India Excavators Market Size, Share, Trends and Forecast by Product, Mechanism Type, Power Range, Application, and Region, 2025-2033

India Excavators Market Size and Share:

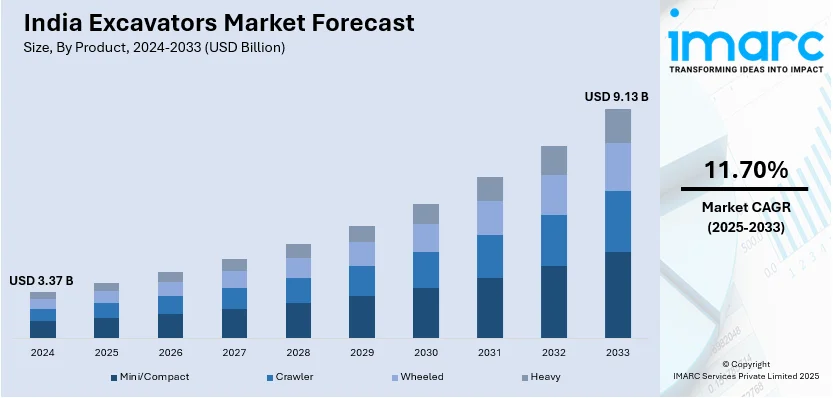

The India excavators market size reached USD 3.37 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.13 Billion by 2033, exhibiting a growth rate (CAGR) of 11.70% during 2025-2033. The market is expanding due to rising infrastructure projects, urbanization, and demand for fuel-efficient machinery. Increased local manufacturing under Make in India, advanced hydraulics, and intelligent engine systems are driving growth. Companies focus on cost efficiency, sustainability, and high-performance machines to meet industry needs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.17 Billion |

| Market Forecast in 2033 | USD 9.13 Billion |

| Market Growth Rate (2025-2033) | 11.70% |

India Excavators Market Trends:

Growing Demand for Fuel-Efficient Excavators

The Indian excavator market is witnessing a rising preference for fuel-efficient machinery as industries seek to reduce operational costs and improve sustainability. With increasing fuel prices and stricter environmental regulations, construction and infrastructure companies are prioritizing machines that offer higher productivity with lower fuel consumption. Technological advancements in hydraulics and engine control systems are playing a crucial role in enhancing efficiency without compromising performance. In October 2024, JCB India launched the NXT 215 LC Fuel Master Tracked Excavator, a machine designed to improve fuel efficiency by 14%, resulting in annual savings of INR 2.90 Lakh. Equipped with Intelliflow Hydraulics, Power Boost, and auto idle stop, it optimizes fuel usage while enhancing overall productivity and cost-effectiveness. These advancements align with the industry's increasing shift toward fuel-efficient models, catering to both domestic and global markets. The demand for fuel-efficient excavators is being driven by large-scale urban development projects, road construction, and mining activities, where energy savings directly impact profitability. Companies investing in advanced hydraulic systems and intelligent engine control are gaining a competitive edge. The trend is expected to accelerate as more construction firms seek equipment that reduces long-term operational expenses while complying with sustainability goals.

To get more information on this market, Request Sample

Expansion of Indigenous Manufacturing Capabilities

India’s construction equipment market is experiencing a transformation with a strong push toward local manufacturing and reduced import dependence. The government's Make in India initiative is encouraging companies to increase indigenization, develop domestic supply chains, and boost exports. This shift is enhancing the country’s position as a global hub for construction equipment manufacturing, offering cost-effective and high-quality alternatives to imported machines. In August 2024, Kobelco Construction Equipment India introduced the SK80 Excavator, an 8-Ton machine with over 70% indigenization, integrating a Yanmar engine and advanced hydraulics for improved fuel efficiency and performance. This launch reinforces India’s growing capability in localized manufacturing, catering not only to domestic demand but also to international markets. By focusing on sustainability and operational efficiency, this development strengthens India’s export potential in the global excavator market. The increasing localization of excavator manufacturing is benefiting infrastructure projects, real estate development, and industrial construction by offering cost-effective, easily serviceable machines. It is also boosting employment, technology transfer, and investments in production facilities across the country. With more manufacturers shifting toward in-house production, India is set to emerge as a key player in the global construction equipment industry.

India Excavators Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, mechanism type, power range, and application.

Product Insights:

- Mini/Compact

- Crawler

- Wheeled

- Heavy

The report has provided a detailed breakup and analysis of the market based on the product. This includes mini/compact, crawler, wheeled, and heavy.

Mechanism Type Insights:

- Electric

- Hydraulic

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the mechanism type. This includes electric, hydraulic, and hybrid.

Power Range Insights:

- Up to 300 HP

- 301-500 HP

- 501 HP and Above

A detailed breakup and analysis of the market based on the power range have also been provided in the report. This includes up to 300 HP, 301-500 HP, and 501 HP and above.

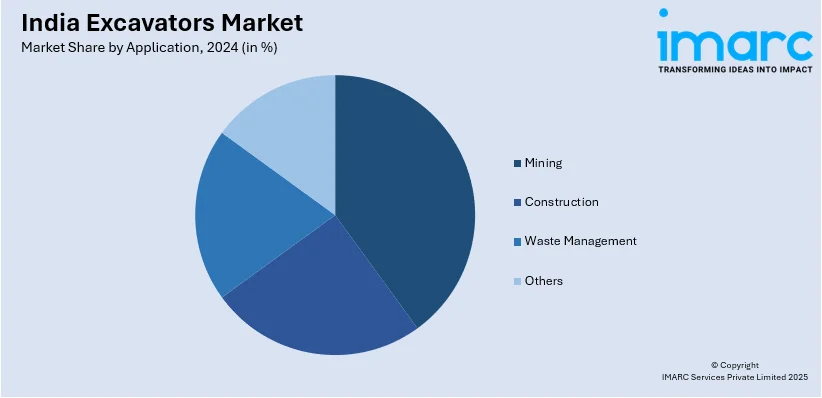

Application Insights:

- Mining

- Construction

- Waste Management

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes mining, construction, waste management, and others.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Excavators Market News:

- September 2024: Tata Hitachi launched the NX80, an 8-Ton mini excavator with a 48.3 HP Yanmar engine, advanced hydraulics, and fuel efficiency. Designed for Indian conditions, it boosts productivity and cost savings, strengthening Tata Hitachi’s market presence and supporting India's growing construction and infrastructure sectors.

- June 2024: Caterpillar launched facelift excavators Cat 323D3, 320D3, and 320D3 GC, featuring an electrohydraulic system for fuel efficiency, a redesigned cab for safety, and advanced technology like GPS and Swing Assist.

India Excavators Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Covered | Mini/Compact, Crawler, Wheeled, Heavy |

| Mechanism Type Covered | Electric, Hydraulic, Hybrid |

| Power Range Covered | Up to 300 HP, 301-500 HP, 501 HP and Above |

| Application Covered | Mining, Construction, Waste Management, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India excavators market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India excavators market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India excavators industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India excavators market was valued at USD 3.37 Billion in 2024.

The India excavators market is projected to exhibit a CAGR of 11.70% during 2025-2033, reaching a value of USD 9.13 Billion by 2033.

The India excavators market is driven by rapid infrastructure development, urban expansion, and government investments in roads, railways, and smart cities. The growth of mining, real estate, and industrial projects, along with advancements in construction equipment technology and leasing options, further fuels demand for excavators across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)