India eSIM Market Size, Share, Trends and Forecast by Solution Type, Application, and Region, 2025-2033

India eSIM Market Overview:

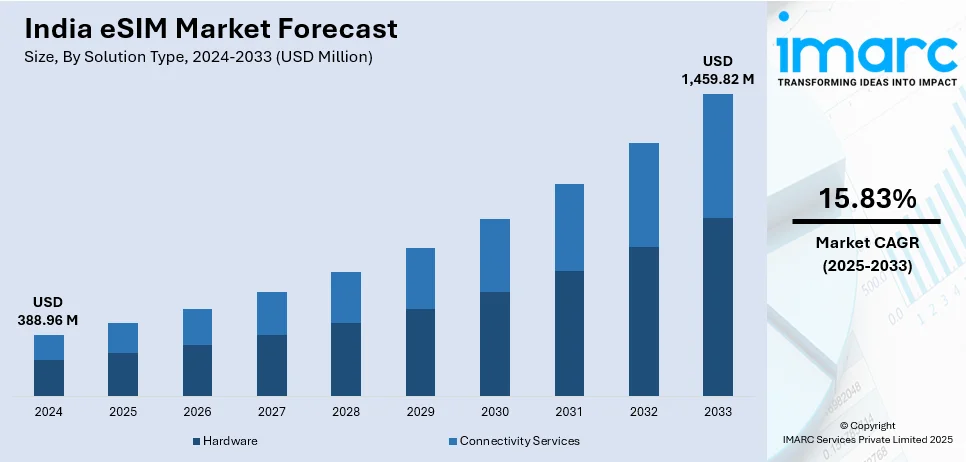

The India eSIM market size reached USD 388.96 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,459.82 Million by 2033, exhibiting a growth rate (CAGR) of 15.83% during 2025-2033. The market is expanding due to the rising smartphone penetration, growing adoption of IoT and M2M communication, and government support for digital connectivity. Automotive, consumer electronics, and enterprise markets' demand, along with enhanced security, remote provisioning features, and increasing 5G networks, further drives market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 388.96 Million |

| Market Forecast in 2033 | USD 1,459.82 Million |

| Market Growth Rate 2025-2033 | 15.83% |

India eSIM Market Trends:

Rising Adoption of eSIM in Consumer Electronics

The widespread use of eSIM technology across consumer devices is one of the key trends in the Indian industry. Smartphone companies are integrating eSIMs into new models, making physical SIM cards obsolete. Laptops, smartwatches, and tablets are also adopting eSIM support in order to enhance user convenience and provide network-free connectivity. The capability to remotely change carriers without the need for a physical SIM swap is fueling adoption among urban shoppers and frequent flyers. This phenomenon is in line with India's expanding digital economy, where customers expect flexibility and seamless connectivity. With telecom operators increasing eSIM support across multiple device categories, the consumer electronics industry is likely to be a key growth driver for eSIM adoption. For instance, in March 2024, Vodafone Idea launched eSIM services for prepaid users in New Delhi, expanding its availability beyond Mumbai and Goa. The eSIM allows users to activate a digital SIM directly from their phone settings, offering flexibility, multiple network profiles, and reduced plastic waste. Supported devices include Apple, Samsung, Google, Vivo, Motorola, and Nokia smartphones. The move enhances convenience and eco-friendliness for prepaid users.

To get more information on this market, Request Sample

eSIM Implementation in Automotive and Connected Mobility

The Indian automotive sector is witnessing increased adoption of eSIM technology, particularly in connected cars and shared mobility solutions. Automakers are integrating eSIMs to enable advanced telematics, real-time vehicle diagnostics, and enhanced safety features. With growing demand for vehicle tracking, infotainment services, and emergency response solutions, eSIMs offer a reliable connectivity option for modern vehicles. Shared mobility services, such as ride-hailing and car rental platforms, are also leveraging eSIMs for fleet management, route optimization, and seamless data connectivity. Government policies promoting intelligent transportation and the rise of electric vehicles further reinforce this trend. As India's automotive industry transitions toward connected and autonomous mobility, eSIM technology will play a crucial role in enhancing vehicle-to-infrastructure communication. For instance, in March 2025, Thales and Cubic partnered to enhance eSIM solutions for connected vehicles, integrating Thales’s GSMA-compliant eSIM management platform into Cubic’s multi-network ecosystem. This collaboration simplifies global connectivity, automating subscription activation and eliminating manual SIM swaps. It benefits major automotive manufacturers, enabling seamless connectivity across borders. Vehicles can now be pre-configured at the factory level and activated dynamically. This partnership strengthens Cubic’s IoT connectivity capabilities while supporting standardization, interoperability, and innovation for the evolving automotive and transportation industries.

Expansion of IoT and Industrial Applications

The rapid expansion of IoT applications in industries such as logistics, smart metering, and manufacturing is fueling the demand for eSIMs in India. Enterprises are leveraging eSIM technology for secure and scalable M2M communication, enabling remote monitoring, predictive maintenance, and real-time data analytics. In logistics, eSIMs are improving asset tracking, fleet management, and supply chain visibility. Smart meters equipped with eSIMs facilitate efficient energy consumption monitoring and billing automation. The adoption of 5G networks is further enhancing IoT deployment, offering low-latency and high-reliability connectivity. As industrial automation and smart infrastructure projects gain momentum, eSIM adoption is expected to accelerate, transforming how businesses operate in India's digital economy. For instance, in March 2024, the Telecom Regulatory Authority of India (TRAI) issued recommendations to streamline M2M eSIM usage across industries like agriculture, transportation, healthcare, and industrial automation. The framework enhances network security, fraud prevention, and profile switching flexibility. Imported devices using M2M eSIMs must switch to Indian telecom profiles within six months. TRAI mandates compliance with GSMA standards, ensuring seamless integration of telecom service providers and M2M service providers. This initiative supports India's homegrown M2M eSIM ecosystem, fostering growth in IoT connectivity.

India eSIM Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on solution type and application.

Solution Type Insights:

- Hardware

- Connectivity Services

A detailed breakup and analysis of the market based on the solution type have been provided in the report. This includes hardware and connectivity services.

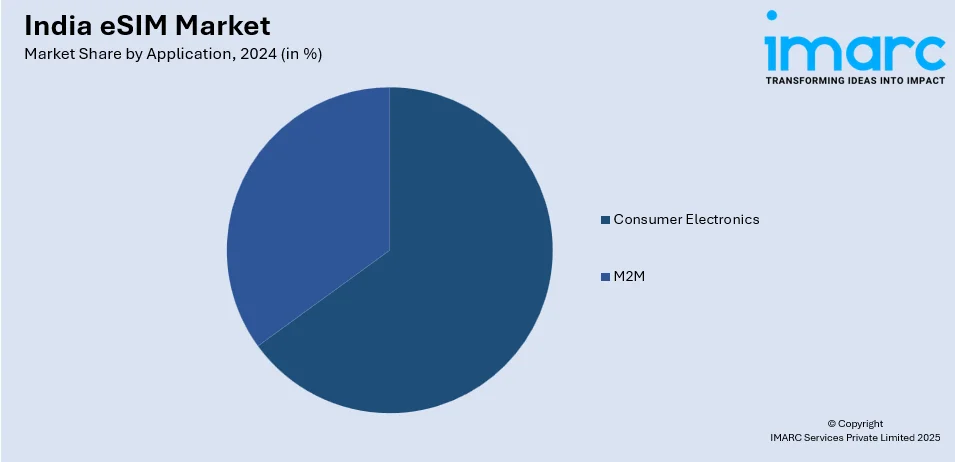

Application Insights:

- Consumer Electronics

- Smartphones

- Tablets

- Smartwatches

- Laptop

- Others

- M2M

- Automotive

- Connected Cars

- Shared Mobility

- Smart Meter

- Logistics

- Others

- Automotive

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes consumer electronics (smartphones, tablets, smartwatches, laptop, and others) and M2M [automotive (connected cars and shared mobility), smart meter, logistics, and others].

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India eSIM Market News:

- In March 2025, SHIFT partnered with Thales to integrate eSIM technology into its sustainable smartphones. Thales’s EcoSIM, made from recycled materials, supports SHIFT’s eco-friendly goals. The solution allows users to store multiple connectivity plans, enhancing flexibility. This partnership positions SHIFT in the growing eSIM market while maintaining its modular and repairable device approach. Thales’s expertise in advanced connectivity ensures secure and seamless digital identity solutions. Together, they aim to set new standards for sustainability and innovation in mobile technology.

- In December 2024, Commbitz, a London-based eSIM provider, launched operations in India to revolutionize travel connectivity with affordable, high-speed, borderless communication solutions. The company aims to cater to travelers, businesses, and SMEs with seamless eSIM technology while promoting sustainability by reducing reliance on physical SIM cards. Commbitz plans to introduce customizable plans and expand B2C offerings, ensuring flexibility for diverse users. With global operations in over 200 countries, the company seeks to collaborate with Indian businesses and technology partners.

- In August 2024, Matrix Cellular launched India's first homegrown eSIM, offering cost-effective international roaming in over 150 countries. The digital SIM card eliminates the need for physical SIMs, providing seamless connectivity for corporate travelers, students, and leisure travelers. This innovation aligns with India’s self-reliance goals, boosting the eSIM market, projected to surpass USD 21.24 Billion by 2032. Managed via an app, the eco-friendly eSIM enhances global coverage and travel tech innovation, positioning Matrix Cellular as a leader in digital communication solutions.

India eSIM Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solution Types Covered | Hardware, Connectivity Services |

| Applications Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India eSIM market performed so far and how will it perform in the coming years?

- What is the breakup of the India eSIM market on the basis of solution type?

- What is the breakup of the India eSIM market on the basis of application?

- What are the various stages in the value chain of the India eSIM market?

- What are the key driving factors and challenges in the India eSIM?

- What is the structure of the India eSIM market and who are the key players?

- What is the degree of competition in the India eSIM market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India eSIM market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India eSIM market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India eSIM industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)