India Ethylene Oxide Market Size, Share, Trends and Forecast by Derivatives, End Use, and Region, 2025-2033

India Ethylene Oxide Market Overview:

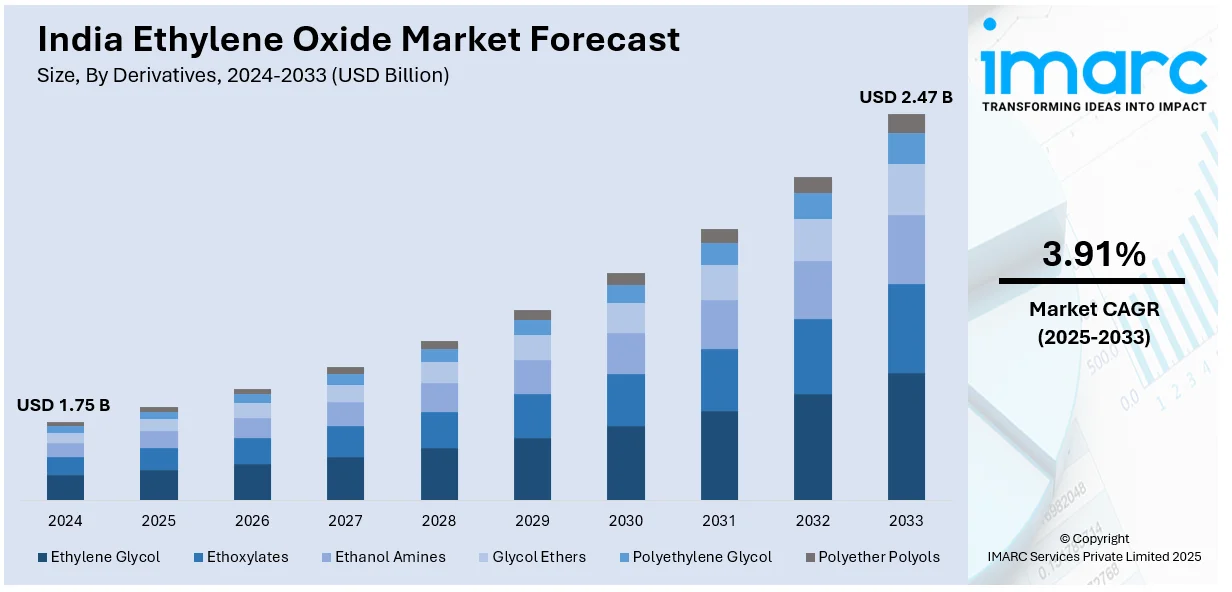

The India ethylene oxide market size reached USD 1.75 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.47 Billion by 2033, exhibiting a growth rate (CAGR) of 3.91% during 2025-2033. The growing demand from the pharmaceuticals, agrochemicals, and textile industries, rising consumption of ethylene glycol in automotive applications, expanding sterilization needs in healthcare, increasing plastic production, strong government support for industrial growth, and rapid urbanization are some of the major factors augmenting India ethylene oxide market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.75 Billion |

| Market Forecast in 2033 | USD 2.47 Billion |

| Market Growth Rate (2025-2033) | 3.91% |

India Ethylene Oxide Market Trends:

Rising Demand for Ethylene Glycol in Automotive and Packaging Sectors

The increasing consumption of ethylene glycol, a key derivative of ethylene oxide, is positively impacting the ethylene oxide market outlook. Ethylene glycol is primarily used in the production of polyethylene terephthalate (PET) and antifreeze solutions. According to an industry report, the yearly production of automobiles in India in FY23 was 25.9 Million vehicles. The increasing vehicle ownership and expanding automotive sector are driving the demand for engine coolants and antifreeze solutions. Additionally, the rise in food and beverage consumption is pushing up PET bottle production. Furthermore, the Indian packaging industry is also witnessing rapid growth due to rising e-commerce penetration and organized retail expansion. These sectors rely heavily on PET resins for lightweight, durable, and cost-effective packaging solutions. Apart from this, domestic manufacturers are scaling up production to meet this rising demand, and major players are investing in downstream integration for ethylene oxide-to-ethylene glycol conversion. In line with this, the implementation of the favorable government initiative is also pushing localized production, reducing import dependency for key PET raw materials. This trend is expected to sustain demand for ethylene oxide over the long term.

To get more information on this market, Request Sample

Expansion of Ethylene Oxide Applications in the Indian Healthcare Industry

India's healthcare sector is witnessing strong growth. According to an industry report, the healthcare industry in India is expected to reach USD 638 Billion by 2025, driven by public and private investments, expanding health insurance coverage, and an increasing focus on infection control. Ethylene oxide is a critical sterilizing agent used for heat-sensitive medical devices such as surgical instruments, catheters, and implants. As demand rises for safe and sterile healthcare products, especially after COVID-19, ethylene oxide sterilization is becoming more essential across hospitals, diagnostic centers, and medical device manufacturers. Additionally, India's push to become a global medical device manufacturing hub under its Production-Linked Incentive (PLI) scheme is also increasing domestic capacity for medical equipment, which is providing a boost to India ethylene oxide market growth. Ethylene oxide's effectiveness in killing bacteria, viruses, and fungi without damaging devices makes it irreplaceable in many cases. Furthermore, regulatory bodies such as the CDSCO and BIS are tightening sterilization standards, which is driving investments in EO-based sterilization facilities. As India's surgical procedure volumes increase and disposable medical product usage rises, ethylene oxide demand from the healthcare sector is projected to maintain an upward trajectory.

India Ethylene Oxide Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on derivatives and end use.

Derivatives Insights:

- Ethylene Glycol

- Ethoxylates

- Ethanol Amines

- Glycol Ethers

- Polyethylene Glycol

- Polyether Polyols

The report has provided a detailed breakup and analysis of the market based on the derivatives. This includes ethylene glycol, ethoxylates, ethanol amines, glycol ethers, polyethylene glycol, and polyether polyols.

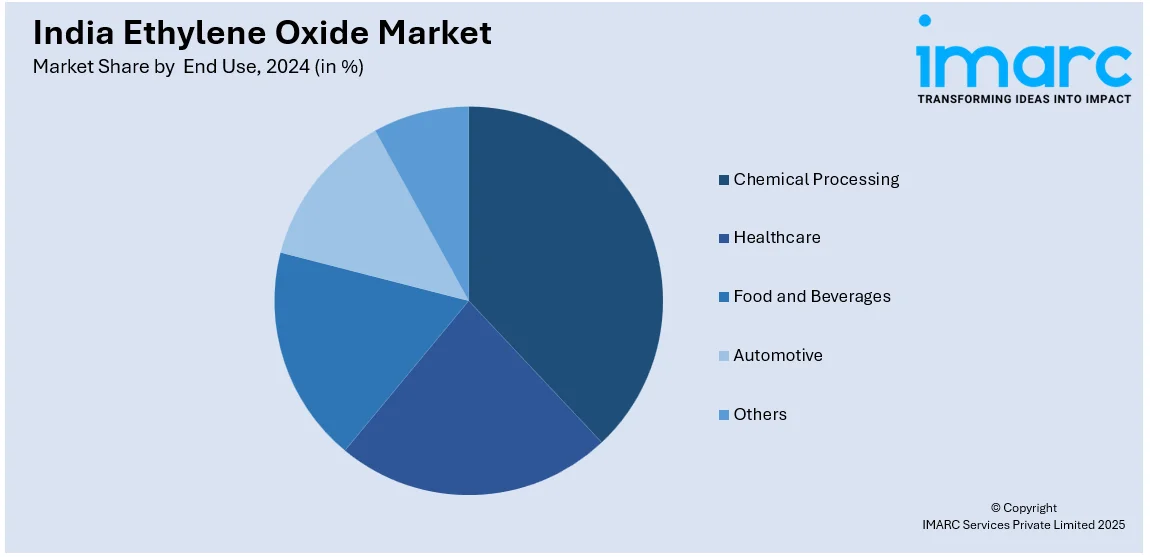

End Use Insights:

- Chemical Processing

- Healthcare

- Food and Beverages

- Automotive

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes chemical processing, healthcare, food and beverages, automotive, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ethylene Oxide Market News:

- On June 11, 2024, GAIL (India) Limited announced plans to invest INR 60,000 Crore (about USD 7.2 Billion) in constructing a 1.5 Million Tonnes per annum ethane cracker and derivative plants at Ashta in the Sehore district of Madhya Pradesh. The planned petrochemical complex by GAIL (India) Limited in Madhya Pradesh is designed to produce high-density polyethylene (HDPE), linear low-density polyethylene (LLDPE), mono ethylene glycol (MEG), and propylene. The Madhya Pradesh Industrial Development Corporation is facilitating the allocation of approximately 800 hectares for the project, with construction anticipated to commence by 2025.

India Ethylene Oxide Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Derivatives Covered | Ethylene Glycol, Ethoxylates, Ethanol Amines, Glycol Ethers, Polyethylene Glycol, Polyether Polyols |

| End Uses Covered | Chemical Processing, Healthcare, Food and Beverages, Automotive, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ethylene oxide market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India ethylene oxide market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ethylene oxide industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ethylene oxide market in India was valued at USD 1.75 Billion in 2024.

The India ethylene oxide market is projected to exhibit a CAGR of 3.91% during 2025-2033, reaching a value of USD 2.47 Billion by 2033.

The market is driven by rising demand for downstream derivatives such as ethylene glycol and ethanolamine, which are used in textiles, automotive, and agrochemicals. Growth in industrialization and urban infrastructure supports demand. Additionally, domestic manufacturing expansion and increasing need for surfactants in personal care and cleaning products contribute to sustained ethylene oxide consumption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)