India Ethnic Frozen Foods Market Size, Share, Trends and Forecast by Type, Distribution Channel, End-User, and Region, 2025-2033

India Ethnic Frozen Foods Market Overview:

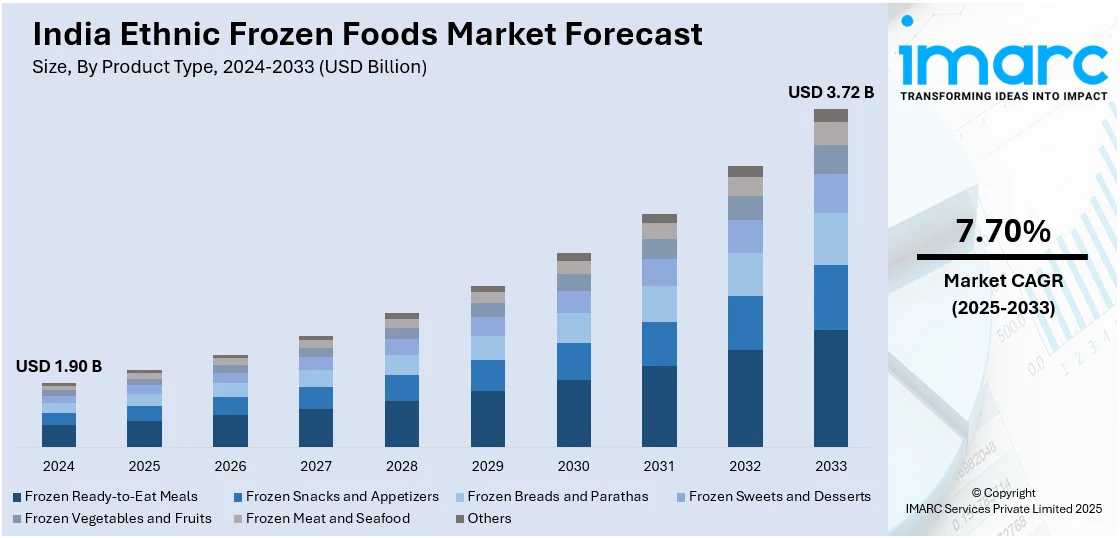

The India ethnic frozen foods market size reached USD 1.90 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.72 Billion by 2033, exhibiting a growth rate (CAGR) of 7.70% during 2025-2033. The market is witnessing significant growth due to rising urbanization, busy lifestyles, and increasing demand for ready-to-eat traditional meals. Expanding organized retail, better cold chain logistics, growing diaspora, rising number of health-conscious variants and premium offerings are also gaining traction, contributing to a significant India ethnic frozen foods market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.90 Billion |

| Market Forecast in 2033 | USD 3.72 Billion |

| Market Growth Rate 2025-2033 | 7.70% |

India Ethnic Frozen Foods Market Trends:

Rising Demand for Ready-to-Eat Traditional Meals

The growing demand for ready-to-eat traditional meals in India is largely driven by the fast-paced lifestyle of urban consumers who seek convenient meal solutions without losing the comfort of familiar flavors. As more people move to cities for work or education, daily cooking becomes challenging due to time constraints, leading to a surge in demand for frozen ethnic food that offers both convenience and taste. Brands are responding by offering a wide variety of frozen Indian dishes such as biryanis, dals, paneer gravies, and stuffed parathas that require minimal preparation. These products often come with authentic spice blends and traditional cooking styles to closely match home-cooked meals. For instance, in March 2023, Meatzza announced the launch of chicken and mutton biryani in frozen format, targeting both retail and HoReCa markets. Founder Rajiv Jaisinghani emphasizes the product's consistent quality, produced under strict safety standards. With a daily production capacity of 1.5 tons, Meatzza aims to cater to food courts and other food service sectors. This trend is also fueled by increased participation of working women, single-person households, and young professionals, all of whom prioritize easy meal options that do not sacrifice traditional culinary preferences or quality.

To get more information on this market, Request Sample

Expansion of Modern Retail and E-Commerce Driving Market Access

The expansion of modern retail formats and digital shopping platforms is a major driver of India ethnic frozen food market growth. Supermarkets and hypermarkets now offer extensive freezer sections dedicated to Indian frozen meals, making them easily accessible to urban consumers. Additionally, the surge in e-commerce driven by platforms like BigBasket, Amazon Fresh, and Blinkit has enabled consumers to order frozen regional delicacies with doorstep delivery, maintaining the cold chain integrity. According to the data published by the India Brand Equity Foundation, India's e-commerce market is projected to grow from US$ 123 billion in FY24 to US$ 292.3 billion by FY28, driven by expansion in tier-2 and tier-3 cities. Strong demand post-pandemic led to a 26.2% increase in order volumes in FY23, highlighting the sector's resilience and potential for growth. Quick commerce apps have further accelerated access, offering instant delivery of frozen snacks and meals within minutes. These channels have not only improved product visibility but also encouraged impulse purchases and experimentation with regional cuisines. As a result, frozen food brands are scaling up operations and diversifying product lines to cater to growing digital demand, directly contributing to India ethnic frozen food market growth across urban and semi-urban regions.

India Ethnic Frozen Foods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and end-user.

Product Type Insights:

- Frozen Ready-to-Eat Meals

- Frozen Snacks and Appetizers

- Frozen Breads and Parathas

- Frozen Sweets and Desserts

- Frozen Vegetables and Fruits

- Frozen Meat and Seafood

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes frozen ready-to-eat meals, frozen snacks and appetizers, frozen breads and parathas, frozen sweets and desserts, frozen vegetables and fruits, frozen meat and seafood, and others.

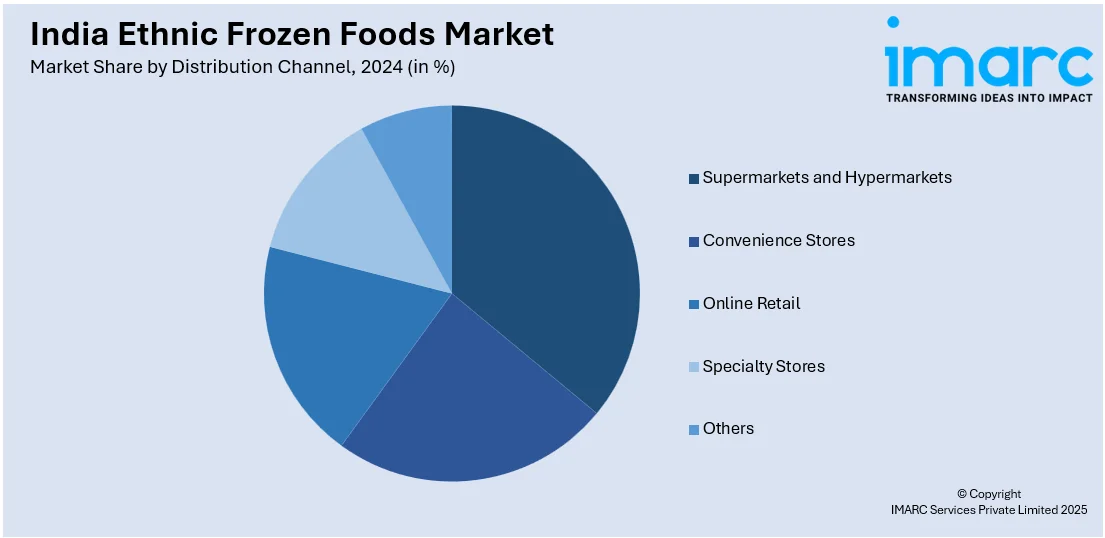

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, online retail, specialty stores, and others.

End-User Insights:

- Household Consumers

- HoReCa

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes household consumers and HoReCa.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ethnic Frozen Foods Market News:

- In February 2025, ITC signed agreements to acquire Prasuma, a major player in India's frozen and chilled foods sector, specializing in oriental cuisine. The deal, involving a 100% stake over three years, aims to strengthen ITC's portfolio in high-growth categories, enhancing its market presence and catering to evolving consumer needs.

- In July 2024, Mumbai-based Scandalous Foods announced its plans to address the increasing demand for frozen Indian sweets by offering single-serve formats specifically designed for quick-service restaurants (QSRs) and hotels. The startup is also planning to launch direct-to-consumer options. While it is approaching EBITDA profitability, it is navigating challenges related to consumer trust in frozen desserts.

India Ethnic Frozen Foods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Frozen Ready-to-Eat Meals, Frozen Snacks and Appetizers, Frozen Breads and Parathas, Frozen Sweets and Desserts, Frozen Vegetables and Fruits, Frozen Meat and Seafood, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, Others |

| End-Users Covered | Household Consumers, HoReCa |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ethnic frozen foods market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India ethnic frozen foods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ethnic frozen foods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ethnic frozen foods market in India was valued at USD 1.90 Billion in 2024.

The India ethnic frozen foods market is projected to exhibit a CAGR of 7.70% during 2025-2033, reaching a value of USD 3.72 Billion by 2033.

The market is witnessing significant growth due to rising urbanization, busy lifestyles, and increasing demand for ready-to-eat traditional meals. Expanding organized retail, better cold chain logistics, growing diaspora, rising number of health-conscious variants and premium offerings are also gaining traction.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)