India Exhaust Fan Market Size, Share, Trends and Forecast by Type, Application Type, and Region, 2025-2033

India Exhaust Fan Market Overview:

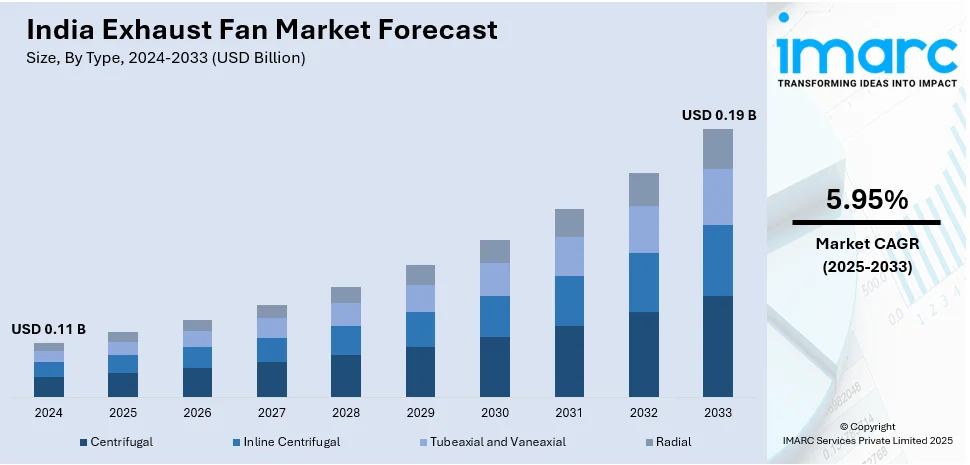

The India exhaust fan market size reached USD 0.11 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.19 Billion by 2033, exhibiting a growth rate (CAGR) of 5.95% during 2025-2033. Rapid urbanization, increasing residential and commercial construction, rising consumer awareness of indoor air quality, growing industrialization, and government initiatives promoting energy-efficient ventilation solutions are the factors propelling the growth of the market. Demand for smart and IoT-enabled exhaust fans is also expanding.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.11 Billion |

| Market Forecast in 2033 | USD 0.19 Billion |

| Market Growth Rate (2025-2033) | 5.95% |

India Exhaust Fan Market Trends:

Growing Focus on Sustainable Ventilation Solutions

The need for energy-efficient ventilation systems is increasing as companies strive to reduce power usage and promote sustainability. Advanced motor technology improves exhaust fan efficiency, lowering operating costs and fulfilling tougher energy restrictions. To reduce their environmental effect, manufacturers are adopting cleaner manufacturing processes, integrating renewable energy, and undertaking waste reduction efforts. Green manufacturing approaches, such as landfill waste reduction and resource optimization, are gaining popularity in ventilation system manufacture. The sector is also being shaped by safety concerns, as specialty motors built for sensitive applications become more prevalent. As organizations prioritize energy efficiency and compliance with changing regulations, the need for high-performance ventilation systems grows throughout the industrial, commercial, and infrastructural sectors. For example, ABB India's Faridabad factory boosts the exhaust fan market by manufacturing energy-efficient IE3 and IE4 low-voltage motors, which reduce energy consumption in ventilation systems. In 2023, the plant produced 180 MWh of solar electricity while diverting 99% of garbage from landfills. It covers 36,000 square meters and manufactures flameproof and smoke extraction motors for sustainable industrial and commercial exhaust fan applications in India.

To get more information on this market, Request Sample

Strengthening Emphasis on Hygienic Ventilation in Public Spaces

The necessity of ventilation in preserving hygiene is gaining traction, particularly in high-traffic places such as public toilets. According to studies, certain toilet styles emit much greater levels of airborne germs, raising health concerns. Proper ventilation systems with exhaust fans may significantly lower bioaerosol levels, reducing exposure to dangerous bacteria. Efficient airflow control enhances interior air quality while also aligning with expanding public health efforts. Facilities are prioritizing modern exhaust fan installations to reduce contamination hazards and provide safer conditions for users. With increased awareness of airborne disease transmission, there is a growing need for high-performance ventilation systems in the commercial and institutional sectors. Enhanced ventilation systems are increasingly important in modern infrastructure, addressing both cleanliness and air quality problems. For instance, a recent study found that active ventilation systems with exhaust fans considerably minimize bioaerosol risks in public toilets. According to research, squat toilets produce 42-62% more S. aureus and 16-27% more E. coli bioaerosols than bidet toilets. Following the first flush of an empty toilet, bioaerosol concentrations decreased by 25-43% (S. aureus) and 16-27% (E. coli). Notably, exhaust fans reduced bioaerosol hazards tenfold, highlighting their importance in enhancing interior air quality.

India Exhaust Fan Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and application type.

Type Insights:

- Centrifugal

- Inline Centrifugal

- Tubeaxial and Vaneaxial

- Radial

The report has provided a detailed breakup and analysis of the market based on the type. This includes centrifugal, inline centrifugal, tubeaxial and vaneaxial, and radial.

Application Type Insights:

.webp)

- Laboratories

- Diesel Generator Exhaust

- Industrial

- Others

A detailed breakup and analysis of the market based on the application type have also been provided in the report. This includes laboratories, diesel generator exhaust, industrial, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Exhaust Fan Market News:

- In November 2024, ABB India and Witt India collaborated to improve tunnel ventilation safety by combining ABB smoke extraction motors with Witt India's Banana Jet Fans. This partnership enhances air management, smoke control, and energy efficiency in major infrastructure projects such as the Rewa Sidhi Tunnel in Madhya Pradesh and the Kuthiran Tunnel Highway in Kerala, therefore propelling India's infrastructure growth.

- In July 2024, Chennai Metro Rail Limited (CMRL) improved its ventilation system by decreasing tunnel ventilation fans from eight to two per station, guaranteeing fire safety compliance while minimizing costs and space needs. This invention reduced mechanical room footprints and electricity loads. The Phase-2 project, which has been acknowledged for its sustainability, got an award at the 20th International Symposium on Aerodynamics, Ventilation, and Fire in Tunnels (ISAVFT 2024) for its effective exhaust fan integration with underground infrastructure.

India Exhaust Fan Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Centrifugal, Inline Centrifugal, Tubeaxial and Vaneaxial, Radial |

| Application Types Covered | Laboratories, Diesel Generator Exhaust, Industrial, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India exhaust fan market performed so far and how will it perform in the coming years?

- What is the breakup of the India exhaust fan market on the basis of type?

- What is the breakup of the India exhaust fan market on the basis of application type?

- What are the various stages in the value chain of the India exhaust fan market?

- What are the key driving factors and challenges in the India exhaust fan market?

- What is the structure of the India exhaust fan market and who are the key players?

- What is the degree of competition in the India exhaust fan market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India exhaust fan market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India exhaust fan market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India exhaust fan industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)