India Essential Oil Market Size, Share, Trends and Forecast by Product, Application, Sales Channel, and Region, 2026-2034

India Essential Oil Market Summary:

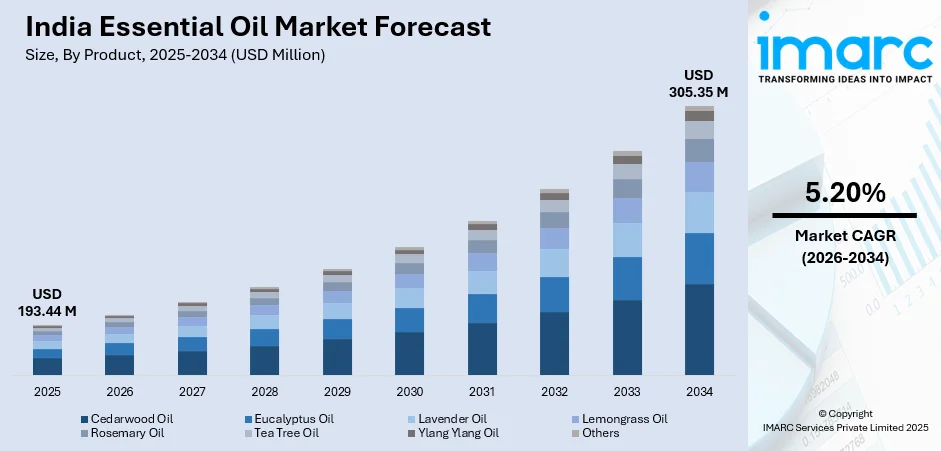

The India essential oil market size was valued at USD 193.44 Million in 2025 and is projected to reach USD 305.35 Million by 2034, growing at a compound annual growth rate of 5.20% from 2026-2034.

The market is driven by the increasing popularity of aromatherapy and rising consumer preference for natural and organic wellness products. Growing awareness of therapeutic benefits of plant-based extracts, coupled with expanding applications across personal care, cosmetics, and pharmaceutical sectors, is propelling industry expansion. The integration of essential oils into traditional Ayurvedic practices continues supporting widespread adoption in India essential oil market share.

Key Takeaways and Insights:

- By Product: Eucalyptus oil dominates the market with a share of 22% in 2025, driven by widespread therapeutic applications in respiratory care, aromatherapy treatments, and strong demand from pharmaceutical manufacturers.

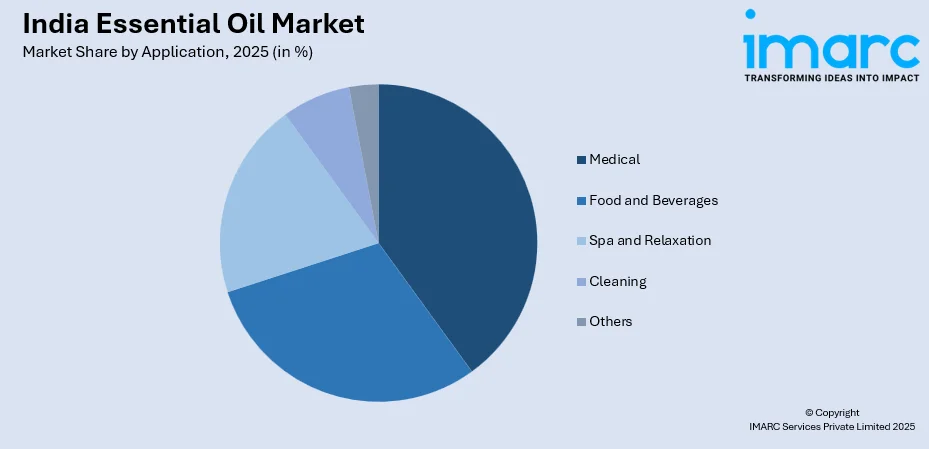

- By Application: Medical leads the market with a share of 25% in 2025, owing to expanding utilization in pharmaceutical formulations, increasing adoption in nutraceutical products, and Ayurvedic medicine integration.

- By Sales Channel: Offline stores represent the largest segment with a market share of 63% in 2025, driven by consumer preference for physical product verification, established pharmacy distribution networks, and immediate availability.

- By Region: North India leads the market with a share of 30% in 2025, driven by mentha and peppermint cultivation concentration in Uttar Pradesh and established distillation infrastructure.

- Key Players: The India essential oil market exhibits a fragmented competitive landscape, with domestic producers competing alongside international wellness brands across various price segments. Market participants are focusing on sustainable sourcing practices, quality certifications, and product innovation to strengthen their positioning.

To get more information on this market Request Sample

The India essential oil market is experiencing robust growth driven by multiple converging factors reshaping consumer preferences and industry dynamics. The increasing popularity of aromatherapy and holistic wellness practices among urban populations is creating substantial demand for high-quality plant-based extracts. According to reports, India recorded 17,772 essential oil export shipments over the previous 12 months, involving 788 exporters and 2,218 buyers, reflecting strong global demand momentum. Moreover, growing consumer awareness regarding therapeutic benefits of essential oils, including stress relief, respiratory support, and skincare applications, is accelerating market penetration. The deep-rooted tradition of Ayurveda and natural medicine practices in India provides a strong cultural foundation supporting essential oil adoption. Rising disposable incomes coupled with the expanding middle-class population are enabling greater spending on wellness and personal care products. The proliferation of e-commerce platforms and improving logistics infrastructure are enhancing product accessibility across tier-two and tier-three cities, further propelling market expansion.

India Essential Oil Market Trends:

Rising Integration of Essential Oils in Wellness and Spa Industry

The wellness and spa industry in India is witnessing remarkable expansion, with essential oils becoming integral components of therapeutic treatments and relaxation services. Luxury hotels, dedicated wellness centers, and urban spa chains are increasingly incorporating aromatherapy sessions into their service offerings. As per sources, in July 2025, Blossom Kochhar Aroma Magic relaunched therapeutic-grade essential oils in redesigned packaging, underscoring rising demand for premium aromatherapy solutions across spas and wellness centers in India. Furthermore, the growing emphasis on mental health and stress management among working professionals is driving demand for calming essential oil blends featuring lavender, chamomile, and ylang-ylang.

Premiumization and Quality Certification Demands

Consumers are demonstrating heightened awareness regarding product authenticity and purity, driving demand for certified organic essential oils. Manufacturers are investing in obtaining international quality certifications to differentiate their offerings and command premium pricing. In May 2025, AG Organica Pvt. Ltd. announced expansion of its essential oil exports to over 30 countries with ISO, GMP and USDA Organic certifications, reinforcing global confidence in Indian quality standards for pure botanicals. Moreover, transparency in sourcing practices and extraction methodologies is becoming a critical purchasing consideration for discerning consumers. The shift toward traceable supply chains and sustainable farming practices is reshaping production standards across the industry.

Expansion of Functional Blends for Targeted Applications

The market is witnessing innovation in pre-formulated essential oil blends designed for specific health and wellness outcomes. Manufacturers are developing synergistic combinations targeting concerns such as respiratory support, hormonal balance, concentration enhancement, and immunity strengthening. In March 2025, BlendToGlow launched a range of handcrafted aromatherapy diffuser oil blends in India, featuring natural essential oil combinations for relaxation, focus, and stress reduction, highlighting rising consumer interest in ready‑to‑use wellness products. Moreover, these functional blends are gaining traction among consumers seeking convenient solutions without requiring expertise in oil selection. The integration of traditional Ayurvedic knowledge with modern formulation science is producing unique product propositions.

Market Outlook 2026-2034:

The India essential oil market is poised for sustained growth, driven by rising consumer interest in natural wellness solutions and expanding application scope across pharmaceuticals, cosmetics, and food processing industries. Government support through initiatives promoting aromatic crop cultivation is expected to strengthen domestic production capabilities. The growing integration of essential oils in personal care formulations and therapeutic applications will drive continued demand. Export opportunities combined with rising domestic consumption will support market expansion throughout the forecast period. The market generated a revenue of USD 193.44 Million in 2025 and is projected to reach a revenue of USD 305.35 Million by 2034, growing at a compound annual growth rate of 5.20% from 2026-2034.

India Essential Oil Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Eucalyptus Oil | 22% |

| Application | Medical | 25% |

| Sales Channel | Offline Stores | 63% |

| Region | North India | 30% |

Product Insights:

- Cedarwood Oil

- Eucalyptus Oil

- Lavender Oil

- Lemongrass Oil

- Rosemary Oil

- Tea Tree Oil

- Ylang Ylang Oil

- Others

Eucalyptus oil dominates with a market share of 22% of the total India essential oil market in 2025.

Eucalyptus oil maintains its leading position in the India essential oil market owing to its versatile therapeutic applications and widespread consumer recognition. The oil is extensively utilized in pharmaceutical preparations for respiratory conditions, serving as a key ingredient in decongestants, inhalers, and medicated balms. Its natural antiseptic and anti-inflammatory properties make it suitable for various skincare formulations and wound care products. As pwr sources, India exported 841 eucalyptus oil shipments to 457 buyers across 118 countries, including the United States, Vietnam, and Canada, highlighting strong international demand for Indian eucalyptus oil.

The aromatherapy sector represents a significant consumption avenue for eucalyptus oil, with consumers appreciating it’s refreshing and invigorating scent profile. Household cleaning product manufacturers are incorporating eucalyptus oil for its antimicrobial properties and pleasant fragrance. Favorable cultivation conditions in South Indian states support consistent supply availability, while established extraction infrastructure ensures competitive pricing. The expanding wellness industry further strengthens eucalyptus oil consumption across therapeutic and personal care segments, reinforcing its market leadership position.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Medical

- Pharmaceutical

- Nutraceuticals

- Food and Beverages

- Bakery and Confectionery

- Beverages

- Meat, Poultry and Seafood

- Others

- Spa and Relaxation

- Aromatherapy

- Personal Care

- Cosmetics

- Toiletries

- Others

- Cleaning

- Kitchen Cleaners

- Floor Cleaners

- Bathroom Cleaner

- Others

- Others

Medical leads with a share of 25% of the total India essential oil market in 2025.

Medical commands the largest share of India essential oil consumption, reflecting deep integration of aromatic compounds in pharmaceutical and nutraceutical formulations. Essential oils with medicinal components are used in the formulation of products for respiratory and digestive problems, and for relieving pains. The Ayurvedic medical sector is a significant consumption sector with practitioners using essential oil products for a range of health and maintenance conditions. Increased acceptance and support for natural medicines open new avenues for medical use.

Medical manufacturers are increasingly exploring essential oils as natural alternatives to synthetic ingredients, driven by consumer preference for plant-based medicines. Research initiatives validating therapeutic efficacy of specific essential oils are supporting their integration into mainstream healthcare products. The nutraceutical industry is leveraging essential oils in supplement formulations targeting immunity enhancement and overall wellness. This expanding application scope continues strengthening the medical segment dominance, with ongoing product development creating new consumption avenues across healthcare categories.

Sales Channel Insights:

- Offline Stores

- Online Stores

Offline stores exhibit a clear dominance with a 63% share of the total India essential oil market in 2025.

Offline stores continue dominating essential oil distribution in India, encompassing pharmacies, specialty wellness stores, supermarkets, and dedicated aromatherapy outlets. Consumer preference for physical product evaluation, including fragrance testing and packaging inspection, sustains the relevance of brick-and-mortar retail. In September 2025, IRIS Home Fragrances launched an 18-product aromatherapy range, including essential oils, roll-on oils, and massage oils, across IRIS Aroma Boutiques and retail outlets, highlighting growing offline retail presence for wellness products. Furthermore, established retail networks ensure widespread product accessibility across urban markets, while personalized customer service enhances the overall shopping experience.

Offline stores offering curated essential oil selections with knowledgeable staff guidance are gaining popularity among discerning consumers. Supermarket chains are expanding their natural products sections to accommodate growing essential oil demand from mainstream shoppers. The immediate product availability and absence of shipping wait times provide offline channels distinct advantages. Consumers making impulse purchases or requiring products for immediate therapeutic use particularly prefer offline retail experiences, reinforcing the sustained dominance of physical retail channels.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India dominates with a market share of 30% of the total India essential oil market in 2025.

North India leads the essential oil market, anchored by its dominant position in mentha and peppermint oil production. The region benefits from favorable agro-climatic conditions supporting large-scale cultivation of aromatic crops alongside established distillation infrastructure developed over decades. Contract farming arrangements between manufacturers and farmers ensure reliable raw material supply chains supporting consistent production volumes. This integrated ecosystem positions North India as the primary production hub, with strong farmer participation driving agricultural output.

The concentration of processing facilities in North India enables cost-effective extraction operations benefiting from economies of scale. Ease of access to the consuming centers helps in the distribution of the product in the Northern regions. Export-friendly manufacturing units catering to global clients generate a major chunk of industry revenue through exports, with peppermint oil being a key export product. The strong agricultural base coupled with the manufacturing capacity continues to maintain its dominance in the market. Continuous improvements in distillation technology enhance manufacturing efficiency.

Market Dynamics:

Growth Drivers:

Why is the India Essential Oil Market Growing?

Rising Consumer Preference for Natural and Organic Products

The fundamental shift in consumer attitudes toward natural and organic products represents a primary growth driver for the India essential oil market. Increasing awareness regarding potential adverse effects of synthetic chemicals in personal care and household products is motivating consumers to seek plant-based alternatives. Essential oils, derived through natural extraction processes from aromatic plants, align perfectly with this clean-label movement gaining momentum across demographic segments. In November 2024, The Body Shop launched its India-inspired “The India Edit” collection with products made from over 90% natural ingredients, highlighting growing consumer demand for clean, plant-based formulations including essential oils.

Expanding Application Scope in Pharmaceutical and Personal Care Industries

The pharmaceutical and personal care industries are increasingly incorporating essential oils into product formulations, creating robust demand across manufacturing sectors. Essential oils serve as active ingredients in medicinal preparations targeting respiratory health, pain relief, and digestive wellness. Personal care manufacturers are integrating essential oils into skincare, haircare, and oral hygiene products to meet consumer demand for natural formulations. For instance, in April 2025, Symrise was honored with Unilever’s “Partner to Win Award” for its transformative work in India’s mint supply chain, engaging 25,000 farmers in Uttar Pradesh to implement sustainable practices and secure a reliable supply of natural mint for oral care products.

Strong Cultural Foundation in Ayurveda and Traditional Medicine

India's rich heritage in Ayurveda and traditional medicine provides a strong cultural foundation supporting essential oil market growth. Ancient texts documenting therapeutic applications of aromatic plant extracts establish historical credibility that resonates with contemporary consumers. In May 2025, India’s Ministry of AYUSH signed a Memorandum of Understanding with WHO to create a dedicated Traditional Medicine module within the International Classification of Health Interventions, enhancing global recognition of Ayurveda, Yoga, Unani, and Siddha practices. Furthermore, government initiatives promoting traditional medicine practices are raising awareness and acceptance of essential oil-based treatments. Ayurvedic practitioners routinely prescribe essential oils for various conditions, creating consistent demand through healthcare channels.

Market Restraints:

What Challenges the India Essential Oil Market is Facing?

Product Adulteration and Quality Concerns

Product adulteration remains a significant challenge affecting consumer trust in the India essential oil market. The prevalence of diluted or synthetically extended products undermines genuine manufacturer reputations and creates skepticism among potential buyers. Limited consumer ability to distinguish authentic essential oils from adulterated alternatives enables unscrupulous operators to capture market share through lower pricing.

High Pricing of Premium Essential Oils

The premium pricing of authentic, pure essential oils poses accessibility challenges for price-sensitive consumer segments in India. Certain essential oils requiring large quantities of raw material for minimal yield command high prices that limit mass-market adoption. The concentration of premium products in urban retail channels restricts availability in smaller cities.

Limited Consumer Awareness in Rural Markets

Consumer awareness regarding essential oil benefits and applications remains limited in rural and semi-urban markets, constraining demand expansion beyond metropolitan centers. Educational gaps regarding proper usage, dilution requirements, and safety precautions create barriers to adoption among uninformed consumers. The concentration of marketing efforts in urban areas perpetuates this awareness disparity.

Competitive Landscape:

The India essential oil market exhibits a fragmented competitive structure characterized by the presence of numerous domestic manufacturers alongside international wellness brands. Regional players specializing in specific essential oil varieties leverage local cultivation expertise and established farmer relationships to maintain competitive positioning. Large-scale manufacturers are investing in vertically integrated operations encompassing cultivation, distillation, and retail distribution to enhance margin capture. Quality certifications including organic accreditations and good manufacturing practice compliance are becoming essential competitive differentiators. Strategic partnerships between essential oil producers and personal care brands are expanding market reach and creating stable demand channels.

Recent Developments:

- In December 2025, CSIR-Central Institute of Medicinal and Aromatic Plants (CIMAP) is set to launch Phase 4 of its Aroma Mission, targeting crops like geranium, lavender, and patchouli to enhance domestic essential oil production for medicines, perfumes, cosmetics, and aromatherapy applications, strengthening India’s self-reliance in aromatic plants.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Cedarwood Oil, Eucalyptus Oil, Lavender Oil, Lemongrass Oil, Rosemary Oil, Tea Tree Oil, Ylang Ylang Oil, Others |

| Applications Covered |

|

| Sales Channel Covered | Offline Stores, Online Stores |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India essential oil market size was valued at USD 193.44 Million in 2025.

The India essential oil market is expected to grow at a compound annual growth rate of 5.20% from 2026-2034 to reach USD 305.35 Million by 2034.

Eucalyptus oil held the largest market share, driven by extensive therapeutic applications in respiratory care, pharmaceutical formulations, aromatherapy treatments, and household cleaning products owing to its natural antimicrobial properties and refreshing scent profile.

Key factors driving the India essential oil market include rising consumer preference for natural products, expanding aromatherapy and wellness industry, growing integration in pharmaceutical and personal care applications, and strong cultural acceptance through Ayurvedic traditions.

Major challenges include product adulteration affecting consumer trust, high pricing of premium essential oils limiting mass-market accessibility, limited consumer awareness in rural markets, inconsistent quality standards, and supply chain vulnerabilities affecting raw material availability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)