India Express Cargo Market Size, Share, Trends and Forecast by Service Type, Mode of Transportation, Cargo Type, Customer Type, End-User Industry, and Region, 2025-2033

India Express Cargo Market Overview:

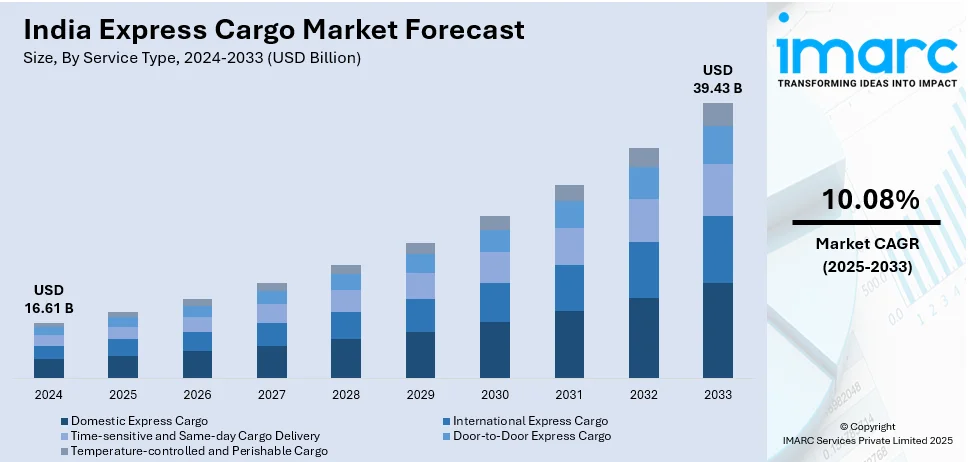

The India express cargo market size reached USD 16.61 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 39.43 Billion by 2033, exhibiting a growth rate (CAGR) of 10.08% during 2025-2033. The market is influenced by booming e-commerce growth, growing demand for speedier delivery services, and development of logistics infrastructure. The National Logistics Policy, supported by technological developments in supply chain management and last-mile delivery, also supports the India express cargo market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 16.61 Billion |

| Market Forecast in 2033 | USD 39.43 Billion |

| Market Growth Rate 2025-2033 | 10.08% |

India Express Cargo Market Trends:

Rise of E-Commerce and Consumer Demand for Faster Deliveries

India's booming e-commerce industry is one of the key trends powering the express cargo space. As more and more consumers are making online purchases, there is a growing need for speedy and secure delivery services. E-commerce leaders such as Amazon, Flipkart, and new-generation startups need express cargo solutions to satisfy customers in terms of faster delivery, typically within a 24-hour to 48-hour time frame. With the demand for next-day and same-day delivery increasing, express cargo service operators are expanding their operations and streamlining their supply chains to make deliveries in time. Furthermore, penetration of mobile and internet connectivity within urban and rural areas is providing greater touchpoints for last-mile delivery. This trend marks a significant shift in the India express cargo market outlook, as logistics firms increase their service quality and implement new-age technologies, like AI and data analytics, to facilitate greater efficiency and quicker, affordable deliveries.

To get more information on this market, Request Sample

Digitalization and Technological Integration in Logistics

Integration of technology and digitalization are changing the Indian express cargo sector. The sophisticated tracking systems, automation, and AI-based solutions are increasing the efficiency and transparency of operations. Customers are able to track shipments in real time, which improves customer satisfaction and increases trust in express cargo operations. Digital platforms are also reducing booking, dispatch, and payment processes, allowing businesses and customers to ship faster with ease. Machine learning software is being employed for route optimization and delivery timing to deliver improved cargo handling and lower operations costs. Warehouse automation, which includes the utilization of robotics and automated sortation systems, is also accelerating and enhancing accuracy in the handling of cargo. As the logistics sector develops further, these technological developments are likely to have a growing crucial role in fueling the India express cargo market share and facilitating competitiveness within the industry.

Expansion of Cold Chain Logistics for Perishable Goods

The increasing need for temperature-sensitive goods like pharmaceuticals, fresh fruits and vegetables, and packaged food is fueling the growth of cold chain logistics in the express cargo industry in India. As the focus on keeping perishable goods intact during transportation gains importance, express cargo companies are increasingly opting for specialized refrigerated transport and storage solutions. The pharma sector, especially, needs stringent temperature control for the movement of vaccines, drugs, and biological specimens. With India's healthcare industry growing, this trend is gaining momentum. In addition, the need for fresh fruits and vegetables, which need to be delivered quickly to remain fresh, is also increasing with the increasing urban population. The implementation of sophisticated cold storage technologies, as well as government efforts in favor of the expansion of the cold chain infrastructure, is likely to continue propelling the development of express cargo services designed for these industries, with the aim of providing efficient and secure transportation of perishable commodities.

India Express Cargo Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on service type, mode of transportation, cargo type, customer type, and end-user industry.

Service Type Insights:

- Domestic Express Cargo

- International Express Cargo

- Time-sensitive and Same-day Cargo Delivery

- Door-to-Door Express Cargo

- Temperature-controlled and Perishable Cargo

The report has provided a detailed breakup and analysis of the market based on the service type. This includes domestic express cargo, international express cargo, time-sensitive and same-day cargo delivery, door-to-door express cargo, and temperature-controlled and perishable cargo.

Mode of Transportation Insights:

- Air Express Cargo

- Road Express Cargo

- Rail Express Cargo

- Sea and Inland Waterways Express Cargo

The report has provided a detailed breakup and analysis of the market based on the mode of transportation. This includes air express cargo, road express cargo, rail express cargo, and sea and inland waterways express cargo.

Cargo Type Insights:

- General Cargo

- High-value and Secured Cargo

- Hazardous Materials (HAZMAT)

- Perishable Goods

- Documents and Parcels

The report has provided a detailed breakup and analysis of the market based on the cargo type. This includes general cargo, high-value and secured cargo, hazardous materials (HAZMAT), perishable goods, and documents and parcels.

Customer Type Insights:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- Individual Consumers

The report has provided a detailed breakup and analysis of the market based on the customer type. This includes small and medium enterprises (SMEs), large enterprises, and individual consumers.

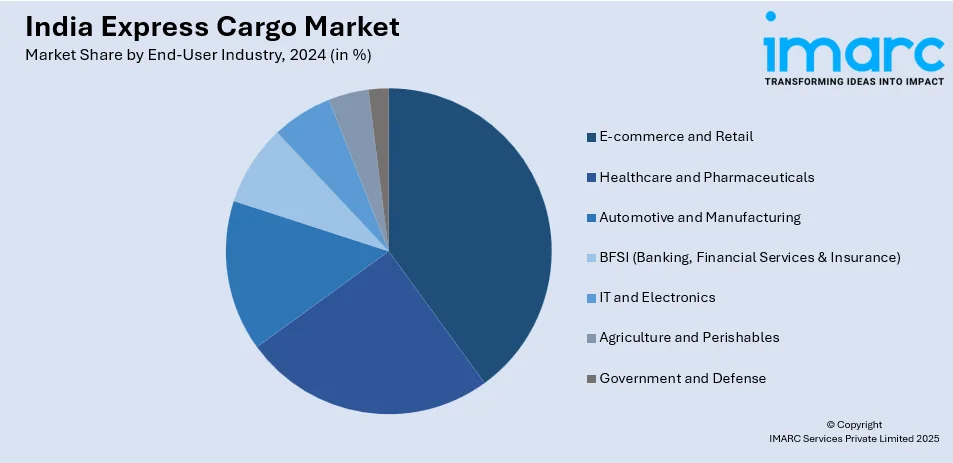

End -User Industry Insights:

- E-commerce and Retail

- Healthcare and Pharmaceuticals

- Automotive and Manufacturing

- BFSI (Banking, Financial Services & Insurance)

- IT and Electronics

- Agriculture and Perishables

- Government and Defense

The report has provided a detailed breakup and analysis of the market based on the end-user industry. This includes e-commerce and retail, healthcare and pharmaceuticals, automotive and manufacturing, BFSI (banking, financial services & insurance), it and electronics, agriculture and perishables, and government and defense.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Express Cargo Market News:

- In January 2025, DHL Group revealed that it is improving Blue Dart Express' abilities in India to strengthen its position in the global express logistics market. The recent inauguration of Blue Dart's largest integrated operating facility in Bijwasan, Delhi represents a major advancement in this endeavor.

- In December 2024, FedEx announced its intentions to create its initial entirely automated air cargo hub in India. This center is intended to function as a sub-regional hub for South Asia, facilitating transshipment processes and enhancing infrastructure for effective operations.

India Express Cargo Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Domestic Express Cargo, International Express Cargo, Time-sensitive and Same-day Cargo Delivery, Door-to-Door Express Cargo, Temperature-controlled and Perishable Cargo |

| Modes of Transportation Covered | Air Express Cargo, Road Express Cargo, Rail Express Cargo, Sea and Inland Waterways Express Cargo |

| Cargo Types Covered | General Cargo, High-value and Secured Cargo, Hazardous Materials (HAZMAT), Perishable Goods, Documents and Parcels |

| Customer Types Covered | Small and Medium Enterprises (SMEs), Large Enterprises, Individual Consumers |

| End-User Industries Covered | E-commerce and Retail, Healthcare and Pharmaceuticals, Automotive and Manufacturing, BFSI (Banking, Financial Services & Insurance), IT and Electronics, Agriculture and Perishables, Government and Defense |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India express cargo market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India express cargo market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India express cargo industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The express cargo market in India was valued at USD 16.61 Billion in 2024.

The India express cargo market is projected to exhibit a (CAGR) of 10.08% during 2025-2033, reaching a value of USD 39.43 Billion by 2033.

E-commerce, business-to-business (B2B) deliveries, and organized retail are fueling the India express cargo market. Third-party logistics (3PL) expansion and last-mile connectivity in tier 2 and 3 cities increase the penetration of services. Investments in air and surface cargo infrastructure, digitalized tracking of shipments, and timely delivery expectations from businesses and consumers further boost the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)