India Ethylene Market Size, Share, Trends and Forecast by Feedstock, Application, and Region, 2026-2034

India Ethylene Market Overview:

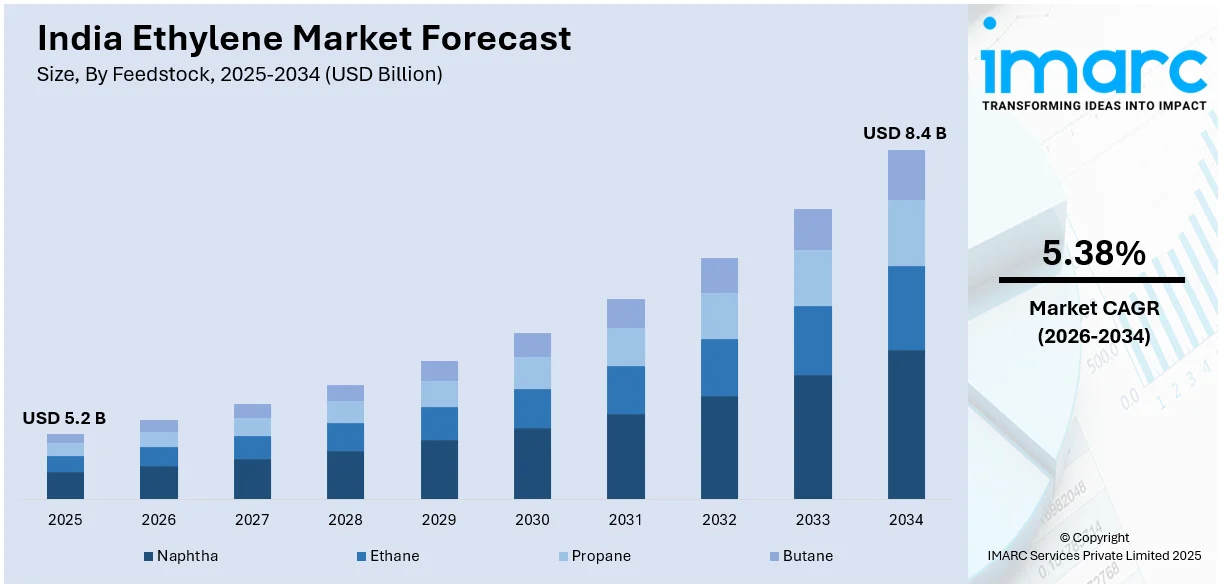

The India ethylene market size reached USD 5.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 8.4 Billion by 2034, exhibiting a growth rate (CAGR) of 5.38% during 2026-2034. The market share is expanding, driven by the expansion of online retail channels that require secure and protective packaging for safe product deliveries, along with the growing shift towards sustainable and recyclable plastics in vehicles, encouraging innovations in ethylene-based materials.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 5.2 Billion |

| Market Forecast in 2034 | USD 8.4 Billion |

| Market Growth Rate (2026-2034) | 5.38% |

India Ethylene Market Trends:

Increasing demand for packaging materials

The rising demand for packaging materials is propelling the India ethylene market growth. Industries like food, beverages, pharmaceuticals, and e-commerce rely heavily on plastic-based packaging. Ethylene is a key raw material for producing polyethylene, which is widely used for flexible and rigid packaging solutions. With the rise in processed and packaged food item consumption, companies are looking for lightweight, durable, and cost-effective packaging, driving the demand for ethylene. The expansion of e-commerce portals is also creating the need for ethylene, as online retail requires secure and protective packaging for safe product deliveries. Additionally, pharmaceutical companies are employing ethylene-derived plastics for medical-grade packaging, ensuring item protection and extended shelf life. As sustainability is becoming a focus, the demand for recyclable and biodegradable packaging materials is increasing, leading to advancements in ethylene-oriented polymers. Government initiatives promoting the Make in India campaign are also boosting domestic manufacturing, leading to higher ethylene adoption. The ongoing shift towards convenient and portable packaging solutions further guarantees that ethylene remains in high demand in India. According to the IBEF, the India Packaging Market is set to grow at a Compound Annual Growth Rate (CAGR) of 26.7% to attain USD 204.81 Billion by 2025.

To get more information on this market Request Sample

Growing vehicle production

The increasing vehicle production is offering a favorable India ethylene market outlook. As per the Society of Indian Automobile Manufacturers (SIAM), the number of commercial vehicles sold rose to 9.68 Lakh in India in FY 2023-24. The sales of medium and heavy commercial vehicles grew from 3.59 Lakh in 2023 to 3.73 Lakh units in 2024. Ethylene is a key raw material for manufacturing polyethylene, polypropylene, and other polymers used in car interiors, fuel tanks, bumpers, and under-the-hood applications. As more vehicles are being produced to meet the rising user demand, the need for lightweight and durable materials is increasing, leading to higher ethylene utilization. Automakers are focusing on fuel efficiency and performance, which is encouraging the use of plastic components over metal, reducing vehicle weight and improving mileage. Additionally, electric vehicles (EVs) are gaining popularity, and ethylene-derived materials play a crucial role in battery packaging, insulation, and lightweight body parts. With the rising execution of government initiatives promoting local manufacturing, the domestic automobile sector is thriving, further catalyzing ethylene demand. The ongoing shift toward sustainable and recyclable plastics in vehicles is also enabling innovations in ethylene-based materials.

India Ethylene Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on feedstock and application.

Feedstock Insights:

- Naphtha

- Ethane

- Propane

- Butane

The report has provided a detailed breakup and analysis of the market based on the feedstocks. This includes naphtha, ethane, propane, and butane.

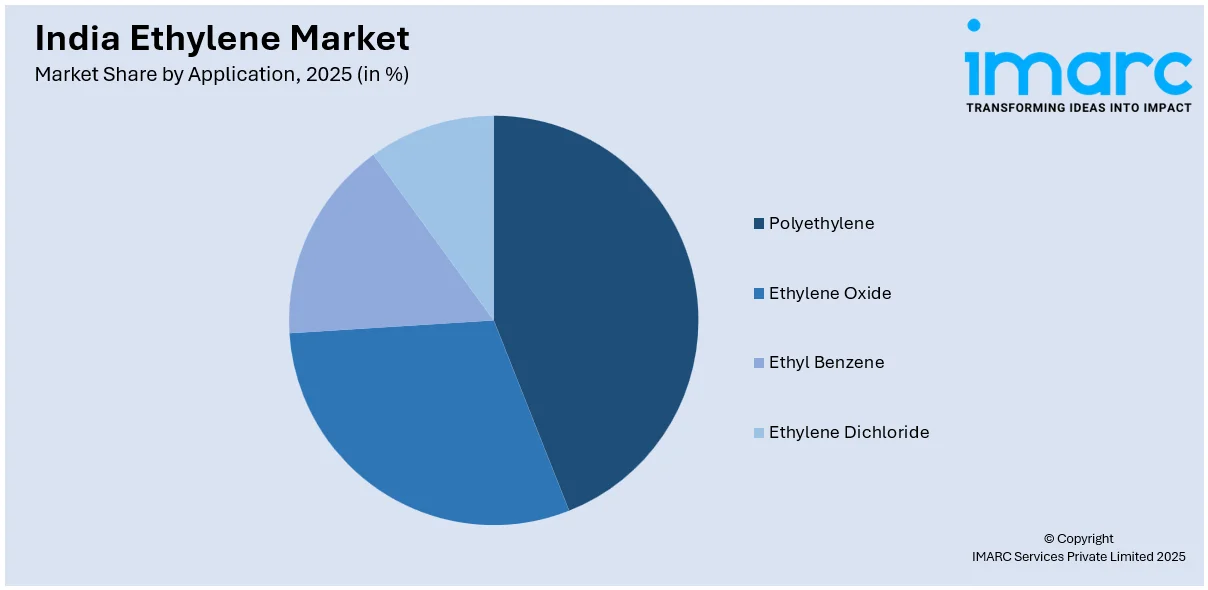

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Polyethylene

- Ethylene Oxide

- Ethyl Benzene

- Ethylene Dichloride

A detailed breakup and analysis of the market based on the applications have also been provided in the report. This includes polyethylene, ethylene oxide, ethyl benzene, and ethylene dichloride.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ethylene Market News:

- In January 2025, Nayara Energy intended to spend INR 68,000 Crore to create a 1.5 MTPA ethane cracker at its 20 MTPA refinery located in Vadinar, Gujarat. This marked the first instance of a foreign firm investing in the petrochemical industry. Ethane crackers could transform ethane into ethylene, the primary component used in synthetic rubber, adhesives, and plastics.

- In October 2024, Lummus Technology, an international supplier of process technologies and energy solutions, chose Bharat Petroleum Corporation Limited (BPCL) for a new large-scale ethylene facility and related downstream units in Bina, India. This expansion was set to generate polymer-grade ethylene and propylene to cater to downstream polymer production units, with capacities of 1200 KTA for ethylene and 550 KTA for propylene.

India Ethylene Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Feedstocks Covered | Naphtha, Ethane, Propane, Butane |

| Applications Covered | Polyethylene, Ethylene Oxide, Ethyl Benzene, Ethylene Dichloride |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India ethylene market performed so far and how will it perform in the coming years?

- What is the breakup of the India ethylene market on the basis of feedstock?

- What is the breakup of the India ethylene market on the basis of application?

- What is the breakup of the India ethylene market on the basis of region?

- What are the various stages in the value chain of the India ethylene market?

- What are the key driving factors and challenges in the India ethylene market?

- What is the structure of the India ethylene market and who are the key players?

- What is the degree of competition in the India ethylene market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ethylene market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India ethylene market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ethylene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)