has helped mainstream discussions about sexual wellness and erectile dysfunction treatment, encouraging more men to seek professional help.

Generic Drug Proliferation Enhancing Affordability

India's robust generic pharmaceutical manufacturing capabilities are driving significant expansion in the availability of affordable erectile dysfunction medications. Numerous domestic pharmaceutical companies manufacture high-quality generic sildenafil and tadalafil formulations at substantially lower price points than branded alternatives. This proliferation of cost-effective options ensures broad market accessibility while maintaining therapeutic efficacy, enabling patients across diverse socioeconomic backgrounds to access effective treatment solutions. This affordability-driven expansion is further supported by widespread distribution through retail pharmacies and online platforms, normalizing treatment adoption and strengthening overall market penetration across urban and rural regions.

Market Outlook 2026-2034:

The India erectile dysfunction drugs market outlook remains positive, driven by the confluence of demographic trends, healthcare infrastructure expansion, and evolving consumer attitudes towards sexual wellness. The increasing prevalence of underlying risk factors, including diabetes, hypertension, and cardiovascular diseases, among the Indian male population creates a substantial addressable patient pool requiring pharmaceutical intervention. The market generated a revenue of USD 69.78 Million in 2025 and is projected to reach a revenue of USD 125.50 Million by 2034, growing at a compound annual growth rate of 6.74% from 2026-2034. Government healthcare initiatives focusing on non-communicable disease management are supporting the market growth by bringing millions of diabetic and hypertensive patients under standardized care protocols where erectile dysfunction screening becomes routine.

India Erectile Dysfunction Drugs Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Viagra (sildenafil citrate) |

32% |

|

Mode of Administration |

Oral Mode of Administration |

85% |

|

Region |

South India |

36% |

Product Insights:

- Cialis (Tadalafil)

- Zydena (udenafil)

- Viagra (sildenafil citrate)

- Levitra/Staxyn (vardenafil)

- Stendra/Spedra (avanafil)

- Others

Viagra (sildenafil citrate) dominates with a market share of 32% of the total India erectile dysfunction drugs market in 2025.

Viagra (sildenafil citrate) leads the India erectile dysfunction market due to its strong first-mover advantage, high brand recognition, and long-standing clinical acceptance among both doctors and patients. Sildenafil has established trust regarding safety and effectiveness, making it the default prescription choice in many cases. Its rapid onset of action and proven success rate enhance patient confidence. Additionally, extensive awareness through medical consultations and word-of-mouth has reinforced Viagra’s position as a reliable and familiar treatment option.

Another key factor is the widespread availability of affordable generic sildenafil produced by Indian pharmaceutical companies. These generics significantly reduce treatment costs while maintaining efficacy, making sildenafil accessible to a broad population base. Flexible dosing options and ease of use further support adoption. Strong distribution networks across retail pharmacies, hospitals, and online platforms ensure consistent availability. Together, affordability, accessibility, and established efficacy enable sildenafil to dominate India’s erectile dysfunction market.

Mode of Administration Insights:

Access the comprehensive market breakdown Request Sample

- Oral Mode of Administration

- Injectable Mode of Administration

- Others

Oral mode of administration leads with a share of 85% of the total India erectile dysfunction drugs market in 2025.

Oral mode of administration commands the overwhelming majority share in the India erectile dysfunction drugs market due to the superior patient convenience, non-invasive nature, and established safety profiles of oral PDE5 inhibitor medications. The ease of self-administration without requiring specialized medical intervention or clinical settings aligns with patient preferences for privacy and discretion when managing erectile dysfunction. Additionally, oral therapies reduce psychological barriers associated with injectable or device-based alternatives, encouraging higher treatment adherence and repeat usage among patients.

The availability of multiple oral formulations across diverse dosage strengths enables healthcare providers to customize treatment protocols based on individual patient response and tolerability profiles. Technological advancements in drug delivery, including orodispersible tablets and sublingual formulations, have further enhanced the appeal of oral medications by reducing onset times and improving bioavailability. The integration of oral erectile dysfunction medications into telemedicine consultation workflows has streamlined the prescription-to-delivery continuum, enabling rapid treatment initiation without in-person clinic visits.

Regional Insights:

- North India

- South India

- East India

- West India

South India exhibits a clear dominance with a 36% share of the total India erectile dysfunction drugs market in 2025.

South India leads the regional market owing to the concentration of major pharmaceutical manufacturing ecosystems across Karnataka, Telangana, Tamil Nadu, and Andhra Pradesh that ensure robust product availability and supply chain efficiency. Hyderabad has emerged as a prominent pharmaceutical hub hosting numerous active pharmaceutical ingredient (API) manufacturers and finished dosage form producers, while Chennai and Bangalore contribute advanced healthcare infrastructure and significant medical tourism inflows. In December 2025, Aster Medcity opened its Andrology Clinic, signifying an important enhancement to its specialized medical services. The initiative sought to deliver specialized attention to male reproductive health, fertility issues, and associated urological conditions.

The advanced healthcare ecosystem across South Indian metropolitan centers provides superior diagnostic capabilities and specialized urology services that facilitate early identification and treatment of erectile dysfunction. The proliferation of corporate hospital networks and multi-specialty clinics has normalized routine sexual health assessments during patient consultations, encouraging proactive healthcare seeking behaviors. Additionally, the growing presence of digital health startups headquartered in Bengaluru has accelerated telemedicine adoption rates, creating alternative treatment access pathways that circumvent traditional social barriers.

Market Dynamics:

Growth Drivers:

Why is the India Erectile Dysfunction Drugs Market Growing?

Rising Burden of Lifestyle Diseases and Associated Comorbidities

The rising incidence of diabetes, hypertension, cardiac illnesses, and obesity within the Indian populace is contributing immensely to growing number of men with high metastable risks of erectile dysfunction, thereby boosting drug therapy demands. Impotence is commonly observed as a precursor symptom of potential underlying conditions of compromised blood vessels, with diabetic patients registering higher risks than non-diabetic patients. The Ministry of Health and Family Welfare's ambitious initiative to bring 75 Million people with diabetes and hypertension under standardized care by 2025 supports the market growth by improving disease awareness and creating clinical touchpoints where sexual health screening can be integrated. The burgeoning prevalence of metabolic syndrome within the increasingly younger male segments guarantees a positive long-term outlook for the market, encouraged by incidence-related impotence.

Expanding Access to Affordable Generic Medications

Domestic players manufacture a high quality, generic version of sildenafil, tadalafil, and vardenafil at much lower costs compared to the branded alternatives. With competitive pricing, a wider pool of customers from broader income classes can afford these drugs, including patients in tier-two and tier-three cities. Additionally, the wide availability of multiple dosage strengths and formulations enables physicians to offer personalized treatment with cost efficiency. Distribution reach further improves due to online pharmacies and organized retail chemists, which ensure discreet and convenient access. The affordability factor also encourages trial usage and long-term adherence since patients are more willing to continue a therapy without putting additional stress on finances. Greater government support to domestic pharmaceutical production and strong regulatory oversight strengthen consumer confidence in generics. Price competition will further intensify as patent expirations continue and manufacturing efficiencies improve, widening market penetration. This cost-driven accessibility places India as one of the fastest broadening markets for erectile dysfunction drugs globally, supported by consistent volume growth across demographics.

Advancements in Treatment Options and Patient-Centric Formulations

Continuous advancements in erectile dysfunction therapies and patient-friendly formulations are driving sustained market growth in India. Pharmaceutical companies are introducing improved drug delivery systems, such as orodispersible tablets, sublingual films, and faster-onset formulations, to enhance convenience and efficacy. Longer-acting molecules enable greater spontaneity, addressing key patient preferences. Combination therapies targeting both erectile dysfunction and related conditions, such as benign prostatic hyperplasia, improve therapeutic outcomes. Enhanced safety profiles and better tolerability support wider prescribing across age groups. Research efforts also focus on personalized dosing strategies to optimize response rates. The availability of diverse formulations allows physicians to tailor treatment based on lifestyle, comorbidities, and patient comfort. Innovation-driven differentiation strengthens patient satisfaction and repeat usage. As companies invest in clinical research and incremental innovations, the Indian erectile dysfunction market continues to evolve towards more effective, convenient, and patient-centric treatment solutions.

Market Restraints:

What Challenges is the India Erectile Dysfunction Drugs Market Facing?

Persistent Social Stigma and Cultural Taboos

Deeply ingrained cultural taboos around talking about sexual health continue to keep many Indian men from getting professional medical help for erectile dysfunction, despite slow changes in attitudes. Treatment avoidance, self-medication with dubious cures, and dependence on conventional practitioners providing inadequate answers are consequences of the accompanying humiliation and embarrassment. This represents significant unrealized market potential that is limited by social constraints.

Limited Awareness in Rural and Semi-Urban Regions

Healthcare awareness regarding erectile dysfunction as a treatable medical condition remains substantially lower in rural and semi-urban India where access to specialist urological services is limited and traditional medicine reliance persists. The concentration of qualified healthcare providers and modern pharmacy infrastructure in metropolitan centers creates significant access disparities. Misconceptions about erectile dysfunction causes, available treatments, and safety profiles of pharmaceutical options continue to inhibit appropriate healthcare seeking behaviors across underserved populations.

Affordability Concerns and Out-of-Pocket Expenditure

Although generic alternatives have improved medication affordability, sustained treatment costs remain challenging for lower-income populations lacking insurance coverage for sexual health medications. India's healthcare system continues to experience high out-of-pocket spending patterns that burden individuals seeking ongoing pharmaceutical treatment. The exclusion of erectile dysfunction medications from most insurance reimbursement frameworks further constrains treatment adherence among price-sensitive patient segments requiring long-term therapy management.

Competitive Landscape:

The India erectile dysfunction drugs market exhibits a highly competitive landscape, characterized by the presence of numerous domestic generic pharmaceutical manufacturers alongside select multinational branded drug providers. Leading Indian pharmaceutical companies have established significant market positions through cost-effective generic sildenafil and tadalafil formulations distributed across extensive retail pharmacy networks. Key competitive strategies encompass product portfolio diversification, digital channel partnerships with emerging telemedicine platforms, and geographic distribution expansion into underserved regions. Companies are increasingly investing in consumer awareness campaigns and direct-to-consumer (D2C) digital marketing to reduce stigma barriers and drive treatment-seeking behaviors.

India Erectile Dysfunction Drugs Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Cialis (Tadalafil), Zydena (udenafil), Viagra (sildenafil citrate), Levitra/Staxyn (vardenafil), Stendra/Spedra (avanafil), Others |

| Mode of Administrations Covered | Oral Mode of Administration, Injectable Mode of Administration, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India erectile dysfunction drugs market size was valued at USD 69.78 Million in 2025.

The India erectile dysfunction drugs market is expected to grow at a compound annual growth rate of 6.74% from 2026-2034 to reach USD 125.50 Million by 2034.

Viagra (sildenafil citrate) dominated the market with a share of 32%, owing to its established clinical efficacy, widespread brand recognition, and extensive availability through retail pharmacies and digital health platforms across India.

Key factors driving the India erectile dysfunction drugs market include rising prevalence of lifestyle diseases, expanding telemedicine platforms addressing social stigma, and increasing awareness among urban populations about available treatment options.

Major challenges include persistent social stigma and cultural taboos preventing treatment seeking, limited healthcare awareness in rural regions, affordability concerns regarding ongoing treatment costs, and low insurance coverage for sexual health medications across India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)